Key Stats:

- Today’s Price Change: -8.9%

- Current Share Price: $178

- 52-Week High: $296

- Year-to-Date Performance: -5%

- 5-Year Return: $1,000 invested 5 years ago would be worth $1,910 today

What Happened?

NXP Semiconductors (NXPI) stock is down almost 9% in early market trading today following the announcement that CEO Kurt Sievers will retire by the end of 2025.

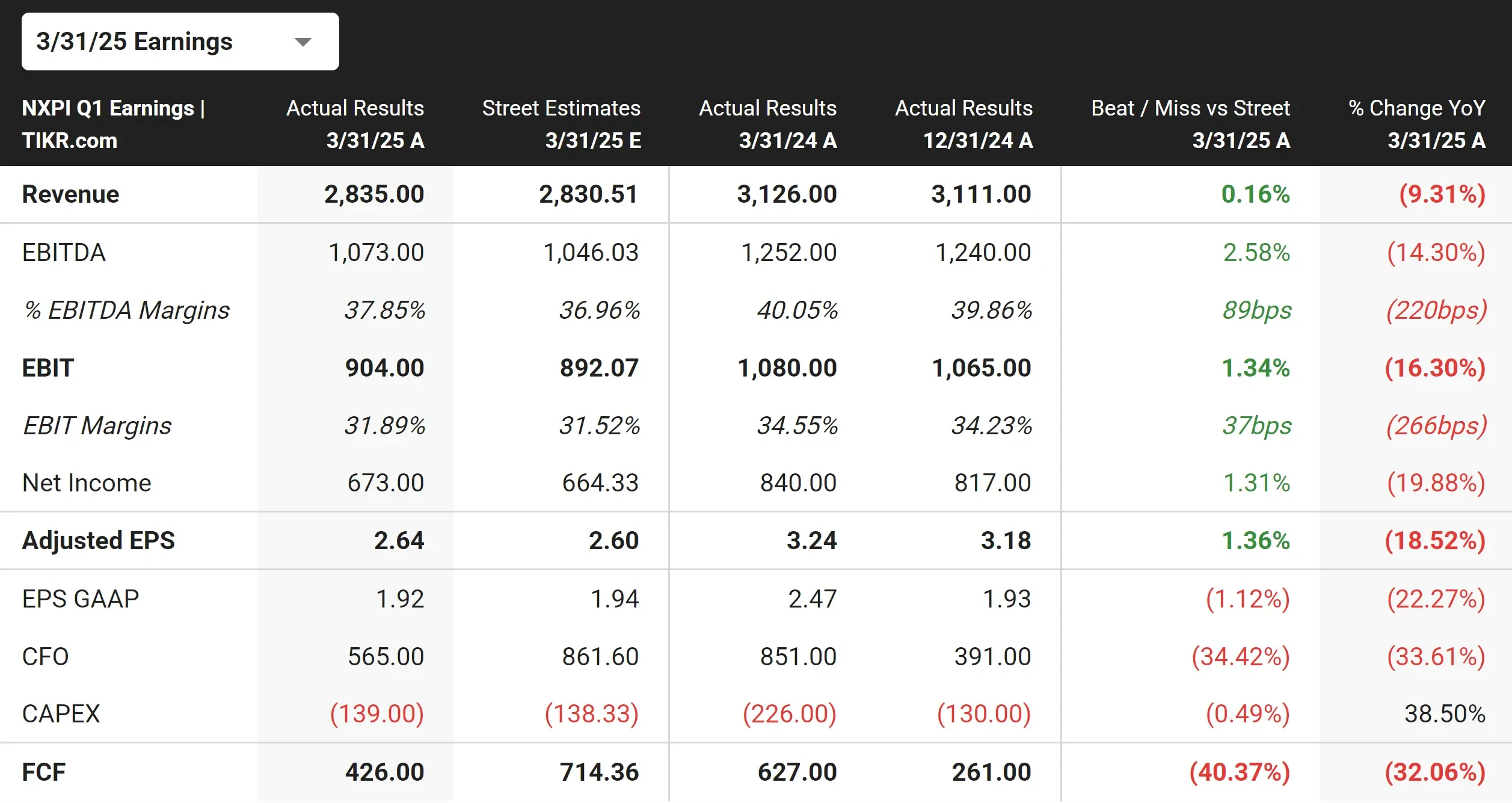

The leadership change overshadowed the company’s Q1 earnings report, which beat Wall Street expectations. In the March quarter, NXPI reported revenue of $2.84 billion versus estimates of $2.83 billion. Adjusted earnings per share of $2.64 were also above forecasts of $2.60 per share.

Despite the earnings beat, Sievers highlighted “a challenging set of market conditions” and expressed concerns about operating in “a very uncertain environment influenced by tariffs with volatile direct and indirect effects.”

NXPI reported a 9% year-over-year decline in sales, with revenue from the automotive segment at $1.67 billion, slightly below the estimated $1.69 billion. For Q2, NXP forecasts revenue of approximately $2.9 billion, modestly above the $2.87 billion that analysts were projecting.

What the Market Is Telling Us

The sharp decline in NXPI stock, despite an earnings beat, signals that investors are more concerned about the CEO transition and cautious outlook than the quarterly results themselves. Leadership changes during turbulent market conditions often trigger investor anxiety, and the timing of Sievers’ departure has unnerved shareholders.

While NXPI stated the retirement was a “personal decision” with no issues related to board relations or company performance, the market appears skeptical, given tariff uncertainties and challenging market conditions.

The stock’s reaction suggests that investors are bracing for potential headwinds in the semiconductor sector, especially for companies with exposure to the automotive market and international trade dynamics.

With NXPI stock trading nearly 40% below its 52-week high, the market is pricing in considerable caution about its near-term growth trajectory despite a healthy Q2 guidance.

Find the best stocks to buy today with TIKR. (It’s free) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover.

- Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!