Key Takeaways:

- Business Inflection: Revenue reached $4.3 billion while EBIT turned positive at $107 million, marking a structural shift from losses to earnings discipline.

- Margin Recovery: Operating margins near 8% reflect lower content costs and higher ad efficiency, improving earnings durability.

- Valuation Setup: Shares trade near 26x forward earnings, a level that prices caution despite improving cash flow trends.

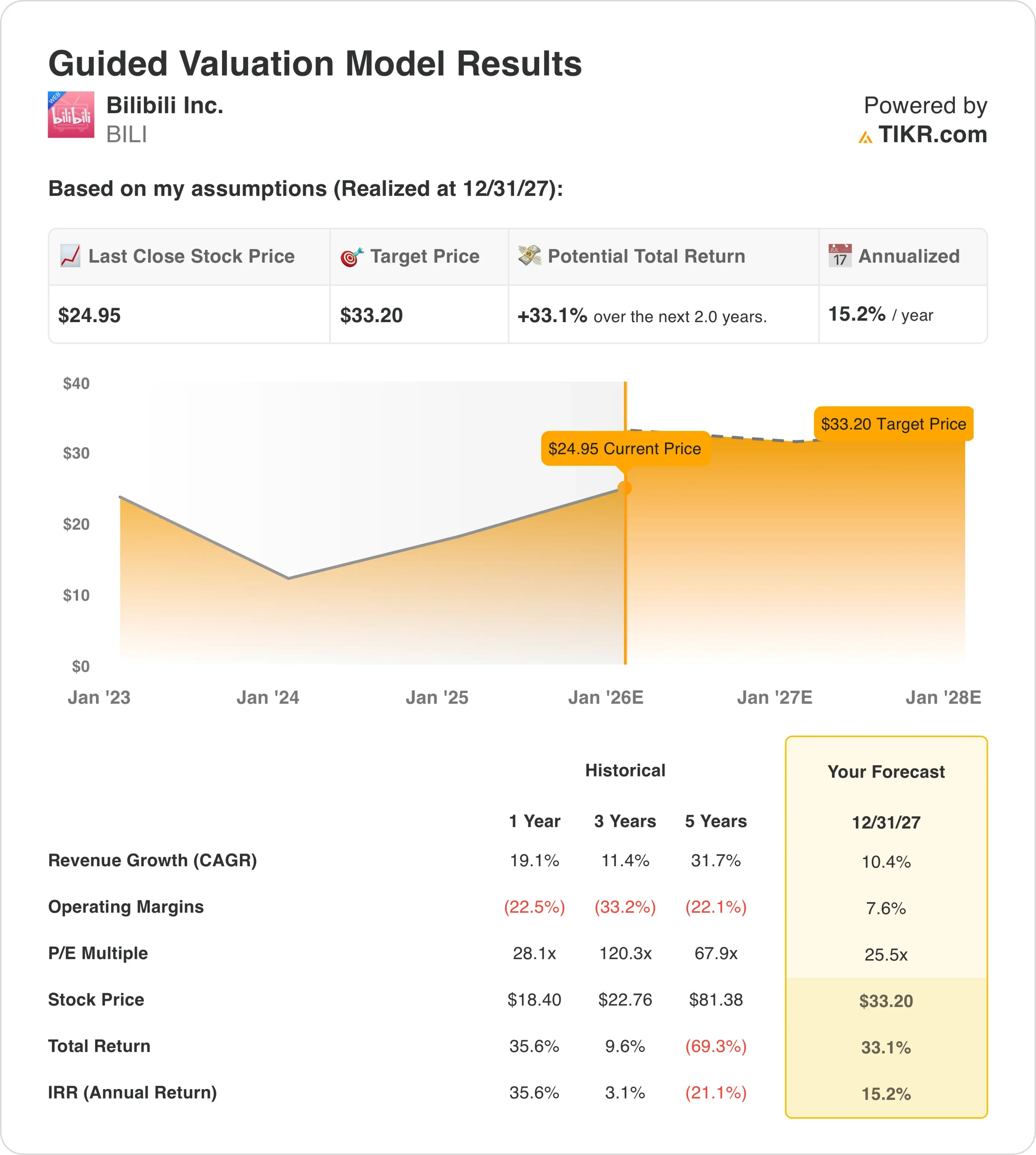

- Price Target: The model supports $33 by 2027, implying 33% total upside and 15% annual returns from the current share price of around $25.

