Brad Gerstner founded Altimeter Capital in 2008 during the depths of the financial crisis. He wasn’t deterred by the chaos. He saw opportunity, and his belief was simple: Technology is the most powerful force in the modern economy, and companies riding long-term innovation waves will outperform over time. His investment playbook is built around identifying these secular “supercycles” early and backing the platform businesses best positioned to dominate.

Today, Gerstner is becoming a household name with his popular podcast, BG2Pod, that he hosts alongside Bill Gurley, and his frequent appearances on Bloomberg, CNBC, and even on Capitol Hill.

Altimeter’s public equity strategy is fairly concentrated. The portfolio is filled with businesses that benefit from structural trends like artificial intelligence, cloud infrastructure, and digital platforms. Gerstner looks for founder-led companies with scale advantages, expanding margins, and long runways. He is not chasing quarterly results. He is trying to own the winners of the next decade.

Below is a snapshot of Altimeter’s full public market portfolio, as of June 30, 2025:

| Symbol | Issuer Name | Shares | Value ($000) |

|---|---|---|---|

| META | Meta Platforms | 1,877,301 | 1,385,617 |

| NVDA | NVIDIA | 8,252,160 | 1,303,759 |

| CFLT | Confluent | 15,552,976 | 387,736 |

| UBER | Uber Technologies | 5,953,104 | 555,425 |

| MSFT | Microsoft | 1,058,121 | 526,320 |

| CPNG | Coupang | 11,432,698 | 342,524 |

| HOOD | Robinhood Markets | 3,245,457 | 303,872 |

| AMZN | Amazon.com | 1,464,863 | 321,376 |

| SNOW | Snowflake | 2,825,630 | 632,291 |

| CART | Maplebear (Instacart) | 4,216,768 | 190,767 |

| TSM | Taiwan Semiconductor | 867,209 | 196,414 |

| Z | Zillow Group | 2,387,772 | 167,263 |

| ARM | Arm Holdings | 933,208 | 150,937 |

| DDOG | Datadog | 881,730 | 118,443 |

| IOT | Samsara | 2,990,578 | 118,965 |

| MELI | MercadoLibre | 46,539 | 121,636 |

| CORE | CoreWeave | 649,536 | 105,913 |

| GRAB | Grab Holdings | 3,502,000 | 1,369 |

If you’re curious to see the full holdings of over 10,000 hedge funds, mutual funds, family offices, and institutional investors, you can sign up for free on TIKR. It’s the easiest way to track investor movements, analyze portfolios, and spot ideas early.

While Altimeter owns more than a dozen names, its capital is heavily concentrated in a few high-conviction positions. Below, we’ll break down the top five holdings and why they reflect Gerstner’s long-term philosophy.

Value stocks in as little as 30 seconds with TIKR’s new Valuation Model (It’s free) >>>

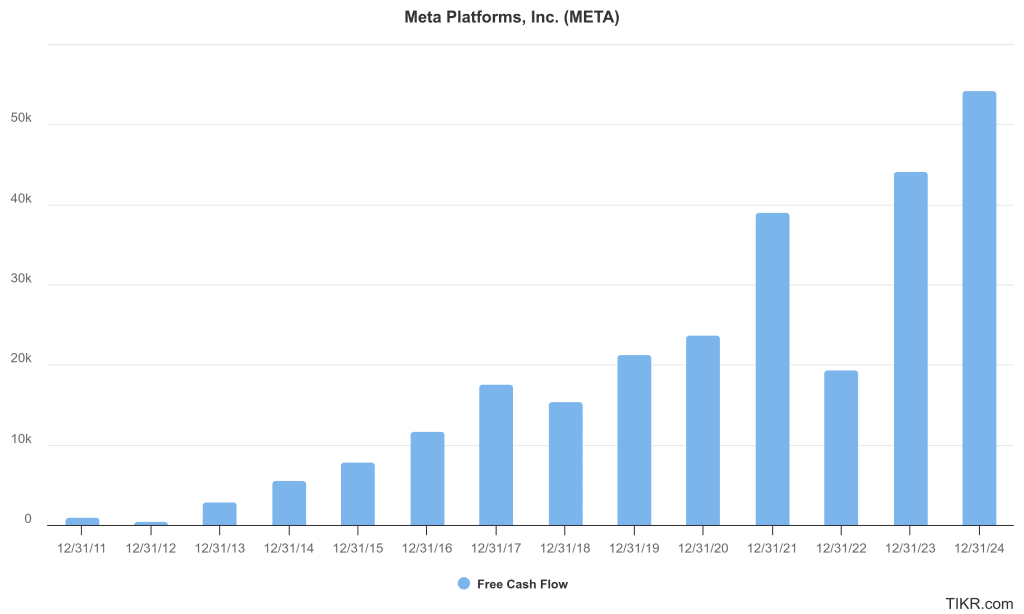

Meta Platforms (META)

