Key Takeaways:

- AES stock currently offers a 6.1% dividend yield, well above its long-term average, making it one of the more attractive income opportunities in the utility sector.

- Despite the high yield, the dividend looks well-covered with a sub-40% payout ratio and earnings projected to grow steadily over the next three years.

- If the stock re-rates to a higher valuation as investor sentiment improves, analysts believe AES could deliver 12%+ annual returns through 2027, on top of its already generous income stream.

- Unlock our Free Report: 5 undervalued compounders with upside based on Wall Street’s growth estimates that could deliver market-beating returns (Sign up for TIKR, it’s free) >>>

AES is a global energy company focused on generating and distributing electricity across the Americas, with a growing portfolio of renewable energy sources, including wind, solar, and battery storage. It operates through long-term contracts that provide steady cash flows, which help support a reliable dividend.

But with the stock down more than 50% since 2022, many investors have written it off. Concerns around rising interest rates, renewable project delays, and debt have weighed heavily on the share price.

Yet underneath the surface, the business is still growing and paying high dividends. The dividend has been raised 12 years in a row, earnings are climbing, and the stock now yields over 6%. For investors looking past short-term noise, AES may be one of the more interesting high-yield income plays in the market today.

Analysts Think AES Stock Is Undervalued With Room to Grow

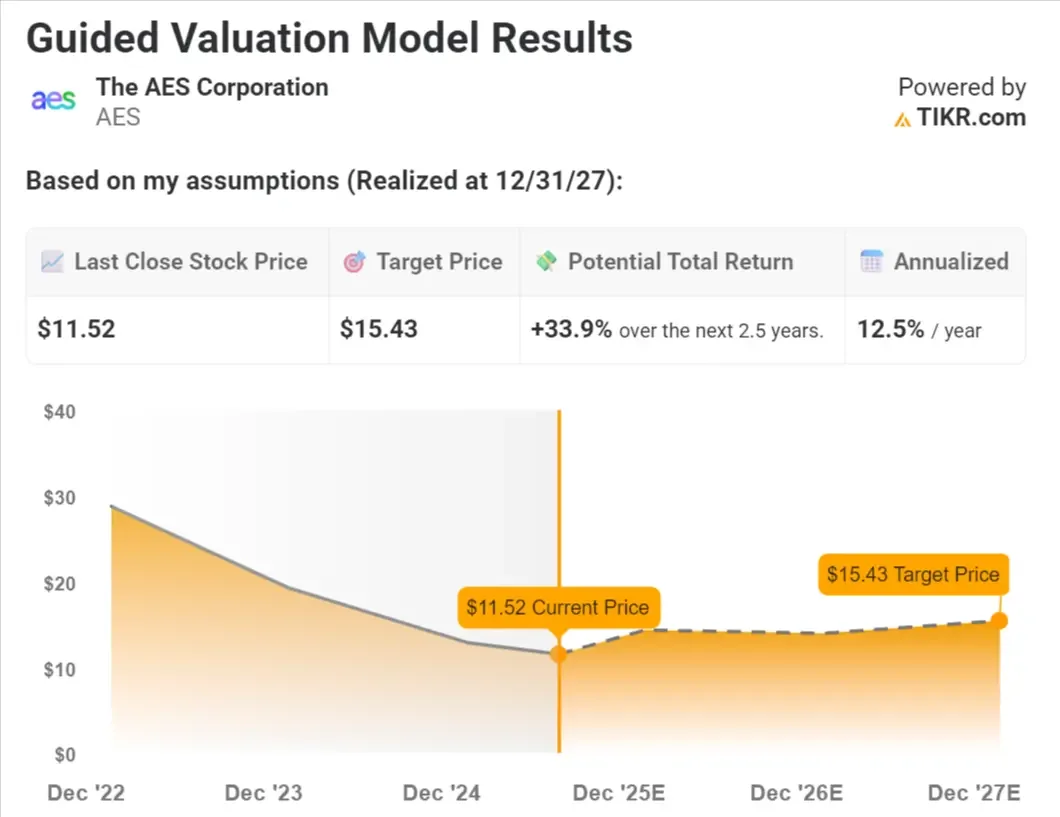

AES stock currently trades at around $11.50, while a base-case valuation based on analysts’ estimates suggests the stock could be worth $15.43 by the end of 2027.

That implies potential total returns of 33.9% over the next 2.5 years, or 12.5% annually, based on earnings growth and modest multiple expansion.

If AES executes well and delivers stronger-than-expected profit growth, the stock could climb higher than the base-case target, especially if investor sentiment improves toward utilities.

With a dividend yield above 6% and upside potential based on valuation, AES looks like a rare opportunity for both dividend income and appreciation.

