Key Stats for FSLY Stock

- Price Change for FSLY stock: +72%

- FSLY Share Price as of Feb. 13: $19.04

- 52-Week High: $17.86

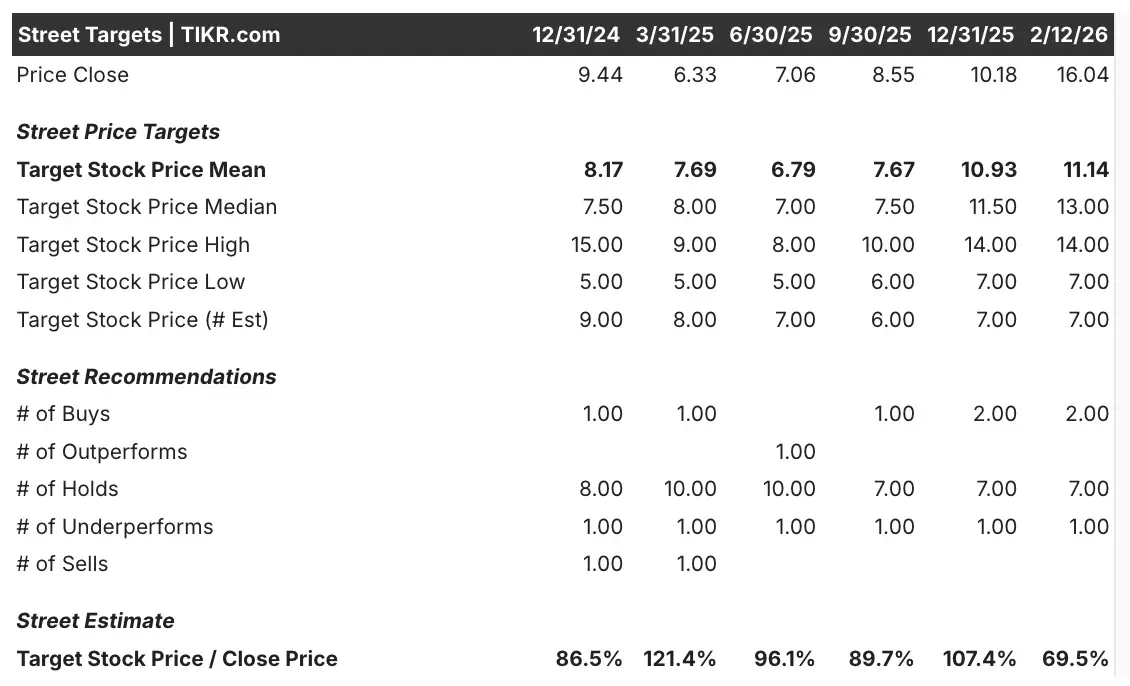

- FSLY Stock Price Target: $11.14

Now Live: Discover how much upside your favorite stocks could have using TIKR’s new Valuation Model (It’s free)>>>

What Happened?

