Key Takeaways:

- Hormel Foods stock offers a rare combination of a 3.9% dividend yield and 59 straight years of dividend growth, supported by some of the most well-known pantry brands in the world.

- While earnings have been under pressure due to inflation and shifting consumer trends, analysts still see upside of over 20% by 2027 if margins recover and valuation improves.

- With a historically high dividend yield, a conservative balance sheet, and steady dividend hikes, Hormel may appeal to long-term investors looking for both dividend income and downside protection.

- Unlock our Free Report: 5 undervalued compounders with upside based on Wall Street’s growth estimates that could deliver market-beating returns (Sign up for TIKR, it’s free) >>>

Hormel Foods is one of the longest-running dividend payers in the market.

Known for brands like SPAM, Skippy, Planters, and Jennie-O, the company sells packaged meats and pantry staples across retail and foodservice channels. It’s a defensive business with consistent demand and strong brand recognition.

Today, Hormel offers a 3.9% dividend yield and trades near multi-year lows after a 30% drop from its 2022 peak. Earnings growth has slowed due to margin pressure and shifting consumer behavior, but that could be exactly why now is the time to take a closer look.

With a long history of dividend increases, a stable balance sheet, and upside potential as margins recover, Hormel may be one of the more overlooked dividend income stocks in the consumer staples sector.

Analysts Think the Stock is Undervalued Today

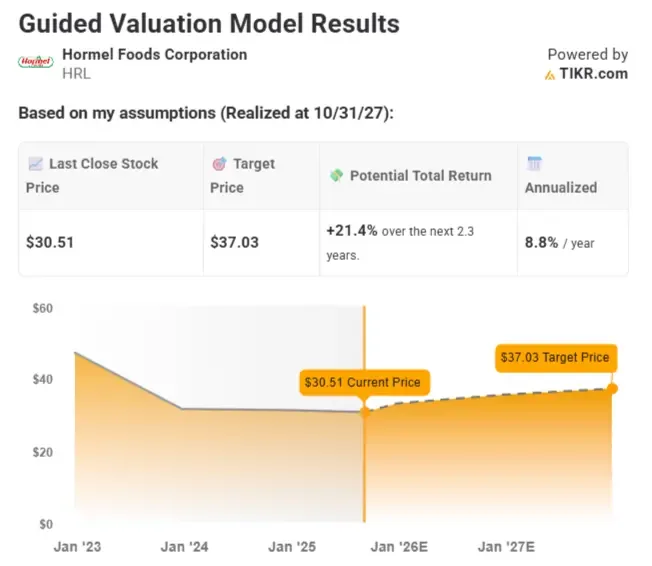

Hormel shares currently trade around $31, but based on analysts’ estimates, the stock could be worth closer to $37 per share by the end of 2027.

That would imply total returns of over 21% in just 2.3 years, or about 8.8% annually, assuming earnings recover and the stock trades at a slightly higher valuation multiple.

With input costs stabilizing and margins expected to improve, Hormel has a clear path back to growth. Even without dramatic upside, the combination of a valuation rebound and a reliable dividend gives long-term investors a strong case to hold or begin building a position.

Value any stock in less than 60 seconds with TIKR (It’s free) >>>

Is Hormel’s 4% Yield a Sign of Value or Trouble?

Hormel’s 3.9% Hormel’s dividend yield is one of the highest it has offered in more than a decade. For most of its history, the yield has stayed closer to 3%, so this is a big shift.

The reason it’s so high right now is because the stock has dropped nearly 40% in the past 3 years. Higher input costs, weaker turkey pricing, and challenges in the Planters business have all pressured margins. Even with that drop, the dividend is still covered by earnings and cash flow, with a payout ratio just above 70%, which is a little elevated but still reasonable.

But this may be more of a reset than a permanent decline. The stock now offers one of the highest yields in its history while the business continues to generate stable cash flow. With earnings expected to rebound to nearly $1.96 by 2027, investors locking in today’s 4% yield may look back and see this as a rare moment when the market was overly pessimistic on a high-quality dividend grower.

Find high-quality dividend stocks that look even better than Hormel today. (It’s free) >>>

Hormel’s Dividend Safety

Analysts expect Hormel’s dividend to continue to grow, even through recent earnings declines. The company is expected to pay $1.16 per share in dividends in fiscal 2025 and is projected to lift that to $1.26 by 2027.

While earnings compression has pushed the payout ratio higher, it’s still manageable at about 73% this year. That’s above historical norms, but not unsustainable given Hormel’s consistent free cash flow and strong balance sheet.

Looking ahead, earnings are expected to grow steadily over the next two years, which should ease pressure on the payout ratio and allow for modest dividend increases. Hormel has raised its dividend for 59 consecutive years, and there’s nothing in the current fundamentals to suggest that streak is at risk.

For long-term investors, the combination of a secure payout, rising earnings, and a historically high yield offers both stability and upside.

See Hormel’s full growth forecast and analyst estimates. (It’s free) >>>

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!