Meta is Altimeter’s largest holding and a near-perfect reflection of Gerstner’s investing mindset. He wants to own companies that dominate their markets, generate high cash flow, and can adapt when the environment changes. Meta checks all those boxes. After years of aggressive spending on the Metaverse, the company pivoted toward efficiency and doubled down on AI. That kind of operational self-awareness is something Gerstner values deeply.

Meta’s scale, margins, and ability to integrate AI across its ad network and messaging apps make it a long-term compounder. It’s not a flashy bet. It’s a bet on durable infrastructure and a management team that still plays offense.

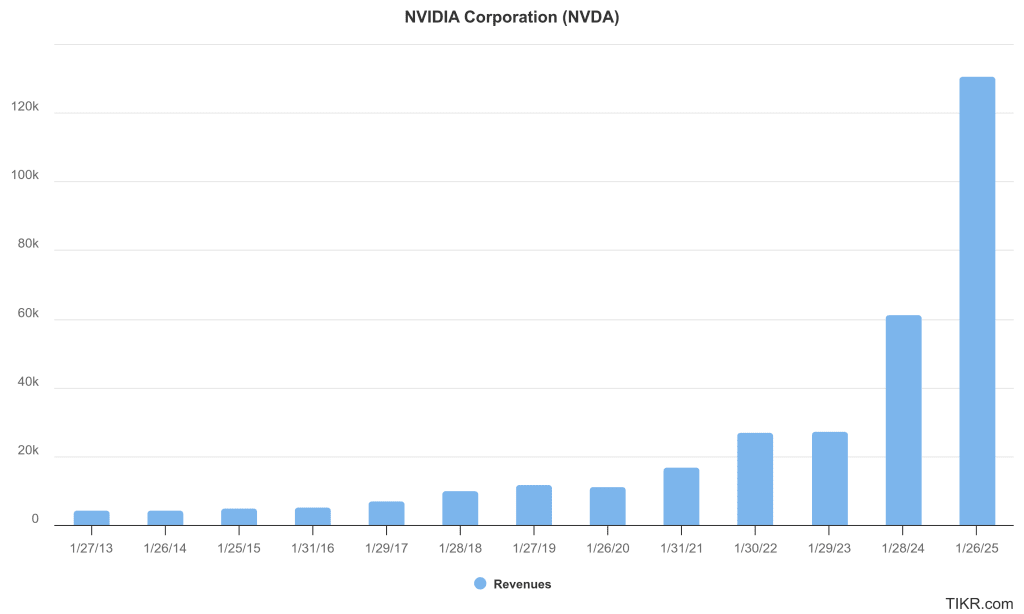

NVIDIA (NVDA)

Gerstner has long viewed AI as the most important technological trend of the next two decades. NVIDIA is the engine behind that trend. While Altimeter trimmed its position slightly in Q1, the stake remains substantial. The company dominates AI infrastructure, with its GPUs powering nearly every major model in production today.

This is exactly the type of business Gerstner wants to hold. It benefits from both explosive demand and high barriers to entry. And while valuation has surged, his framework emphasizes terminal value. In other words, he’s not concerned with this year’s price-to-earnings ratio if the company can become 10 times more valuable over the next 10 years.

Confluent (CFLT)

Altimeter’s interest in Confluent likely reflects its role as the leading platform for real-time data streaming, a critical layer for AI and modern enterprise apps. Despite some near-term optimization by customers, the company continues to post double-digit subscription growth, expanding margins, and strong uptake of new products.

Flink, Confluent’s managed stream processing engine, nearly tripled ARR in the first half of the year, while competitive win rates above 90% show its product edge. Growing partnerships with EY, Infosys, and Databricks are driving more than 20% of new business.

Positioning itself as the “real-time backbone” for AI, Confluent powers live, trusted data flows for companies like Notion and Wix, enabling personalization, analytics, and automation. With a $100+ billion market opportunity, it offers the kind of scalable growth Altimeter targets.

