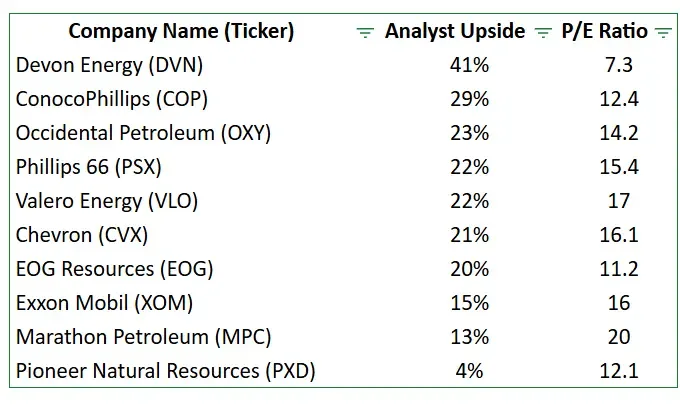

Energy companies have been quietly returning mountains of cash to shareholders in recent years through rising dividends, stock buybacks, and balance sheet improvements.

This article highlights 10 energy stocks that stand out for their healthy cash flows and consistent shareholder returns.

Find high-quality energy stocks today with TIKR (It’s free) >>>

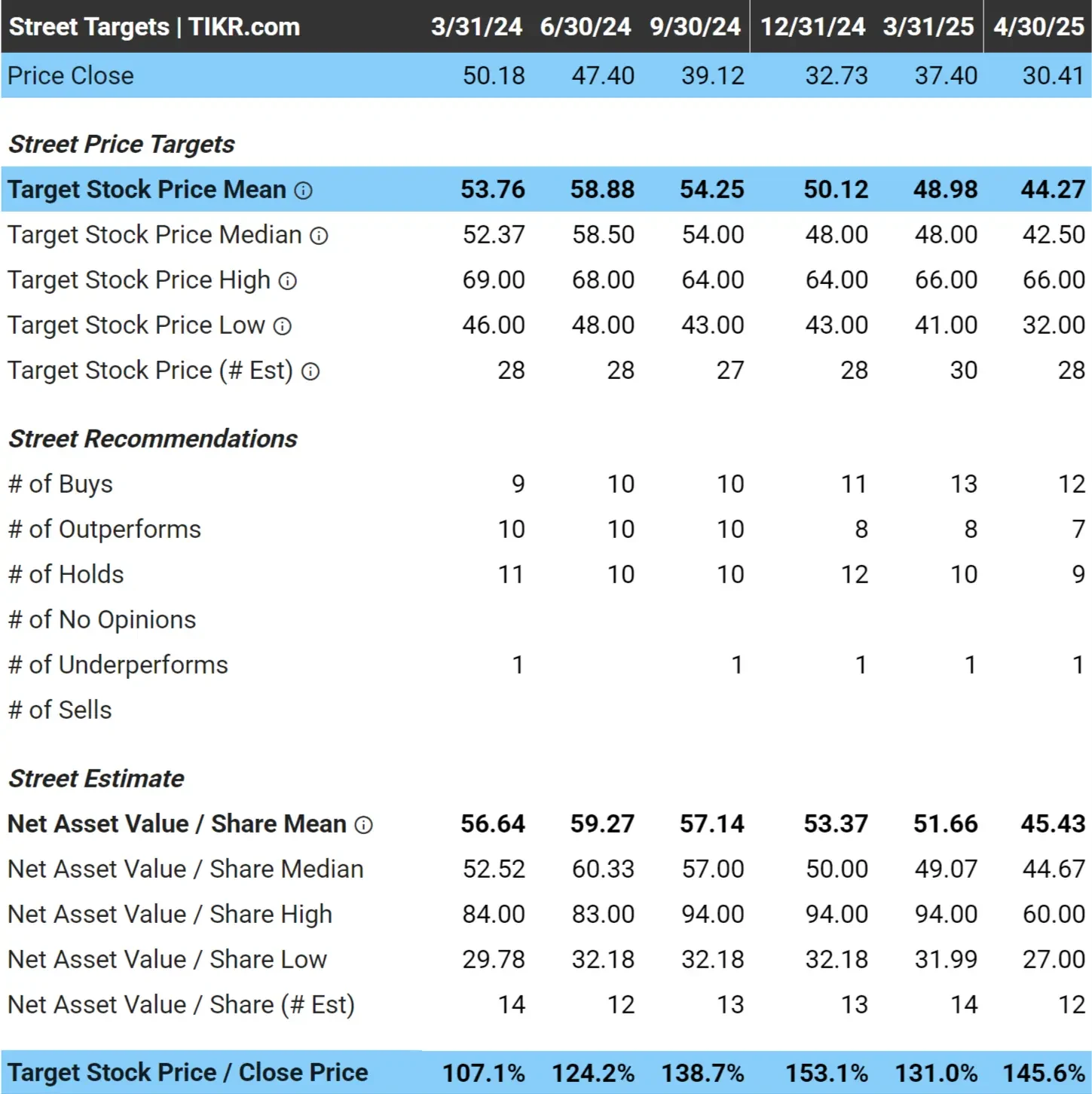

Devon Energy (DVN)

- Market Cap: $20 billion

- Industry: Oil, Gas and Consumable Fuels

- Analyst Upside: 41%

- P/E Ratio: 7.3

Company Overview: Devon Energy is a U.S.-based oil and gas producer with operations across multiple basins, including the Delaware Basin, STACK formation, Eagle Ford Group, and the Rocky Mountains.

Business Strategy: Devon focuses on generating strong returns through disciplined capital allocation and operational efficiency. The company emphasizes shareholder value by maintaining a strong dividend and share repurchase program.

Recent Developments:

- Earnings & Profitability: Achieved record production levels, surpassing guidance, with improved well productivity and efficiency gains.

- Business Growth Trends: The acquisition of Grayson Mill expanded Devon’s scale, particularly in the Williston Basin, which ended up extending inventory life.

- Shareholder Returns: The business returned significant capital to shareholders through dividends and buybacks, while maintaining a strong balance sheet.

Find stocks that are even better today than Devon Energy with TIKR (It’s free) >>>

