Key Takeaways:

- Verizon offers a high 6.2% dividend yield today.

- The stock has a safe dividend payout ratio, which should make the dividend sustainable for the next several years.

- Analysts expect Verizon’s earnings and dividends to grow in the low-single-digits over the next 3 years.

- Get accurate financial data on over 100,000 global stocks for free on TIKR >>>

Verizon is a popular choice for dividend investors thanks to its generous dividend, backed by steady cash flows.

Analysts expect the business to return to growth over time, which is why many see the stock as undervalued today.

Why Has Verizon’s Stock Price Struggled?

There are three key reasons why Verizon’s stock has struggled in recent years:

- Limited Revenue Growth: Verizon’s top-line growth has been sluggish, as the U.S. wireless market is mature and highly competitive. This leaves little room to expand beyond price wars and incremental service upgrades.

- Profitability Pressures: While earnings have stabilized, high capital spending on 5G infrastructure and elevated debt levels have weighed on profitability and investor sentiment.

- Lack of a Clear Growth Catalyst: Verizon’s core businesses, wireless and broadband, remain solid but aren’t delivering breakout growth. The company has yet to show that its 5G investments can meaningfully boost revenue.

The stock is still down roughly 20% over the past year despite a recent bounce, and while Verizon remains a stable dividend payer, it may need stronger growth signals to win back market enthusiasm.

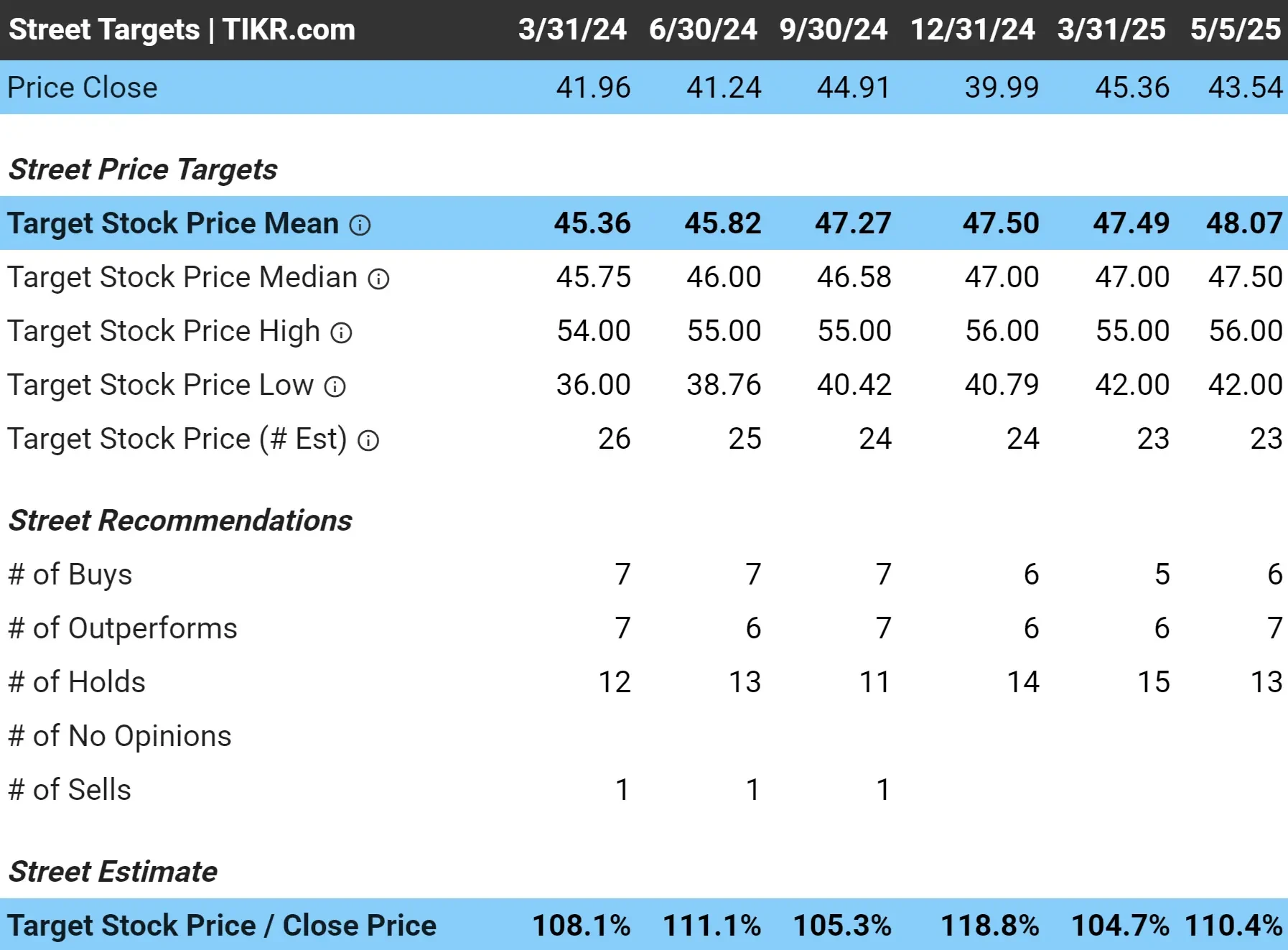

Analysts Think The Stock Has 10% Upside Today

The average analyst price target for Verizon is $48/share today.

