Key Takeaways:

- Celsius Holdings stock could conservatively be worth over $63/share by the end of 2027.

- That’s a potential 38% upside from today’s price of ~$46/share.

- CELH stock is projected to benefit from explosive revenue growth and margin expansion as the company scales its dual-brand energy portfolio.

- Unlock our Free Report: 5 stock screeners inspired by top investors like Warren Buffett to help you find high-upside stock ideas (Sign up for TIKR, it’s free) >>>

Celsius Holdings (CELH) is a rapidly growing energy drink company that has revolutionized the category with its better-for-you, functional beverage portfolio, including the flagship Celsius brand and its recent acquisition of Alani Nu.

The company has disrupted the traditional energy drink market by focusing on health-conscious consumers with sugar-free, fitness-oriented products that deliver functional benefits beyond just caffeine.

We ran CELH stock through a comprehensive valuation model to assess its current value and potential upside for investors.

Using reasonable assumptions based on its growth trajectory and market positioning, the model suggests CELH stock could be worth over $63/share by the end of 2027. That would imply 38% upside from Celsius’s current $45.89 share price.

The compelling aspect of this forecast is that it assumes continued execution of the company’s proven growth strategy while the energy category evolves toward healthier, functional alternatives.

Try TIKR’s Valuation Model today for FREE (It’s the easiest way to find undervalued stocks) >>>

What Does Celsius Holdings Do?

Celsius operates a portfolio of premium functional energy drinks led by two powerhouse brands: Celsius and Alani Nu. Together, these brands command a 16.2% share of the U.S. energy drink market, making them the #3 player in the category.

Its franchise model focuses on sugar-free, fitness-oriented beverages that appeal to health-conscious consumers seeking functional benefits, such as metabolism acceleration and fat burning.

The business has demonstrated remarkable growth, with Celsius and Alani Nu accounting for 50% of total energy category growth in 2024, demonstrating their ability to drive category expansion rather than just taking share.

Here’s why CELH stock could deliver exceptional returns over the next 2.5 years through continued category leadership and operational excellence.

Our Valuation Assumptions

TIKR’s Valuation Model lets you plug in your own assumptions for a company’s revenue growth, operating margins, and P/E multiple, and calculates the stock’s expected returns.

In our valuation, we’ll simply use analysts’ consensus estimates and break down what analysts think the stock is worth today.

Here’s what we used for CELH stock:

