Key Stats for GLBE Stock

- Price Change for GLBE stock: +17.21%

- GLBE Share Price as of Feb. 18: $34.81

- 52-Week High: $50.39

- GLBE Stock Price Target: $49.85

Now Live: Discover how much upside your favorite stocks could have using TIKR’s new Valuation Model (It’s free)>>>

What Happened?

Global-E Online (GLBE) stock surged over 17% on Feb. 18 after the company reported record fourth-quarter 2025 results that beat Wall Street expectations and issued guidance that topped consensus for 2026.

Revenue in Q4 rose 28% year over year to about $337 million as gross merchandise value climbed nearly 45% to $2.36 billion, reflecting strong demand from large luxury and consumer brands using its cross-border e-commerce platform.

Adjusted earnings per share jumped to $0.49 from $0.30 a year earlier, highlighting improving operating leverage and better cost control as the business scaled.investing+3

Management guided for 2026 revenue of $1.21 billion to $1.27 billion, above analyst expectations of roughly $1.18 billion, which helped fuel the sharp move in the stock.

The company also highlighted accelerating adoption among enterprise merchants and continued expansion with global partners, supporting its view that cross-border e-commerce will remain a structural growth tailwind.

With the shares still well below their 52-week high even after the post-earnings jump, investors focused on the stronger profitability profile and the potential for sustained double-digit revenue growth.

See analysts’ growth forecasts and price targets for GLBE stock (It’s free!) >>>

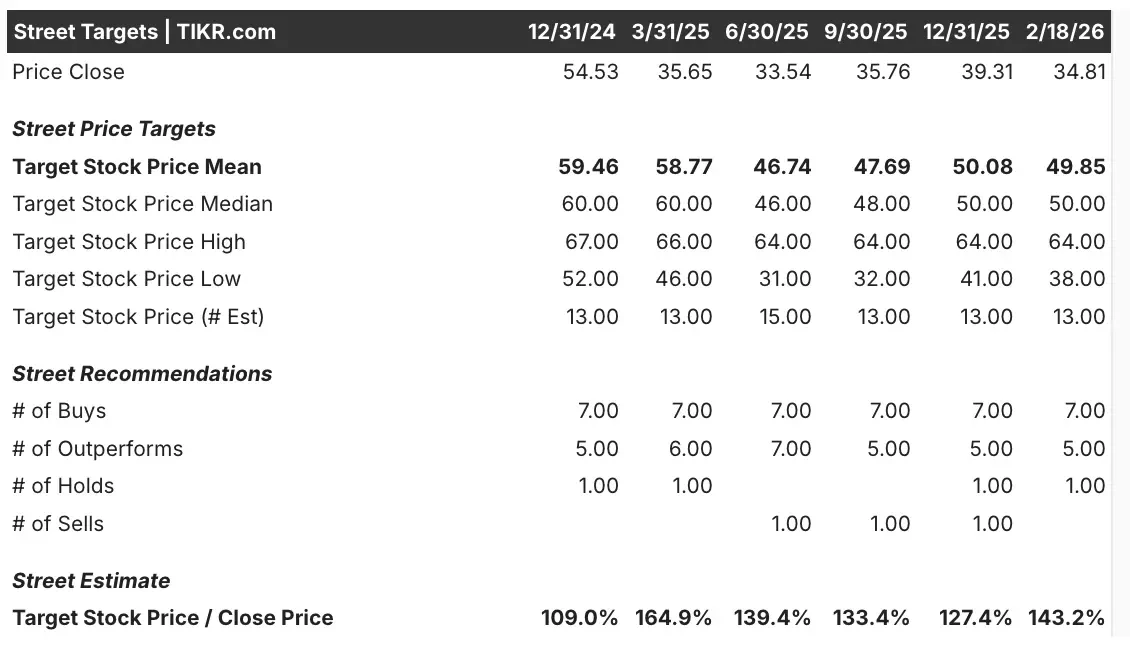

What the Market Is Telling Us About GLBE Stock

Analysts’ average 12‑month price target of about $49.85 implies meaningful upside from the current $35 share price, even after the earnings rally.

That target sits slightly below the $50 consensus high and above the $38–$41 low end of recent Street estimates, suggesting a generally bullish but balanced view on the stock.

At today’s price, Global-E trades at roughly 6x trailing sales and about 33x forward earnings, which is rich versus many traditional retailers but more in line with high-growth software and payments peers.

Margin trends help explain why investors are willing to pay a premium multiple. Global‑E’s gross margin is around 45%, and the company has recently crossed into positive operating and net margins, with an operating margin near 7.4% and a profit margin of just under 7.10%.

That profitability marks a notable improvement from 2024, when the business still posted negative operating and net income despite $753 million of revenue and a 45% gross margin. The latest quarter’s 25% EBITDA margin underscores the operating leverage in the model as volumes grow across its merchant base.

Estimate a company’s fair value instantly (Free with TIKR) >>>

How Much Upside Does GLBE Stock Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

See a stock’s true value in under 60 seconds (Free with TIKR) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!