Key Stats for META Stock

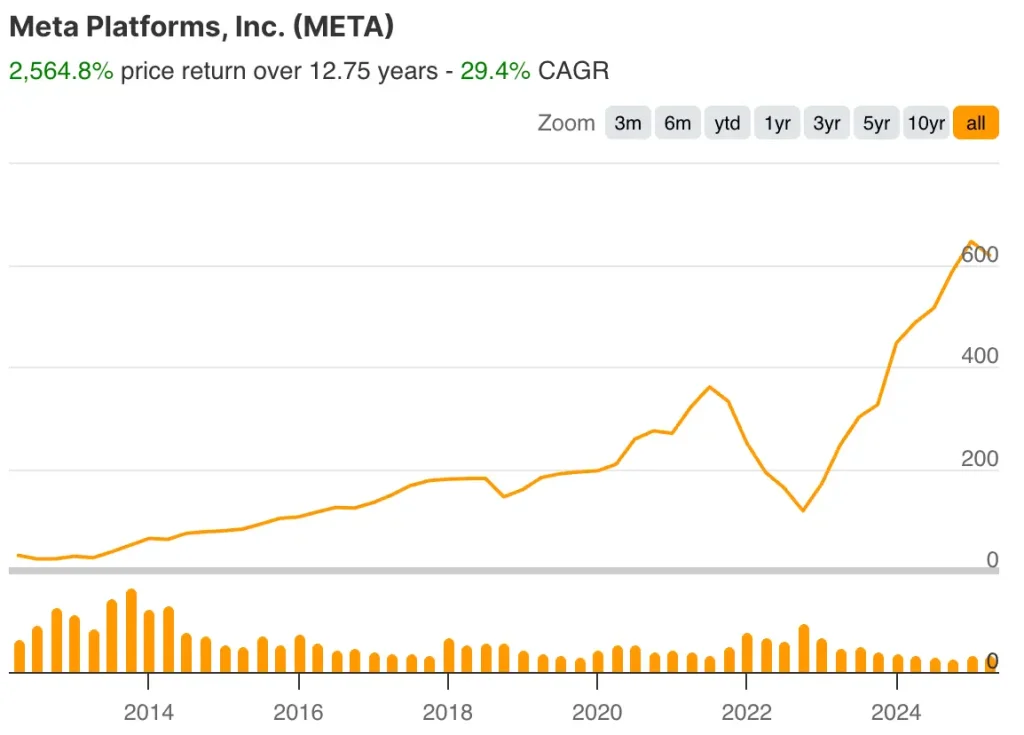

- Price Change Since IPO for Meta stock: 2,565%

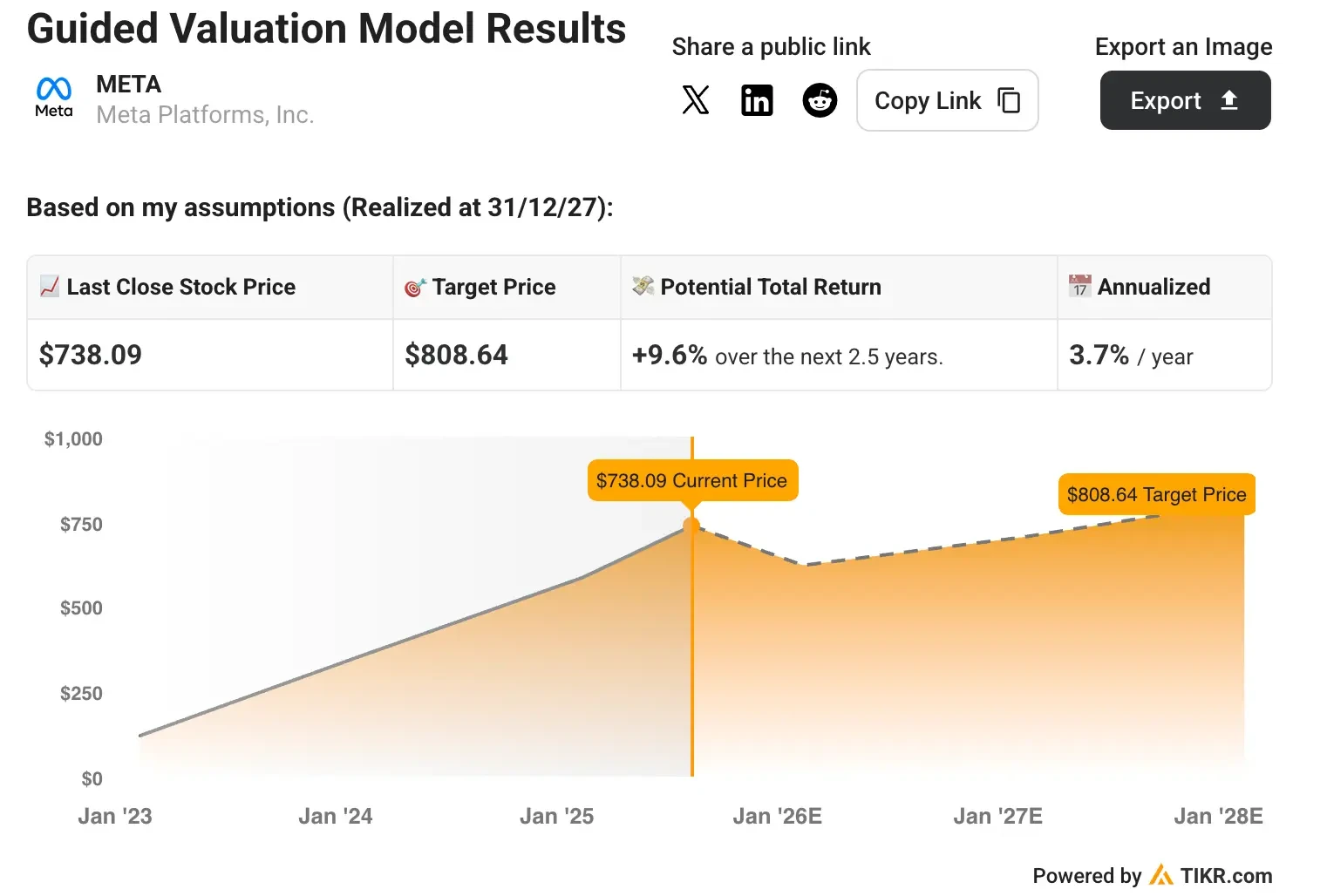

- Current Share Price: $738

- 52-Week High: $747

- META Stock Price Target: $729

What Happened?

Meta (META) stock soared to a record high on Monday, driven by investor excitement over CEO Mark Zuckerberg’s aggressive push into artificial intelligence through massive talent acquisition and the formation of a new “superintelligence” division.

The surge in META stock, which is up over 2,400% since its IPO, reflects growing confidence in Meta’s ability to compete with AI leaders like OpenAI and Google in the race toward artificial general intelligence.

The rally comes as Zuckerberg unveiled Meta Superintelligence Labs (MSL), a new internal organization that consolidates the company’s AI foundation models, products, and research teams under a unified structure.

Leading this initiative is newly hired Chief AI Officer Alexandr Wang, the former CEO of Scale AI, whom Meta acquired for $14.3 billion along with several of his colleagues.

Meta’s hiring spree has been nothing short of extraordinary, with reports indicating that it is offering signing bonuses of up to $100 million to top AI researchers.

The social media giant has successfully poached key talent from rivals, including OpenAI, Google’s DeepMind, and Anthropic. Notable new hires include former OpenAI researchers who contributed to the creation of the O-series models, GPT-4’s voice capabilities, and ChatGPT itself.

The aggressive recruitment strategy has drawn criticism from OpenAI CEO Sam Altman, who called Meta’s compensation packages “crazy” and questioned whether such massive upfront payments would build a strong culture.

However, Meta’s approach appears to be working, with the company assembling what many consider one of the most impressive AI research teams in the industry.

Try TIKR’s Valuation Model today for FREE (It’s the easiest way to find undervalued stocks) >>>

Meta’s AI ambitions extend beyond talent acquisition. Its Llama models now power Meta AI, which has over 1 billion monthly active users across Meta’s apps.

The new superintelligence lab will focus on developing next-generation models to compete at the forefront of AI capabilities, with plans for Llama 4.1 and 4.2 already underway.

