Oracle Corporation (NYSE: ORCL) develops software and cloud infrastructure that power businesses worldwide, from databases and enterprise applications to AI-driven cloud services. The company has steadily climbed into the top tier of global technology companies, recently trading around $236 per share with a market value of about $658 billion.

Once defined by its dominance in databases, Oracle has transformed into a broad enterprise software and cloud infrastructure giant, now positioning itself as a key player in the AI era. Its Fusion applications, expanding cloud services, and push into generative AI partnerships are reshaping how the market views the company.

Backed by strong margins in its legacy software business and a fast-growing cloud arm, Oracle has become an increasingly important holding for large institutional investors. Founder Larry Ellison still controls a massive personal stake, but the majority of Oracle stock is held by global index funds, asset managers, and hedge funds that continue to adjust their exposure as the company’s strategy evolves.

Looking at ownership trends and insider moves helps show how the big money is thinking about Oracle after such a strong run.

Who Are Oracle’s Top Shareholders?

Track the top shareholders of over 50,000 global stocks (It’s free) >>>

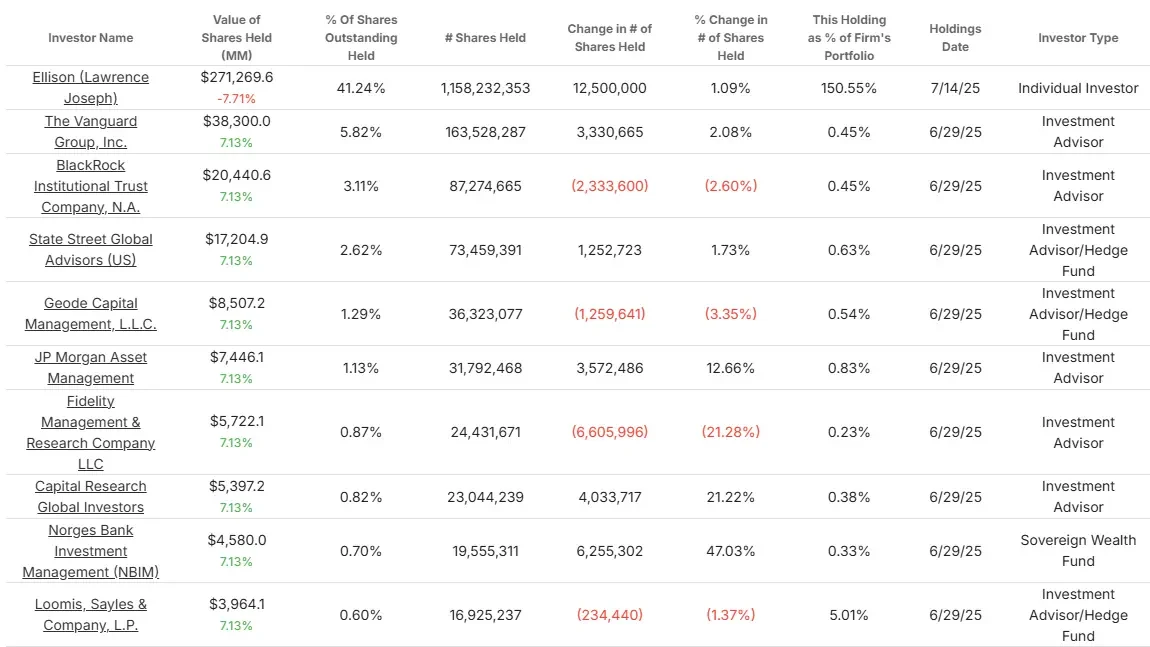

Oracle develops databases, enterprise applications, and cloud infrastructure that serve businesses across the globe. Its ownership is anchored by founder Larry Ellison, while index giants like Vanguard, BlackRock, and State Street also hold meaningful stakes. Some active managers have recently made sharper moves.

