Key Takeaways:

- Sales Momentum: Costco stock reflects steady demand, with December sales reaching $30 billion and comparable sales rising 7% across U.S. and international warehouses.

- Capital Discipline: Costco stock reinforces shareholder returns through a $1 quarterly dividend while maintaining operating margins near 4% and disciplined expense control.

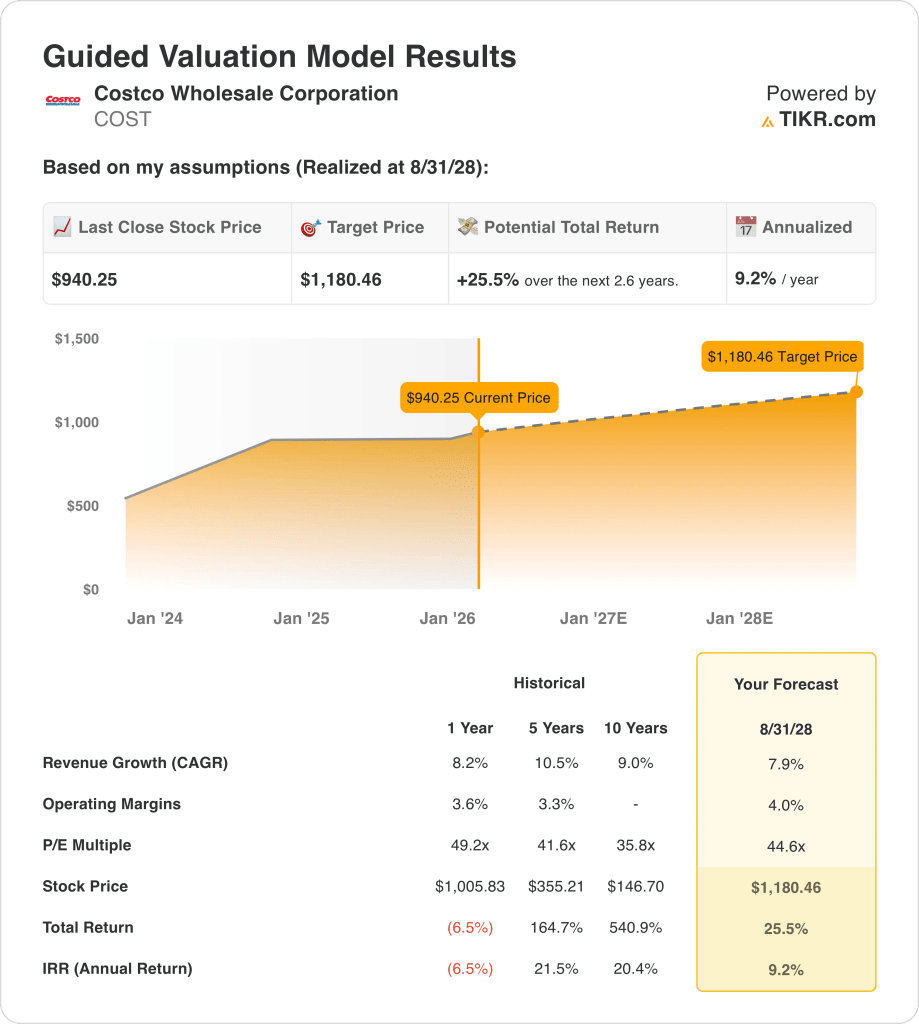

- Price Projection: Based on 8% revenue growth, 4% operating margins, and a 45x multiple, Costco stock could reach $1,180 by August 2028.

- Upside Math: From a $940 share price, Costco stock implies 26% total upside, translating into a 9% annualized return over 3 years.

Costco Wholesale Corporation runs membership warehouses globally, competing on price leadership and scale, with 923 locations supporting consistent volume-driven growth.

On January 8, Costco reported $30 billion in December sales, confirming steady consumer demand despite slowing discretionary spending across global retail markets.

Costco generated $280 billion in LTM revenue, reflecting durable traffic growth and membership renewal strength across grocery, fuel, and ancillary warehouse services.

COST stock’s operating income reached $11 billion with operating margins near 4%, supported by pricing discipline, private-label mix, and tight control over labor and logistics costs.

Costco’s $420 billion market value prices stable execution, yet a $1,180 valuation target raises questions about how far fundamentals can justify premium multiples.

What the Model Says for COST Stock

The model ties Costco’s scale position to 7.9% revenue growth and 4.0% operating margins supported by membership fees and volume stability.

Based on a 44.6x exit multiple, steady capital returns, and normalized profitability, the model points to a $1,180 share value.

That implies 26% total upside from $940, equal to a 9% annualized return over roughly three years.

Our Valuation Assumptions

TIKR’s Valuation Model lets you plug in your own assumptions for a company’s revenue growth, operating margins, and P/E multiple, and calculates the stock’s expected returns.

Here’s what we used for COST stock:

1. Revenue Growth: 7.9%

Costco generated about $280 billion in LTM revenue, with one-year growth of 8.2%, showing consistent expansion driven by warehouse additions and steady member spending.

