Key Takeaways:

- NextEra Energy stock offers a rare combination of a 3.1% dividend yield and 31 consecutive years of dividend growth, backed by one of the most stable utility businesses in the U.S.

- While the stock has pulled back due to higher interest rates and slower revenue, analysts expect nearly 10% annual EPS growth through 2027, with dividend growth projected to rebound to 9–10% annually.

- With potential total returns of nearly 39% over the next 2.5 years, NextEra may appeal to long-term investors looking for steady dividend income and upside in a high-quality utility stock.

NextEra Energy, the parent of Florida Power & Light (FPL), is also one of the world’s largest renewable energy companies. It’s known for stable earnings, healthy margins, and a long track record of dividend growth.

But after a challenging stretch driven by rising interest rates and slower growth, the stock’s valuation has pulled back. Now, with earnings expected to rebound and the dividend still increasing, sentiment may be shifting.

With a 3.1% yield, improving earnings outlook, and nearly 40% upside based on analyst targets, NextEra looks like one of the more compelling dividend plays in the utility sector today.

Analysts Think the Stock Is Undervalued Today

NextEra Energy shares currently trade around $75/share, while analysts’ consensus estimates suggest the stock could be worth ~$104/share by the end of 2027.

That scenario implies total returns of 38.7% over the next 2.5 years, or 14.2% annually, assuming NEE’s earnings grow around 11.7% annually. For a utility with strong earnings visibility, a long dividend track record, and consistent dividend growth ahead, that level of upside is compelling.

NEE also has exposure to clean energy infrastructure, which could support both long-term capital appreciation and rising shareholder payouts.

Value NextEra or any stock in less than 60 seconds with TIKR (It’s free) >>>

A 3.1% Yield From a Recession-Resistant Utility With Long-Term Upside

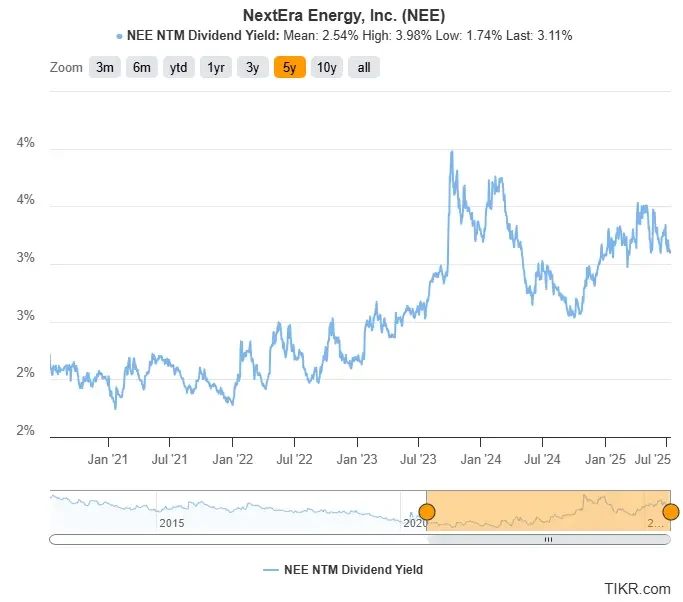

NextEra Energy’s dividend yield sits at 3.1%, near five-year highs. This is largely the result of a sharp pullback in the stock after delays in clean energy projects and higher interest expenses lowered investor confidence.

The company also faced pressure from the rising cost of capital due to higher interest rates, which affected the valuation of its renewables business and its financing plans through its affiliate, NextEra Energy Partners.

Investors today are getting paid more than usual to hold a business with visible cash flows, steady dividend growth, and long-term exposure to clean energy. If sentiment improves and earnings stay on track, the stock may re-rate higher and compress the yield, offering both dividend income and capital appreciation.

Find high-quality dividend stocks that look even better than NextEra today. (It’s free) >>>

NextEra’s Dividend Growth Is Likely to Pick Back Up

NextEra’s dividend growth hit a brief speed bump in 2025, with just a 1% increase following a sharp 20% dividend increase in 2024. But that dividend growth slowdown looks more like a pause than a warning sign.

The company’s core utility business, Florida Power & Light, continues to deliver steady, regulated earnings. Management still expects 6% to 8% annual EPS growth through 2026, and analysts are forecasting dividend growth to return to around 9% to 10% per year. That pace would bring it back in line with where it’s been historically.

The dip in 2025 was partly due to timing. EPS growth softened just as the company raised the dividend aggressively the year before, which pushed the payout ratio higher temporarily. But with earnings expected to rebound and strong 36% operating margins across the business, NextEra has plenty of room to keep growing its dividend going forward.

NextEra’s payout ratio currently sits around 60% based on forward earnings. That’s slightly elevated due to last year’s 20% dividend hike, but still within a healthy range for a utility as NEE continues to grow earnings.

NextEra has raised its dividend for 31 straight years. Unless earnings seriously disappoint, investors looking for steady income and long-term dividend growth still have good reason to be confident in the years ahead.

See NextEra’s full growth forecast and analyst estimates. (It’s free) >>>

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!