Key Stats for BAM Stock

- Price Change for BAM stock: 1.5%

- $BAM Share Price as of Nov. 19: $50.65

- 52-Week High: $64

- $BAM Stock Price Target: $63

Now Live: Discover how much upside your favorite stocks could have using TIKR’s new Valuation Model (It’s free)>>>

What Happened?

Brookfield Asset Management (BAM) stock surged on Wednesday following the company’s announcement of a massive $100 billion global AI infrastructure program launched in partnership with NVIDIA and the Kuwait Investment Authority (KIA).

The program centers on the Brookfield Artificial Intelligence Infrastructure Fund, which launches with a $10 billion equity target and has already secured $5 billion in capital commitments from institutional partners, including Brookfield, NVIDIA, and KIA.

The announcement came on the heels of Brookfield’s strong third-quarter earnings results, which showed record fundraising of $30 billion in the quarter and over $100 billion over the past 12 months.

Fee-related earnings grew 17% year-over-year to $754 million, while fee-bearing capital reached $581 billion.

Brookfield’s AI infrastructure program will invest across the entire AI value chain, from energy and land to data centers and compute infrastructure.

The company has already secured several seed investments, including a $5 billion framework agreement with Bloom Energy to install up to 1 GW of behind-the-meter power solutions for data centers and AI factories.

See analysts’ growth forecasts and price targets for BAM stock (It’s free!) >>>

What the Market Is Telling Us About BAM Stock

The market’s enthusiastic response reflects growing confidence in Brookfield’s ability to capitalize on one of the largest infrastructure buildouts in history.

Sikander Rashid, Head of AI Infrastructure at Brookfield, compared the opportunity to the formation of the modern power grid and global telecom networks, estimating that the AI infrastructure buildout will require $7 trillion of capital over the next decade.

BAM stock has been gaining momentum throughout 2024 as investors recognize the company’s unique positioning at the intersection of several major trends.

With over $100 billion already invested in digital infrastructure and clean power, Brookfield owns and operates the physical assets needed to support AI growth.

The partnership with NVIDIA adds significant validation to Brookfield’s strategy, as NVIDIA CEO Jensen Huang noted that “AI is transforming every industry, and like electricity, it will require every nation to build the infrastructure to power it.”

Beyond the AI announcement, BAM stock benefits from improving fundamentals across Brookfield’s core businesses.

The company raised a record $106 billion over the past 12 months, which indicates strong demand for its investment strategies.

Management expects 2026 to be an even stronger fundraising year, with multiple flagship funds entering the market, including infrastructure, private equity, and the new AI infrastructure fund.

The transaction environment has also improved significantly, with global M&A volumes up nearly 25% year-over-year, creating favorable conditions for both deploying capital and monetizing mature investments.

Brookfield deployed nearly $70 billion over the past 12 months while selling approximately $23 billion of real estate properties at attractive returns.