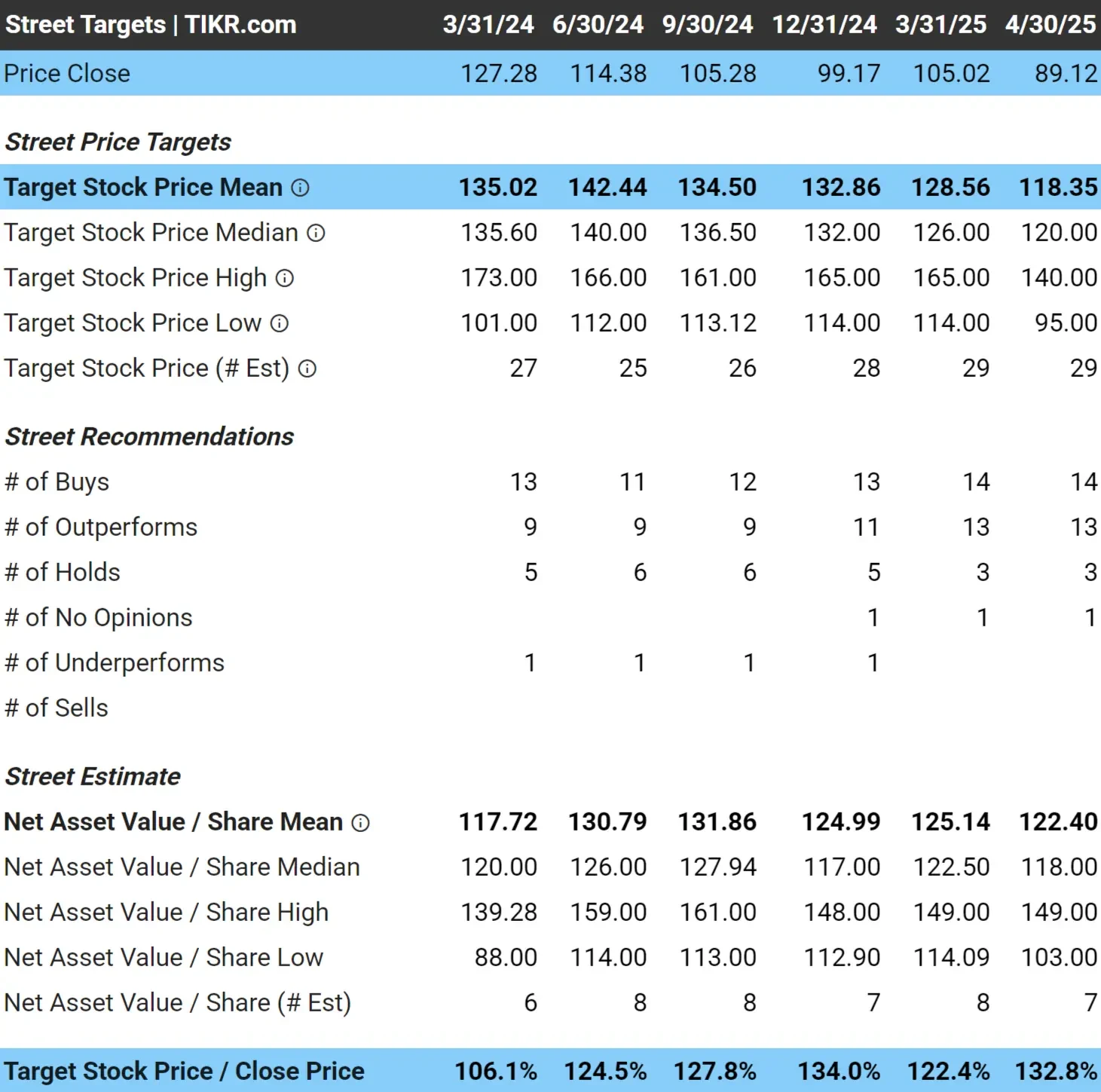

ConocoPhillips (COP)

- Market Cap: $116 billion

- Industry: Oil, Gas and Consumable Fuels

- Analyst Upside: 29%

- P/E Ratio: 12.4

Company Overview: ConocoPhillips is a global exploration and production company with operations in 15 countries, focusing on crude oil, natural gas, and natural gas liquids.

Business Strategy: The company aims to deliver sustainable returns through disciplined capital investment, portfolio optimization, and shareholder distributions. The company has grown its asset base through recent strategic acquisitions.

Recent Developments:

- Earnings & Profitability: The company reported strong adjusted earnings, driven by increased production and operational efficiency.

- Business Growth Trends: Completed the acquisition of Marathon Oil in November 2024, adding high-quality assets and expanding its U.S. unconventional position.

- Shareholder Returns: ConocoPhillips announced a $10 billion capital return target for 2025, including dividends and share repurchases.

