Key Stats for AMZN Stock

- Price Change for Amazon stock: -6.6%

- Current Share Price: $219

- 52-Week High: $242

- Amazon Stock Price Target: $252

What Happened?

Amazon (AMZN) stock tumbled over 6% despite reporting second-quarter results that beat Wall Street expectations across key metrics.

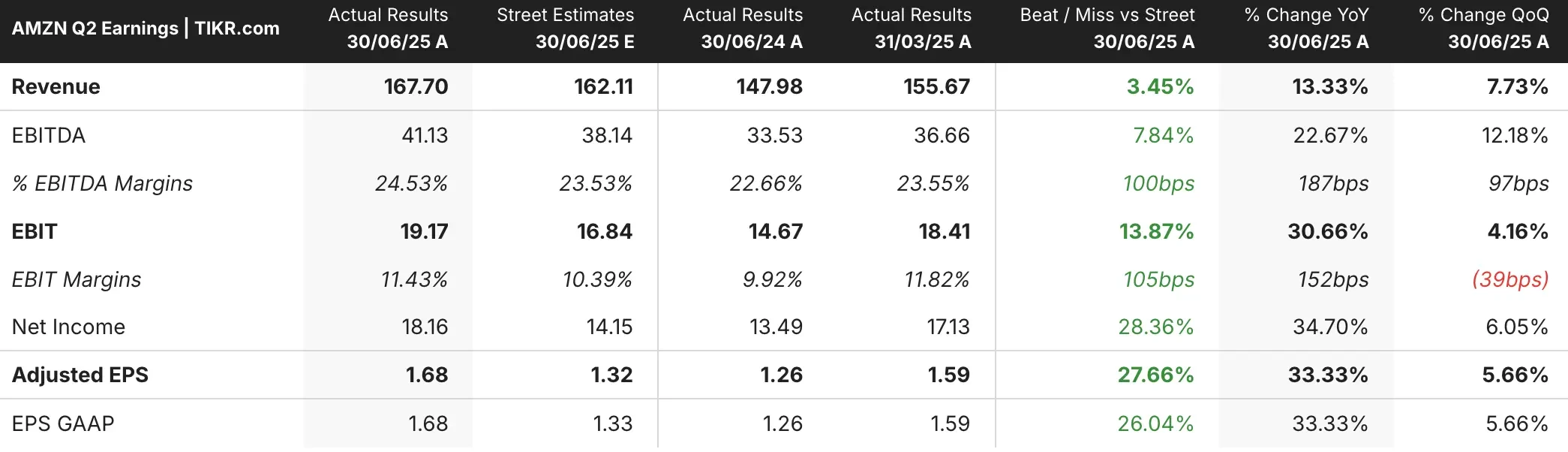

The e-commerce and cloud computing giant posted earnings per share of $1.68 versus the $1.32 consensus estimate, while revenue of $167.7 billion exceeded expectations of $162.11 billion, representing 13% year-over-year growth.

The disappointment came from Amazon’s third-quarter operating income guidance of $15.5-20.5 billion, with the midpoint falling short of analyst expectations of $19.48 billion.

This guidance concerned investors who are eager to see returns on Amazon’s massive AI investments, with the tech heavyweight committing to spend up to $100 billion this year on artificial intelligence infrastructure.

Adding to investor concerns were questions about competitive pressure in the cloud computing space.

While AWS revenue grew 18% to $30.87 billion (slightly beating estimates), this growth rate lagged behind Microsoft Azure’s 39% and Google Cloud’s 32% growth in their latest quarters.

During the investor call, CEO Andy Jassy faced pointed questions about AWS potentially falling behind in the AI race, though he defended the company’s “pretty significant” leadership position.

See analysts’ growth forecasts and price targets for AMZN (It’s free!) >>>

What the Market Is Telling Us About AMZN Stock

The sell-off in AMZN stock reflects investor frustration with Amazon’s massive AI capital expenditures, which surpassed $31 billion in Q2.

However, AI investments are not yet translating into the accelerated growth rates seen by competitors.

While Amazon’s advertising business was a bright spot, growing 23% to $15.69 billion, investors appear focused on the competitive dynamics in cloud computing and whether AWS can maintain its market leadership as rivals gain ground.

The conservative operating income guidance suggests Amazon expects continued heavy investment in AI infrastructure to pressure near-term profitability.

With AWS facing capacity constraints and “more demand than supply,” the challenge isn’t necessarily customer interest but rather Amazon’s ability to scale infrastructure fast enough while maintaining margins.

Investors may be questioning whether Amazon’s deliberate, long-term approach to AI investments will allow faster-moving competitors to capture market share in this critical growth area.

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!