Key Takeaways:

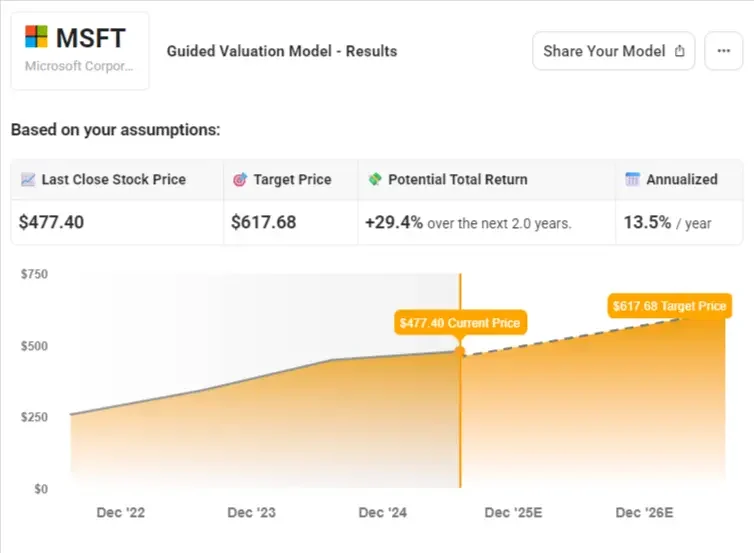

- Microsoft (MSFT) stock could be worth over $618/share by mid-2027, implying nearly 30% total upside from today’s price of $477/share.

- Based on TIKR’s Valuation Model, investors could see 13.5% annualized returns with Microsoft stock over the next two years using reasonable assumptions.

- This forecast simply assumes Microsoft continues executing at its current pace.

- Unlock our Free Report: 5 stock screeners inspired by top investors like Warren Buffett to help you find high-upside stock ideas (Sign up for TIKR, it’s free) >>>

Microsoft (MSFT) is one of the world’s most dominant technology companies. It powers businesses and consumers through cloud computing, enterprise software, and AI-enabled tools.

Its product ecosystem spans Azure, Microsoft 365, Windows, GitHub, LinkedIn, and more, with strong recurring revenue and global reach.

We ran Microsoft through TIKR’s new Valuation Model to see what the stock could be worth based on analysts’ estimates, and the model suggests Microsoft could be worth over $617/share by mid-2027. This would be nearly 30% upside from today’s price of around $477.

The best part is that this forecast expects Microsoft will trade at a lower P/E ratio in the future. All Microsoft has to do is continue growing and see small margin improvements to reach this valuation.

Try TIKR’s Valuation Model today for FREE (It’s the easiest way to find undervalued stocks) >>>

What Microsoft Does

Microsoft is one of the world’s most dominant tech platforms. Its businesses span cloud computing (Azure), enterprise software (Office, Dynamics), infrastructure (Windows), AI (Copilot), and gaming (Xbox).

With its scale, recurring revenue, and multiple growth engines, it remains a core holding for long-term investors, and TIKR’s Valuation Model shows why there could still be significant upside ahead.

Our Valuation Assumptions

TIKR’s Valuation Model lets you plug in your own assumptions for a company’s revenue growth, operating margins, and P/E multiple, and the model calculates the stock’s fair value and expected returns.

In our valuation, we’ll simply use analysts’ consensus estimates to determine what the stock could be worth today.

Here’s what we used for Microsoft:

