Key Takeaways:

- Applied Materials currently offers a 1% dividend yield, which is significant for a dividend growth stock.

- Earnings and dividends are projected to grow around 7-10% annually through 2027.

- Analysts see nearly 20% upside for the stock, driven by strong demand across the semiconductor industry.

- Get accurate financial data on over 100,000 global stocks for free on TIKR >>>

Applied Materials makes the machines that power the chip industry, but it’s also been quietly growing its dividend.

From AI to advanced chip packaging, Applied Materials plays a key role in shaping modern technology. With strong financials and exposure to major long-term trends, the stock could be a solid choice for investors with a long-term view.

Why Is AMAT Stock Down 20% This Year?

Here are some of the factors that have led to Applied Materials stock falling 20% this year:

- Geopolitical Tensions and Export Restrictions: U.S. export controls on advanced chipmaking equipment to China have hurt Applied Materials, which gets a large portion of its revenue from Chinese customers. These restrictions are expected to cut $400 million from 2025 sales, with more impact coming in Q2.

- Semiconductor Industry Downcycle: The chip industry has entered a cyclical slowdown, especially in memory segments like DRAM and NAND. This has led to weaker demand for the tools Applied Materials sells.

- Analyst Downgrades and Valuation Pressure: Barclays and other analysts have cut price targets for AMAT due to revenue risks from tariffs and trade headwinds. Investors are also concerned the stock may be overvalued relative to its forward growth potential.

These factors have led to the stock looking undervalued today.