Analyze stocks like ConocoPhillips quicker with TIKR (It’s free) >>>

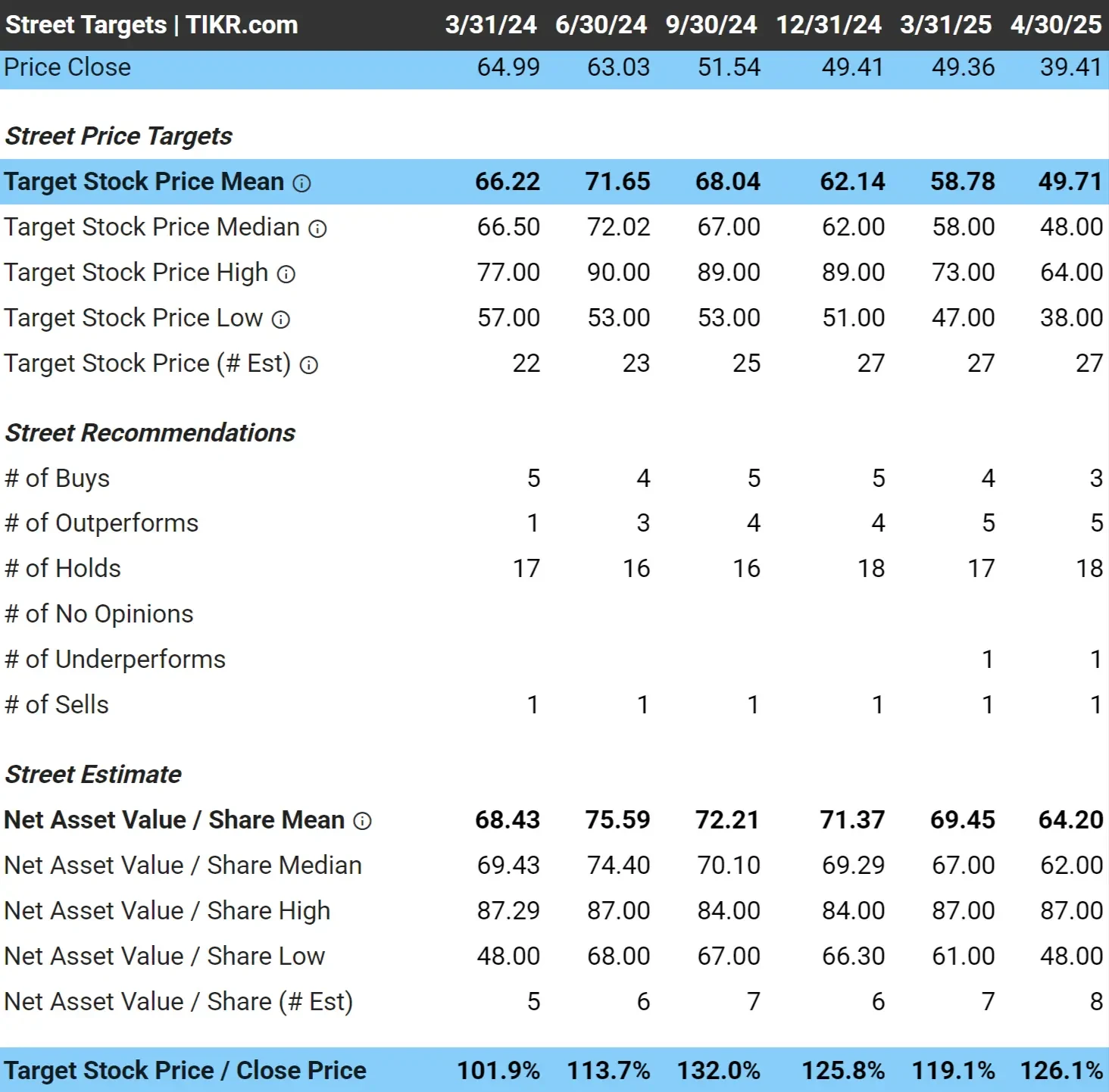

Occidental Petroleum (OXY)

- Market Cap: $40 billion

- Industry: Oil, Gas and Consumable Fuels

- Analyst Upside: 23%

- P/E Ratio: 14.2

Company Overview: Occidental Petroleum is an international energy company with operations in the U.S., Middle East, and Latin America, focusing on oil and gas exploration and production.

Business Strategy: Occidental is focused today on driving shareholder value through strategic acquisitions, debt reduction, and operational efficiency. The company is also investing in carbon capture technologies to support sustainability goals.

Recent Developments:

- Earnings & Profitability: Occidental reported increased earnings per share, surpassing expectations, and focused on debt reduction efforts.

- Business Growth Trends: In August of 2024, Occidental acquired CrownRock, which expanded its Permian Basin presence and enhanced its production capabilities.

- Shareholder Returns: The company increased its quarterly dividend and announced asset divestitures to further reduce debt and strengthen the balance sheet.

Check out Occidental Petroleum’s latest analyst forecasts on TIKR (it’s free) >>>

TIKR Takeaway

Devon Energy (DVN), ConocoPhillips (COP), and Occidental Petroleum (OXY) stand out for their strong free cash flow and shareholder returns. These companies use their financial strength to drive dividends and share buybacks while focusing on sustainable growth in the energy sector.

Looking for deeply undervalued stocks? Browse TIKR’s stock screener to find the best stocks to buy today.

- Already love the stocks you own? Get real-time news and in-depth stock insights when you add your holdings to your watchlist on TIKR.

- Want to stay ahead? TIKR’s analysts’ estimates give you 5 years of Wall Street forecasts so you can feel confident in the stocks you invest in.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!