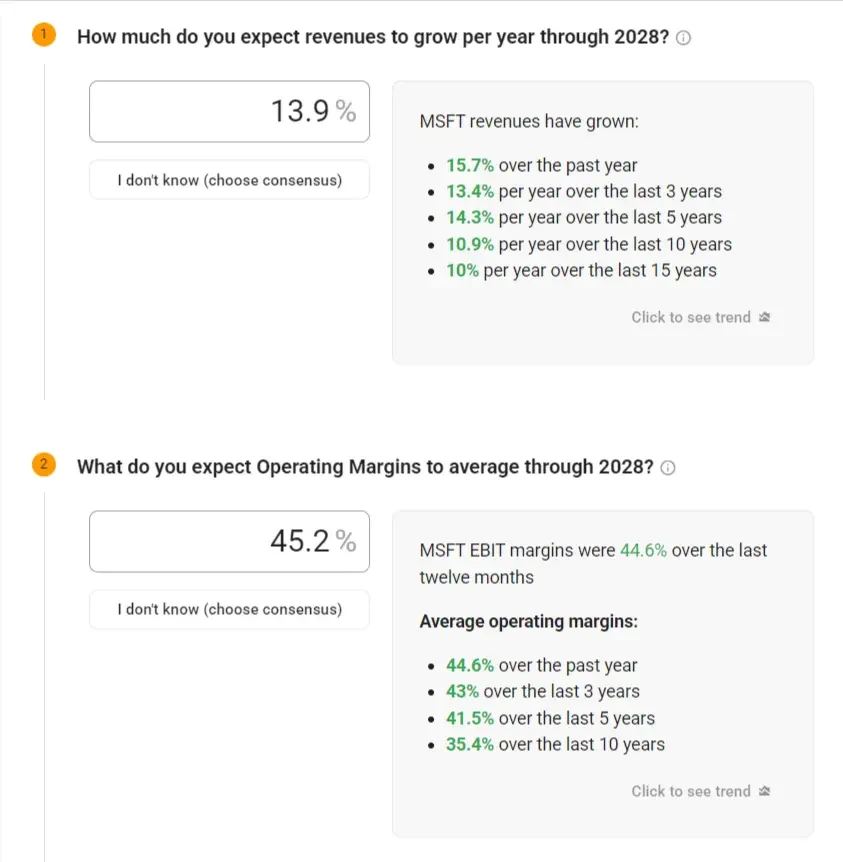

1. Revenue Growth: 13.9% CAGR

Microsoft’s revenue has grown:

- 15.7% over the past year

- 14.3% over the last five years

- 10.9% over the past decade

Using a 13.9% growth assumption lines up with both recent trends and long-term analyst forecasts.

2. Operating Margins: 45.2%

Microsoft’s operating margin has consistently expanded thanks to scale in Azure and pricing power across its software suite.

Analysts have an average estimate of 45.2% operating margins through 2028, which is just higher than the company’s actual performance over the last twelve months.

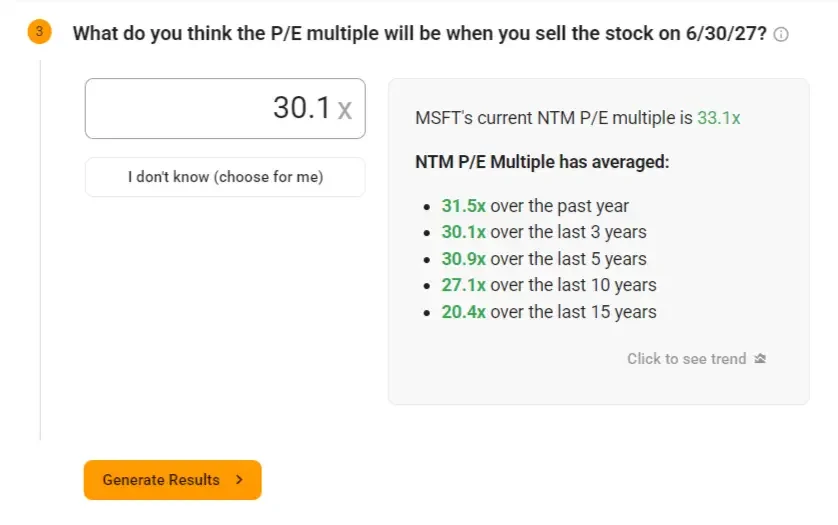

3. Exit P/E Multiple: 18x

Microsoft currently trades at a 33.1x forward P/E multiple. We used a 30.1x multiple, which is in-line with its 3-year average.

It’s worth noting that Microsoft currently trades at a P/E ratio of around 33x, so maintaining a 33x multiple instead of trading at 30x could unlock about 10% additional upside.

Still, we’ll be conservative and use a 30x P/E multiple:

Build your own Valuation Model to value any stock (It’s free!) >>>

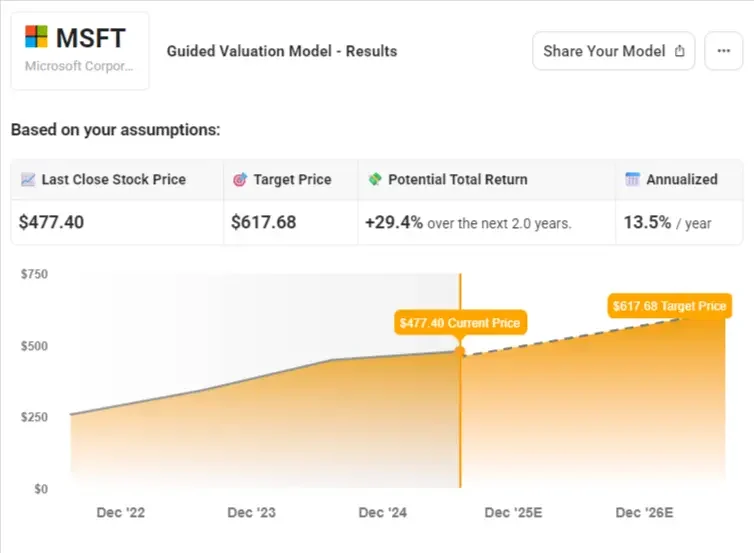

What the Model Says

With the inputs we shared earlier, TIKR’s Valuation Model estimates that Microsoft stock could reach ~$618/share in the next 2 years.

That’s a potential gain of more than 29% from today’s price of ~$477. The model also shows this would translate into an annualized return of around 13.5% over the next 2 years, which would beat the market’s long-time average annual returns of about 10%.

The model forecasts the business’s future earnings-per-share based on revenue growth and operating margins, then applies a P/E multiple to estimate the future stock price.

This can be a helpful tool for investors to understand what returns a stock could see, and what a company would need to do for that to come true.

Try TIKR’s Valuation Model today for FREE (It’s the easiest way to find undervalued stocks) >>>

What Happens If Things Go Better or Worse?

