Royal Caribbean Cruises Ltd. (NYSE: RCL) has cruised back stronger than many expected. The stock trades near $305/share, rebounding from its pandemic lows as travel demand remains robust. After a 57% price gain over the past year, investors now wonder whether that momentum still has room to run.

Still, the company isn’t standing still. Analysts expect Royal Caribbean’s revenue to grow around 9% annually through 2027, reflecting confidence in resilient pricing and steady cruise demand. The company is also improving efficiency through newer, more fuel-efficient ships and tighter cost controls, helping offset inflation and support margins. These efforts highlight how Royal Caribbean is transitioning from a post-pandemic rebound into a more sustainable phase of long-term growth.

This article explores where Wall Street analysts expect Royal Caribbean to trade by 2027, based on consensus forecasts and TIKR’s valuation model. These figures reflect analyst estimates, not TIKR’s own predictions.

Unlock our Free Report: 5 AI compounders that analysts believe are undervalued and could deliver years of outperformance with accelerating AI adoption (Sign up for TIKR, it’s free) >>>

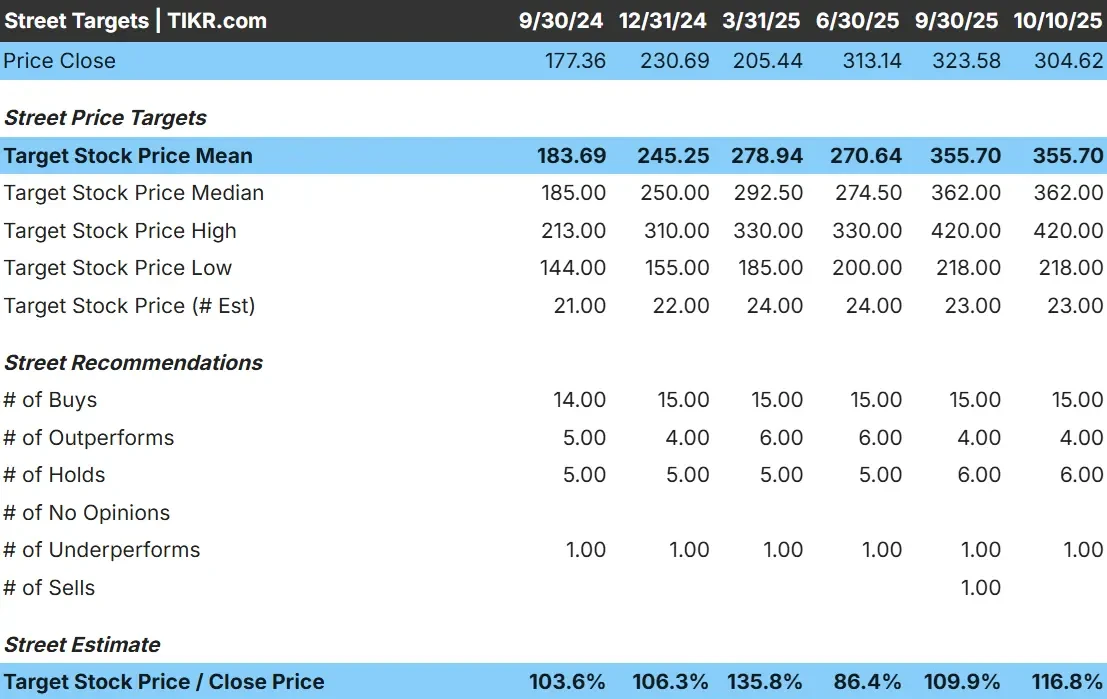

Analyst Price Targets Suggest Modest Upside

Royal Caribbean trades at about $305/share today. The average analyst price target is $356/share, implying roughly 17% upside over the next year. Forecasts are relatively close together, showing steady conviction across Wall Street:

- High estimate: ~$420/share

- Low estimate: ~$218/share

- Median target: ~$362/share

- Ratings: 15 Buys, 4 Outperforms, 6 Holds, 1 Underperform, 1 Sell

For investors, this points to modest upside from current levels. Analysts see Royal Caribbean as a stable leader in cruise demand with solid earnings momentum. Continued gains will depend on steady demand, disciplined pricing, and the company’s progress in reducing debt.

See analysts’ growth forecasts and price targets for Royal Caribbean (It’s free!) >>>

