Key Takeaways:

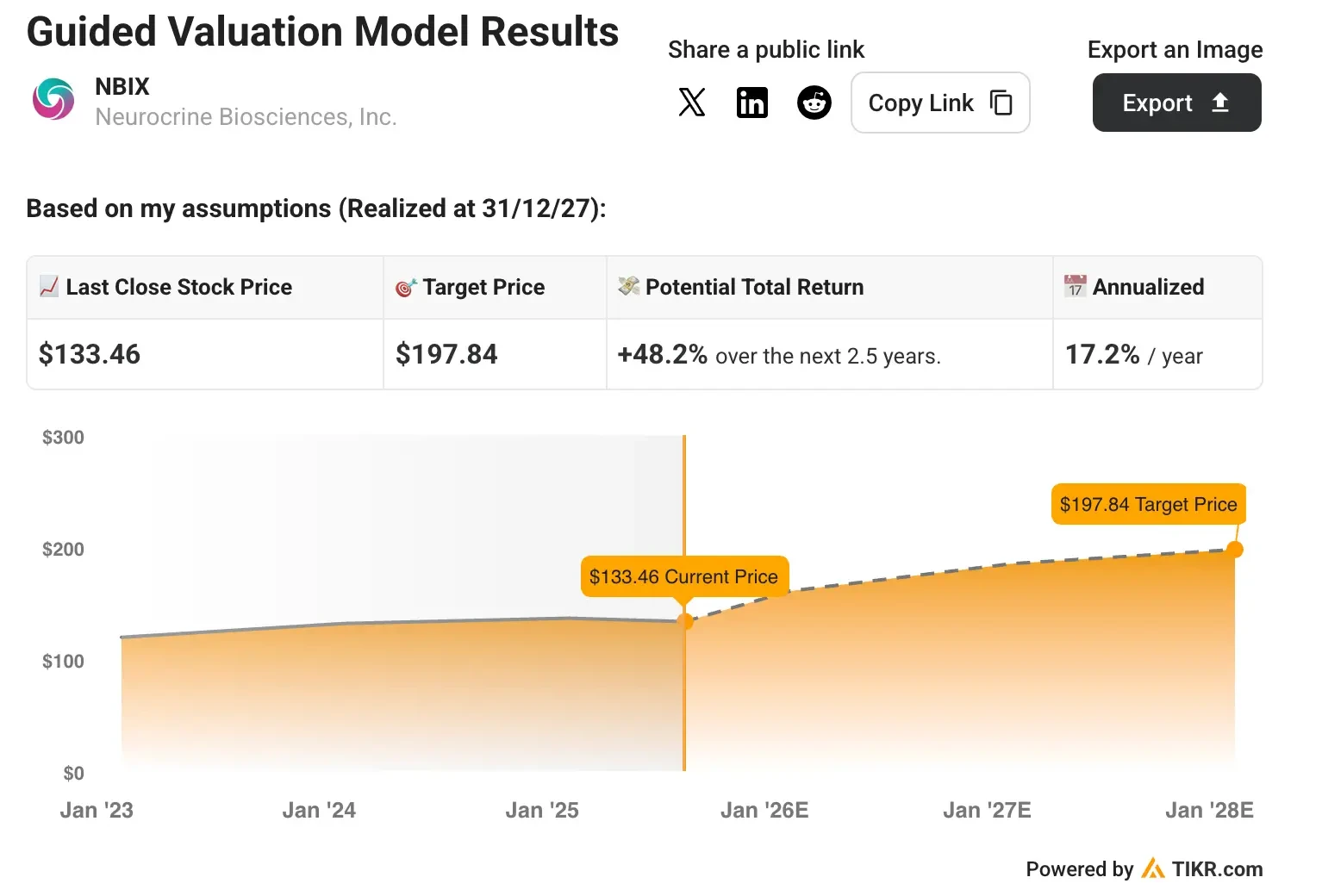

- Neurocrine Biosciences stock could reasonably reach $198/share by the end of 2027, based on our valuation assumptions.

