Key Stats for Atlassian Stock

- This Week Performance: -10%

- 52-Week Range: $75 to $296

- Current Price: $76

What Happened to Atlassian Stock?

Atlassian (TEAM) closed at $75.98 yesterday, down 10% this week and sitting just cents above its 52-week low of $75.01, as a sector-wide AI disruption selloff that has erased 47% of TEAM’s value year-to-date collided with the CFO transition announcement and broader institutional flight from software in the same week.

The stock’s February pressure intensified after Atlassian named James Chuong as its incoming CFO on February 18, replacing retiring Joe Binz effective March 30, arriving at the worst possible moment as the S&P 500 Software and Services index shed 19% year-to-date and more than 90% of software components traded lower that same session.

Underneath the selloff, however, Atlassian delivered its strongest operational quarter on record, crossing $1 billion in cloud revenue for the first time, growing RPO 44% year-over-year to $3.8 billion, and surpassing 1 million Teamwork Collection seats in under nine months.

Yet the market is aggressively repricing Atlassian from a high-growth enterprise software compounder to an AI disruption target, ignoring NRR above 120% for three consecutive quarters, record $1 million-plus ACV deal volume nearly doubling year-over-year, and 5 million Rovo monthly active users actively expanding customer workflows.

Michael Cannon-Brookes, Chief Executive Officer and Co-Founder, stated on the Q2 FY2026 earnings call that “our RPO at 44%, growing, accelerating for the third quarter in a row is a really fantastic vote of confidence from those customers,” with those customers signing multiyear deals committing to the Atlassian platform through 2027, 2028, and 2029.

Notably, Morgan Stanley chief U.S. equity strategist Michael Wilson named Atlassian specifically as one of the stocks offering an “attractive entry point” on February 19, arguing that AI disruption fears are jumping too many steps ahead and disproportionately punishing long-duration software names with solid fundamentals.

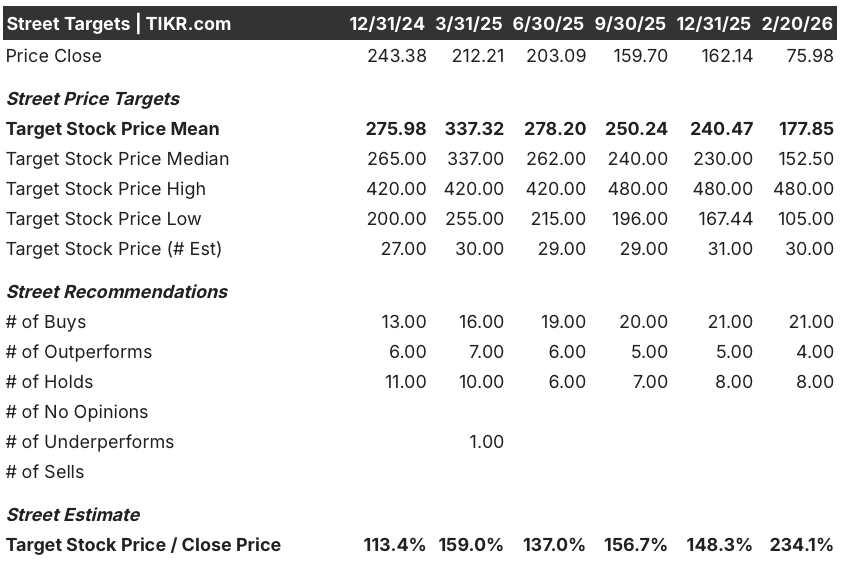

Wall Street’s Take on TEAM Stock

Despite the 10% collapse to $75.98 and a price sitting just cents above its 52-week low, the CFO transition to LinkedIn veteran James Chuong and Atlassian’s reaffirmed 20%-plus revenue CAGR through FY2027 together set up a forward story where execution, not sentiment, becomes the determining factor.

The fundamental case demands attention, with consensus forecasting FY2026 revenue of $6.37 billion (+22.2% YoY) and normalized EPS of $4.76 (+29.4% YoY), powered by a cloud business that just crossed $1 billion in quarterly revenue and an RPO accelerating for three consecutive quarters to $3.8 billion.