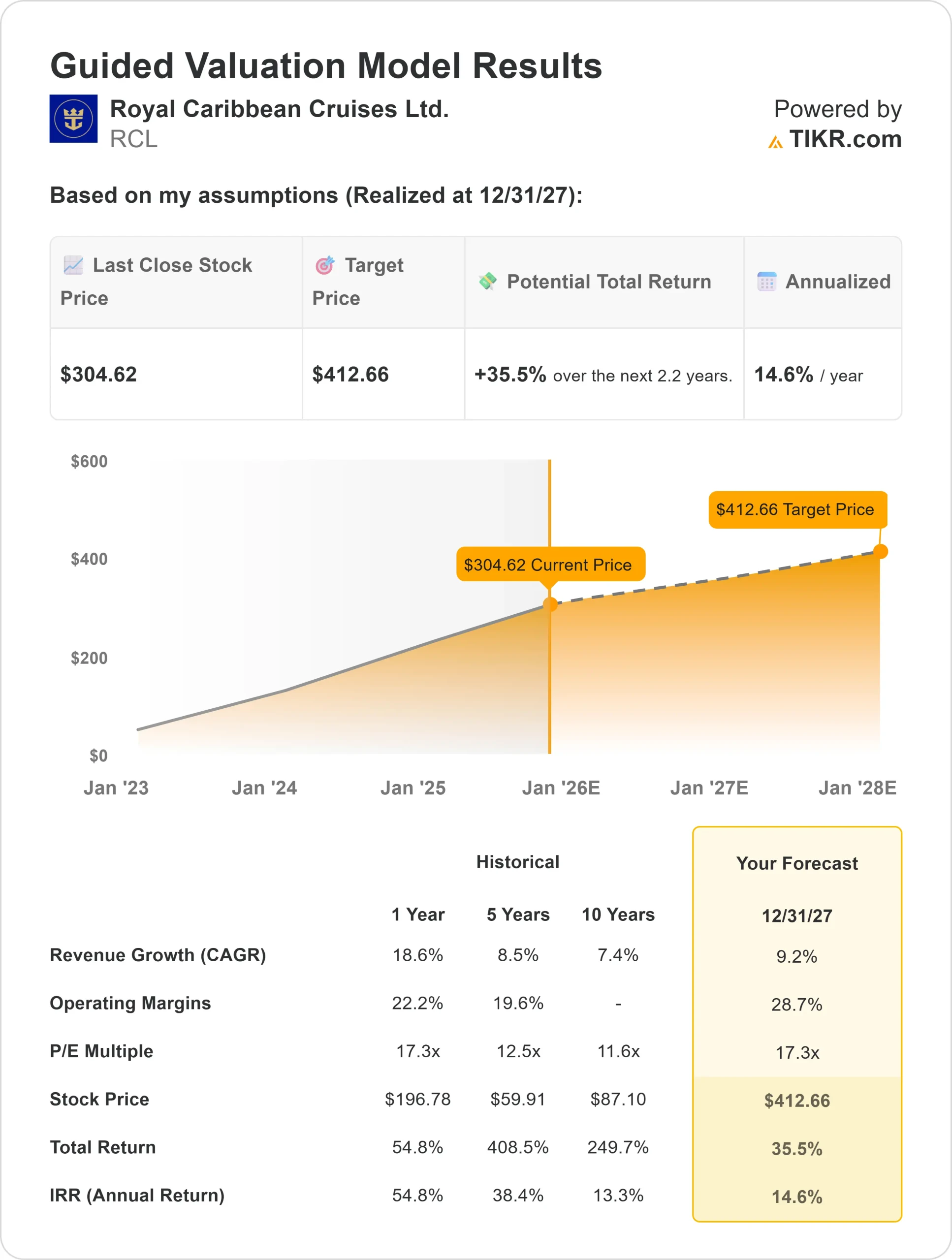

Royal Caribbean: Growth Outlook and Valuation

The company’s fundamentals remain strong, supported by robust bookings and margin expansion:

- Revenue is projected to grow around 9% annually through 2027

- Operating margins are expected to reach roughly 29%

- Shares trade near 17x forward earnings, in line with long-term averages

- Based on analysts’ average estimates, TIKR’s Guided Valuation Model using these inputs suggests about $413/share by 2027

- That implies around 36% total upside, or roughly 15% annualized returns

These projections show Royal Caribbean’s shift from a rebound story into a steady compounder. Improving margins, growing free cash flow, and debt reduction all strengthen its long-term outlook.

For investors, the company offers consistent growth potential rather than explosive gains, backed by strong fundamentals and operational discipline.

Value stocks like Royal Caribbean in as little as 60 seconds with TIKR (It’s free) >>>

What’s Driving the Optimism?

Cruise demand remains resilient across all major markets. Bookings continue to outpace pre-pandemic levels, and new ships are attracting premium pricing. Onboard spending and global route expansion are both adding steady revenue growth.

For investors, this sustained demand shows Royal Caribbean’s ability to thrive in a normalized travel environment. Its focus on guest experience, technology, and cost management supports durable profitability even as the market matures.

Bear Case: Debt and Cost Pressure

Despite these positives, Royal Caribbean still carries significant debt from its recovery years. Although leverage has improved, it remains elevated and limits flexibility if demand slows. Rising fuel and labor costs could also pressure margins if pricing weakens.

At around 17x forward earnings, the stock’s valuation already assumes stable growth. For investors, the main risk is that much of the recovery optimism is already reflected in the price. Any slowdown in consumer spending or cruise pricing could weigh on returns.

Outlook for 2027: What Could Royal Caribbean Be Worth?

Based on analysts’ average estimates, TIKR’s Guided Valuation Model suggests Royal Caribbean could trade near $413/share by 2027. That would represent about 36% total upside, or roughly 15% annualized returns from today’s price.

This forecast assumes steady demand, moderate margin expansion, and continued debt improvement. While achievable, it already factors in optimistic expectations about pricing and capacity.

For investors, Royal Caribbean looks like a quality long-term compounder in travel. The company has regained its financial strength, and while the biggest recovery gains are behind it, consistent execution could still deliver meaningful returns over time.

AI Compounders With Massive Upside That Wall Street Is Overlooking

Everyone wants to cash in on AI. But while the crowd chases the obvious names benefiting from AI like NVIDIA, AMD, or Taiwan Semiconductor, the real opportunity may lie on the AI application layer where a handful of compounders are quietly embedding AI into products people already use every day.

TIKR just released a new free report on 5 undervalued compounders that analysts believe could deliver years of outperformance as AI adoption accelerates.

Inside the report, you’ll find:

- Businesses already turning AI into revenue and earnings growth

- Stocks trading below fair value despite strong analyst forecasts

- Unique picks most investors haven’t even considered

If you want to catch the next wave of AI winners, this report is a must-read.

Click here to sign up for TIKR and get your free copy of TIKR’s 5 AI Compounders report today.