Key Stats for GE Vernova Stock

- Price Change for GE Vernova stock: 200%

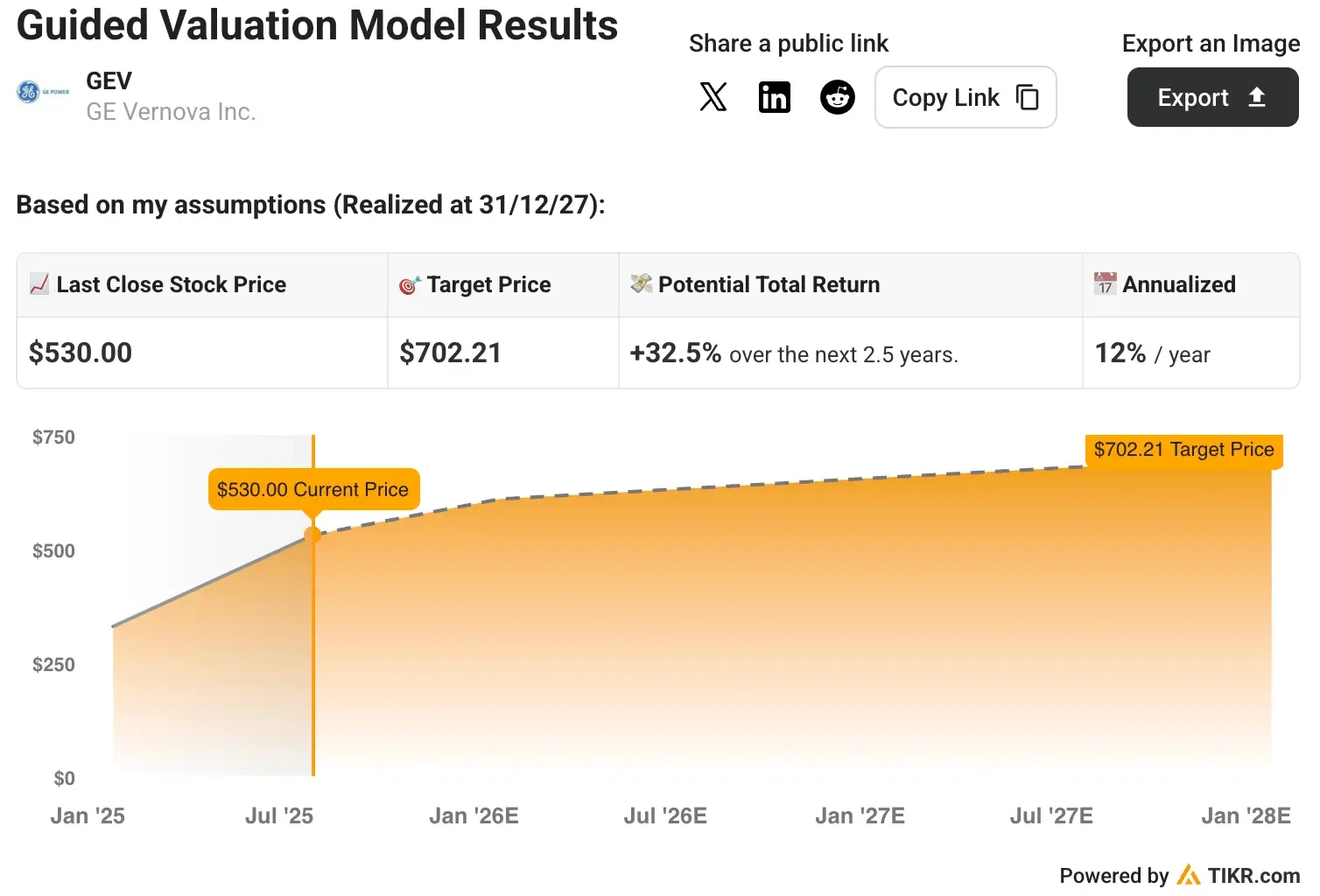

- Current Share Price: $530

- 52-Week High: $537

- GEV Stock Price Target: $474

What Happened?

GE Vernova (GEV) stock continues its remarkable surge in 2025 as the company capitalizes on unprecedented demand for gas-fired power generation driven by data center expansion and global electrification needs.

GEV stock has more than tripled over the past year, transforming from a spin-off story into one of Wall Street’s most compelling infrastructure plays.

Its exceptional performance stems from what CEO Scott Strazik calls a “very unique time” requiring massive electrical grid expansion not seen since the post-World War II era.

With over $123 billion in total backlog and gas turbine orders extending into 2029, GE Vernova is riding a wave of demand that combines data center power requirements, reindustrialization, and the transition from molecules to electrons across multiple sectors.

Value GE Vernova with TIKR’s Valuation Model today for FREE (It’s the easiest way to find undervalued stocks) >>>

What the Market Is Telling Us About GEV Stock

Wall Street’s bullish sentiment reflects GE Vernova’s strategic positioning at the center of multiple secular growth trends.

The company has nearly sold out its gas turbine capacity through 2027 and is actively filling 2028 slots while signing agreements for deliveries beyond 2028.

With 50 gigawatts of gas turbines under contract and expectations to ship over 10 gigawatts of equipment through the remaining quarters of fiscal 2025, GE Vernova is experiencing the kind of visibility that infrastructure investors prize.

The $14.2 billion Saudi Arabia deal announced following President Trump’s visit demonstrates how GE Vernova’s infrastructure exports can help address trade imbalances while securing long-term revenue streams.

As Strazik noted, “LNG needs to be consumed with something and a lot of times it’s going to be consumed with power generation equipment that we can ship out of Greenville, South Carolina.”

Notably, GEV is expanding manufacturing capacity from 15 gigawatts annually to 20 gigawatts by the third quarter of 2026, with services revenue representing a 2-3x lifetime opportunity for every turbine sold.

With roughly one-third of GE Vernova’s 21 gigawatt slot reservations intended for data center power supply, GEV is well-positioned to benefit from the AI-driven infrastructure buildout, which shows no signs of slowing.

The combination of strong pricing power, expanding margins (targeting 16%+ EBITDA by 2028), and $2-2.5 billion in expected free cash flow generation for fiscal 2025 creates a compelling investment narrative that has driven the meteoric rise in GEV stock.

See analysts’ growth forecasts and price targets for GEV stock (It’s free!) >>>

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!