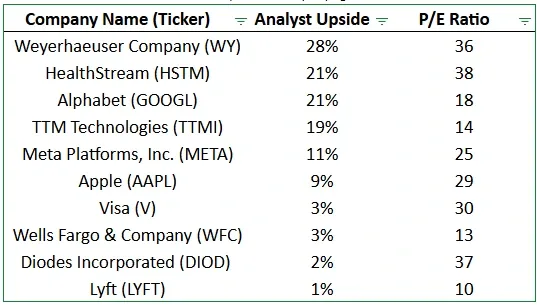

The most shareholder-friendly companies often build value in the background without attracting much attention. This article highlights 10 businesses with strong balance sheets and steady cash flows that are actively buying back their own stock.

Share buybacks reduce the number of shares outstanding for a stock, which increases a company’s earnings per share. Share repurchases also signal management’s confidence in the business, making these companies worth watching for long-term investors.

Find cash-rich stocks buying back shares today (It’s free) >>>

Here are a few of our favorite stocks from this list:

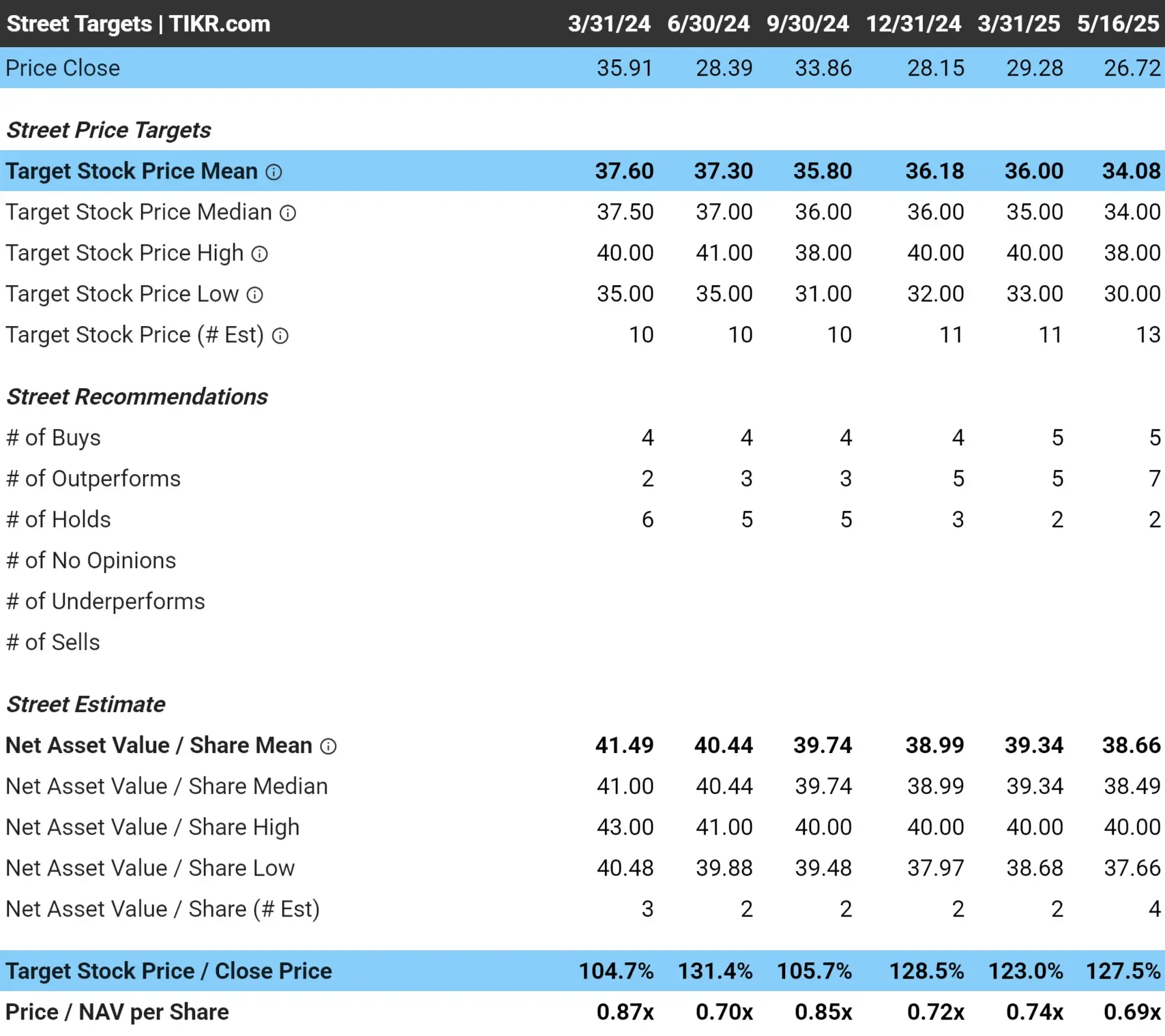

Weyerhaeuser Company (WY)

- Market Cap: $19 billion

- Industry: Specialized REITs

- Analyst Upside: 28%

- P/E Ratio: 36

Company Overview: Weyerhaeuser Company (NYSE: WY) is a leading U.S.-based timberland and forest products company, managing over 12 million acres of timberlands. It operates through three core segments: Timberlands, Wood Products, and Real Estate.

