The global push for infrastructure revitalization is fueling a powerful wave of demand across the industrials sector. With governments committing trillions to modernize transportation networks, upgrade utilities, and accelerate clean energy transitions, select companies are poised to capture significant growth.

As capital flows into projects that are critical for economic resilience, these stocks stand at the intersection of stability and expansion, offering a rare combination of cyclical upside and defensive appeal.

Here are 10 of the top industrial stocks benefiting from infrastructure stimulus. With strong analyst coverage and rising international interest, these companies are well-positioned for growth and investor appeal.

| Company Name (Ticker) | Analyst Upside | P/E Ratio |

| Caterpillar (CAT) | 7.6% | 22.02 |

| Deere & Company (DE) | 11.7% | 24.69 |

| Quanta Services (PWR) | 11.6% | 32.57 |

| Vulcan Materials Company (VMC) | 4.4% | 32.20 |

| Nucor (NUE) | 4.2% | 15.01 |

| Fluor (FLR) | 21.6% | 21.19 |

| MasTec (MTZ) | 12.7% | 26.29 |

| AECOM (ACM) | 6.6% | 22.78 |

| United Rentals (URI) | -5.8% | 21.11 |

| Martin Marietta Materials, (MLM) | 4.8% | 30.62 |

Unlock our Free Report: 5 undervalued compounders with upside based on Wall Street’s growth estimates that could deliver market-beating returns (Sign up for TIKR, it’s free) >>>

With governments unleashing record infrastructure spending, industrial companies are securing new revenue streams and strengthening cash flows. Backed by dividends, cost advantages, and global opportunities, they offer a rare mix of growth and stability. Here are three of the top picks.

Quanta Services (PWR)

Quanta Services stands at the heart of America’s infrastructure transformation, with operations that directly align with stimulus priorities such as grid modernization, broadband expansion, renewable energy integration, and electric vehicle (EV) charging networks. The company’s specialized expertise in utility infrastructure has become a critical enabler of both the energy transition and the expansion of next-generation communication systems. As federal and state governments roll out funds earmarked for power reliability and digital connectivity, Quanta’s $27+ billion project backlog offers strong visibility into future revenue streams.

Unlike traditional cyclical industrials, Quanta’s business model benefits from multi-decade investment themes. The aging U.S. power grid requires significant reinforcement to handle renewable energy loads and climate resilience demands, while broadband expansion has become a national imperative. Quanta’s positioning as a turnkey solution provider in these spaces means it is likely to capture outsized demand as infrastructure capital is deployed. For investors, this translates into durable growth with secular tailwinds that buffer against typical industrial volatility.

Value any stock in under 30 seconds with TIKR’s new Valuation Model (it’s free) >>>

Fluor (FLR)

Fluor is one of the world’s largest engineering, procurement, and construction (EPC) firms, and its fortunes are tightly linked to infrastructure spending cycles. With expertise spanning transportation systems, energy facilities, and environmental projects, Fluor is uniquely positioned to win large-scale contracts under government-backed initiatives. Its broad global presence and reputation for handling complex, capital-intensive projects make it a natural participant in stimulus-driven development.

Recent trends show that Fluor is increasingly leveraging its scale to capture opportunities in clean energy, advanced manufacturing, and transportation infrastructure, all priority areas under federal and state stimulus programs. The company’s backlog growth reflects this pivot, as megaprojects in liquefied natural gas, highway modernization, and renewable energy take shape. For investors, Fluor offers both cyclical upside as infrastructure spending accelerates and a longer-term pivot toward sustainable, higher-margin projects. This combination makes it a compelling play on the infrastructure stimulus theme.

Find stocks that we like even better than Fluor today with TIKR (It’s free) >>>

MasTec (MTZ)