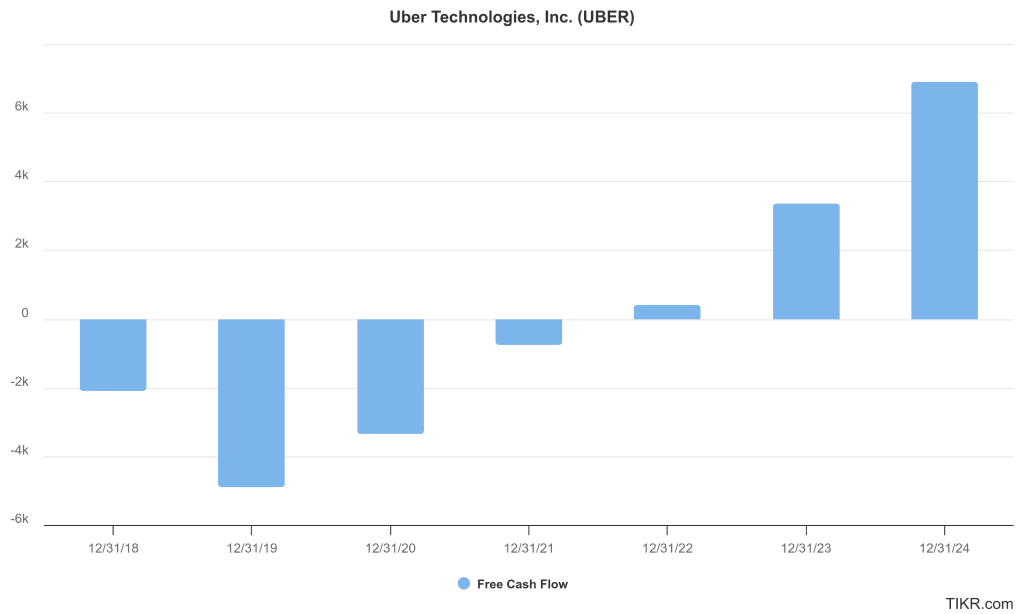

Uber Technologies (UBER)

Uber has evolved from a growth-at-all-costs company into a cash-flow-generating logistics platform. That transformation fits perfectly with Gerstner’s preference for businesses that scale efficiently and benefit from operating leverage. Uber now dominates mobility and delivery across most of its markets and is increasingly integrating payments and advertising into its ecosystem.

Altimeter added slightly to its position this quarter. The thesis is clear. As the company continues to consolidate market share and expand into higher-margin adjacencies, the financial profile improves dramatically. Uber may not be a traditional tech company, but Gerstner sees it as a foundational part of the modern urban economy.

Microsoft (MSFT)

Microsoft is one of the most reliable platforms in tech. Its integration of generative AI into Office, Azure, and GitHub is already paying off, and its financial profile is about as strong as it gets. For an investor like Gerstner, Microsoft is a way to gain large-scale exposure to enterprise software and AI without taking on the volatility of earlier-stage names.

He values companies that innovate while also generating strong returns on capital. Microsoft has done that consistently, and with its early investment in OpenAI, it has positioned itself at the center of the next big wave in computing.

Focused Capital, Aligned Incentives, Long-Term Thinking

Altimeter’s portfolio doesn’t try to cover every sector or theme. It reflects a concentrated bet on where the world is going. Gerstner looks for platforms, not products. He wants businesses with network effects, expanding margins, and leaders who can adapt and scale. That’s why nearly 70% of Altimeter’s public equity capital sits in just five names.

This is not index hugging. It’s a firm conviction that long-term value creation comes from understanding where innovation is headed and partnering with the winners early. Whether through Meta’s AI transformation, NVIDIA’s dominance in compute, or Snowflake’s role in data infrastructure, Altimeter is investing in the architecture of the future.

And Gerstner’s strategy is clear. When the world is changing fast, don’t scatter your bets. Double down on the companies building it.

Quickly value any stock with TIKR’s powerful new Valuation Model (It’s free!) >>>

Want to Know What a Stock Could Return in as Little as 30 Seconds?

TIKR just launched a powerful Valuation Model tool that shows you how much upside (or downside) a stock could have based on real analyst forecasts.

In seconds, you’ll see:

- What a stock’s fair value is based on revenue growth, margin, and P/E multiple estimates

- Return projections across bull, base, and bear case scenarios

- Whether Wall Street expects the stock to outperform, underperform, or stay flat based on consensus estimates

This tool helps you value stocks smarter in under a minute. No Excel required. No finance background needed.

Click here to sign up for TIKR and try TIKR’s new Valuation Model, completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!