Key Takeaways:

- OneMain offers a forward dividend yield of 8.2%, and analysts expect earnings-per-share to grow over 25% annually.

- The dividend is well-covered with a 2025 payout ratio around 69%, expected to improve to under 50% by 2027.

- Analysts think the stock has about 15% upside based on current price targets.

- Get accurate financial data on over 100,000 global stocks for free on TIKR >>>

OneMain is one of the largest personal loan providers in the U.S., serving non-prime borrowers who often have limited access to traditional bank credit.

While it’s not a fast-growing tech company, OneMain has become a dependable dividend stock. With steady free cash flow, a high dividend yield, and consistent shareholder returns, it’s positioning itself as a strong dividend play for long-term investors looking for reliable yield and solid upside.

Why Is $OMF Down 10% in the Past 3 Months?

Here’s what’s been affecting OneMain Holdings stock the most:

- Rising interest rates: Higher rates have increased borrowing costs for customers and slightly raised credit losses, which has created some pressure on earnings.

- Credit normalization: After several years of unusually low delinquencies, credit metrics are now returning to pre-pandemic levels. While this is healthy in the long run, it has added some short-term volatility.

- Cautious investor sentiment: Wall Street has been hesitant on consumer finance stocks that cater to lower-credit borrowers. Even though OneMain remains profitable and conservative in its lending, the sector has been out of favor with investors.

Still, analysts remain optimistic about OneMain’s fundamentals. The company continues to generate strong free cash flow, returns capital to shareholders, and has a surprisingly high dividend yield for the level of earnings growth the business is expected to see.