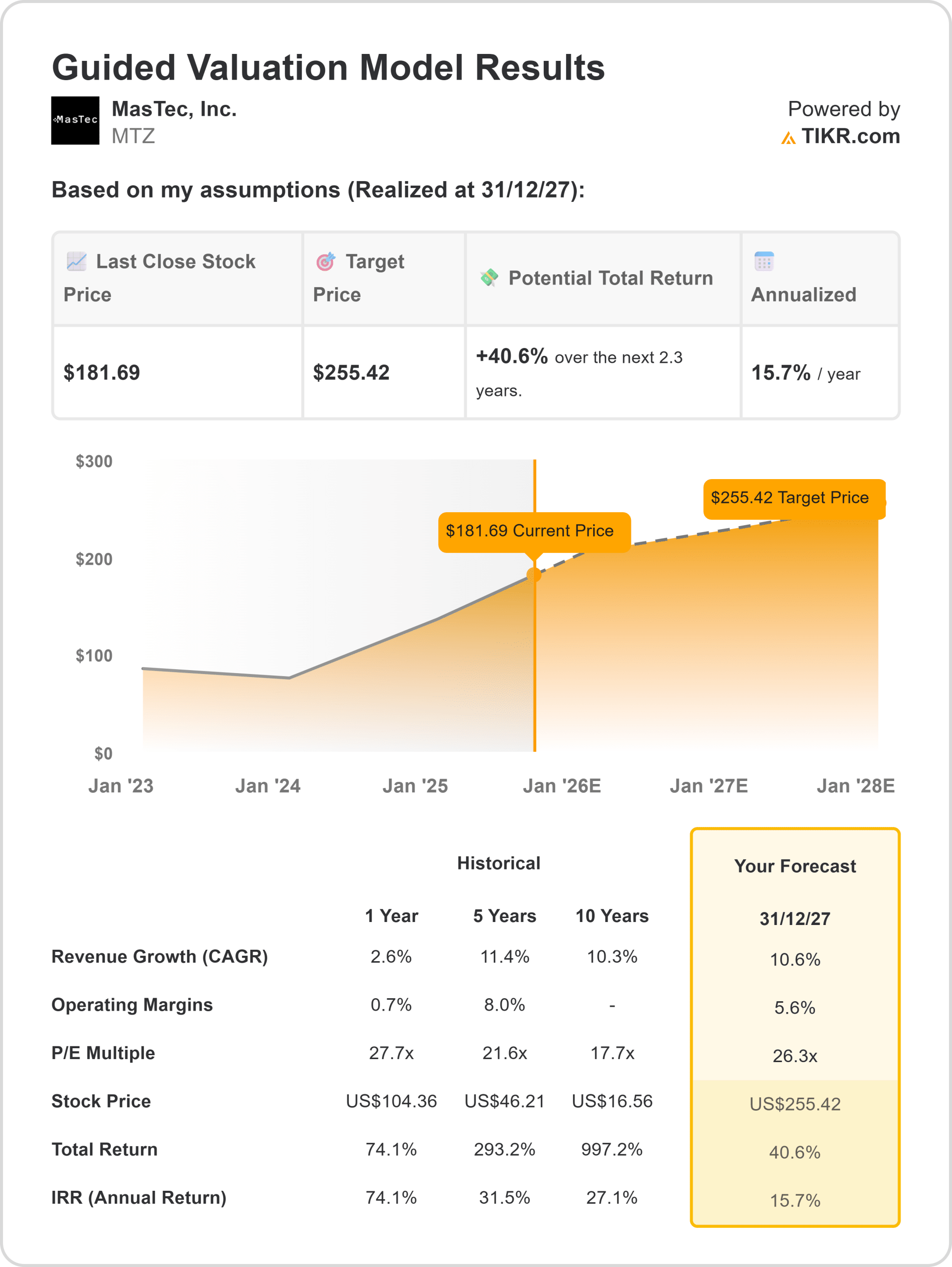

MasTec has built its business at the intersection of critical infrastructure needs, specializing in energy, utility, and communications construction. This diversified foundation directly ties the company to government-driven investments in renewable energy, pipeline modernization, and nationwide broadband rollouts. With stimulus funding accelerating across these verticals, MasTec’s integrated capabilities, from design to deployment, position it to capture a broad share of infrastructure-related spending.

What sets MasTec apart is its exposure to secular megatrends such as clean energy and 5G infrastructure. The firm is a leader in renewable power projects, including wind and solar installations, and it is deeply involved in expanding fiber and wireless networks. These areas are central to stimulus allocations, ensuring a long runway of demand. For investors, MasTec represents a high-growth infrastructure contractor that marries cyclical upside from traditional projects with structural tailwinds from the energy transition and digital connectivity push.

Value stocks like MasTec quicker with TIKR >>>

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!