Key Takeaways:

- OpenAI Platform Expansion: Snowflake’s $200 million OpenAI partnership expands model access across 3 major clouds, positioning Snowflake to embed enterprise agents directly inside governed customer data rather than pushing workloads to separate AI layers.

- Insider Transaction Signal: Snowflake disclosed a director share sale dated February 6, 2026, a governance datapoint that investors track closely when the stock is pricing in a higher growth and margin path.

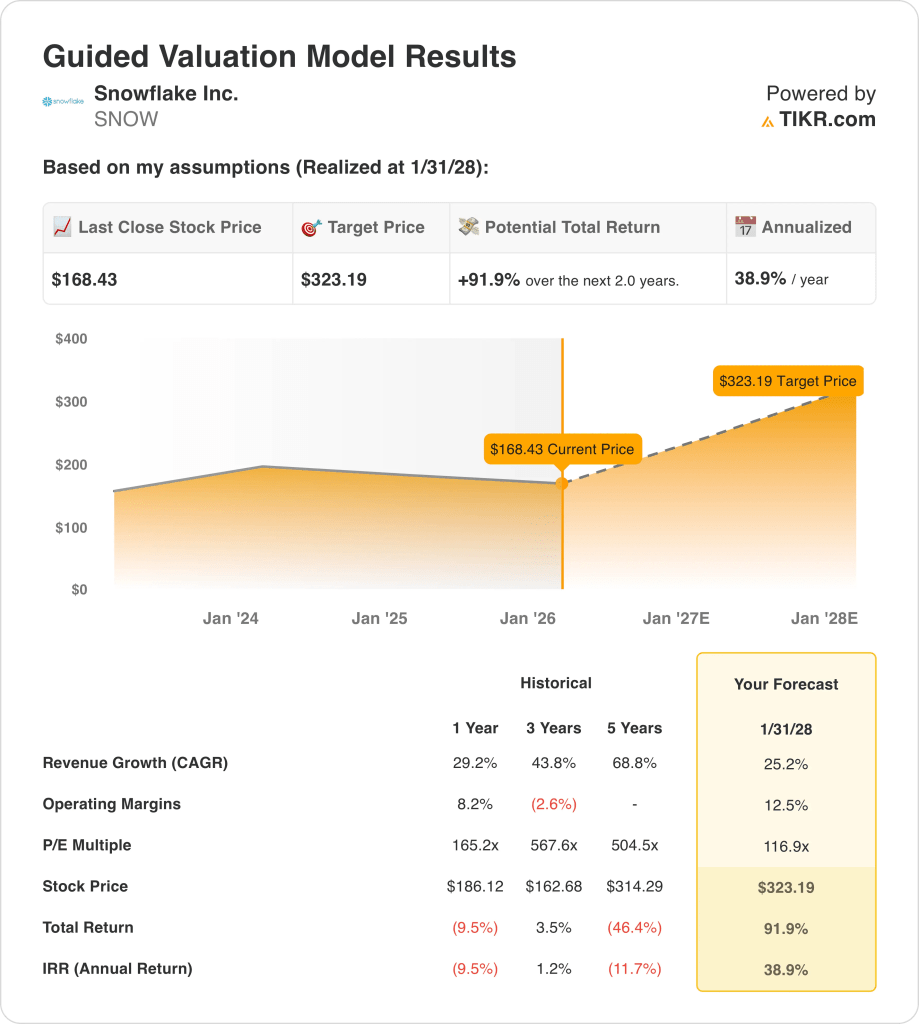

- Valuation Anchor: Based on 25% revenue growth and 13% operating margins by 2028 with a 117x exit P/E, Snowflake stock could reach $323 over the next 2 years as profitability scales with product momentum.

- Return Math: From the current price of $168, Snowflake implies 92% total upside to $323, translating to about 39% annualized returns over a 2 year holding period if assumptions hold.

Snowflake Inc. (SNOW) sells a cloud data platform that monetizes consumption as enterprises run analytics and AI workloads, and the business spans financial services, retail, healthcare, and government customers across 3 major cloud ecosystems.

The AI Data Cloud centralizes enterprise datasets so teams can run BI, data engineering, and agent workflows in 1 governed environment, a category that has become a key battleground as AI deployments move beyond pilots.

Financially, Snowflake stock’s revenue reached about $4 billion LTM with gross profit near $3 billion, yet operating expenses around $4 billion drove operating income of roughly -$1 billion and an operating margin near -31%.

Last week, management announced a $200 million OpenAI partnership to embed models inside the platform for natural-language analytics and workflow agents, with early named users including Canva and WHOOP supporting commercialization intent.

Furthermore, Snowflake CEO, Sridhar Ramaswamy framed execution priorities by saying, “the 2 main objectives for the Snowflake team and me were around accelerated project, product velocity, and taking these products to market,” setting a measurable standard for pace and go-to-market lift.

Shares trade near $168 after a 7% one-day gain, while the model assumes a 117x exit P/E against a -31% operating margin today, leaving investors debating whether growth and efficiency can align quickly enough to support the valuation.

What the Model Says for SNOW Stock

Snowflake stock’s data platform maintains strong strategic relevance, while elevated reinvestment requirements and a -31% operating margin weigh on present operating efficiency.

Regardless, valuation assumptions embed 25.2% revenue growth, 12.5% operating margins, and a 116.9x exit multiple, translating into a modeled equity value of $323.19.

The implied 91.9% total upside and 38.9% annualized return exceed standard opportunity costs tied to equity risk.