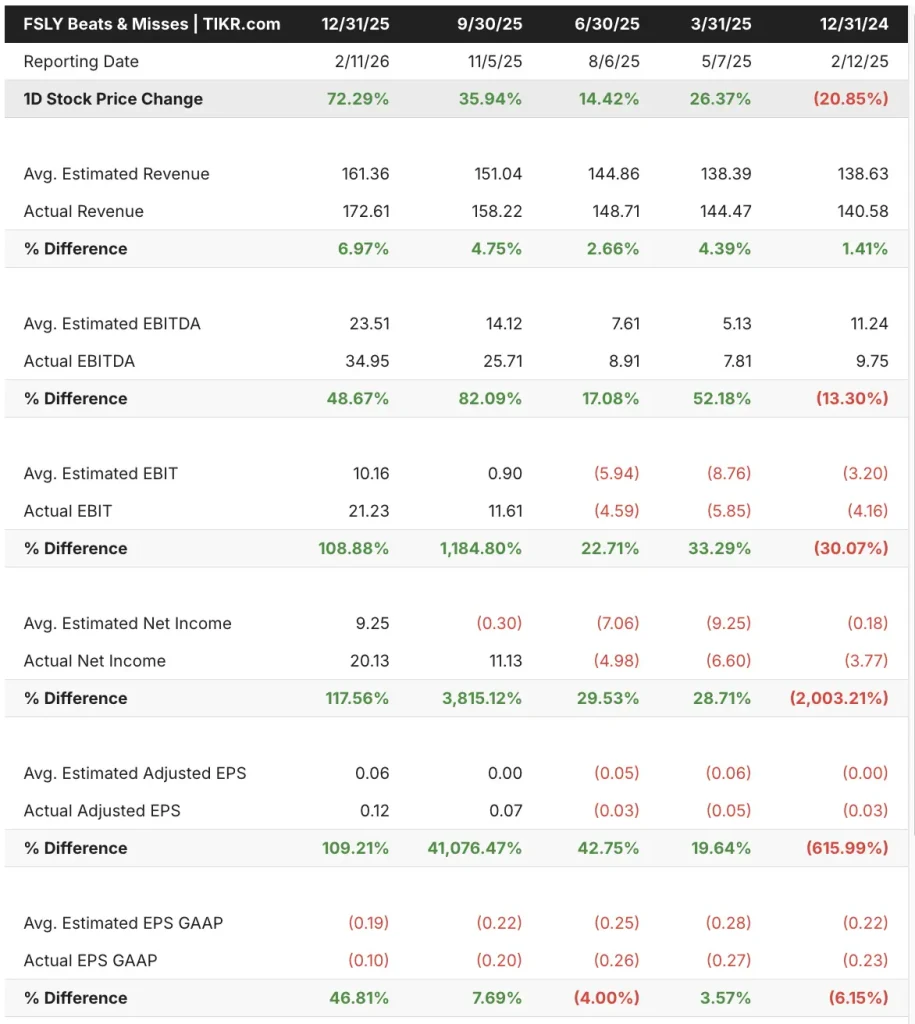

Fastly (FSLY) stock surged 72% in a single trading session after the company reported fourth-quarter earnings for the period ended Dec. 31, 2025, which significantly exceeded market expectations.

The earnings report showed stronger-than-expected revenue, alongside a sharp improvement in profitability metrics, which marked a clear inflection from the margin pressure that weighed on the stock over the past several years.

Adjusted EBITDA came in well ahead of estimates, and operating leverage improved meaningfully as Fastly benefited from tighter cost controls and higher utilization across its network infrastructure.

Investors reacted strongly because the results suggested Fastly’s multi-year restructuring and efficiency initiatives are beginning to translate into tangible financial outcomes. The magnitude of the move reflects how under-owned and pessimistically positioned the stock had become ahead of the earnings release.

The rally immediately pushed Fastly shares to their highest levels in more than a year, and trading volume spiked well above normal levels, signaling broad participation rather than isolated short covering.

See analysts’ growth forecasts and price targets for FSLY stock (It’s free!) >>>

What the Market Is Telling Us About FSLY Stock

The sharp rally indicates that investors are reassessing Fastly’s near-term outlook after a prolonged period of skepticism around its business model and competitive positioning.

In the weeks following the earnings release, Fastly shares have largely held their gains, suggesting that the move was not purely reactive but instead reflects a reassessment of the company’s earnings power.

Sustained price strength after such a large single-day move often indicates that new buyers are stepping in, rather than early traders immediately exiting positions. That said, analyst sentiment remains cautious, as reflected in price targets that still sit well below the current share price.

This disconnect highlights an ongoing debate about whether Fastly’s improved margins can be sustained in a highly competitive edge computing and content delivery market. Fastly has made progress expanding gross margins and narrowing operating losses, but the company continues to face pricing pressure from larger competitors with deeper balance sheets.

As a result, the market appears willing to reward near-term execution improvements, while remaining hesitant to price in aggressive long-term growth assumptions.

Estimate a company’s fair value instantly (Free with TIKR) >>>

How Much Upside Does FSLY Stock Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

See a stock’s true value in under 60 seconds (Free with TIKR) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!