Key Stats for BWA Stock

- Price Change for BWA stock: +22.45%

- BWA Share Price as of Feb. 11: $66.10

- 52-Week High: $68.82

- BWA Stock Price Target: $50.54

Now Live: Discover how much upside your favorite stocks could have using TIKR’s new Valuation Model (It’s free)>>>

What Happened?

BorgWarner (BWA) stock has surged to new highs in 2026 as investors reacted to a combination of strong earnings execution and improving sentiment around the company’s electrification strategy.

The stock is up more than 50% year to date, and it recently hit a new high near $66, significantly outperforming the broader auto components sector.

The rally followed multiple quarterly earnings beats, particularly at the EBITDA and adjusted EPS levels. In the most recent quarter, BorgWarner delivered adjusted EPS of $1.24, beating consensus estimates by over 5%. EBITDA also exceeded expectations by more than 10%, reflecting disciplined cost control and margin resilience.

Investors have also responded positively to BorgWarner’s steady revenue base. The company generated $14.2 billion in trailing twelve-month revenue, and analysts expect revenue to remain relatively stable near $14.4 billion over the next year.

At the same time, BorgWarner continues to secure new contracts tied to hybrid and electric vehicle platforms. Recent announcements include turbocharger and electrification-related supply agreements with major North American and European OEMs, reinforcing the company’s long-term positioning.

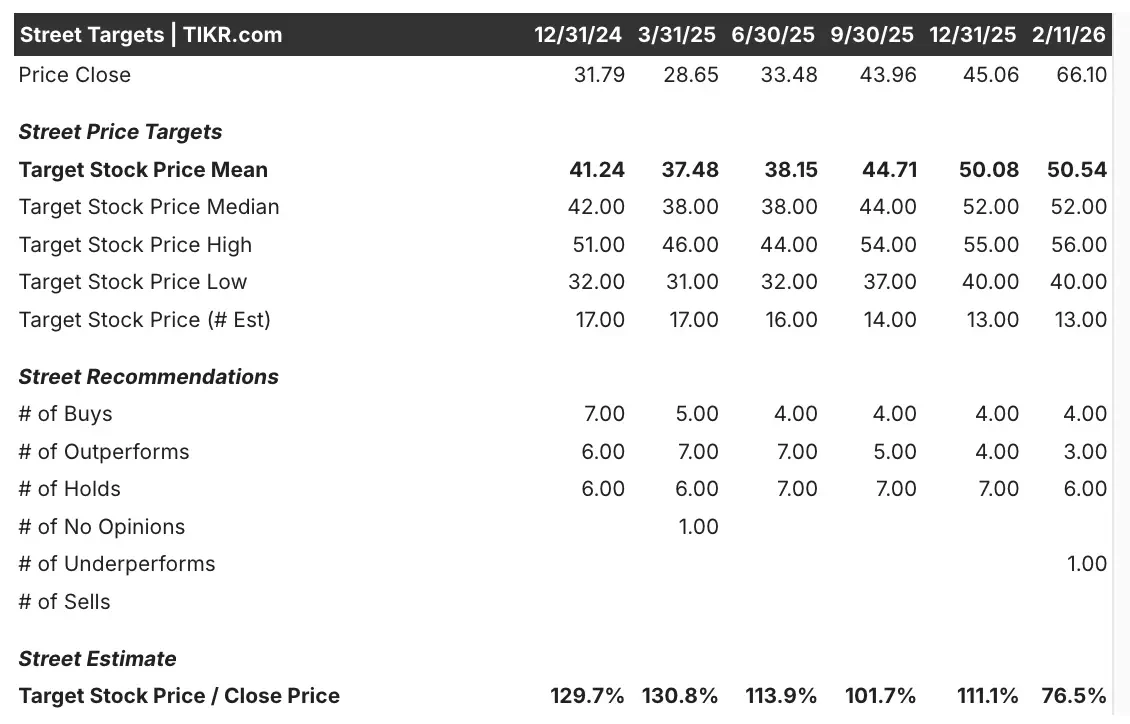

According to analyst Street Targets, BorgWarner’s average price target is about $51, with estimates ranging from $40 on the low end to $56 on the high end.

At today’s price near $66, the stock is trading well above the current consensus target. The target-to-price ratio has declined to about 77%, signaling that much of the near-term optimism may already be reflected in the share price.

See analysts’ growth forecasts and price targets for BWA stock (It’s free!) >>>

What the Market Is Telling Us About BWA Stock

The market’s reaction suggests confidence in BorgWarner’s operational execution, but also growing caution on valuation.

BorgWarner’s operating margin sits near 9%, and gross margins remain stable around 18%. While margins are not expanding aggressively, consistency has helped support earnings visibility.

From a balance sheet perspective, BorgWarner maintains a solid capital structure. The company holds over $2.1 billion in cash and short-term investments, while long-term debt stands at roughly $3.9 billion. Free cash flow remains positive, with nearly $1 billion generated on a trailing basis.

BorgWarner also continues to return capital to shareholders. The company pays a dividend yielding about 1% and has been active with share repurchases, buying back more than $200 million of stock over the past year.

However, valuation multiples have expanded meaningfully. BorgWarner now trades near 13x forward earnings and about 6x forward EBITDA, which is elevated relative to its own recent history.

Headwinds remain as well. Auto production volatility, EV adoption pacing, and pricing pressure from OEMs could weigh on margins if demand softens.

Estimate a company’s fair value instantly (Free with TIKR) >>>

How Much Upside Does BWA Stock Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

See a stock’s true value in under 60 seconds (Free with TIKR) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!