Key Stats for Amgen Stock

- Past-Week Performance: -4%

- 52-Week Range: $261 to $385

- Current Price: $373

- Valuation Model Target: $467

What Happened to Amgen Stock?

Amgen Inc. (AMGN) peaked near $385 in early February 2026 before pulling back to $373.36 by February 17, returning +14.0% year-to-date despite falling 4.0% in the past week.

Amgen reported Q4 2025 revenue of $9.87B on February 3, beating the $9.47B IBES estimate by 4.29%, with adjusted EPS of $5.29 beating the $4.73 estimate by 11.94%.

EBITDA came in at $5.14B against a $6.96B estimate, missing by 26.13%, with EBITDA margins of 52.08% falling sharply below the 73.52% Street expectation for the quarter.

FCF of $0.96B missed the $3.69B estimate by 73.98%, while FY2025 operating cash flow totaled $10.0B and Amgen retired $6.0B of debt during the year.

Amgen guided FY2026 adjusted EPS of $21.60–$23.00 versus the $22.09 IBES estimate, and total revenue of $37.0B–$38.4B versus the $37.08B estimate, with share repurchases capped at $3.0B.

The FDA approved UPLIZNA for generalized myasthenia gravis on February 9, 2026, marking its third FDA approval, followed by European Commission approval for the same indication on February 12, 2026.

Amgen filed for a four-part senior notes offering of up to $4.0B per SEC filing on February 17, 2026, following $6.0B of debt retired in FY2025.

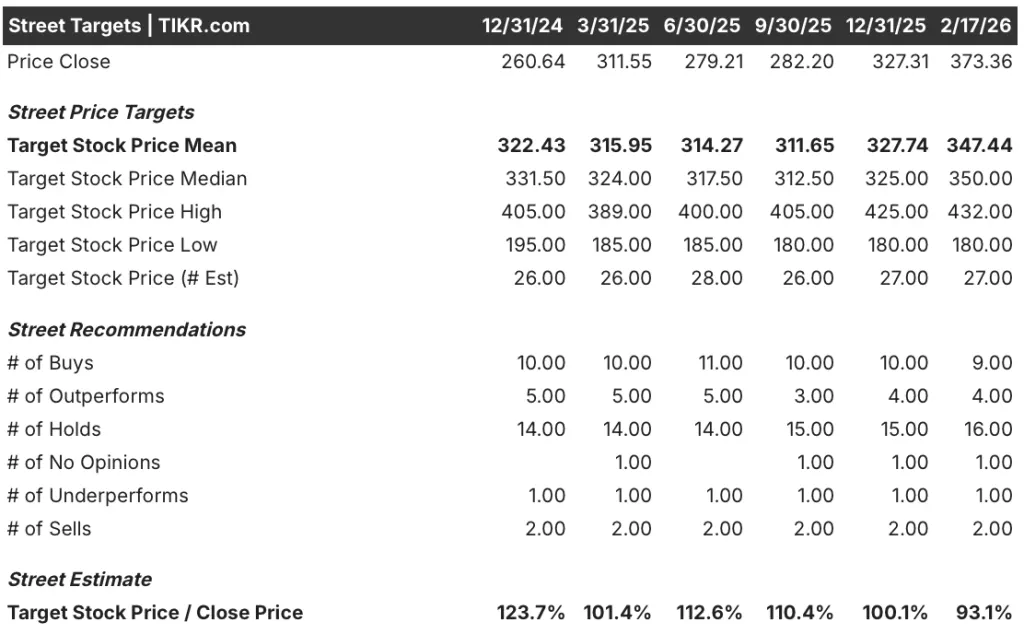

Buy and Outperform ratings total 13 of 27 analysts as of February 17, 2026, with Holds at 16 and active Sell and Underperform ratings totaling 3; AMGN is currently trading above the consensus mean target of $347.

What the Market is Telling Us About Amgen Stock

Amgen has gained 14% this year, peaking near $385 after back-to-back FDA and European Commission approvals for UPLIZNA within four days of each other.

- Earnings beat on revenue and EPS, but FCF missed hard: Q4 adjusted EPS of $5.29 beat the $4.73 estimate, yet FCF of $0.96B missed the $3.69B estimate by 74%.

- Two regulatory approvals in four days: FDA approved UPLIZNA on February 9 and the European Commission followed on February 12, marking UPLIZNA’s third FDA approval and first EC clearance for the same indication.

- Stock now trades above consensus: At $373.36, AMGN sits above the mean analyst target of $347.44, with the Target/Close ratio falling to 93.1% and Holds dominating at 16 of 27 analysts.

FY2025 operating income rose 19.6% to $11.57B, with margins recovering to 31.5% from 28.9% in FY2024, reflecting improved product mix as R&D spending rose 21.8% to $7.27B.