- That implies a 48% total return from today’s price of $133.46/share, with an annualized return of 17% over the next 2.5 years.

- Neurocrine operates as a leading neuroscience-focused biopharmaceutical company with two commercial products and a robust pipeline targeting CNS disorders.

Neurocrine Biosciences (NBIX) is a commercial-stage biopharmaceutical company focused on discovering, developing, and commercializing life-changing treatments for patients with neurological, neuroendocrine, and neuropsychiatric disorders.

The company benefits from the continued growth of its blockbuster INGREZZA franchise for tardive dyskinesia, the successful launch of CRENESSITY for congenital adrenal hyperplasia, and a deep pipeline of muscarinic agonists and next-generation compounds targeting major psychiatric disorders.

With $2.5-2.6 billion in guided 2025 revenue, record new patient additions, and multiple Phase III programs advancing, Neurocrine remains positioned as a premier growth story in the neuroscience space.

Here’s why NBIX stock could return 17% annually through 2027 and continue its strong performance through 2030.

Try TIKR’s Valuation Model today for FREE (It’s the easiest way to find undervalued stocks) >>>

What the Model Says for NBIX Stock

We analyzed Neurocrine’s upside using valuation assumptions based on the company’s dual commercial franchise and advancing late-stage pipeline.

Based on estimates of 14% annual revenue growth, 26% operating margins, and stable valuation multiples, the model projects NBIX stock could rise from $133/share to $198/share.

That represents a 48% total return and a 17% annualized return over the next 2.5 years.

Value NBIX with TIKR’s Valuation Model today for FREE (Find undervalued stocks fast) >>>

Our Valuation Assumptions

TIKR’s Valuation Model lets you plug in your own assumptions for a company’s revenue growth, operating margins, and P/E multiple, and calculates the stock’s expected returns.

Here’s what we used for NBIX stock:

1. Revenue Growth: 14%

Neurocrine delivered strong Q1 results with $545 million in INGREZZA sales and $14.5 million from newly launched CRENESSITY. It reaffirmed the 2025 guidance of $2.5-2.6 billion total revenue.

We used a 14% forecast reflecting continued INGREZZA growth despite competitive pressures and significant CRENESSITY expansion potential.

2. Operating Margins: 26%

Neurocrine demonstrates exceptional profitability with strong gross margins and efficient operations. We project continued margin expansion as CRENESSITY scales and R&D spending moderates after the current Phase III programs complete.

3. Exit P/E Multiple: 18.1x

Neurocrine trades at reasonable multiples for a commercial-stage biotech with growth prospects. We maintain current forward P/E valuation levels given the company’s proven execution track record and diversified revenue base.

Build your own Valuation Model to value any stock (It’s free!) >>>

What Happens If Things Go Better or Worse?