Wall Street stands firmly behind the recovery thesis, with 21 buys and 4 outperforms against just 8 holds and zero sells as of February 20, 2026, while the mean price target of $177.85 implies a staggering 134.1% upside from the current close of $75.98.

The target spread underscores just how much is at stake, ranging from a bear case of $105.00, itself still 38% above the current price, to a bull case of $480.00 that would require Atlassian to fully execute on its AI monetization and enterprise expansion roadmap through FY2027.

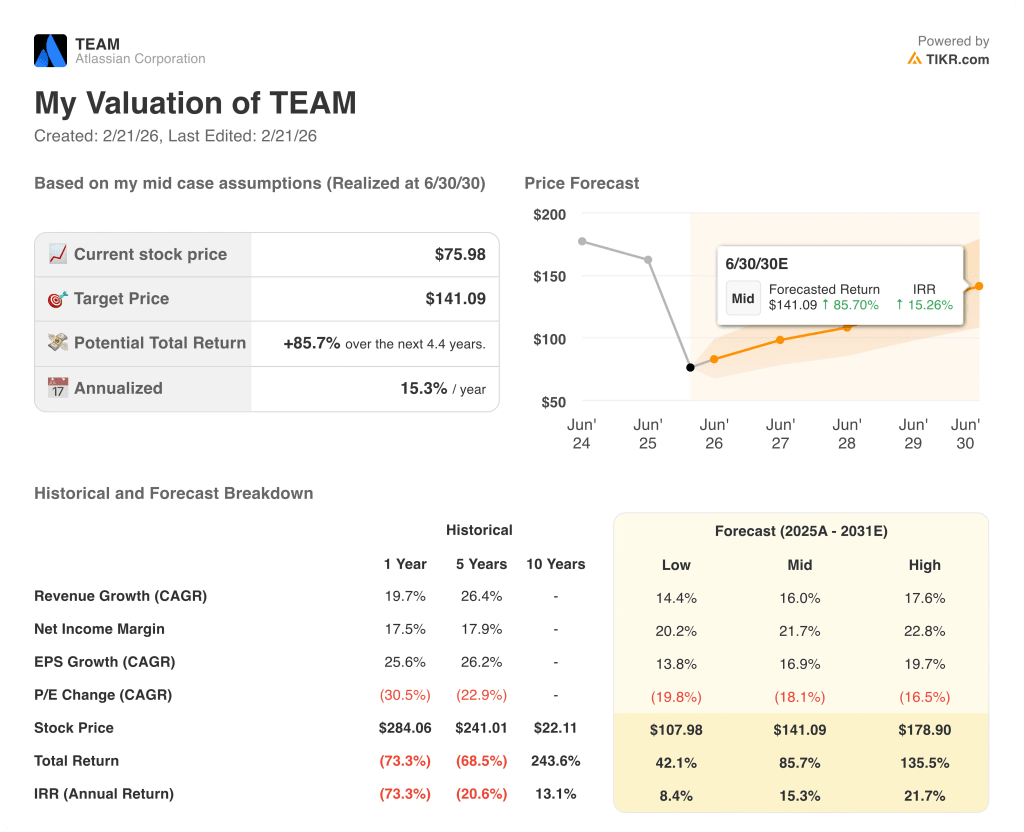

What Does the Valuation Model Say?

For investors willing to look past the noise, a mid-case valuation model prices TEAM at $141.09 by June 2030, implying an 85.7% total return and a 15.3% annualized IRR from current levels, a scenario grounded in the same 20%-plus revenue CAGR and improving net income margins the company itself reaffirmed just two weeks ago.

The most credible risk is the P/E multiple compression the model already forecasts at a negative 18.1% CAGR through 2031, meaning even if Atlassian delivers on every fundamental promise, multiple contraction driven by AI disruption fears and software sector rerating could continue to suppress returns in the near term.

At $75.98, Atlassian looks deeply undervalued relative to its earnings trajectory, analyst consensus, and valuation model, making it a compelling long-term entry point for investors who can tolerate further multiple compression before the market catches up to the fundamentals.

Value Any Stock in Under 60 Seconds (It’s Free)

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.