Key Takeaways:

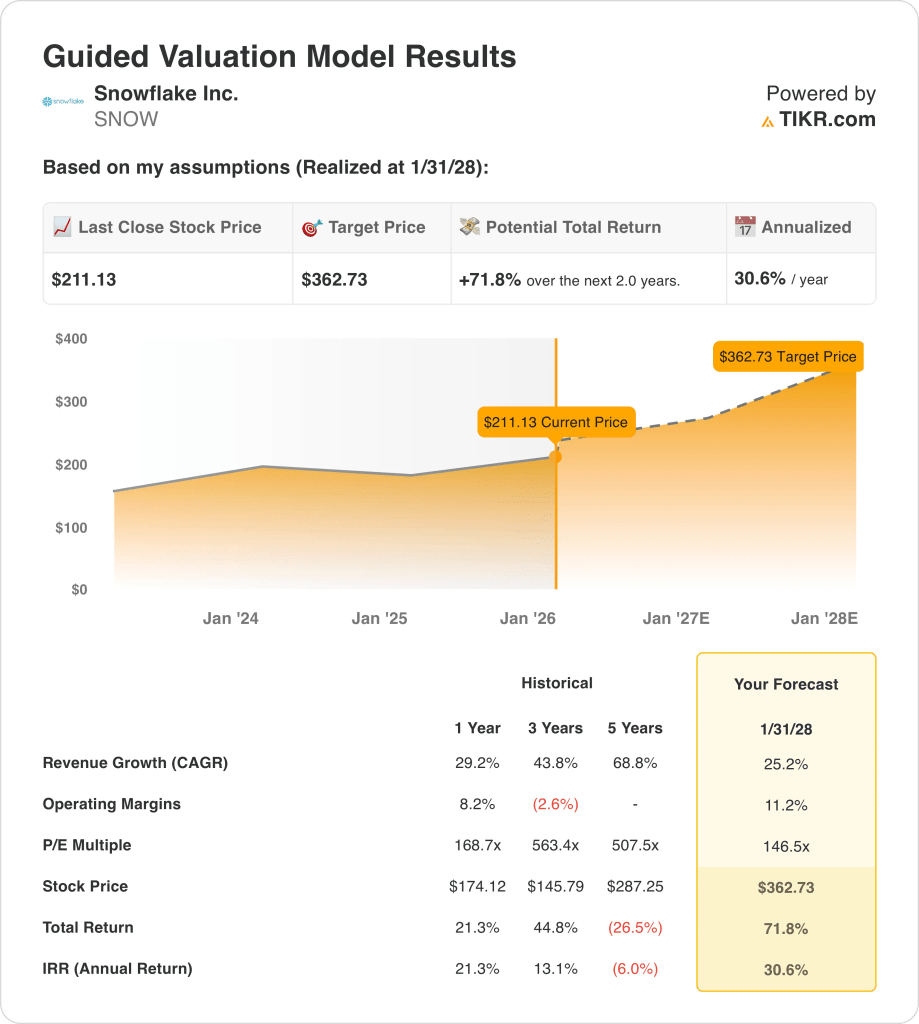

- Price Projection: Snowflake stock carries a modeled value of $363 by 2028 based on sustained growth and an exit multiple near 147x.

- Upside Potential: This target represents 72% total upside from the current price of $211 as revenue and margins expand.

- Annual Return: The valuation implies a 31% annualized return over the next 2 years driven by operating leverage.

- Growth Profile: Snowflake assumes 25% revenue growth and 11% operating margins, reflecting scale benefits from its AI Data Cloud platform.

Snowflake (SNOW) operates a cloud-based data platform generating $4 billion in trailing revenue, serving enterprises across analytics, AI, and application workloads.

In January 2026, Snowflake agreed to acquire Observe, expanding its platform into AI-powered observability for enterprise-scale data operations.

The company reported about $1 billion in quarterly revenue, confirming strong top-line momentum as profitability trends improve.

Snowflake stock operates near 11% margins and a roughly $70 billion market cap supported by high retention and usage-based expansion.

Despite strong growth and improving margins, valuation reflects elevated expectations, keeping focus on sustained execution.

What the Model Says for SNOW Stock

We evaluated Snowflake’s upside using operating scale, margin expansion, and enterprise AI positioning reflected in its guided valuation framework.

Assuming 25.2% revenue growth, 11.2% operating margins, and a 146.5x exit multiple, the model projects sustained earnings leverage.

That setup supports a $362.73 target price, implying a 71.8% total return and a 30.6% annualized return.

Our Valuation Assumptions

TIKR’s Valuation Model lets you plug in your own assumptions for a company’s revenue growth, operating margins, and P/E multiple, and calculates the stock’s expected returns.