What the Market Is Telling Us About META Stock

The record-high META stock price signals investor belief that Meta’s massive AI investments will pay off in the long term. Unlike some tech companies that are cutting costs, Meta is doubling down on AI research and development, viewing superintelligence as the next transformative computing platform.

Zuckerberg’s hands-on approach to recruitment, personally reaching out to candidates and maintaining a “secret list” of top AI talent, demonstrates the strategic importance he places on this initiative.

The formation of MSL creates a focused organization that can compete directly with dedicated AI companies while leveraging Meta’s massive user base and financial resources.

The market is responding positively to Meta’s unique positioning in the AI race. Unlike pure-play AI companies, Meta has an established business model that generates substantial cash flow to fund its expensive AI research.

Its experience building products for billions of users gives it advantages in deploying AI at scale. Meta joins Microsoft and Nvidia among tech megacaps reaching new highs, reflecting broader investor enthusiasm for companies leading the AI revolution.

The stock’s performance suggests investors believe Meta’s combination of talent acquisition, financial resources, and product distribution channels positions it well to capture value from the AI transformation.

Want to Invest Like Warren Buffett, Joel Greenblatt, or Peter Lynch?

TIKR just published a special report breaking down 5 powerful stock screeners inspired by the exact strategies used by the world’s greatest investors.

In this report, you’ll discover:

- A Buffett-style screener for finding wide-moat compounders at fair prices

- Joel Greenblatt’s formula for high-return, low-risk stocks

- A Peter Lynch-inspired tool to surface fast-growing small caps before Wall Street catches on

Each screener is fully customizable on TIKR, so you can apply legendary investing strategies instantly. Whether you’re looking for long-term compounders or overlooked value plays, these screeners will save you hours and sharpen your edge.

This is your shortcut to proven investing frameworks, backed by real performance data.

Click here to sign up for TIKR and get this full report now, completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!