Key Stats for PNC Stock

- Price Change: +3.8%

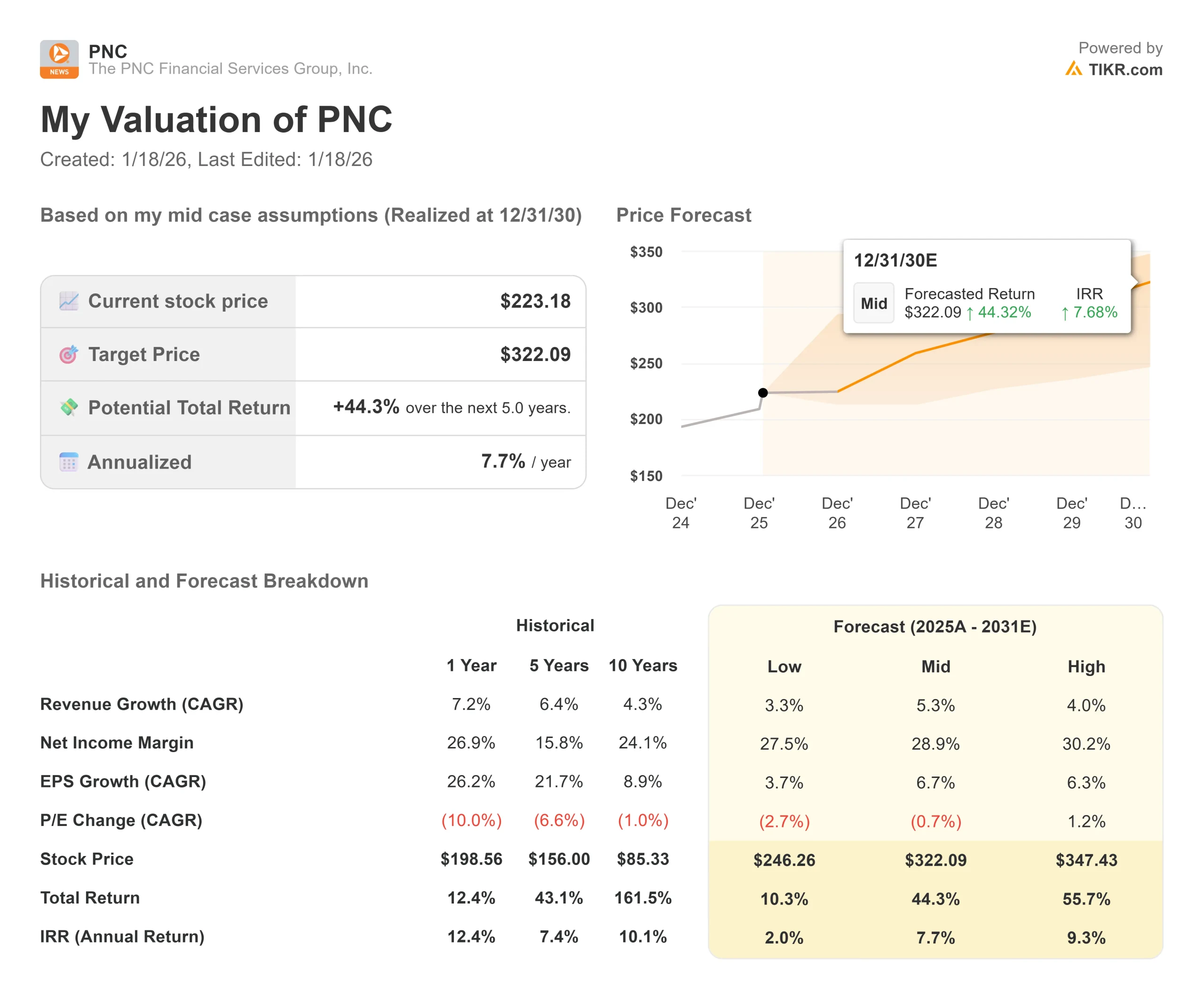

- Current Price: $223

- Advanced Model Price Target: $322

Want to know how much upside PNC could have in 2026? Run the numbers yourself on TIKR (It’s free) →

What Happened?

Shares of The PNC Financial Services Group (PNC) climbed nearly 4% on Friday, hitting $223 after delivering a “record-breaking” Q4 earnings report.

The bank reported record revenue of $6.1 billion, beating analyst estimates and signaling robust health in its core lending business.

CEO Bill Demchak called 2025 a “successful year,” highlighting that the bank achieved 21% EPS growth while successfully closing the FirstBank acquisition on January 5.

Consequently, investors are rotating into PNC as a “safe haven” play, favoring its steady profits and 21% earnings growth over the volatility seen in the tech sector.

Is PNC Undervalued Today?

While the stock is near 52-week highs, TIKR’s data suggests the market has not fully priced in the synergies from the FirstBank deal.

Management expects the acquisition to be accretive to earnings by $1.00 per share in 2027, creating a long-term tailwind for the stock.

According to TIKR’s Advanced Valuation Model, the stock still trades at a significant discount to its intrinsic value.

- Implied Fair Value: $322

- Current Price: $223

- Potential Upside: +44.3%

The model assumes PNC can maintain a 5.3% revenue CAGR while expanding margins to 28.9% as it integrates its new regional footprint.

If the bank successfully delivers on its post-merger cost savings, a move to $322 offers a compelling risk-to-reward ratio for conservative investors.

Estimate PNC’s fair value instantly (Free with TIKR) >>>

How Much Upside Does PNC Stock Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

See a stock’s true value in under 60 seconds (Free with TIKR) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!