Key Takeaways:

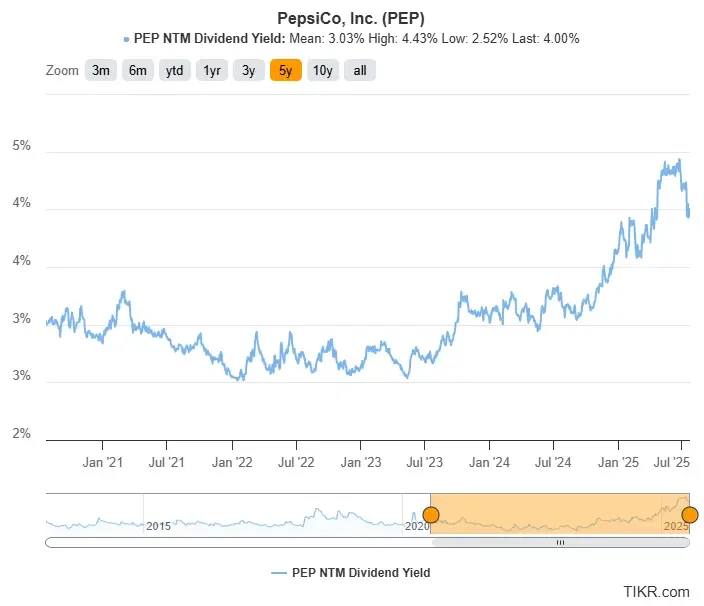

- PepsiCo offers a 4.0% dividend yield, the highest it’s been in years.

- Analysts expect EPS to grow around 3% annually, while dividends are projected to rise about 5% per year, continuing PepsiCo’s 53-year dividend growth streak.

- TIKR’s valuation model suggests 19.3% total return potential over the next 2.4 years, or about 7.5% annually, driven by modest earnings growth and a rebound in valuation.

PepsiCo is one of the largest food and beverage companies in the world, with brands like Frito-Lay, Gatorade, Quaker, and Pepsi-Cola found in pantries and stores across more than 200 countries.

The business generates strong recurring cash flow from its global product portfolio, backed by pricing power, wide distribution, and decades of brand loyalty.

But the stock has pulled back more than 16% over the past year, as investors worry about slowing demand, margin pressure, and how much pricing power consumer staples can hold in a high-inflation environment.

That decline has pushed PepsiCo’s dividend yield up to 4%, the highest in years and well above its 5-year average of about 3%.

With stable earnings, a disciplined capital strategy, and steady dividend growth expected ahead, PepsiCo could offer a compelling mix of reliable income and long-term upside for patient investors.

Potential 19% Upside for Pepsi Today

PepsiCo shares currently trade around $143, while TIKR’s valuation model, with assumptions based on analysts’ estimates, suggests the stock could reach $171 by 2027, assuming stable margins and moderate earnings growth.

That would imply a 19.3% total return over the next 2.4 years, or about 7.5% annually, including dividends. PepsiCo offers the kind of brand strength, global scale, and dividend consistency that long-term investors value, especially when bought at a slight discount.

Value any stock in less than 60 seconds with TIKR (It’s free) >>>

A 4.0% Dividend Yield Near the Top of Its Historical Range

PepsiCo’s forward dividend yield sits at 4.0%, well above its 5-year average of 3.03% and close to the highest level seen in years.

The elevated yield reflects a 16% drop in the stock over the past year, driven by concerns over consumer demand, input costs, and margin pressure.

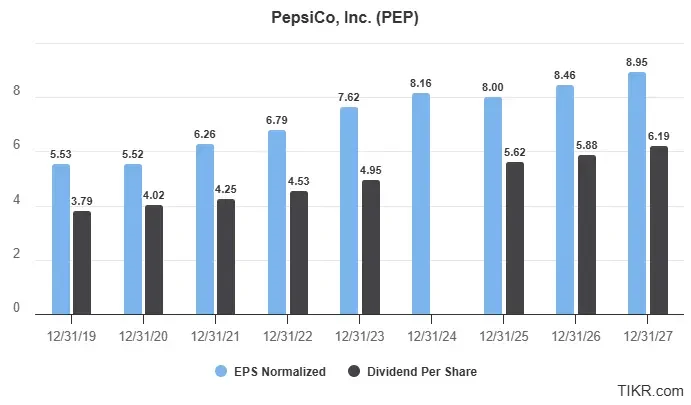

Despite the pullback, PepsiCo is projected to pay $5.62 per share in dividends for 2025, and analysts expect that to grow to $6.19 by 2027.

That growth is supported by consistent free cash flow and iconic global brands like Frito-Lay and Gatorade, which help the company maintain stable earnings even in tougher markets.

For long-term investors seeking steady income from a global consumer staple, PepsiCo offers a compelling mix of yield, safety, and brand strength.

Find high-quality dividend stocks that look even better than Pepsico today. (It’s free) >>>

PepsiCo’s Dividend Expected to Grow 5% Through 2027

PepsiCo is expected to earn $8.95 per share and pay out $6.19 in dividends by 2027, putting the payout ratio at about 69%, well within its historical range and signaling plenty of room to keep increasing the dividend. PepsiCo paid out $5.33 in dividends for 2024, but it doesn’t show up on the graph below because of a visual glitch!

Analysts expect PepsiCo to grow EPS at around 3% annually through 2027, driven by margin recovery and strong global demand across its portfolio, while dividends are expected to grow at a 5% CAGR.

The company has also raised its dividend for 53 consecutive years, showing an exceptional track record of consistency and shareholder returns.

Much of PepsiCo’s earnings strength comes from its well-diversified product mix. Brands like Frito-Lay, Doritos, Quaker Oats, Gatorade, and Pepsi-Cola continue to show pricing power and category leadership.

New product launches, healthier offerings, and increased investment in premium snacks and zero-sugar beverages are helping the company meet changing consumer preferences and maintain volume stability.

PepsiCo is also focusing on international expansion, especially in developing markets where snack and beverage consumption is growing faster. This global reach gives the company added resilience in tougher U.S. retail environments.

See Pepsico’s full growth forecast and analyst estimates. (It’s free) >>>

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!