Value any stock in less than 60 seconds with TIKR (It’s free) >>>

AES’s Dividend Yield Has Surged to Multiyear Highs

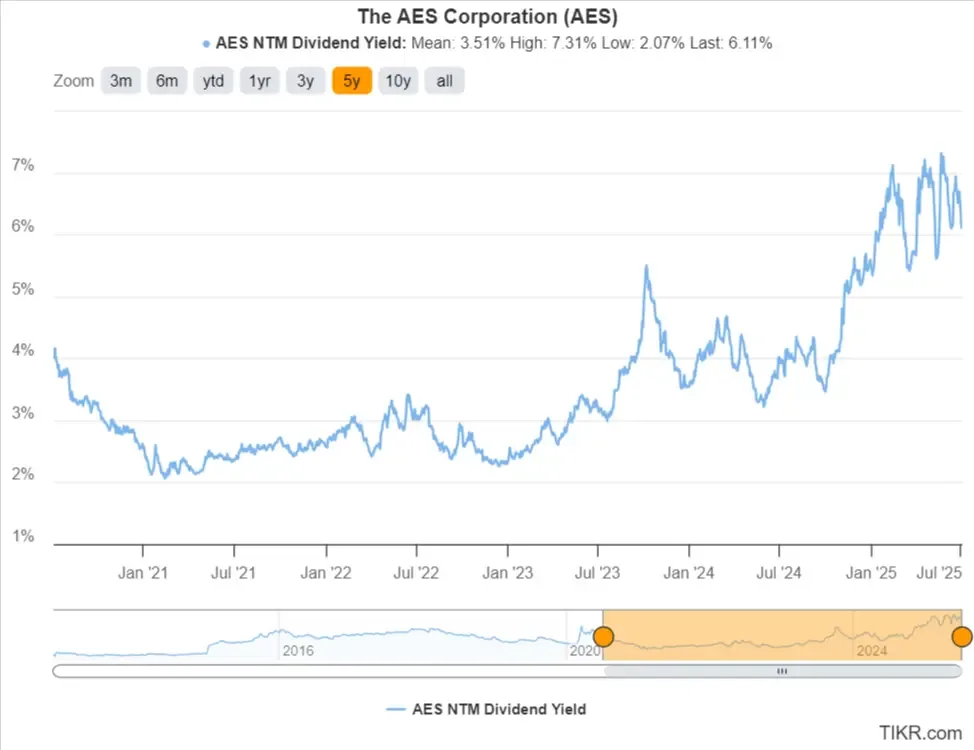

AES’s dividend yield has spiked to around 6.1%, one of the highest levels the stock has offered in over a decade.

That’s nearly double its 5-year average yield of 3.5% and significantly above the low end of its historical range near 2.1%. Yield levels this elevated have historically marked attractive entry points for long-term investors.

The recent spike in yield is the result of the stock price dropping while the company has grown its dividend. That combination makes today’s yield especially attractive for income-focused investors.

AES shares have fallen by more than 50% since early 2022 because investors grew concerned about rising interest rates, renewable energy delays, and AES’s debt levels following large-scale investments in clean energy infrastructure.

Find high-quality dividend stocks that look even better than AES today. (It’s free) >>>

AES Dividend Looks Sustainable Thanks to Rising Profits

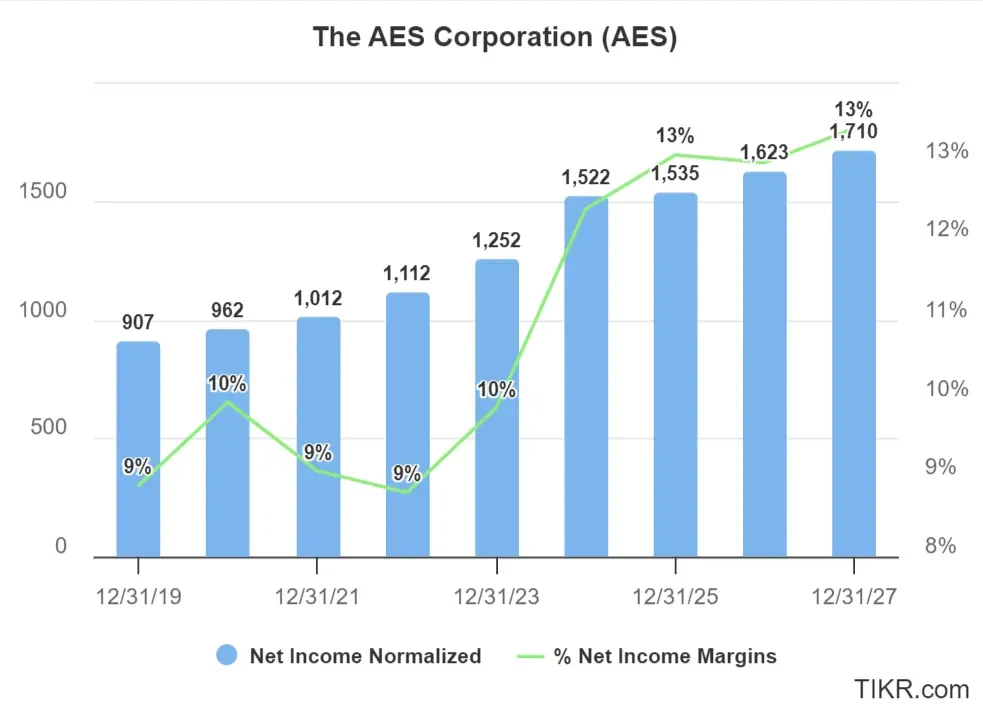

AES is expected to earn $1.52 billion in normalized net income in 2024, with steady expected growth to over $1.71 billion by 2027. Profit margins are also expanding, with net income margins expected to increase to 13% over the next several years.

Despite the stock’s high yield, AES maintains a payout ratio under 40%, leaving plenty of room to sustain and even grow its dividend. The company has raised its dividend for 12 consecutive years and has shown a clear commitment to rewarding shareholders.

With rising profits, expanding margins, and a conservative payout policy, AES’s dividend looks well-supported for the long term.

See AES Corporation’s full growth forecast and analyst estimates. (It’s free) >>>

TIKR Takeaway

AES combines the financial stability of a traditional utility with the long-term upside of a clean energy transition. Its high yield is backed by a reasonable payout ratio, consistent dividend growth, and reliable long-term contracts.

If earnings keep growing and the stock rebounds from depressed levels, AES could reward investors with both dividend income and price appreciation.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks and was built for investors who think of buying stocks as buying a piece of a business.

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!