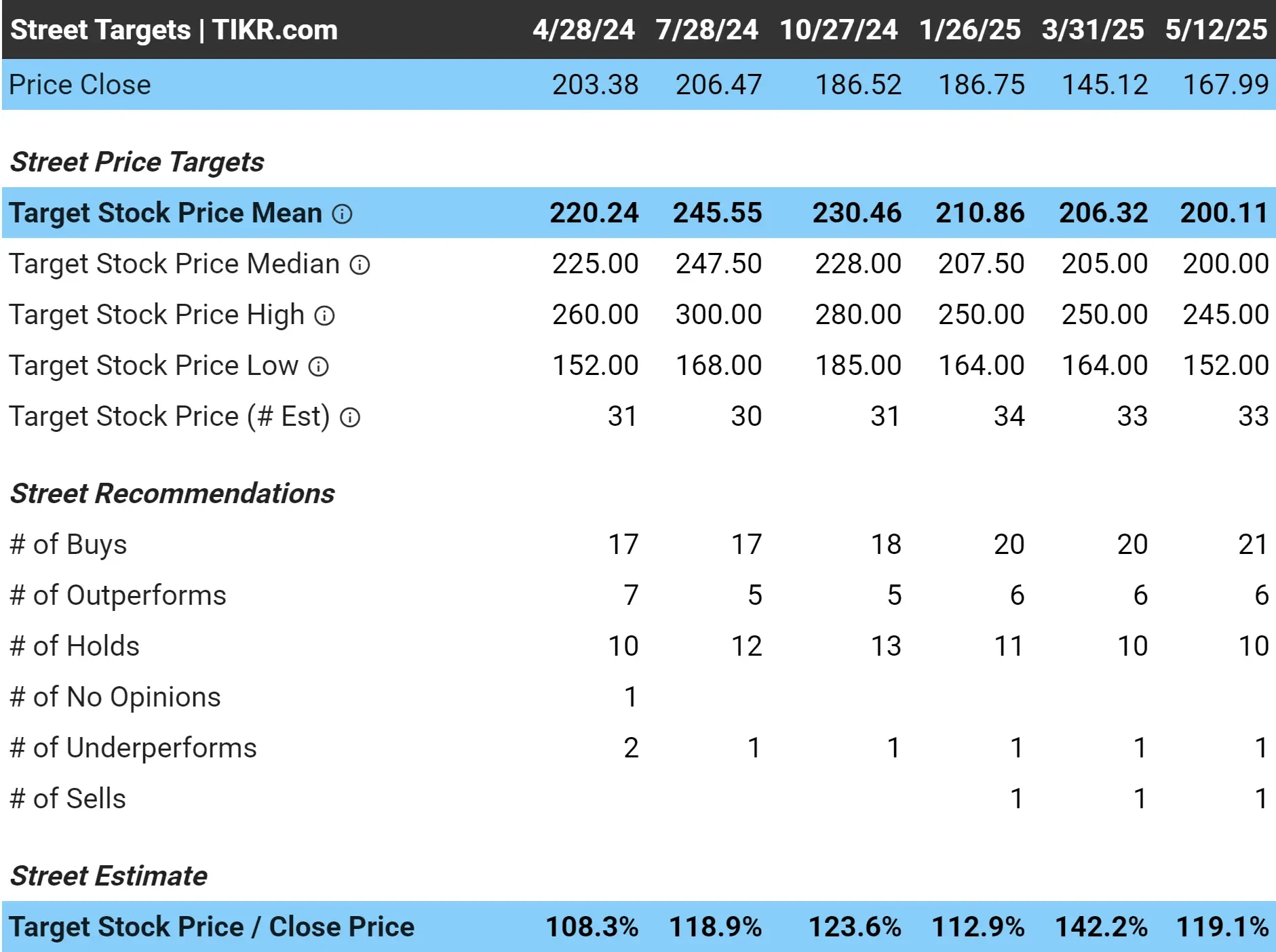

Analysts Think the Stock Has About 20% Upside

Wall Street analysts currently have an average price target of $200/share for Applied Materials, which implies that the stock has 19% upside today since it’s trading around $168/share today.

With 21 “Buy” ratings among 39 analysts, Wall Street is overwhelmingly bullish on AMAT today. The stock’s upside is driven by strong earnings power, a healthy chip equipment cycle, and sustained AI infrastructure demand.

See why AMAT looks undervalued today with TIKR (It’s free) >>>

1: Dividend Yield

Applied Materials’ dividend yield currently stands at about 1%. That might not jump off the page, but it’s actually higher than its 5-year average yield of 0.9%, which suggests that the stock could be a touch undervalued today.

Applied Materials is a long-term dividend growth stock, with analysts expecting earnings and dividends to continue growing for years to come.

Find dividend stocks that are even better than Applied Materials today with TIKR. (It’s free) >>>