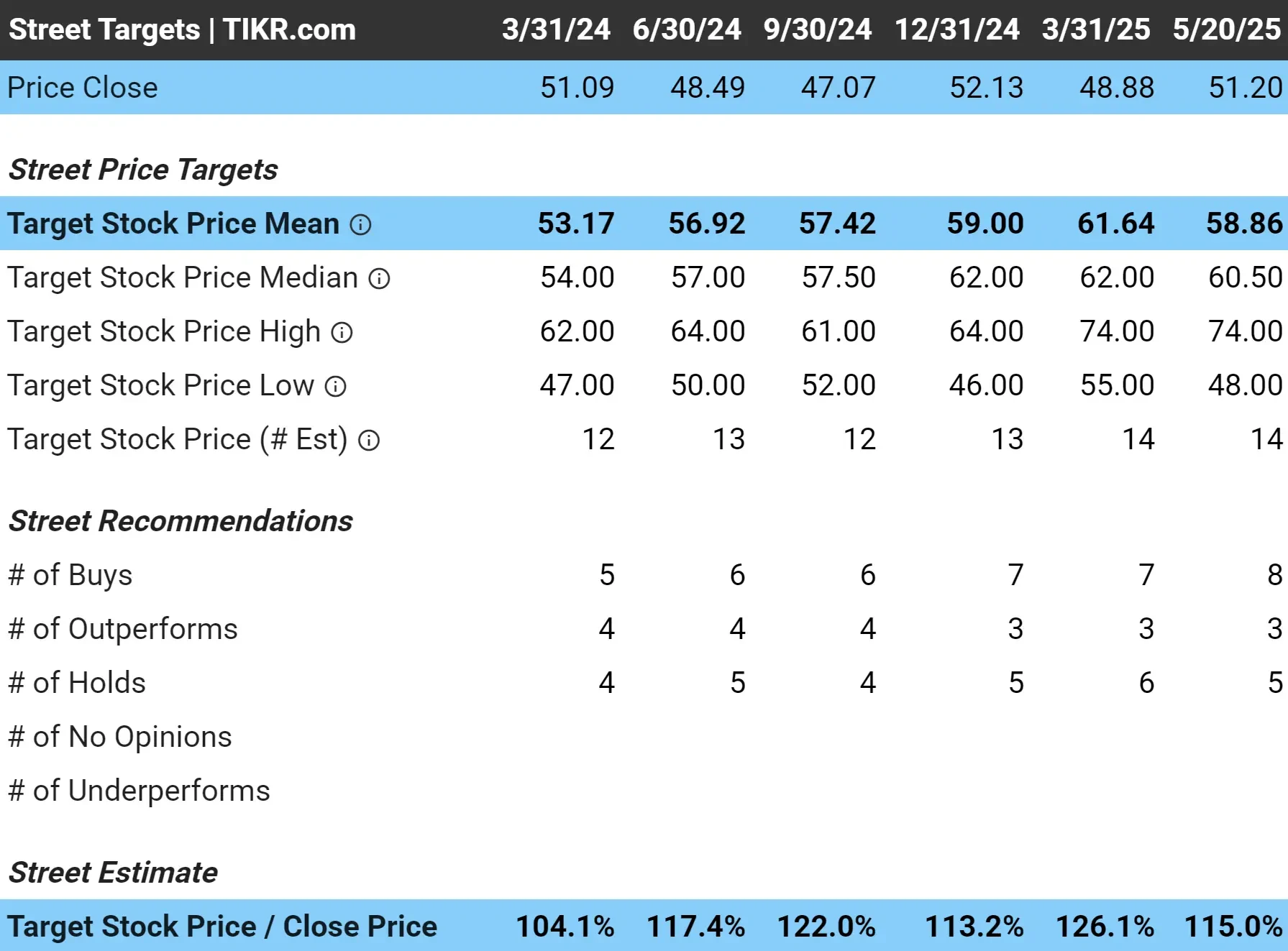

Analysts Think the Stock Has 15% Upside Today

Wall Street analysts currently have an average price target of $59/share for OneMain, which suggests the stock has about 15% upside from its current price of $51/share.

That might not seem like a huge upside on its own, but when combined with OneMain’s 8.2% dividend yield, the total return potential becomes much more attractive.

For dividend-focused investors, this combination of yield and value makes OMF a compelling option.

Find stocks that analysts think are more undervalued than OneMain Holdings today (It’s free) >>>