Business Strategy: Weyerhaeuser makes money through sustainable timber harvesting, manufacturing wood products like lumber and strand board, and monetizing its land and natural resources. The company focuses on strategic timberland acquisitions, efficient operations, and steady shareholder returns.

Recent Developments:

- Earnings & Profitability: Adjusted earnings fell in 2024 due to weaker market conditions, though the company maintained profitability through cost controls and operational discipline.

- Business Growth Trends: Weyerhaeuser expanded its Southern Timberlands with a major land acquisition in Alabama, aligning with its long-term investment strategy.

- Shareholder Returns: The company raised its base dividend and continued share repurchases, returning over $700 million to investors in 2024.

Track Weyerhaeuser’s financials, growth trends, and analyst forecasts on TIKR >>>

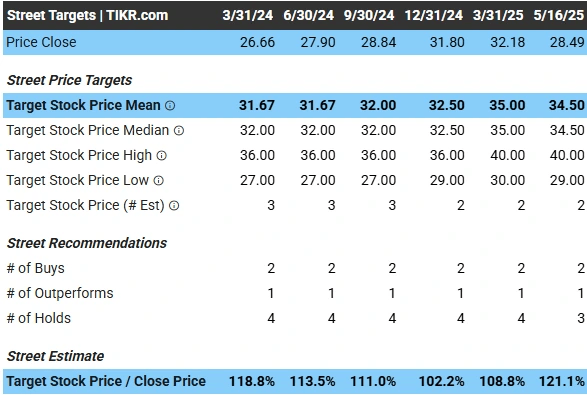

HealthStream (HSTM)

- Market Cap: $827 million

- Industry: Health Care Technology

- Analyst Upside: 21%

- P/E Ratio: 38

Company Overview: HealthStream provides workforce development and compliance solutions for the U.S. healthcare industry. Its platform offers tools for training, credentialing, performance assessment, and simulation-based education.

Business Strategy: HealthStream generates revenue through subscription-based software solutions and professional services tailored to healthcare organizations. The company focuses on expanding its platform’s capabilities and acquiring complementary businesses to enhance its service offerings.

Recent Developments:

- Earnings & Profitability: HealthStream reported $0.14 in EPS and $73.5 million in revenue for Q1 2025, showing modest growth but falling short of analyst expectations as higher investments in cloud infrastructure and labor weighed on profits.

- Business Growth Trends: Although the company didn’t make new acquisitions this quarter, it focused on scaling its recent buys in clinical rotation management. This helps hospitals and nursing schools better manage student placements, a growing need in healthcare education.

- Shareholder Returns: HealthStream boosted its quarterly dividend by 10.7% and authorized a $25 million share repurchase plan, signaling continued confidence in its cash flow and a stronger commitment to rewarding shareholders.

Find stocks that we like even better than HealthStream today with TIKR (It’s free) >>>

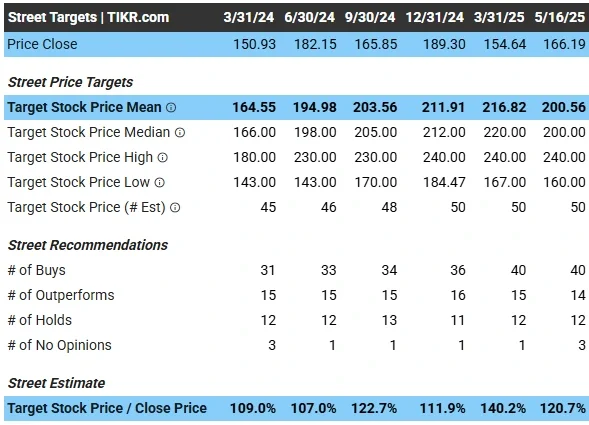

Alphabet (GOOGL)

- Market Cap: $2 trillion

- Industry: Interactive Media and Services

- Analyst Upside: 21%

- P/E Ratio: 18

Company Overview: Alphabet Inc. is a global technology conglomerate and the parent company of Google, encompassing major businesses such as Google Search, YouTube, Google Cloud, and Waymo. Established in 2015, Alphabet also includes other ventures like Verily and Calico.

Business Strategy: Alphabet generates revenue primarily through digital advertising across its platforms, with significant growth from cloud services and AI-driven products. The company is investing heavily in AI infrastructure and applications to drive future growth and maintain its competitive edge.

Recent Developments:

- Earnings & Profitability: In Q1 2025, Alphabet reported a double-digit revenue increase and strong earnings growth, led by strength in Search, Cloud, and YouTube.

- Business Growth Trends: Google Cloud continues to grow rapidly, and YouTube’s ad revenue rebounded solidly. Alphabet is leveraging its Gemini AI models to boost product engagement and monetization.

- Shareholder Returns: Alphabet raised its dividend and authorized a large share buyback program, signaling a commitment to returning capital to shareholders.

Analyze stocks like Alphabet quicker with TIKR >>>

TIKR Takeaway

These three cash-rich companies, Weyerhaeuser, HealthStream, and Alphabet, are buying back shares, and analysts think they are undervalued today.

- Looking for stocks with long-term growth potential? Browse TIKR’s stock screener to find the best stocks to buy today.

- Already love the stocks you own? Get real-time news and in-depth stock insights when you add your holdings to your watchlist on TIKR.

- Want to stay ahead? TIKR’s analysts’ estimates give you 5 years of Wall Street forecasts so you can feel confident in the stocks you invest in.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!