2: Dividend Safety

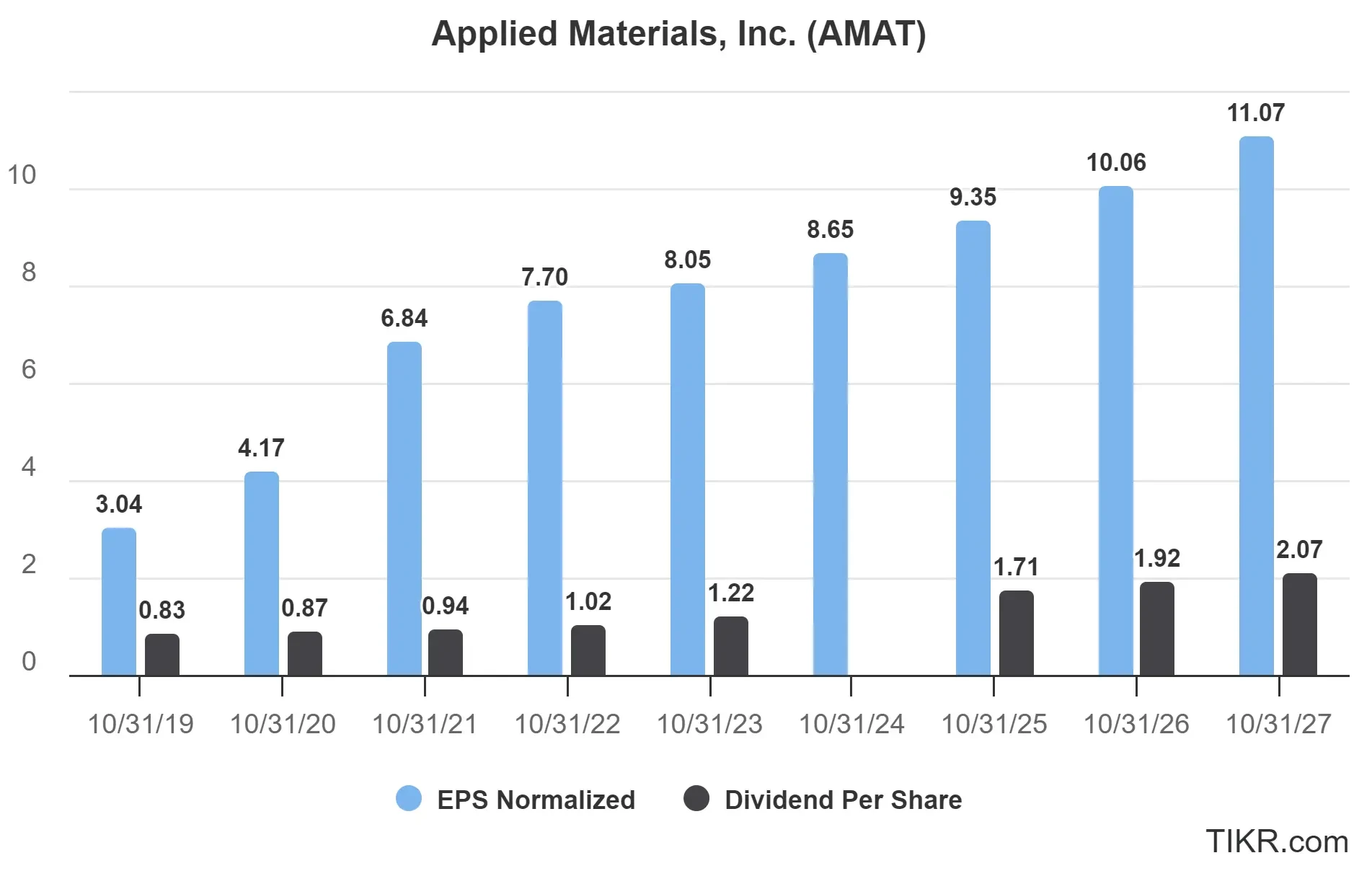

As of the end of Applied Materials’ fiscal year-end 2024, the stock had a dividend payout ratio of just under 18%, based on normalized EPS of $8.65 and dividends per share of $1.52.

(Applied Materials paid $1.52/share in dividends in 2024, even though the chart below doesn’t show it.)

That’s an extremely low payout ratio, which gives AMAT a lot of flexibility. This means that the company can easily cover dividends while still reinvesting in R&D, buying back shares, or navigating down cycles.

Analysts expect EPS to grow from $8.65 in 2024 to over $11.00 by 2027, while dividends are projected to rise to $2.07. That keeps the payout ratio comfortably low and supports dividend stability and growth.

See Applied Materials’ full growth forecast and analyst estimates. (It’s free) >>>