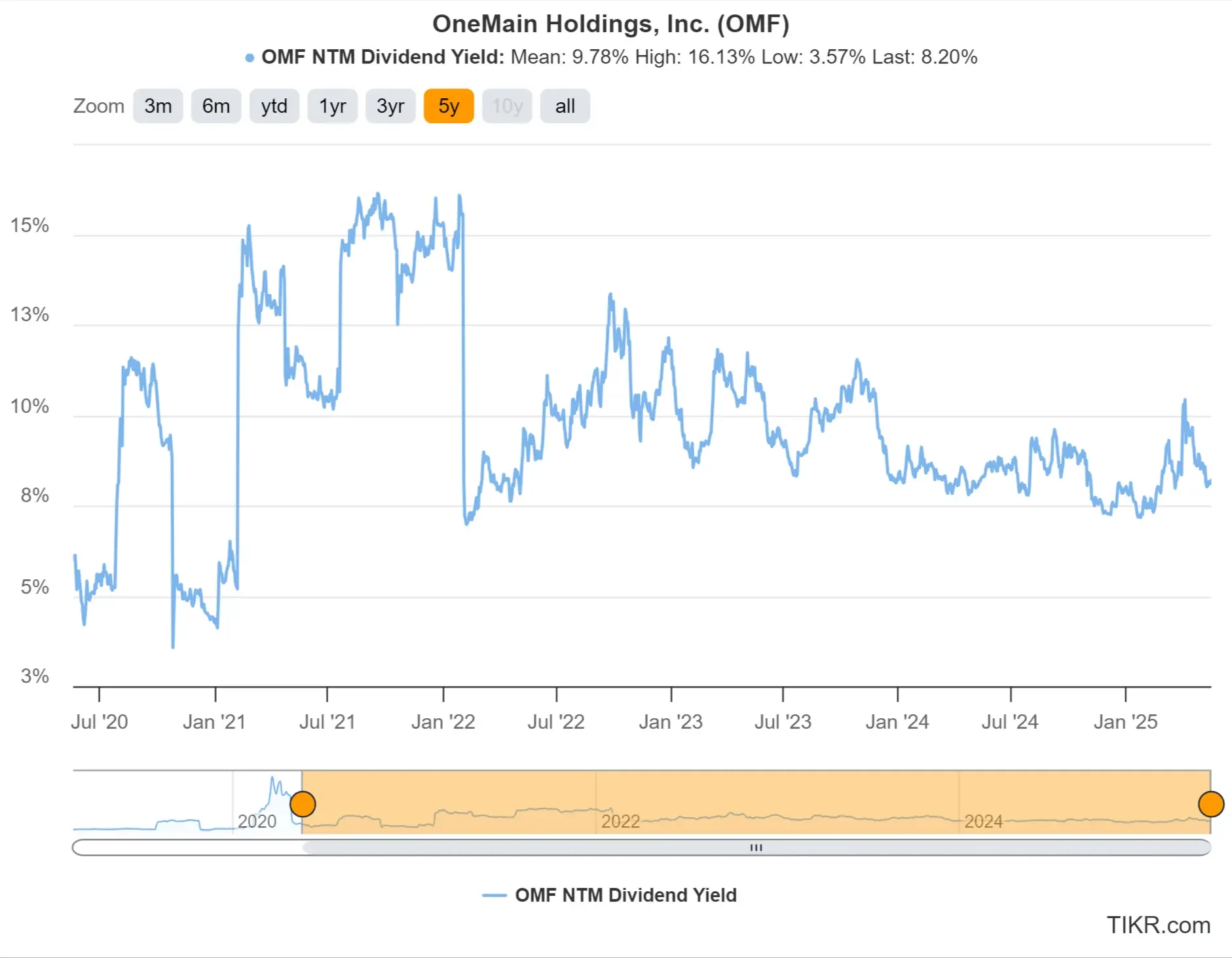

1: Dividend Yield

OneMain currently offers a trailing dividend yield of about 8.2%. Although that yield is lower than the stock’s 5-year average yield, earnings are expected to see strong growth, making OneMain attractive.

OneMain has also been returning capital to shareholders through regular buybacks. Over the past 3 years, the company has repurchased over $400 million worth of stock, highlighting its strong commitment to shareholder returns.