With the stock trading around $44/share, this implies that the stock has about 10% upside today.

This is pretty decent upside, since it also doesn’t factor in the 6.2% annual returns investors would make from Verizon’s dividend yield.

See why Verizon looks undervalued today with TIKR (It’s free) >>>

1: Dividend Yield

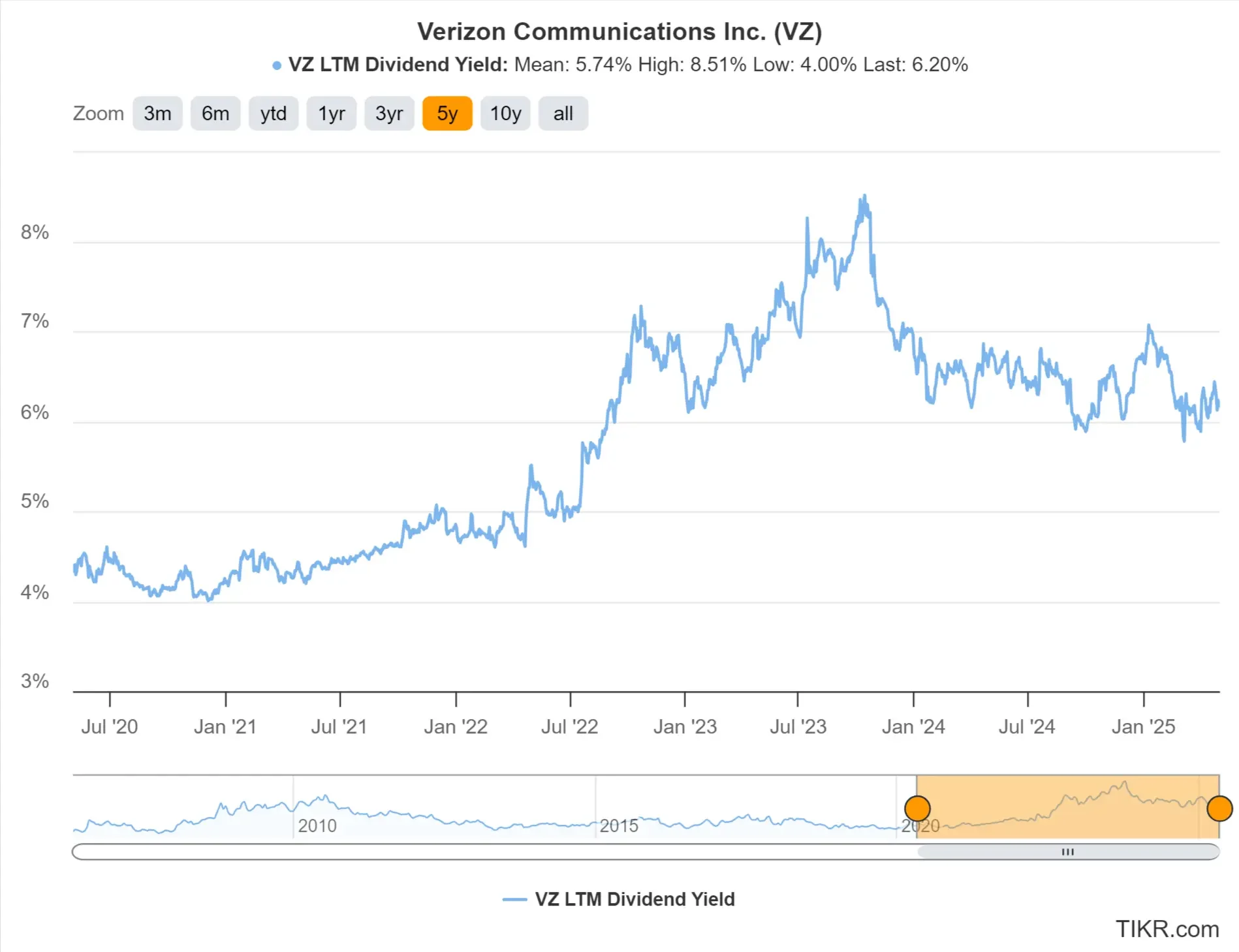

Verizon is paying a dividend yield of around 6.2% right now, which is one of the highest yields among large-cap U.S. stocks today.

