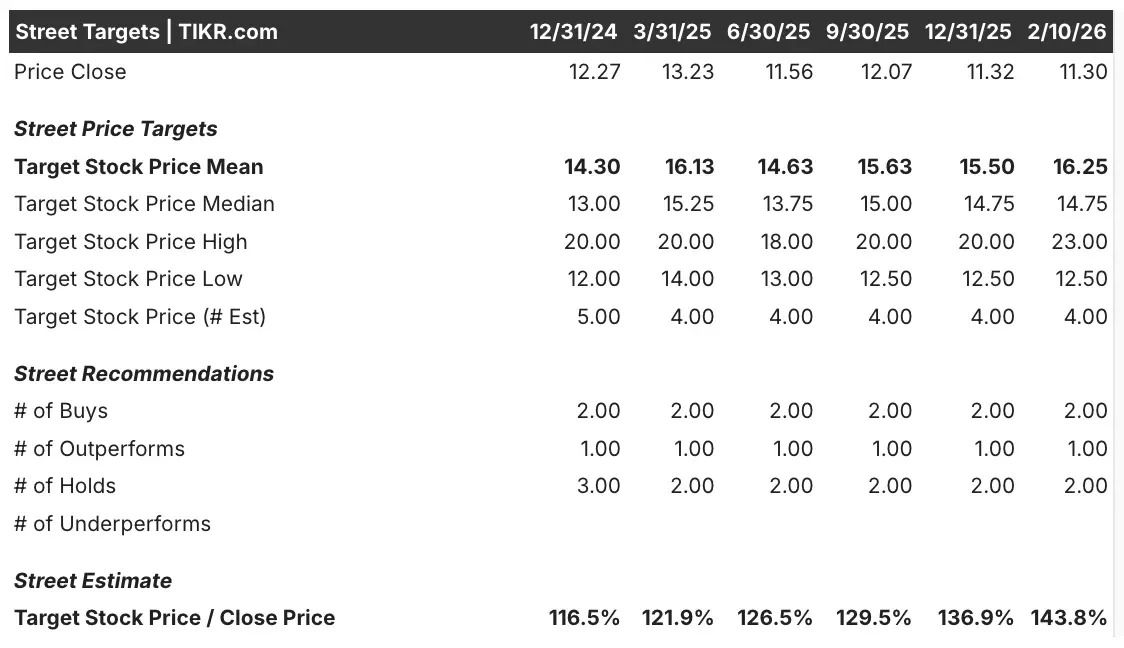

Key Stats for GCMG Stock

- Price Change for GCMG stock: +14.14%

- GCMG Share Price as of Feb. 10: $11.30

- 52-Week High: $14.48

- GCMG Stock Price Target: $16.25

Now Live: Discover how much upside your favorite stocks could have using TIKR’s new Valuation Model (It’s free)>>>

What Happened?

GCM Grosvenor (GCMG) stock jumped over 14% yesterday after the company announced a record $10.7 billion fundraising for 2025, up 49% year-over-year.

The results included GAAP net income up 143%, fee-related earnings up 11%, and adjusted net income up 18%.

The board increased the share repurchase authorization by $35 million to $255 million. It also declared a $0.12 per share dividend payable March 16, 2026.

The firm initiated a $65 million debt prepayment, strengthening its balance sheet. These moves highlight strong demand in infrastructure and private credit. The pipeline for 2026 is larger than last year’s.

The company is a global alternative asset management solutions provider with $87 billion in assets under management. CEO Michael Sacks, speaking at the Bank of America Securities Financial Services Conference, emphasized margin expansion and growth.

GCMG aims to double fee-related earnings from 2023 levels to over $280 million by 2028 through organic growth and diversification.

See analysts’ growth forecasts and price targets for GCMG stock (It’s free!) >>>

What the Market Is Telling Us About GCMG Stock

The strong rally in GCMG stock signals that investors are optimistic about the company’s growth strategy. The earnings beat adds credibility and shows robust demand in alternative assets.

GCMG reported fourth-quarter revenue of $177 million, beating estimates of $160 million. Adjusted EPS was $0.31, above the consensus of $0.24. The company outperformed in absolute return strategies.

Management remains confident about expanding margins to 55% and growing AUM organically. The alternative asset management industry is growing, but fragmented. This creates opportunities for consolidation.

Companies with scale can improve efficiency and negotiate better terms. GCMG’s diversified platform could drive improvements across strategies.

However, GCMG faces execution risk as it pursues growth targets. Meeting fundraising goals requires discipline. Rising interest rates and economic uncertainty could impact asset valuations and investor commitments.

Investors should monitor GCMG’s fundraising pipeline closely. The company needs to deploy capital effectively rather than chasing scale. The buyback increase could support shares if volatility rises.

Estimate a company’s fair value instantly (Free with TIKR) >>>

How Much Upside Does GCMG Stock Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

See a stock’s true value in under 60 seconds (Free with TIKR) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!