Key Stats for AMD Stock

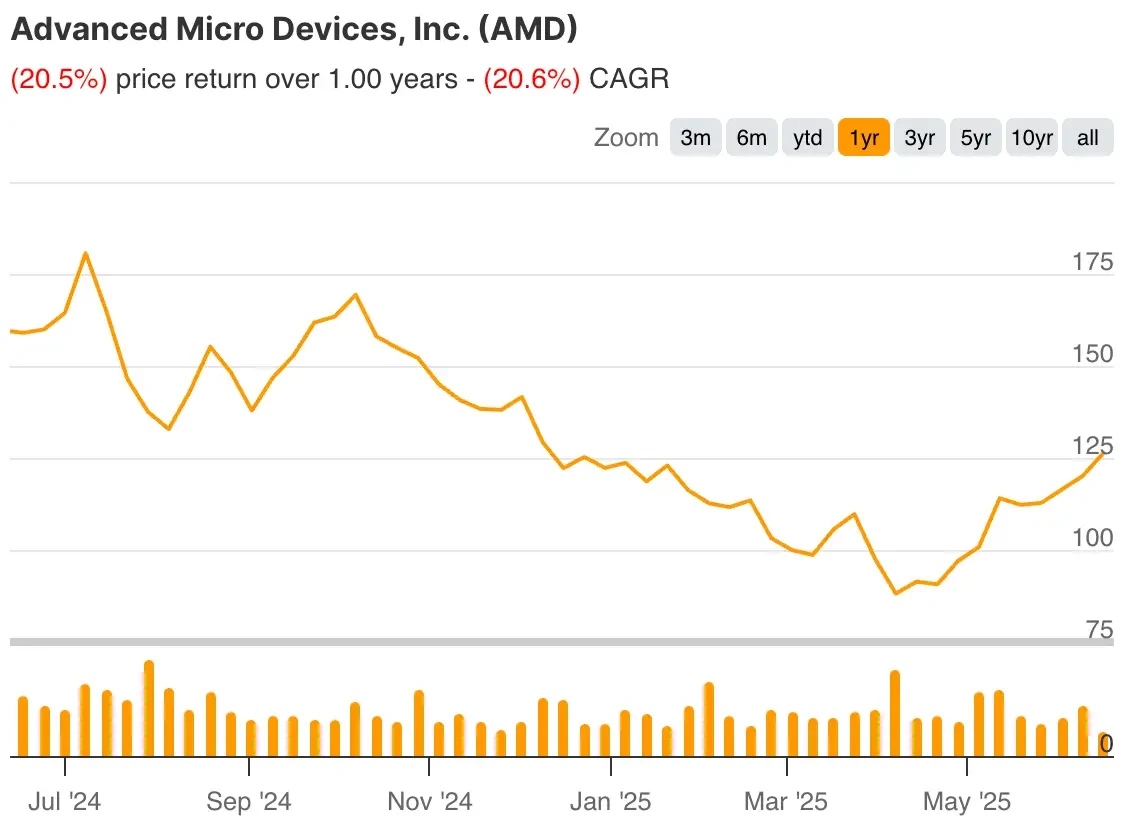

- Yesterday’s Price Change: 9%

- Current Share Price: $126

- 52-Week High: $187

- AMD Stock Price Target: $131

What Happened?

Advanced Micro Devices (AMD) stock surged nearly 9% on Monday after Piper Sandler raised its price target from $125 to $140, citing excitement around the company’s “Advancing AI” event last week.

The upgrade came on the heels of AMD’s unveiling of its next-generation MI400 series AI chips and the revolutionary Helios full-server rack system, expected to launch in 2026.

The Helios rack represents a technological leap, enabling thousands of AMD’s MI400 chips to be interconnected as a unified “rack-scale” system.

This directly competes with Nvidia’s upcoming Vera Rubin racks, positioning AMD to serve large-scale AI workloads better.

Notably, OpenAI CEO Sam Altman appeared on stage with AMD CEO Lisa Su, confirming that the ChatGPT maker will use AMD’s new chips and calling the technology “totally crazy.”

Piper Sandler analysts highlighted the Helios rack as “pivotal for AMD Instinct growth” and expressed optimism about a “snapback” in the GPU business in the fourth quarter.

This timing aligns with AMD’s efforts to address the bulk of $800 million in charges related to new U.S. export license requirements for China, which have impacted data center GPU revenue this year.

See AMD’s full analyst estimates, earnings results, and earnings transcript (It’s free) >>>

What the Market Is Telling Us About AMD Stock

The strong response to AMD stock reflects growing confidence in its ability to compete effectively against Nvidia in the AI chip market.

As CFO Jean Hu noted in recent comments, AMD expects the AI processor market to grow from $45 billion in 2023 to over $500 billion by 2028, indicating an annual growth rate of more than 60%.

The chip maker’s strategic positioning with the MI400 series and Helios architecture suggests it’s well-prepared to capture a meaningful share of this explosive growth.

What’s encouraging for investors is AMD’s execution timeline. While the MI400 series won’t ship until 2026, the company is already seeing strong traction with current-generation products.

As Hu emphasized, AMD exceeded $5 billion in AI GPU revenue in its first year after launching the MI300, and it expects continued momentum with the launch of MI350 this quarter.

Want to Invest Like Warren Buffett, Joel Greenblatt, or Peter Lynch?

TIKR just published a special report breaking down 5 powerful stock screeners inspired by the exact strategies used by the world’s greatest investors.

In this report, you’ll discover:

- A Buffett-style screener for finding wide-moat compounders at fair prices

- Joel Greenblatt’s formula for high-return, low-risk stocks

- A Peter Lynch-inspired tool to surface fast-growing small caps before Wall Street catches on

Each screener is fully customizable on TIKR, so you can apply legendary investing strategies instantly. Whether you’re looking for long-term compounders or overlooked value plays, these screeners will save you hours and sharpen your edge.

This is your shortcut to proven investing frameworks, backed by real performance data.

Click here to sign up for TIKR and get this full report now, completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!