This valuation model delivers a Buy signal, as a 38.9% annualized return materially exceeds equity hurdle rates, compensating investors for sustained losses today, execution risk, and the capital intensity required to scale Snowflake’s platform toward durable profitability.

Our Valuation Assumptions

TIKR’s Valuation Model lets you plug in your own assumptions for a company’s revenue growth, operating margins, and P/E multiple, and calculates the stock’s expected returns.

Here’s what we used for Snowflake stock:

1. Revenue Growth: 25.2%

Snowflake stock’s revenue expanded 29.2% over the past year, reflecting strong consumption elasticity from large enterprise customers despite a decelerating cloud software spending cycle.

Current growth is supported by AI workloads, migration activity, and expanding enterprise use cases that sustain demand across analytics, data engineering, and agent deployments at multibillion dollar scale.

Sustaining 25.2% growth requires continued migration momentum and rising AI usage, while weaker enterprise budgets or slower workload expansion would reduce consumption growth quickly.

This is below the 1-year historical revenue growth of 29.2%, indicating the model assumes moderating growth consistent with a maturing but still expanding platform.

2. Operating Margins: 12.5%

Snowflake stock generated an 8.2% operating margin over the past year as heavy sales, R&D, and infrastructure spending continued to weigh on near term profitability.

Margin improvement to 12.5% depends on revenue scale absorbing fixed costs while management restrains headcount growth and incremental spending relative to topline expansion.

This is above the 1-year historical operating margin of 8.2%, indicating the model assumes improved cost efficiency without sacrificing growth momentum.

3. Exit P/E Multiple: 116.9x

Snowflake has traded at elevated valuation levels historically, with a 1-year average P/E of 165.2x reflecting scarcity value and long duration growth expectations.

An exit multiple of 116.9x capitalizes terminal earnings that already embed margin expansion and sustained revenue growth, avoiding additional optimism beyond operational delivery.

The multiple assumes durable earnings visibility by 2028, while any execution shortfall or margin disappointment would lead to rapid compression rather than expansion.

This is below the 1-year historical P/E of 165.2x, indicating the model assumes valuation compression as Snowflake transitions toward greater earnings maturity.

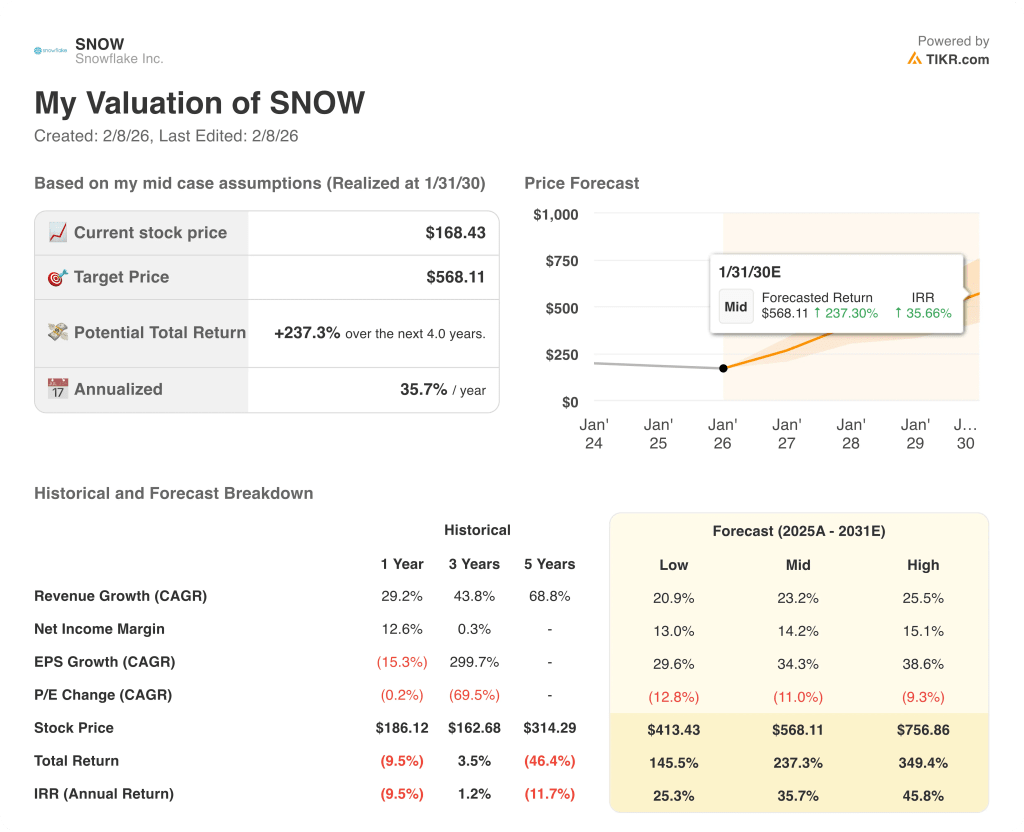

What Happens If Things Go Better or Worse?

Snowflake stock outcomes depend on enterprise data consumption, AI workload adoption, and cost discipline execution, setting up a range of possible paths through 2030.

- Low Case: If enterprise spending softens and cost leverage stalls, revenue grows around 20.9% with margins near 13.0% → 25.3% annualized return.

- Mid Case: With core migrations and AI usage executing as planned, revenue growth near 23.2% and margins improving toward 14.2% → 35.7% annualized return.

- High Case: If AI agents scale faster and cost control tightens, revenue reaches about 25.5% and margins approach 15.1% → 45.8% annualized return.

How Much Upside Does Snowflake Stock Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!