3: Dividend Growth Potential

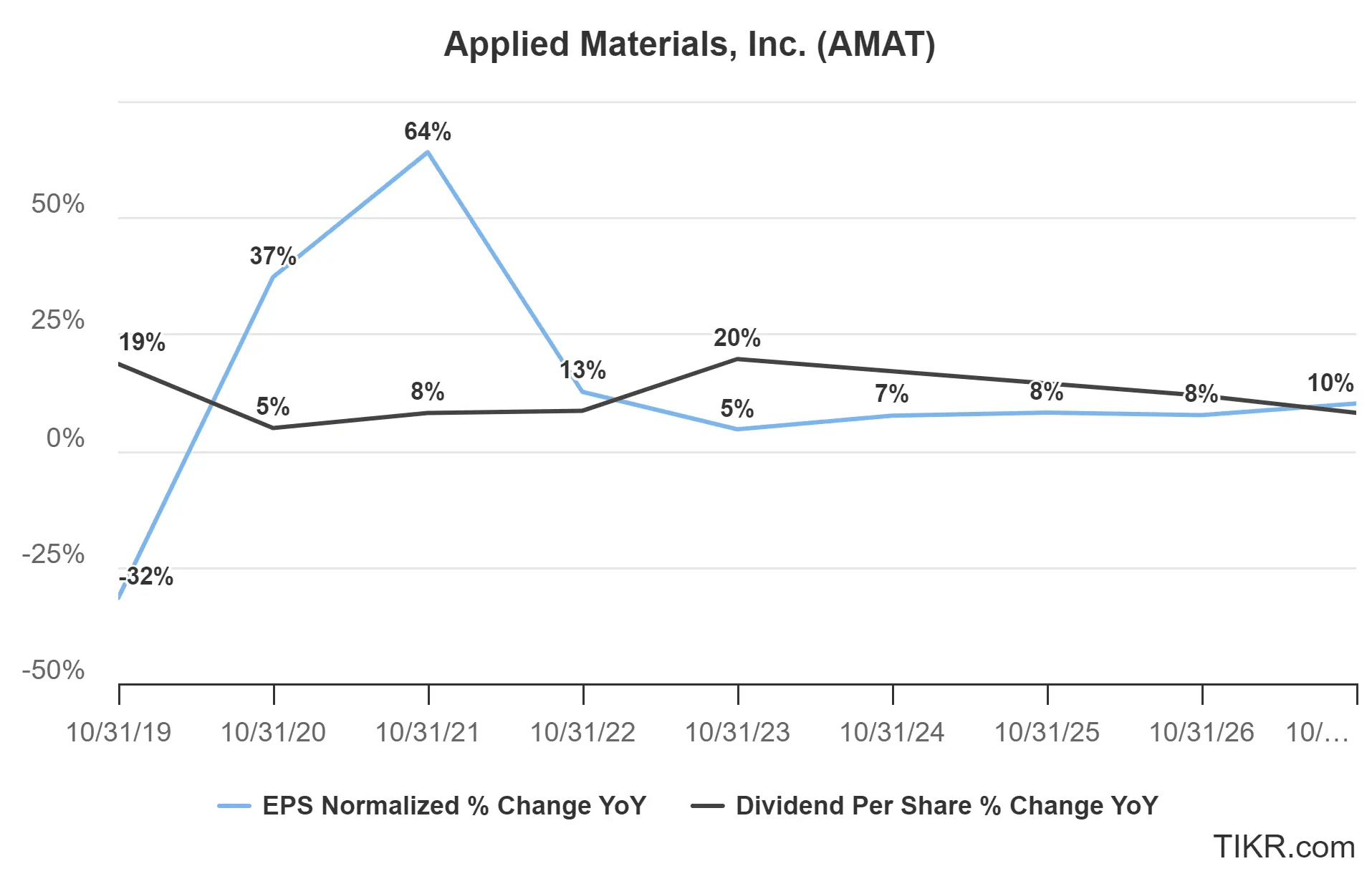

Applied Materials has built a solid track record of dividend growth.

Since 2018, the company has steadily increased its dividends per share every year, even during periods of earnings volatility. While EPS growth has fluctuated more sharply, ranging from a 64 percent jump in 2021 to more moderate gains in recent years, dividend growth has remained consistent.

Analysts expect AMAT to continue growing both earnings and dividends at around 7-10% annually through 2027. This high-single-digits growth is actually rather significant and can drive compounding returns over time.

TIKR Takeaway

Applied Materials isn’t a traditional dividend stock, but it has all the right ingredients for long-term success.

AMAT could be a compelling dividend growth stock. Analysts forecast annual earnings and dividends to grow in the high single digits through 2027, and the stock currently offers a potential 20% upside based on analysts’ average price target of around $200/share.

For investors looking for a dependable dividend from a company tied to long-term tech trends like AI and semiconductor expansion, $AMAT might be worth a closer look today.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks and was built for investors who think of buying stocks as buying a piece of a business.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!