TIKR lets you build conservative and optimistic scenarios so you can see how a stock might perform depending on how the business executes.

Over the next 5 years, based on analyst estimates, Microsoft stock could deliver about 7-19% annualized returns.

Here’s a quick look:

- Low Case: $619.78 → 6.7% annual return

- Mid Case: $807.20 → 13.9% annual return

- High Case: $970.17 → 19.2% annual return

Even the low case beats inflation and offers solid returns, while the high case reflects strong execution and continued margin expansion.

Microsoft’s earnings growth will likely be driven by a mix of strong top-line momentum and operating leverage:

- Cloud Growth: Azure continues gaining market share and should drive a large portion of Microsoft’s future revenue.

- AI Monetization: Copilot is being integrated across the Microsoft suite, creating new revenue streams with little incremental cost.

- Enterprise Stickiness: Microsoft 365 and Teams remain deeply embedded in corporate IT stacks, supporting consistent subscription growth.

- Margin Leverage: As higher-margin segments like cloud and software expand, overall profitability should improve even further.

How the Street Sees It

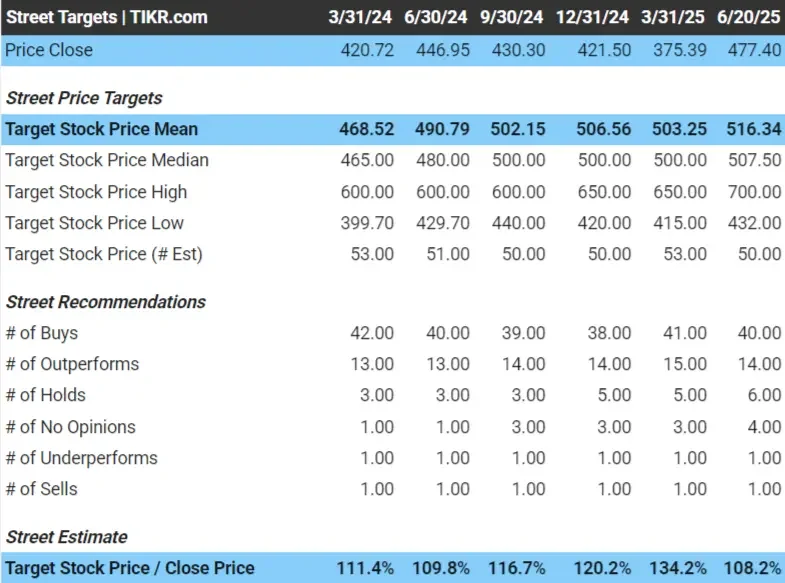

In the near term, Wall Street sees a small amount of upside for the stock. It’s important to keep in mind that Microsoft will likely continue to be a long-term compounder, so it doesn’t necessarily need to be undervalued to be a good long-term holding.

Analysts have an average price target of ~$516/share, which means they see about 8% upside for the stock:

See analysts’ growth forecasts and price target for Microsoft (It’s free!) >>>

Risks to Consider

Despite the strong outlook, investors should be aware of several risks that could affect Microsoft’s growth and valuation:

- AI Monetization Risk: Microsoft is investing heavily in AI through Copilot and Azure. If adoption is slower than expected or monetization falls short, it could weigh on future earnings growth.

- Regulatory Pressure: As one of the world’s largest tech companies, Microsoft faces ongoing antitrust scrutiny in both the U.S. and Europe. Regulatory changes could limit acquisitions or impact business practices.

- Cloud Competition: Azure continues to grow, but it faces stiff competition from AWS and Google Cloud. Slowing growth or pricing pressure in the cloud segment could impact Microsoft’s top line.

- Valuation Sensitivity: Microsoft trades at a premium relative to most large-cap peers. If growth expectations are not met, even a modest decline in its P/E multiple could compress returns.

TIKR Takeaway

Microsoft is a rare mix of scale, profitability, and long-term growth, and TIKR’s Valuation Model shows it still has room to run.

If the company keeps executing, investors could see 13%+ annual returns over the next couple years without needing any multiple expansion.

Is Microsoft stock a buy over the next 24 months? Use TIKR’s Valuation Model alongside analysts’ growth forecasts and price targets to see if it is undervalued today.

Value any stock with TIKR’s Valuation Models (It’s free!) >>>

Want to Invest Like Warren Buffett, Joel Greenblatt, or Peter Lynch?

TIKR just published a special report breaking down 5 powerful stock screeners inspired by the exact strategies used by the world’s greatest investors.

In this report, you’ll discover:

- A Buffett-style screener for finding wide-moat compounders at fair prices

- Joel Greenblatt’s formula for high-return, low-risk stocks

- A Peter Lynch-inspired tool to surface fast-growing small caps before Wall Street catches on

Each screener is fully customizable on TIKR, so you can apply legendary investing strategies instantly. Whether you’re looking for long-term compounders or overlooked value plays, these screeners will save you hours and sharpen your edge.

This is your shortcut to proven investing frameworks, backed by real performance data.

Click here to sign up for TIKR and get this full report now, completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!