Bilibili (BILI) operates a leading youth-focused online video and entertainment platform in China, monetizing through advertising, mobile games, live broadcasting, and premium memberships.

Recent disclosures show JPMorgan (JPM) increased its ownership to 17%, a notable signal as operating losses narrowed and free cash flow turned positive during the company’s profitability transition.

Bilibili generated $4.3 billion in trailing revenue, reflecting high-teens growth that matters because it shows demand stability even as content spending was reduced.

EBIT reached $107 million with operating margins near 8%, an inflection that matters because it confirms monetization gains are translating into real earnings power.

With a market cap near $10 billion and shares trading around 26x forward earnings, valuation reflects skepticism despite rising margins, raising questions about how quickly execution shifts investor perception.

What the Model Says for BILI Stock

We evaluated Bilibili assuming improving monetization efficiency, controlled content spending, and disciplined capital allocation as losses convert into sustainable operating profits.

Using 10% revenue growth, 7.6% operating margins, and a 25.5× exit multiple, the model projects BILI reaching $33 per share by 2027.

That implies a 33.1% total return, or 15.2% annualized, from the current price of $25.

Our Valuation Assumptions

TIKR’s Valuation Model lets you plug in your own assumptions for a company’s revenue growth, operating margins, and P/E multiple, and calculates the stock’s expected returns.

Here’s what we used for BILI stock:

1. Revenue Growth: 10.4%

Bilibili’s revenue expanded from $19.4B in 2021 to $29.8B LTM, reflecting recovery from regulatory pressure and renewed advertising demand.

The company’s growth slowed to 19% YoY in 2024, marking a transition from hypergrowth toward more sustainable expansion.

Consensus forecasts point to revenue reaching $36.1B by 2027, implying low-double-digit growth as scale increases.

Advertising efficiency and gaming monetization remain primary drivers, supported by content IP expansion and improving user monetization.

Macro sensitivity and competitive intensity cap upside compared to earlier cycles, particularly in discretionary ad spending.

Street expectations point to a 10.4% growth outlook, reflecting improving monetization while accounting for platform maturity and a more normalized Chinese digital advertising landscape.

2. Operating Margins: 7.6%

Bilibili generated positive EBIT of $747M LTM, marking a clear inflection after multiple years of operating losses.

Operating margins improved from negative mid-30% levels in 2021–2022 to 2.5% LTM, driven by cost discipline.

Content spending has been rationalized, while marketing efficiency improved through higher ad load and better targeting.

Gross margins expanded to 36.4% LTM, supporting further operating leverage as fixed costs scale.

Margins remain below global peers, reflecting continued investment needs and competitive content dynamics.

Current profitability trends support operating margins of 7.6%, aided by cost discipline and monetization progress, but limited by ongoing reinvestment needs.

3. Exit P/E Multiple: 25.5x

Bilibili trades near 25.5× forward earnings, reflecting cautious optimism around its profitability transition.

Historical multiples were significantly higher during growth-heavy years but compressed sharply amid regulatory uncertainty.

Investor sentiment remains guarded, prioritizing earnings durability over pure user growth metrics.

Improving free cash flow and narrowing losses have stabilized valuation, but re-rating requires consistent execution.

Institutional accumulation, including JPMorgan’s increased stake, signals growing confidence but not exuberance.

Valuation assumptions imply a 25.5× exit multiple, consistent with a profitable yet cyclical digital platform that continues to earn measured investor confidence.

What Happens If Things Go Better or Worse?

Bilibili’s outlook depends on user monetization, content cost control, and whether valuation reflects sustained profitability. Here is how BILI might look in different scenarios through 2027:

- Low Case: If annual revenue growth slows to 9% and margins only improve to 9% due to weaker advertising demand → 5.4% annual return.

- Mid Case: With revenue growing 10% and operating margins expanding near 10% → 12.0% annual return.

- High Case: If monetization accelerates and margins expand into low-teens → potential for 18% annual returns

Bilibili has moved past loss-heavy expansion and is now showing operating leverage as content costs normalize and ad efficiency improves.

Reaching $33 by 2027 is feasible if operating margins keep improving and valuation remains anchored near today’s earnings range.

How Much Upside Does It Have From Here?

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E multiple

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!