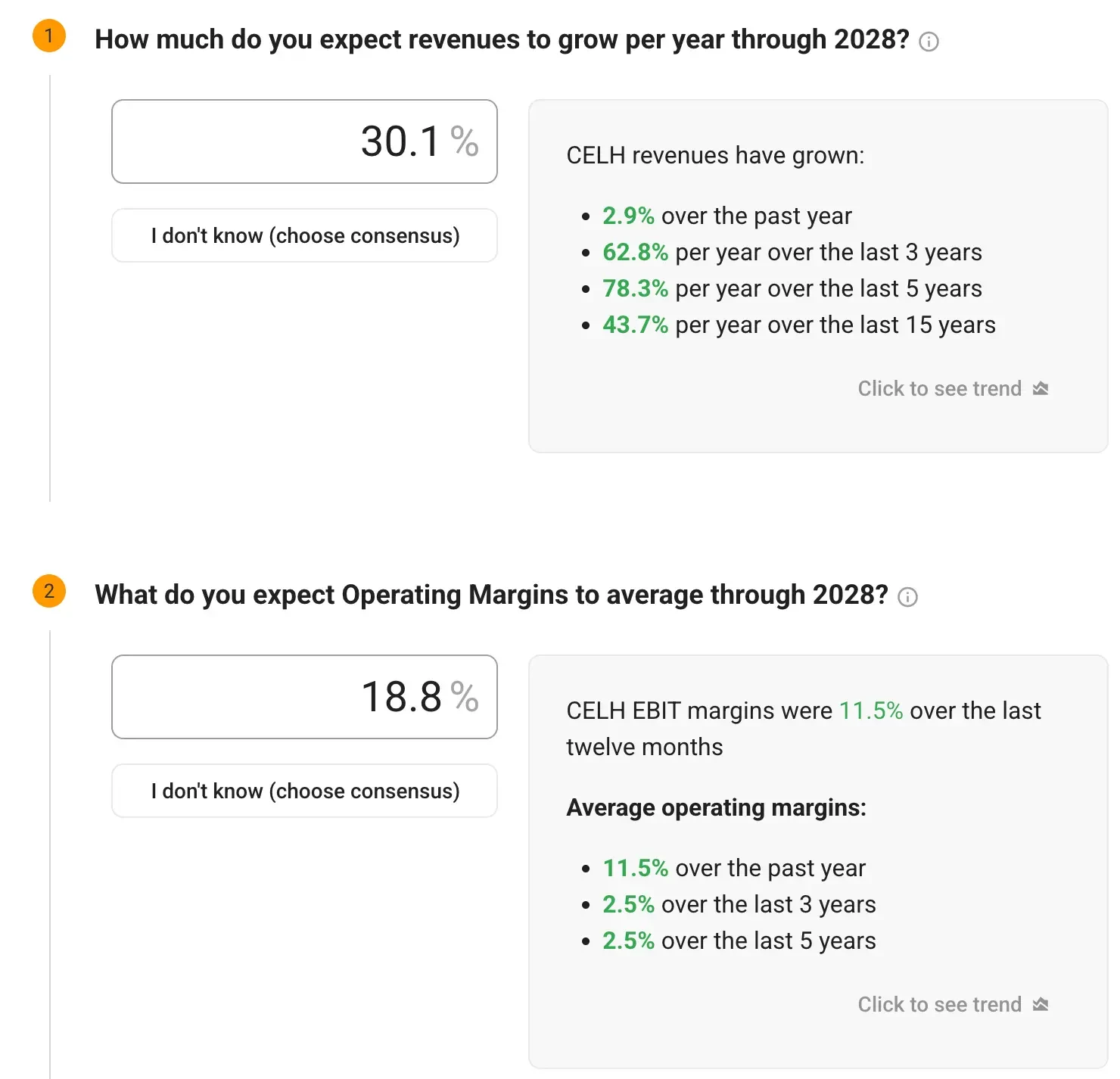

1. Revenue Growth: 30.1% CAGR

Celsius has delivered extraordinary growth, with 78.3% annual revenue growth over the last five years and 62.8% over the last three years.

While growth is expected to moderate as the company scales, we project continued robust expansion of 30.1% annually through 2028, driven by market share gains, distribution expansion, and the acquisition of Alani Nu.

2. Operating Margins: 18.8%

Celsius’s EBIT margins have expanded to 11.5% over the last twelve months as the business scales.

We project margins will average 18.8% through 2028 as Celsius leverages its operational infrastructure, realizes synergies from the Alani Nu acquisition, and benefits from increased manufacturing efficiency.

3. Exit P/E Multiple: 35x

Celsius currently trades at premium multiples reflecting its high-growth profile and market leadership position.

We used a 35x P/E multiple, which acknowledges the beverage giant’s continued growth potential while considering normalization from historical peaks.

