Key Stats for UPWK Stock

- Price Change for UPWK stock: -19.08%

- UPWK Share Price as of Feb. 10: $15.21

- 52-Week High: $22.84

- UPWK Stock Price Target: $23.70

Now Live: Discover how much upside your favorite stocks could have using TIKR’s new Valuation Model (It’s free)>>>

What Happened?

Upwork (UPWK) stock plunged 19.1% on February 10 after investors reacted negatively to the company’s latest update. The sharp selloff followed earnings results and forward commentary that disappointed market expectations.

While Upwork continued showing progress on profitability and cost discipline, investors focused on slower growth trends.

Management’s outlook suggested near-term revenue expansion could remain pressured by cautious enterprise spending. As a result, the stock saw heavy volume and broad selling, pushing shares down to about $15 by market close.

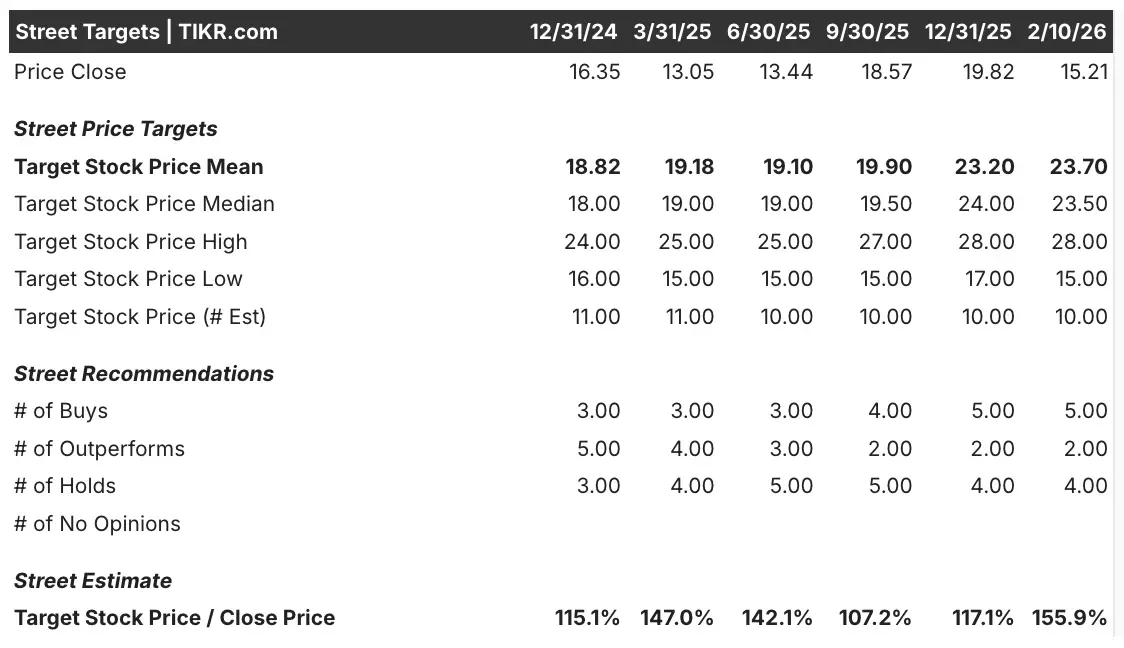

Despite the sharp drop, analysts have not meaningfully reduced their long-term price targets. The average price target for UPWK stock is $23.70, based on analyst estimates.

Targets range from $15 on the low end to $28 on the high end. This spread reflects uncertainty around growth reacceleration rather than balance sheet risk.

See analysts’ growth forecasts and price targets for UPWK stock (It’s free!) >>>

What the Market Is Telling Us About UPWK Stock

The one-day selloff signals that investors are recalibrating expectations after Upwork’s recent rally. Heading into earnings, the stock had climbed close to $20, pricing in faster growth and operating leverage.

Upwork has improved margins and generated positive free cash flow. However, revenue growth has moderated as hiring demand remains uneven across industries.

The market reaction suggests that profitability progress alone is not enough to support the prior valuation multiple.

At current levels, UPWK trades well below its consensus analyst target. Future performance depends on stabilizing client spend and sustaining margin improvements.

However, results remain sensitive to labor market trends and discretionary technology budgets. Investors should watch upcoming quarters for signs of renewed marketplace growth.

Estimate a company’s fair value instantly (Free with TIKR) >>>

How Much Upside Does UPWK Stock Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

See a stock’s true value in under 60 seconds (Free with TIKR) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!