- Larry Ellison (Founder & CTO): 1.16B shares (41.2%), ~$271.3B. Added 12.5M (+1.1%)

- Vanguard Group: 163.5M (5.8%), ~$38.3B. Added 3.3M (+2.1%)

- BlackRock: 87.3M (3.1%), ~$20.4B. Cut 2.3M (-2.6%)

- State Street: 73.5M (2.6%), ~$17.2B. Added 1.25M (+1.7%)

- Geode Capital: 36.3M (1.3%), ~$8.5B. Trimmed 1.26M (-3.4%)

- JP Morgan Asset Mgmt: 31.8M (1.1%), ~$7.4B. Added 3.6M (+12.7%)

- Fidelity Mgmt: 24.4M (0.9%), ~$5.7B. Cut 6.6M (-21.3%)

- Capital Research Global Investors: 23.0M (0.8%), ~$5.4B. Added 4.0M (+21.2%)

- Norges Bank: 19.6M (0.7%), ~$4.6B. Added 6.3M (+47.0%)

- Loomis Sayles: 16.9M (0.6%), ~$4.0B. Trimmed 234K (-1.4%)

One highlight from last quarter is Dmitry Balyasny’s Balyasny Asset Management, which boosted its Oracle stake by more than 1,424%, now holding 1.21M shares worth $265M. That kind of sharp increase suggests stronger conviction in Oracle’s cloud trajectory.

Another notable move came from Sander Gerber’s Hudson Bay Capital, which raised its position by over 1,324% to about 39K shares worth $8.5M. While smaller in size, the scale of the increase marks a clear shift in exposure.

Meanwhile, Steven Schonfeld’s Schonfeld Strategic Advisors lifted its stake by 778% to 349K shares worth $76M, and David Harding’s Winton Group expanded by 330% to nearly 40K shares worth $8.7M. These aggressive jumps indicate that hedge funds have been leaning more bullish on Oracle after its strong run.

Oracle’s shareholder base is a mix of founder-led control, passive index dominance, and selective active bets. Ellison’s 41% stake keeps the company firmly under his influence. Index funds ensure wide institutional ownership, while hedge funds and active managers are showing increasing confidence, though some large investors like BlackRock and Fidelity have been taking profits.

See whether Oracle’s top shareholders are buying or selling today >>>

Oracle’s Recent Insider Trades

Insider trading activity at Oracle has picked up, with a combination of sales and new share grants.

For investors, these moves can offer clues into how confident leaders feel about the stock’s valuation. While insider trades are not always straightforward signals, consistent patterns can sometimes highlight whether management is leaning optimistic or cautious.

Here are some recent insider sales:

- Larry Ellison: Sold 6.5M shares in July (~$1.7B), received 5M new shares. Still owns more than 1.1B shares.

- Michael Sicilia (Officer): Sold 39K at ~$244–254.

- Jeffrey Henley (Officer & Director): Sold 11K at ~$244, received 25K shares.

- Clayton Magouyrk (Officer): Sold 24K, received 62.5K shares.

- Maria Smith (Officer): Sold 1.8K shares.

- Naomi Seligman (Director): Sold 3.3K shares in July.

Ellison’s massive transactions draw headlines but don’t change his overall control. Other sales look relatively small and may simply reflect diversification or equity plans. The lack of notable insider buying suggests leadership might not see the stock as undervalued at today’s levels.

See recent insider trade data for over 50,000 global stocks (It’s free) >>>

What the Ownership & Insider Trade Data Tell Us

Oracle’s ownership is shaped by founder Larry Ellison, whose 41% stake gives him unusual influence for a company of this size. Alongside him, passive giants like Vanguard and State Street keep the stock deeply embedded in global portfolios. Some active managers, including Norges Bank and Capital Research, have been increasing their positions, suggesting selective confidence in Oracle’s long-term cloud strategy. Others, such as BlackRock and Fidelity, have trimmed exposure, which may reflect profit-taking after the strong rally.

Insider activity appears more about equity plans and diversification than directional bets. Ellison’s large sales make headlines, but his overall stake remains unchanged at over 1.1B shares. Other executive transactions have been small and may not carry much signaling power.

For investors, the message looks mixed. Oracle remains both tightly controlled and widely owned, with institutions divided on whether the cloud push can sustain the company’s momentum. The absence of meaningful insider buying may indicate that management sees the stock as fairly valued after its recent run.

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.