Key Stats for AAPL Stock

- Price Change for Apple stock: 2%

- Current Share Price: $211

- 52-Week High: $260

- Apple Stock Price Target: $252

What Happened?

Apple (AAPL) stock is up roughly 2% following a stellar third-quarter earnings report that exceeded Wall Street expectations across nearly all key metrics.

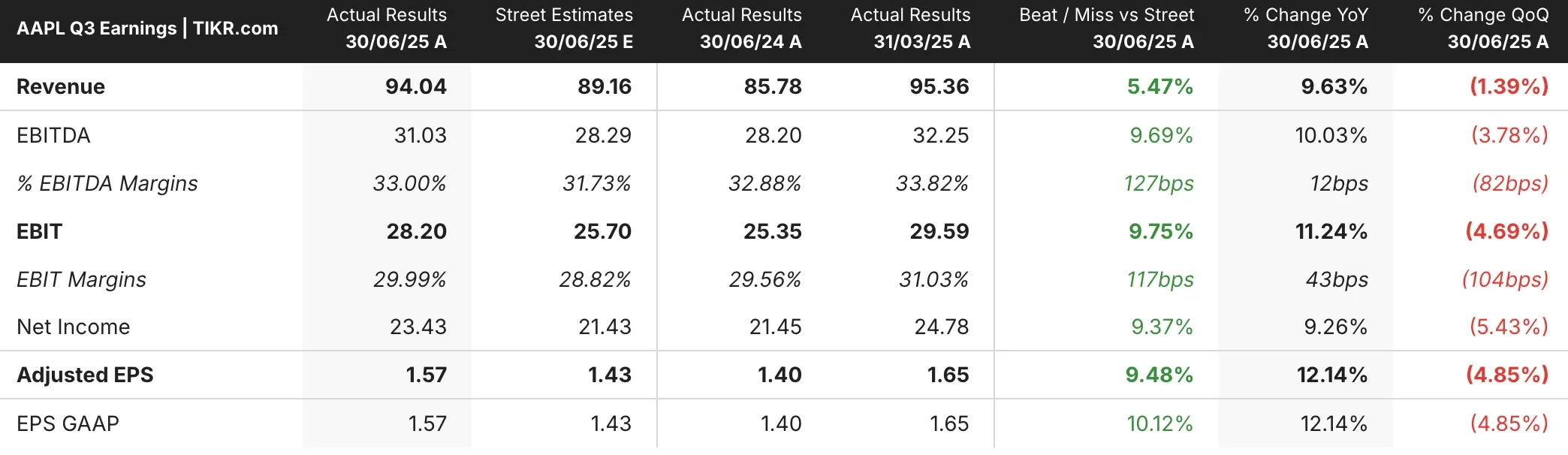

The hardware giant posted earnings per share of $1.57, surpassing the $1.43 consensus estimate, while revenue of $94.04 billion exceeded expectations of $89.16 billion, representing a 10% year-over-year growth rate. This was Apple’s largest quarterly revenue increase since December of 2021.

The standout performance was driven by exceptional iPhone sales, which grew 13% year-over-year to $44.58 billion, far exceeding the $40.22 billion estimate.

CEO Tim Cook attributed this strength to the iPhone 16 family’s popularity, noting it performed “strong double digits” better than the iPhone 15 family in the same period last year.

Mac revenue also impressed with 15% growth to $8.05 billion versus $7.26 billion expected, while Services hit another record at $27.42 billion.

Apple’s recovery in China was noteworthy, with sales rising 4% after two consecutive quarters of declines.

Cook credited Chinese government subsidies for some devices and highlighted record-breaking metrics, including all-time highs for iPhone installed base and upgraders in Greater China.

See analysts’ growth forecasts and price targets for Apple (It’s free!) >>>

What the Market Is Telling Us About AAPL Stock

Investors are responding positively to Apple’s ability to deliver broad-based growth despite ongoing tariff headwinds and competitive pressures.

Apple’s guidance for mid-to-high single-digit revenue growth in the September quarter, with Services maintaining similar 13% growth rates, suggests sustained momentum ahead.

Cook’s confidence about AI positioning, calling it “one of the most profound technologies of our lifetime,” while increasing investments, appears to be reassuring investors concerned about Apple’s AI strategy.

His dismissal of AI devices as iPhone replacements, stating “it’s difficult to see a world where iPhone is not living in it,” reinforces the durability of Apple’s core business.

With AAPL stock successfully navigating tariff challenges (absorbing $800 million in costs while maintaining margins) and demonstrating pricing power across products, investors appear optimistic about Apple’s ability to sustain growth while investing in future technologies.

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!