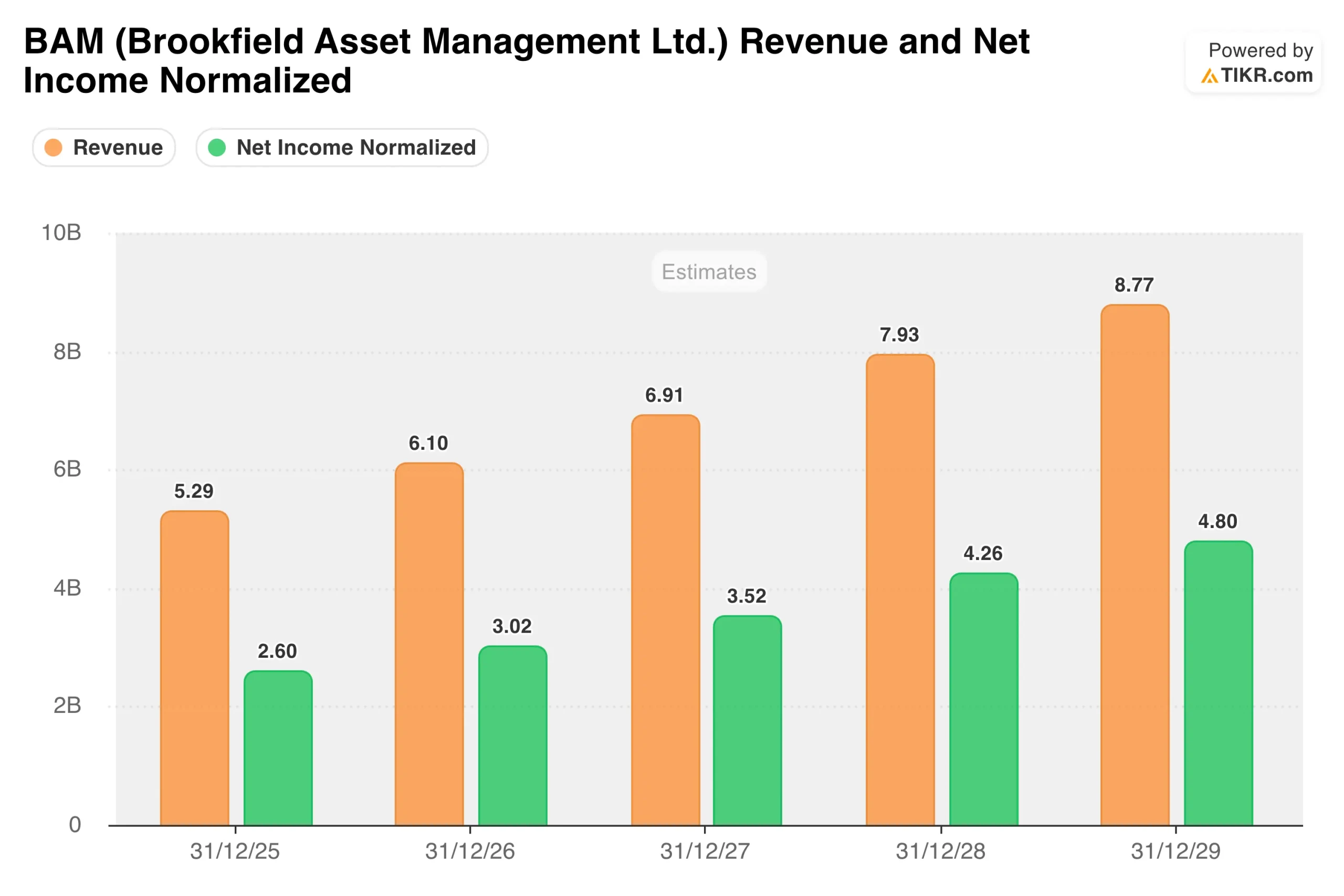

Looking ahead, Brookfield’s aggressive growth targets suggest continued upside for BAM stock. At its recent Investor Day, management outlined plans to double the business by 2030, with fee-related earnings reaching $5.8 billion and fee-bearing capital reaching $1.2 trillion.

The company’s focus on megatrends like digitalization, decarbonization, and deglobalization positions it well to capture growth opportunities across multiple sectors.

The AI infrastructure announcement represents a natural evolution of Brookfield’s strategy rather than a pivot.

BAM has spent years building expertise in renewable power, data centers, and digital infrastructure. This new fund packages those capabilities into a focused solution for one of the fastest-growing segments of the global economy.

Investors should monitor Brookfield’s progress on its AI infrastructure deployments and fundraising momentum heading into 2026.

With strong execution of its growth initiatives and exposure to structural tailwinds in infrastructure and real assets, BAM stock could have significant upside from current levels.

Estimate a company’s fair value instantly (Free with TIKR) >>>

How Much Upside Does BAM Stock Have From Here?