Verizon offers a higher yield today than it did a few years ago largely because the stock’s price has dropped substantially over this time. Analysts expect the company to return to earnings growth, which could drive price appreciation for Verizon over time.

Find high-quality dividend stocks that look even better than Verizon today. (It’s free) >>>

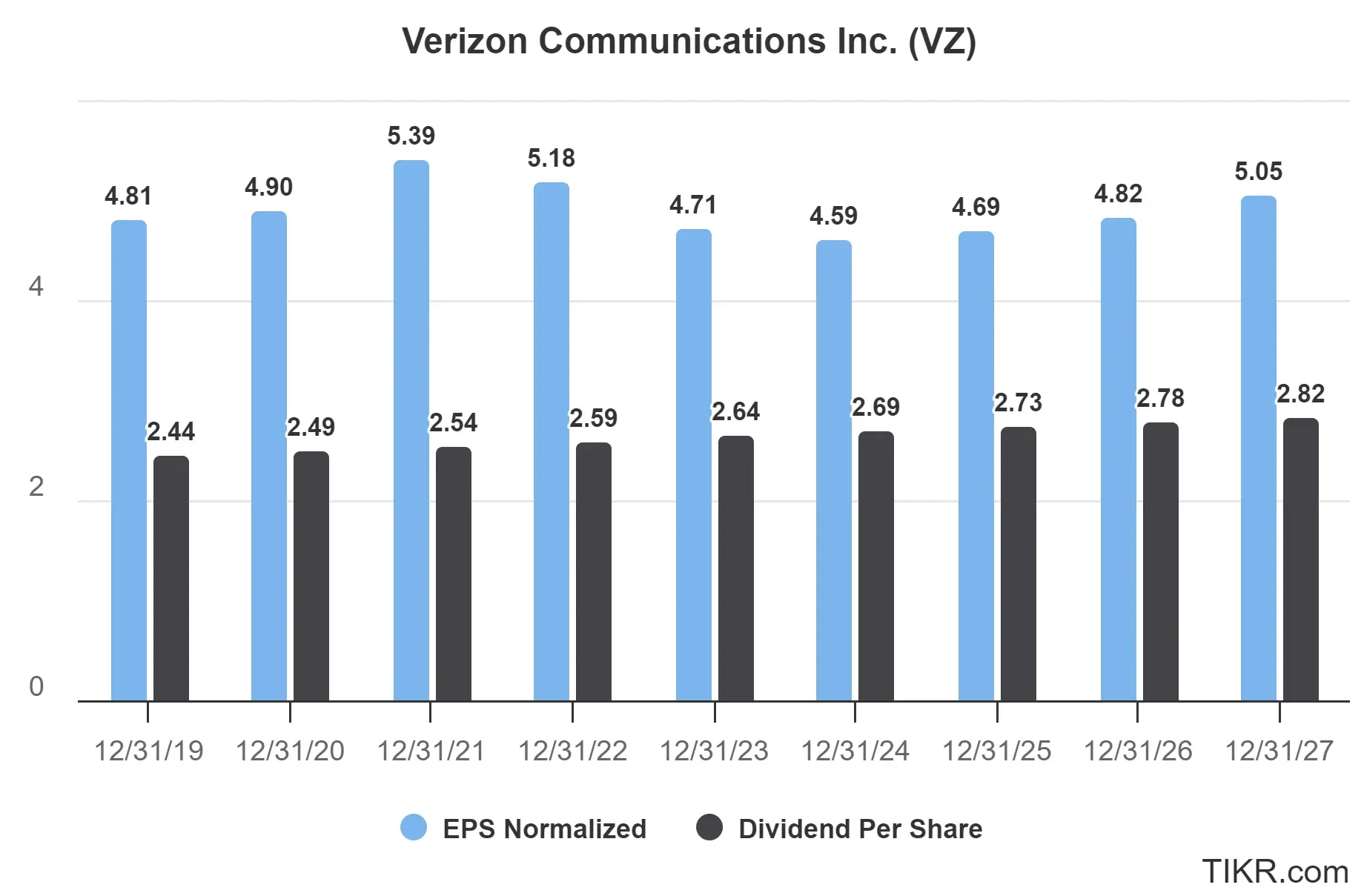

2: Dividend Safety

Verizon’s dividend payout ratio came in around 59% in 2024, based on $2.69 in dividends and $4.59 in normalized earnings per share. That’s a little high, but still below the 70% threshold that we consider to be a safe range for a business like Verizon.