Build your own Valuation Model to value any stock (It’s free!) >>>

What the Model Says for CELH Stock

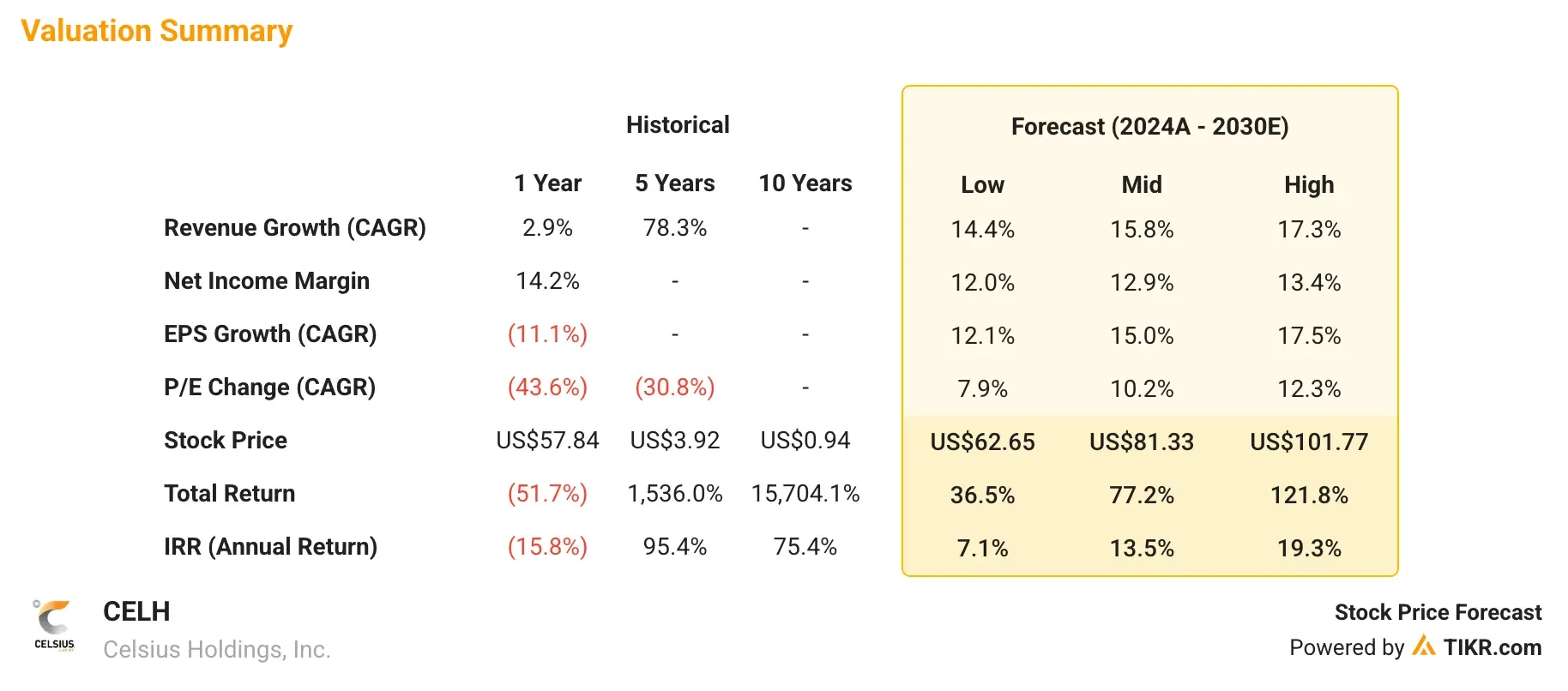

With these inputs, the valuation model estimates that CELH stock could reach approximately $63.45/share by the end of 2027.

Value Celsius with TIKR’s Valuation Model today for FREE (Find undervalued stocks fast) >>>

That represents a potential gain of 38% from today’s price of around $45. The model shows this would translate into an annualized return of approximately 14% over the next 2.5 years.

This forecast reflects an ability to continue leading the modern energy revolution while expanding its addressable market through innovation and strategic acquisitions.

The model forecasts the business’s future earnings-per-share based on revenue growth and margin expansion, then applies a P/E multiple to estimate the future stock price.

This helps investors understand what financial performance is required to generate strong returns and how much upside is available if those expectations are met.

What Happens If Things Go Better or Worse?

The model enables various scenarios based on how effectively Celsius executes its strategy and responds to market conditions.