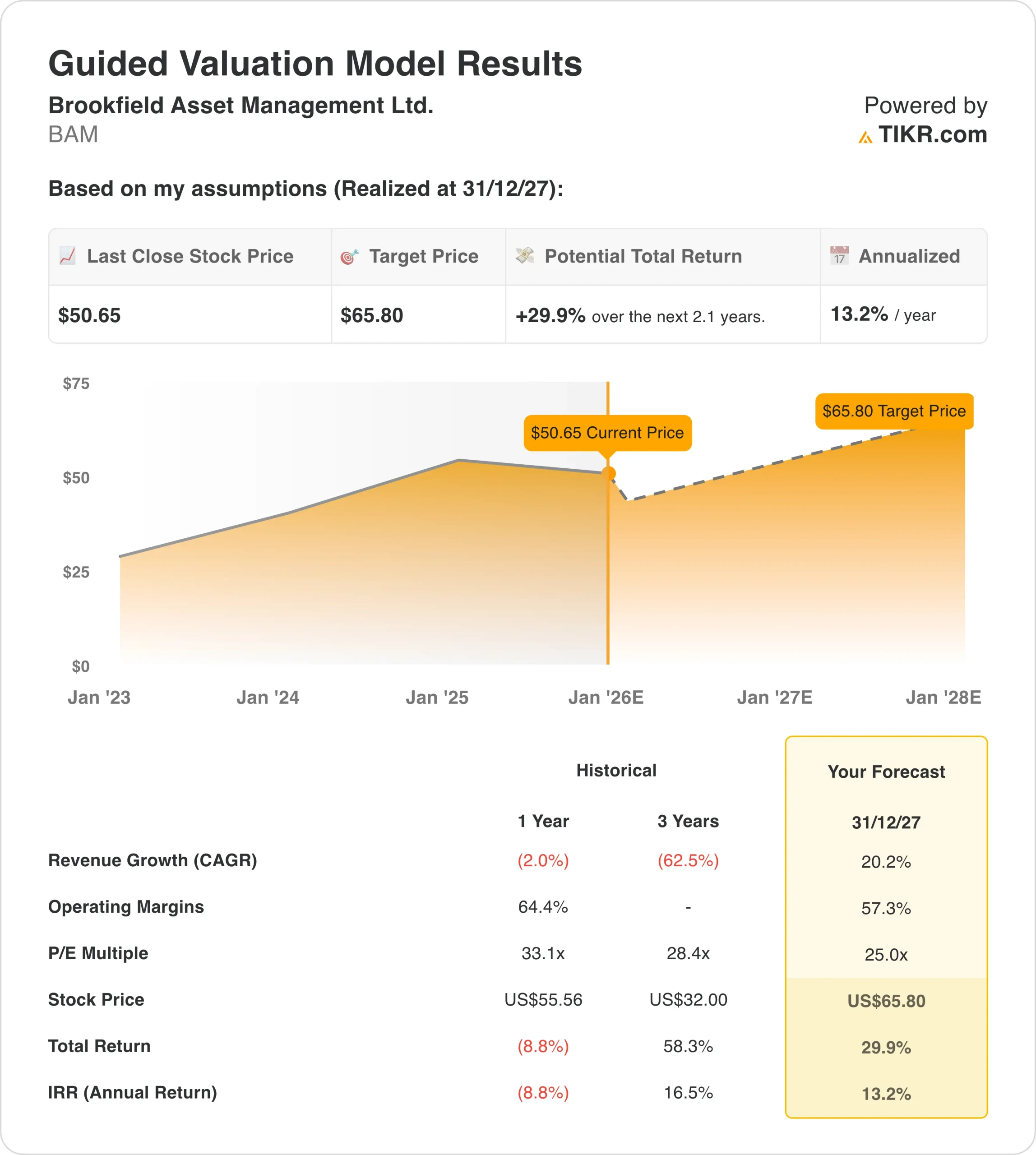

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

See a stock’s true value in under 60 seconds (Free with TIKR) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!