Here’s what we used for SNOW stock:

1. Revenue Growth: 25.2%

Snowflake stock expanded trailing revenue to about $4 billion, sustaining growth above 25% as enterprise data workloads consolidated onto a single cloud platform.

Quarterly revenue near $1.2 billion grew 29% year over year, showing demand resilience despite cautious enterprise spending.

A 25.2% revenue growth balances strong AI adoption against normalization from prior hypergrowth, supporting a projected 30.6% annual return.

2. Operating Margins: 11.1%

Operating margins improved from deeply negative levels toward high single digits as scale efficiencies reduced infrastructure and acquisition costs.

Recent EBIT margins near 11% reflect better usage economics, disciplined spending growth, and higher contribution from large enterprise customers.

An 11.2% operating margins represent normalized profitability without assuming aggressive cost cuts or structural pricing shifts.

3. Exit P/E Multiple: 146.5x

Snowflake stock historically traded above 150x earnings during peak growth when revenue exceeded 40% and margins were still forming.

Current valuation embeds optimism but reflects caution as investors monitor margin durability and competitive intensity within cloud data platforms.

A 146.5x exit multiple assumes sustained growth credibility, yielding a $362.73 target and 71.8% total return, or 30.6% annually.

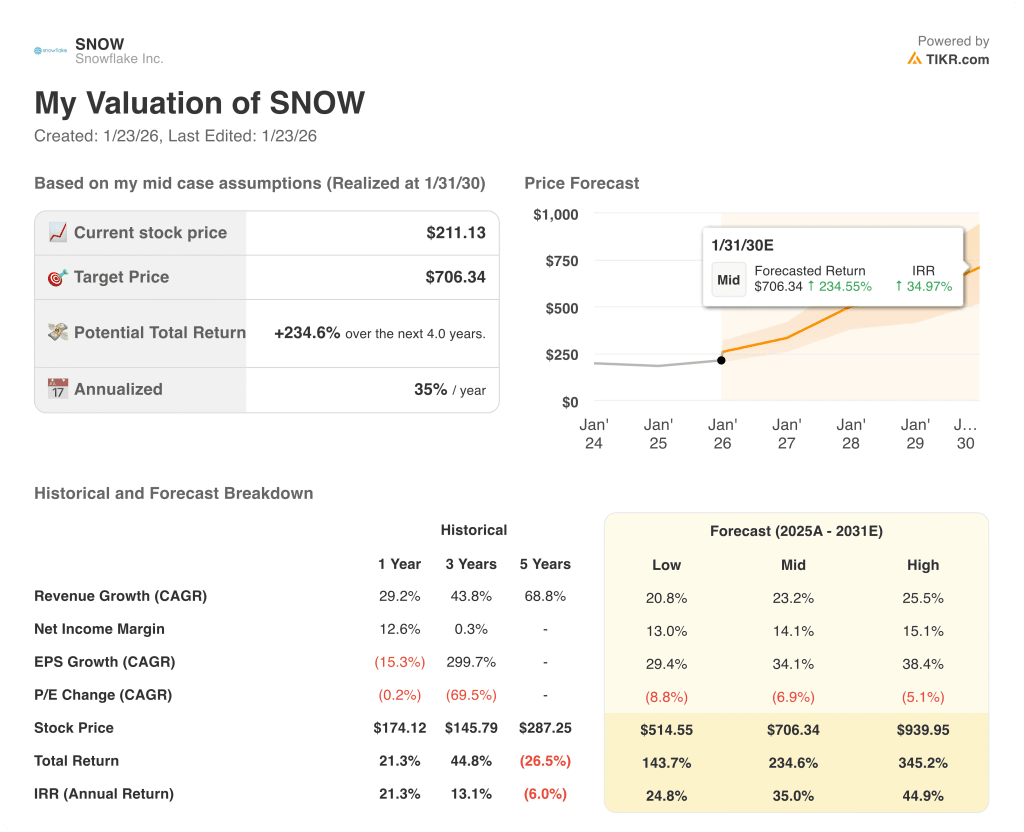

What Happens If Things Go Better or Worse?

Snowflake’s outcomes depend on enterprise data consumption, AI workload adoption, and cost discipline, creating distinct execution paths through 2030.

- Low Case: If enterprise spending stays cautious and usage growth slows, revenue grows around 20.8% with margins near 13.0% → 24.8% annualized return.

- Mid Case: With core data workloads scaling as expected, revenue growth near 23.2% and margins improving toward 14.1% → 35.0% annualized return.

- High Case: If AI-driven workloads accelerate and efficiency improves, revenue reaches about 25.5% with margins approaching 15.1% → 44.9% annualized return.

The $706.34 mid-case target price is achievable through sustained execution and usage expansion, without relying on multiple expansion or speculative sentiment.

How Much Upside Does It Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!