Recent execution reflects stable traffic trends and strong digital growth, with December net sales up 8.5%, reinforcing revenue visibility across U.S. and international warehouses.

Looking ahead, growth is supported by new warehouse openings and e-commerce penetration, while mature markets and price discipline limit acceleration beyond historical patterns.

According to consensus analyst estimates, a 7.9% revenue growth assumption reflects durable membership economics balanced against Costco’s large revenue base.

2. Operating Margins: 4%

Costco’s operating margins have historically ranged around 3.3% to 3.8%, reflecting a low-margin model designed to maximize volume and member value.

Recent results show operating margins near 3.8% LTM, supported by higher membership income and disciplined expense control despite inflation pressures.

Margin expansion remains limited by pricing philosophy, but scale efficiencies, private-label mix, and steady ancillary income support modest normalization.

In line with analyst consensus projections, operating margins around 4.0% balance efficiency gains with Costco’s structural commitment to low consumer prices.

3. Exit P/E Multiple: 44.6x

Costco has historically traded at earnings multiples between roughly 36x and 49x, reflecting premium valuation tied to stability, scale, and predictable cash generation.

Investor optimism remains supported by consistent capital returns, recurring membership fees, and defensive demand during economic uncertainty.

However, valuation sensitivity persists given modest margin expansion and slowing growth versus prior years, tempering expectations for sustained multiple expansion.

Based on street consensus estimates, a 44.6x exit multiple reflects confidence in Costco’s defensive earnings quality without relying on sentiment-driven valuation expansion.

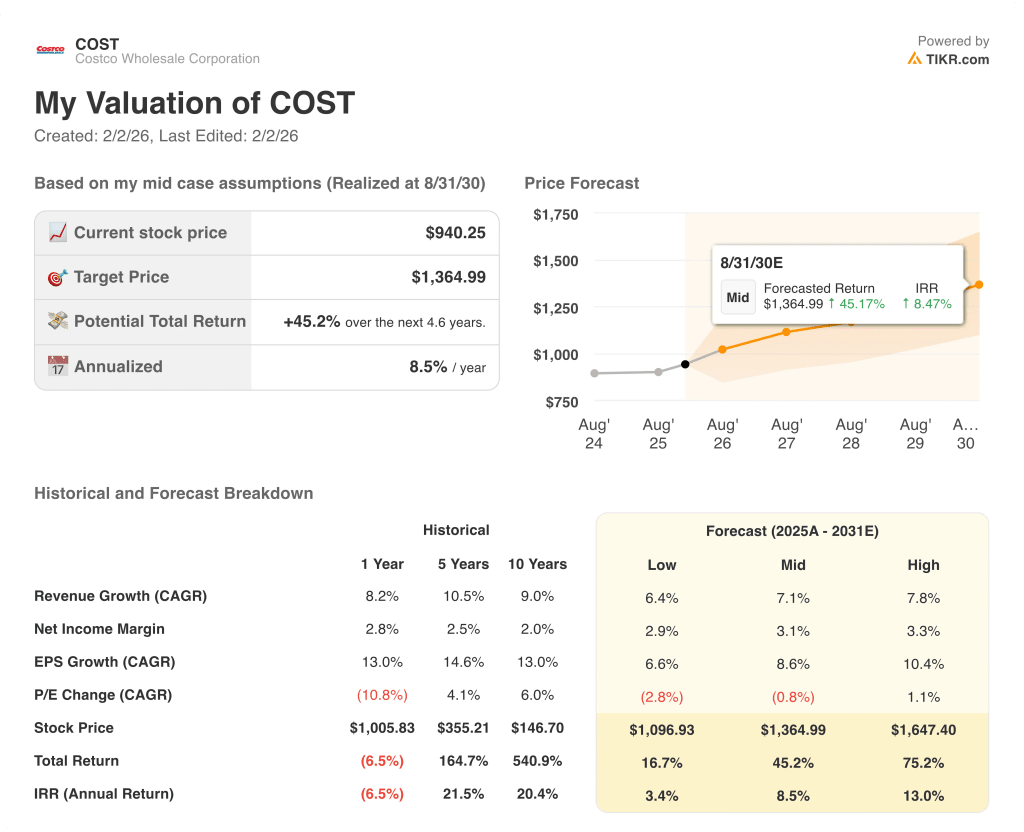

What Happens If Things Go Better or Worse?

Costco’s outcomes depend on member renewal rates, warehouse expansion discipline, and traffic resilience, setting up a range of possible paths through 2030.

- Low Case: If traffic softens and pricing stays cautious, revenue grows around 6.4% and net margins stay near 2.9% → 3.4% annualized return.

- Mid Case: With steady renewals and consistent warehouse growth, revenue growth near 7.1% and margins improving toward 3.1% → 8.5% annualized return.

- High Case: If international growth accelerates and efficiency improves, revenue reaches about 7.8% and margins approach 3.3% → 13.0% annualized return.

How Much Upside Does It Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!