Here’s the range of potential outcomes:

- Low Case: Slower growth with competitive pressure → 6-9%% annual returns

- Mid Case: Continued market leadership execution → 12-14% annual returns

- High Case: Accelerated category expansion and international growth → 19%+ annual returns

Even the conservative scenario offers steady returns that outpace inflation estimates, reflecting Celsius’s strong competitive position in a growing category.

The earnings growth for Celsius Holdings is likely to be driven by a combination of factors:

- Category Leadership: The two-brand portfolio (Celsius and Alani Nu) is driving 50% of energy category growth, demonstrating the ability to expand the total addressable market.

- Health & Wellness Trends: The shift toward sugar-free, functional beverages is accelerating, with sugar-free options now representing over 50% of energy drink sales for the first time.

- Distribution Expansion: Celsius continues to gain shelf space and enter new channels, with 15-20% annual distribution increases expected, and expansion into foodservice through partnerships like Subway’s 18,000 locations.

- International Opportunity: With only 5% of revenue from international markets compared to Monster’s 40%, there’s significant runway for global expansion.

- Operational Synergies: The Alani Nu acquisition is expected to deliver $50 million in run-rate synergies over 24 months through supply chain optimization and operational leverage.

How the Street Sees Celsius Stock

In the near term, Wall Street does not see much upside for Celsius stock. In fact, consensus estimates forecast CELH stock to move marginally lower.

While consensus estimates have an 18-month target price, our valuation model has a longer time horizon of 30 months.

It’s possible that CELH stock could underperform in the near term and then recover to deliver outsized gains to shareholders in 2027.

See analysts’ growth forecasts and price target for CELH stock (It’s free!) >>>

Risks to Consider

Despite the bullish outlook, investors should be aware of several risks that could impact Celsius Holdings’ growth trajectory:

- Competitive Pressure: Monster and Red Bull are responding with increased innovation and marketing investment in the sugar-free segment, potentially pressuring market share gains.

- Integration Execution: Successfully integrating Alani Nu while maintaining both brands’ distinct identities and growth trajectories requires careful execution over the next 24 months.

- Valuation Sensitivity: CELH stock trades at premium multiples, making it sensitive to any growth disappointments or margin pressures.

- Consumer Behavior: Changes in health trends or economic pressures could impact the premium-priced functional beverage category.

- Supply Chain Risks: Potential tariff impacts on aluminum and other inputs could pressure margins if not successfully mitigated through pricing or operational efficiency.

TIKR Takeaway

Celsius Holdings has established a robust platform at the intersection of key consumer trends toward health, wellness, and functional nutrition.

If the company continues to execute its multi-brand strategy while capitalizing on the structural shift toward better-for-you energy drinks, we believe CELH stock offers exceptional upside for growth-oriented investors.

The 38% upside potential over the next 2.5 years reflects an ability to drive category growth and the runway ahead in both domestic and international markets.

Is CELH stock a buy over the next 24 months? Use TIKR’s Valuation Model alongside analysts’ growth forecasts and price targets to see if it is undervalued today.

Value any stock with TIKR’s Valuation Models (It’s free!) >>>

Want to Invest Like Warren Buffett, Joel Greenblatt, or Peter Lynch?

TIKR just published a special report breaking down 5 powerful stock screeners inspired by the exact strategies used by the world’s greatest investors.

In this report, you’ll discover:

- A Buffett-style screener for finding wide-moat compounders at fair prices

- Joel Greenblatt’s formula for high-return, low-risk stocks

- A Peter Lynch-inspired tool to surface fast-growing small caps before Wall Street catches on

Each screener is fully customizable on TIKR, so you can apply legendary investing strategies instantly. Whether you’re looking for long-term compounders or overlooked value plays, these screeners will save you hours and sharpen your edge.

This is your shortcut to proven investing frameworks, backed by real performance data.

Click here to sign up for TIKR and get this full report now, completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!