In Q1 2025, the company generated $3.6 billion in free cash flow, which was more than enough to cover the dividend and reduce debt.

Verizon’s reliable cash flow gives management room to keep supporting the dividend, even if earnings growth stays slow.

See Verizon’s full growth forecast. (It’s free) >>>

3: Dividend Growth Potential

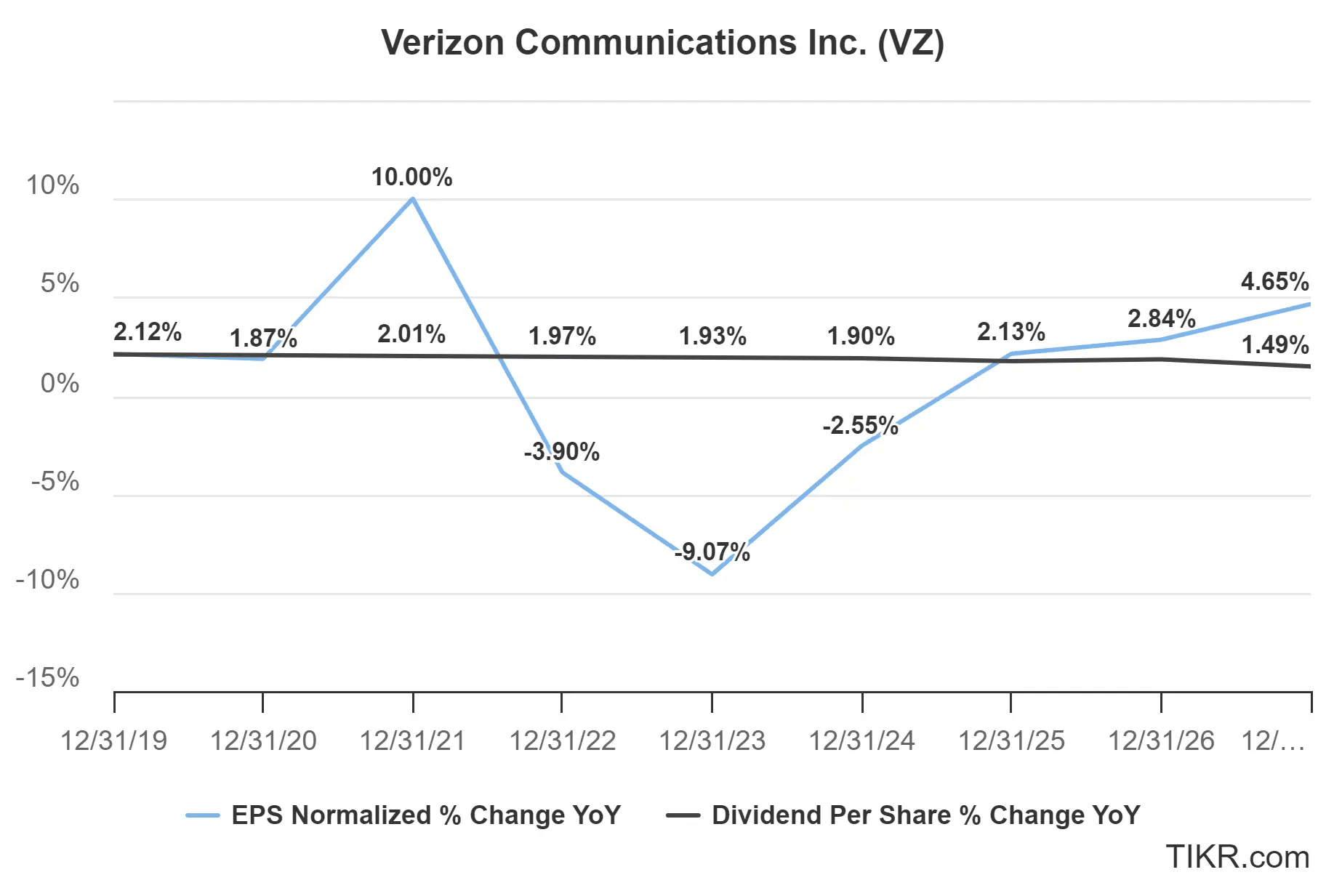

Verizon has raised its dividend for 18 consecutive years, and that streak looks set to continue.

Analysts expect earnings to pick up in the coming years, with 2025 expected to bring earnings growth. Analysts also expect dividends to continue growing in the low-single-digits.

TIKR Takeaway

Verizon isn’t a flashy stock, but it still delivers a high dividend yield and is expected to return to earnings growth.

With analysts seeing double-digit upside, Verizon might be worth a closer look for those who want income with some potential value upside too.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks and was built for investors who think of buying stocks as buying a piece of a business.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!