Amgen retired $6B of debt in FY2025 and raised its quarterly dividend 6% to $2.38 per share, then declared a further 6% increase to $2.52 for Q1 2026.

The $4.0B senior notes filing on February 17 follows the debt retirement, signaling continued balance sheet activity within the same trading period.

Pipeline activity remains active, with a Phase 1 obesity study enrolling and Phase 3 diabetes trials for Maritide planned to initiate in 2026.

AMGN is up 14% YTD, with FY2025 revenue growing 10.0% to $36.75B and gross margins recovering to 70.8% from 68.7% in FY2024. The FCF miss of 74% against estimates is the key near-term financial overhang.

The February 18 Citi Oncology Leadership Summit presentation and the initiation of Maritide Phase 3 trials in 2026 are the next disclosed catalysts to watch alongside FY2026 guidance execution of $37.0B–$38.4B in revenue.

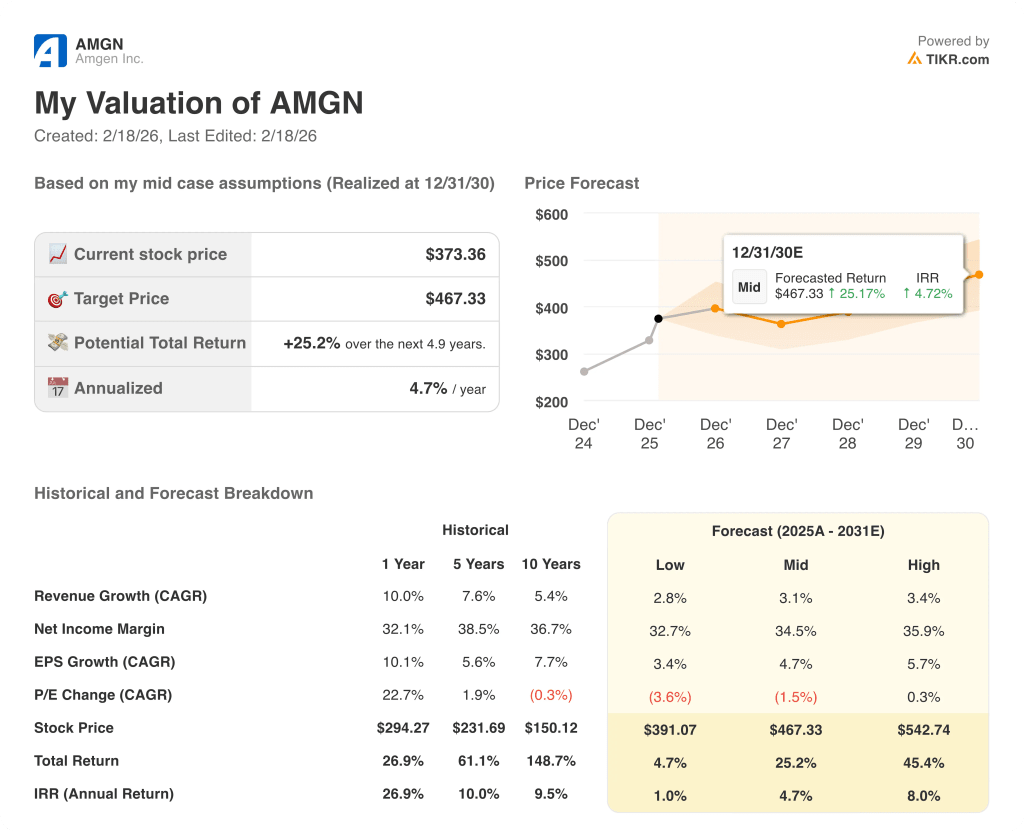

Amgen’s revenue trajectory, margin recovery, and pipeline execution set up meaningfully different paths through December 2030.

Low Case: If pipeline momentum stays muted and margin recovery stalls near current levels, revenue grows around 2.8% with net margins near 32.7% → 1.0% annualized return.

Mid Case: With UPLIZNA scaling across approved indications and obesity and diabetes programs advancing on schedule, revenue grows near 3.1% and margins improve toward 34.5% → 4.7% annualized return.

High Case: If Maritide Phase 3 delivers and the drug portfolio expands further, revenue reaches around 3.4% growth and margins approach 35.9% → 8.0% annualized return.

The mid-case target of $467 does not require multiple expansion — it reflects margins returning toward Amgen’s own historical range on modest revenue growth.

With UPLIZNA freshly approved in two major markets and Phase 3 obesity trials initiating in 2026, the mid case is grounded in pipeline execution already underway, not speculation.

How Much Upside Does AMGN Stock Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!