Twilio Inc. (NYSE: TWLO) has become one of the more surprising recovery stories in software. The stock now trades near $103/share, up about 61% over the past year. A sharper focus on margins, improved execution, and new AI-enabled tools for customer engagement have helped rebuild investor confidence. Still, the outlook remains debated as growth slows and competition intensifies.

Recently, Twilio reported Q2 2025 revenue of $1.23 billion, up 13% year over year, while free cash flow surged to $263.5 million. The company also used its SIGNAL 2025 conference to launch ConversationRelay AI agents and new conversational intelligence tools, expanding its role in the AI-driven customer engagement market. These updates underscore Twilio’s effort to shift from a growth-at-all-costs model to a more profitable and innovative platform.

This article explores where Wall Street analysts think Twilio could trade by 2027. We have reviewed consensus targets, growth forecasts, and TIKR’s Guided Valuation Model to understand the stock’s potential path. These figures reflect analyst expectations and not TIKR’s own predictions.

Unlock our Free Report: 5 AI compounders that analysts believe are undervalued and could deliver years of outperformance with accelerating AI adoption (Sign up for TIKR, it’s free) >>>

Analyst Price Targets Suggest Modest Upside

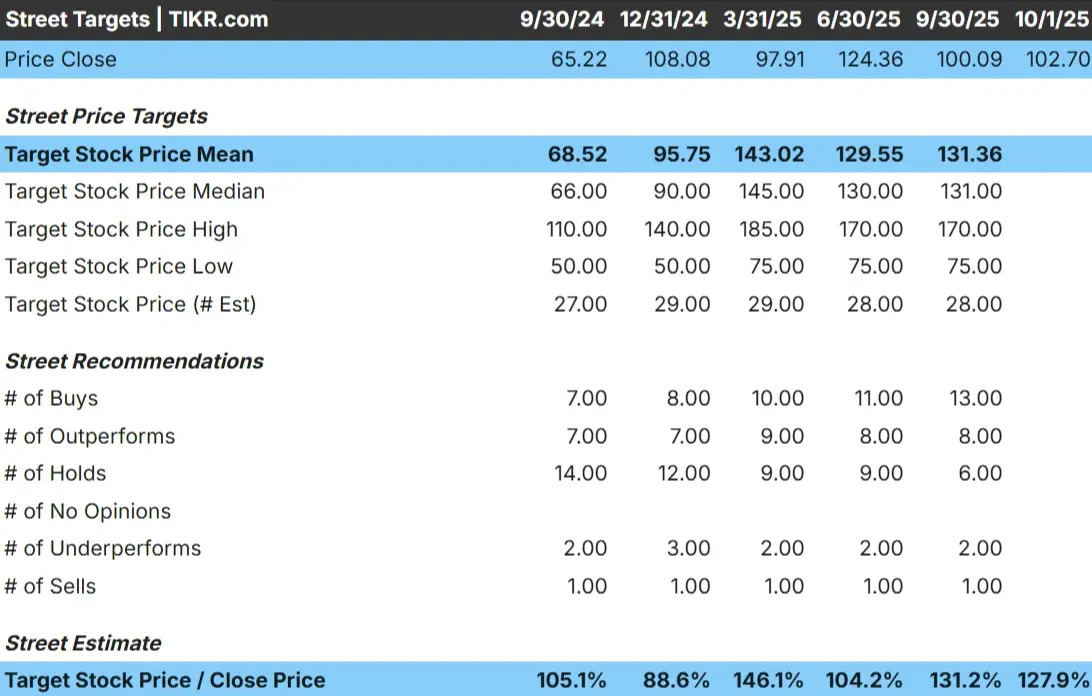

Twilio trades at about $103/share today. The average analyst price target is $131/share, which points to around 28% upside. Forecasts show a wide spread and reflect divided sentiment:

- High estimate: ~$170/share

- Low estimate: ~$75/share

- Median target: ~$131/share

- Ratings: 13 Buys, 8 Outperforms, 6 Holds, 2 Underperforms, 1 Sell

It looks like analysts see some room for gains, but the range from $75 to $170 underscores the uncertainty. For investors, this means Wall Street expects upside but is far from unanimous, reflecting both Twilio’s improving fundamentals and the risks tied to execution.

See analysts’ growth forecasts and price targets for Twilio (It’s free!) >>>

Twilio: Growth Outlook and Valuation

The company’s fundamentals are improving, though expectations already assume a successful turnaround. Revenue is projected to grow at a steady pace, while operating margins could expand sharply from today’s low levels. Shares currently trade at ~22x forward earnings, which looks reasonable compared to peers in the software sector.

Based on analysts’ average estimates, TIKR’s Guided Valuation Model using a 22x forward P/E suggests about $135/share by 2027. That would represent roughly 31.6% upside, or about 13% annualized returns.

For investors, these numbers imply Twilio could deliver steady gains if profitability continues to improve. The stock does not look drastically overpriced, but it already reflects optimism around margin expansion, leaving less room for error.

Value stocks like Twilio in as little as 60 seconds with TIKR (It’s free) >>>

What’s Driving the Optimism?

Twilio has regained attention by shifting from chasing revenue growth to focusing on profitability. Management has tightened costs and put greater emphasis on operating discipline, which has started to show up in stronger margins.

At the same time, the company is leaning into AI-driven communication tools that could increase customer adoption and monetization over time. Combined with its large developer ecosystem and global API footprint, Twilio has durable advantages that support the bull case.

For investors, this optimism rests on Twilio’s ability to balance profitability with innovation, making the recovery more sustainable.

Bear Case: Execution and Competition

Despite the improvements, Twilio still faces meaningful risks. Growth has slowed, which raises questions about whether the company can accelerate again in a competitive environment. Larger rivals and smaller challengers are all investing heavily in communications APIs, and pricing pressure could follow.

Another challenge is execution. Twilio’s leverage means it has less room for error if margins do not scale as planned. For investors, this is the core risk: the turnaround requires consistent delivery, and any stumble could leave the stock vulnerable to a sharp re-rating.

Outlook for 2027: What Could Twilio Be Worth?

Based on analysts’ average estimates, TIKR’s Guided Valuation Model using a 22x forward P/E suggests Twilio could trade near $135/share by 2027. That would represent about a 32% gain from today’s level, or roughly 13% annualized returns.

While this would mark solid progress, the forecast already builds in optimism. To generate stronger returns, Twilio would need to exceed current expectations on AI adoption or reignite revenue growth more quickly. Without that, gains may be steady but limited.

For investors, Twilio looks like a turnaround play with moderate upside. Success hinges on management’s ability to sustain profitability improvements while defending market share in a competitive landscape.

AI Compounders With Massive Upside That Wall Street Is Overlooking

Everyone wants to cash in on AI. But while the crowd chases the obvious names benefiting from AI like NVIDIA, AMD, or Taiwan Semiconductor, the real opportunity may lie on the AI application layer where a handful of compounders are quietly embedding AI into products people already use every day.

TIKR just released a new free report on 5 undervalued compounders that analysts believe could deliver years of outperformance as AI adoption accelerates.

Inside the report, you’ll find:

- Businesses already turning AI into revenue and earnings growth

- Stocks trading below fair value despite strong analyst forecasts

- Unique picks most investors haven’t even considered

If you want to catch the next wave of AI winners, this report is a must-read.

Click here to sign up for TIKR and get your free copy of TIKR’s 5 AI Compounders report today.