Key Stats for LIF Stock

- Past-Week Performance: 21%

- 52-Week Range: $30 to $113

- Valuation Model Target Price: $87

- Implied Upside: 58% over 1.9 years

What Happened?

Life360 (LIF) stock rose about 21% during the fourth week of January, following an earnings-related reaction tied to preliminary full-year operating results.

The move was Life360’s preliminary 2025 update, projecting $486–$489 million revenue and record $95.8 million Q4 monthly active users.

The update mattered because Life360’s valuation is sensitive to revenue growth and subscriber conversion, mechanically driving an upward recalibration of expectations.

Importantly, there were no changes to guidance, demand trends, or the company’s long-term outlook for Life360.

The move reflects a recalibration of expectations rather than a deterioration in the underlying business.

Is LIF Stock Fairly Valued Right Now?

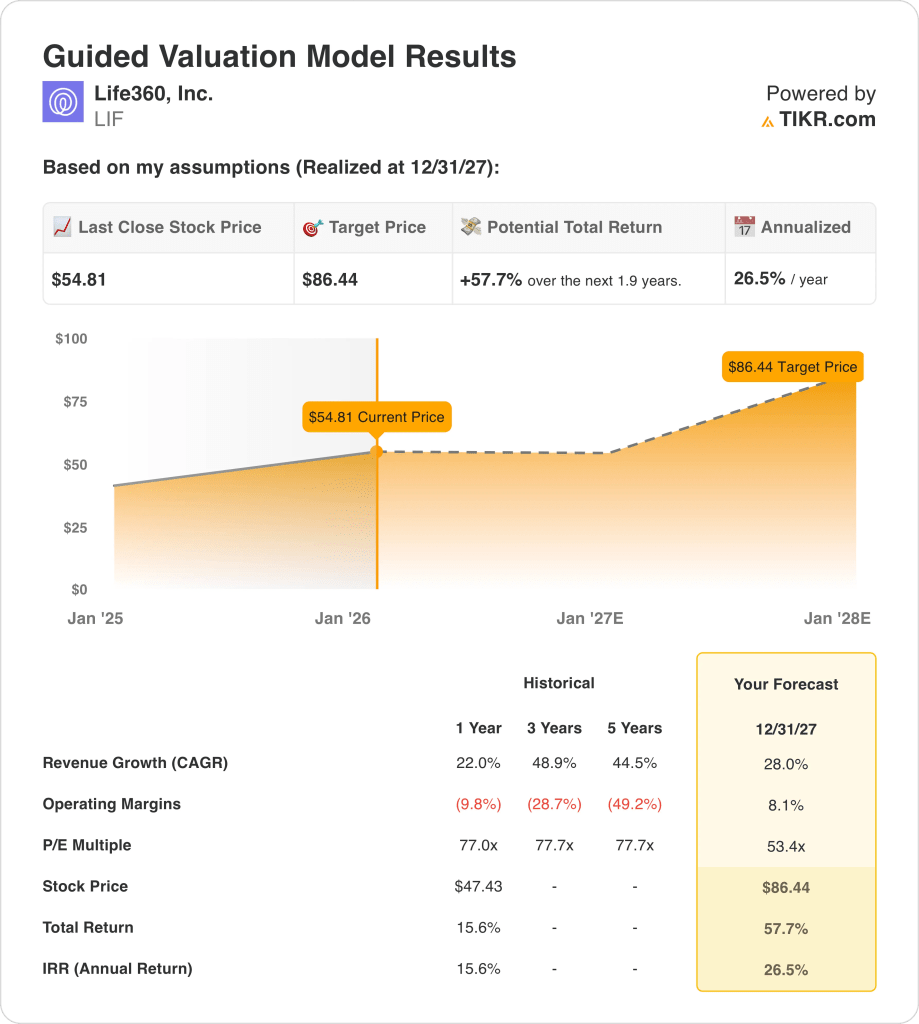

Under the valuation model shown, the stock is modeled using:

- Revenue Growth: 28%

- Operating Margins: 8.1%

- Exit P/E Multiple: 53.4x

Under the valuation model realized through 2027, Life360’s outcome depends on revenue growth, margin expansion, and exit multiple assumptions holding.

The model assumes 28% revenue CAGR, 8.1% operating margins, and a 53.4x exit P/E multiple by 2027.

Based on these inputs, the model estimates an $87 target price, implying 57.7% total upside and 26.5% annualized returns.

Execution requires sustained user growth, strong paid subscription conversion, operating leverage, and successful monetization across Life360’s expanding global user base.

Life360 stock valuation embeds execution risk tied to sustaining MAU growth, subscription conversion efficiency, and margin leverage, rather than assuming outsized multiple expansion.

Value Any Stock in Under 60 Seconds (It’s Free)

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.