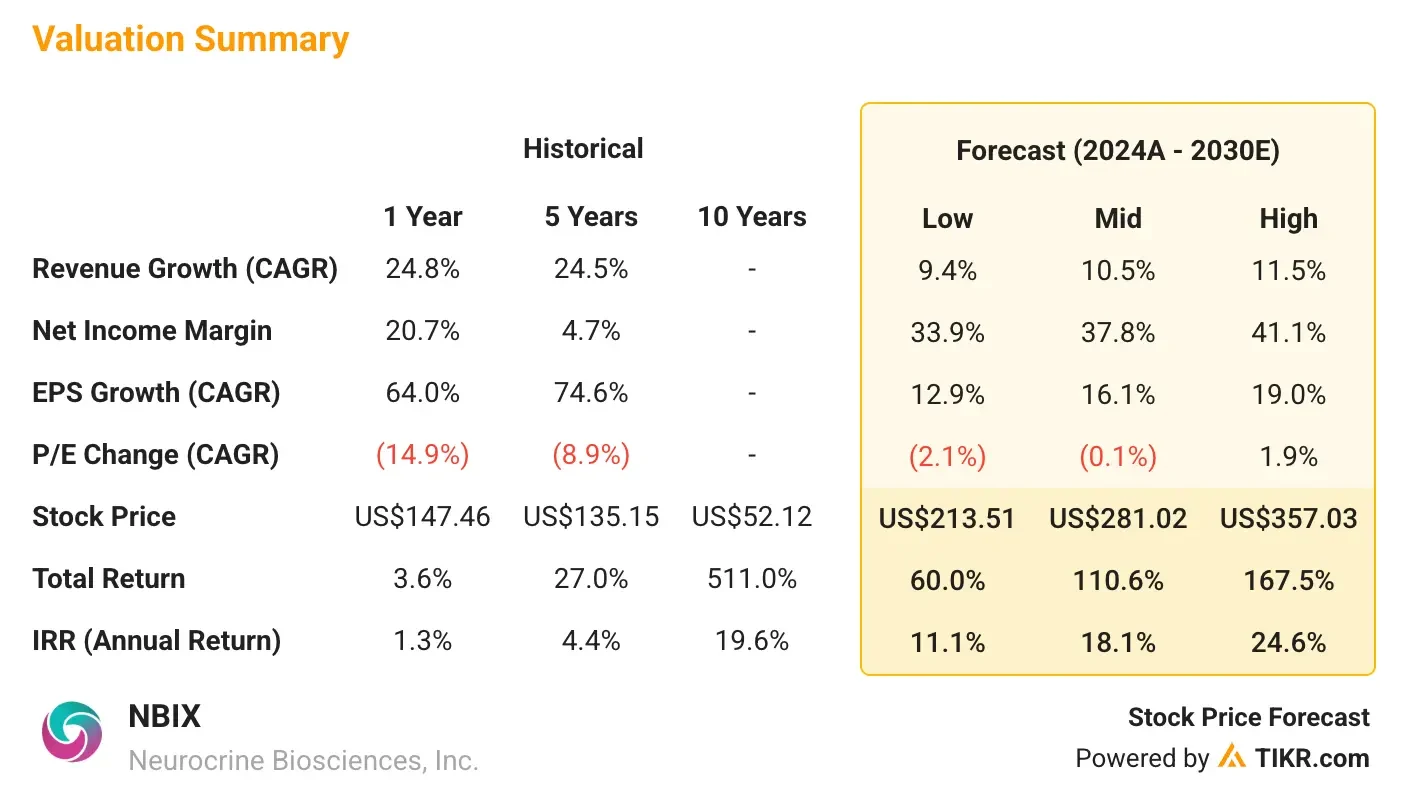

TIKR’s valuation tool allows investors to test a wide range of outcomes based on how NBIX stock performs through 2030 under different scenarios (these are estimates, not guaranteed returns):

- Low Case: Pipeline setbacks and competitive pressure → 11% annual returns

- Mid Case: Solid execution across commercial and clinical assets → 18% annual returns

- High Case: CRENESSITY blockbuster success and pipeline breakthroughs → 25% annual returns

Even in the conservative case, Neurocrine stock offers attractive double-digit returns, while the upside scenario could deliver exceptional gains if multiple catalysts materialize.

See analysts’ growth forecasts and price targets for any stock (It’s free!) >>>

TIKR Takeaway

Neurocrine represents a compelling combination of established commercial products and high-potential pipeline assets in large CNS markets.

With an estimated 48.2% upside by the end of 2027 and potential annual returns of 17.2%, Neurocrine stands out as a premier neuroscience growth play benefiting from sustained INGREZZA performance, CRENESSITY’s blockbuster potential, and multiple late-stage pipeline catalysts.

NBIX stock is best suited for investors seeking exposure to CNS therapeutics, companies with proven commercial execution capabilities, and diversified biotech platforms with multiple shots at major psychiatric and neurological indications.

The combination of near-term revenue visibility, pipeline optionality, and strong balance sheet makes Neurocrine an attractive consideration for growth-oriented biotech portfolios positioned for long-term outperformance.

Is NBIX stock worth buying today? Use TIKR’s Valuation Model and analyst forecasts to see if it looks undervalued.

Value any stock with TIKR’s Valuation Model (It’s free!) >>>

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!