See OneMain Holdings’ full dividend stats with TIKR. (It’s free) >>>

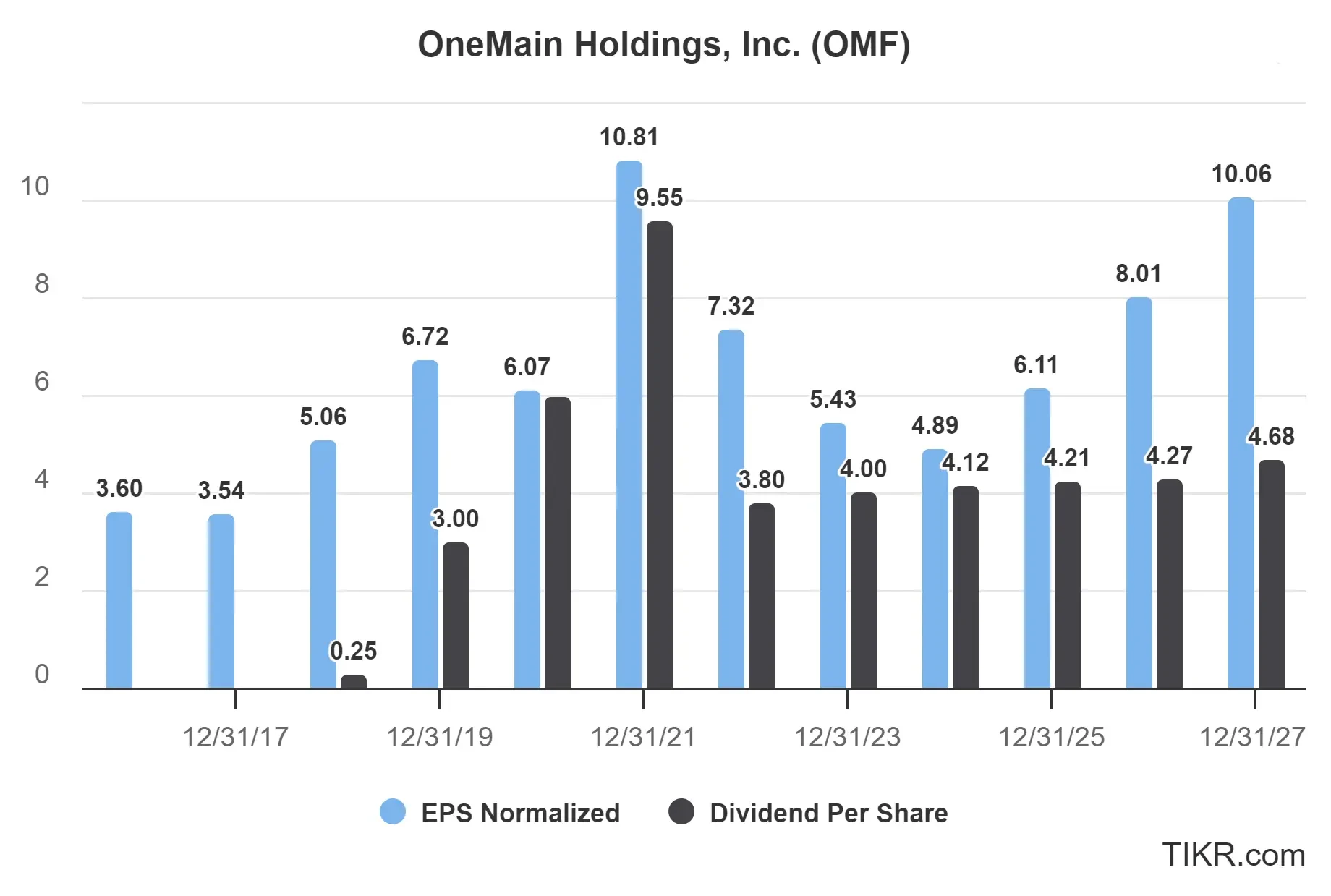

2: Dividend Safety

OneMain is expected to have a dividend payout ratio of about 69% in 2025, based on projected EPS of $6.11 and dividends of $4.21 per share.

While that’s higher than the typical target for most companies, it’s still manageable for a lender with consistent earnings and strong cash flow. Analysts expect EPS to grow steadily in the years ahead, reaching over $10 per share by 2027, while dividends rise more gradually to around $4.68.

That would bring the payout ratio back under 50%, giving OneMain more flexibility to invest in the business and still support its dividend. With solid free cash flow and a history of stable distributions, the dividend looks safe for now.

See OneMain Holdings’ full growth forecast and analyst estimates. (It’s free) >>>

3: Dividend Growth Potential

OneMain’s dividend growth has been uneven over the past five years. The dividend jumped from $3.00 per share in 2019 to $9.55 in 2021, but it was then cut to $3.80 in 2022.

Since then, it’s been growing modestly at about a 3% compound annual growth rate, and analysts expect steady increases going forward with no further cuts on the horizon. EPS is projected to grow at a strong 28.3% annual pace over the next three years, giving the company plenty of room to continue raising its dividend.

Analysts expect dividend growth of about 4.3% annually, which could boost total returns while allowing OneMain to improve its payout ratio gradually. That’s a healthy setup for an already high-yielding dividend stock.

TIKR Takeaway

OneMain may not be a traditional growth stock, but it’s a rare high-yield opportunity that combines solid earnings, improving payout ratios, and long-term upside.

With a dividend yield over 8% and analyst targets suggesting 14% price appreciation, this stock could be a compelling option for investors looking to lock in strong total returns.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks and was built for investors who think of buying stocks as buying a piece of a business.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!