Over the next five years, entire industries will be reshaped by new technologies, shifting consumer behavior, and global market expansion. Some of today’s rising stars could be as common in portfolios in 2030 as stocks like Amazon or Microsoft are today.

The 8 companies in this list were chosen because they combine rapid growth with the potential to dominate their industries. Each one has a large and expanding addressable market, a clear competitive advantage, and a track record of execution that suggests they could be much bigger players in the years ahead.

Not every name here will go the distance, but the ones that do could define their markets for the next decade and reward early investors with outsized returns.

| Company Name | P/E Ratio | Analyst Upside |

| Inspire Medical Systems (INSP) | 89 | 73% |

| Duolingo (DUOL) | 44 | 54% |

| Samsara (IOT) | 78 | 46% |

| Global-E Online (GLBE) | 33 | 42% |

| e.l.f Beauty (ELF) | 31 | 14% |

| Celsius Holdings (CELH) | 43 | 6% |

| Hims & Hers Health (HIMS) | 41 | 3% |

| Super Micro Computer (SMCI) | 18 | -1% |

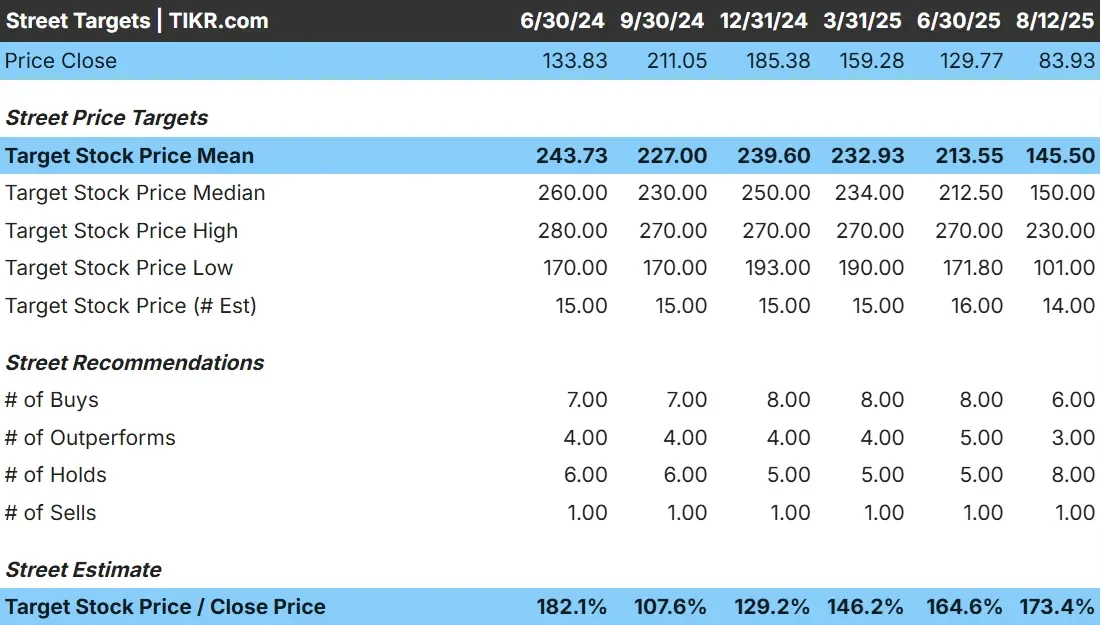

Inspire Medical Systems (INSP)

Inspire Medical Systems (INSP) develops and markets an FDA-approved implantable device for treating obstructive sleep apnea (OSA), offering an alternative for patients who cannot tolerate CPAP machines. The system uses neurostimulation to open the airway during sleep, addressing a large and underserved patient population.

The company’s revenue continues to grow, posting an 11% increase in its most recent quarter, with full-year 2025 guidance projecting growth of 12% to 13% as it expands its presence in both domestic and international markets. Inspire continues to invest heavily in physician training, direct-to-consumer marketing, and clinical data to support broader adoption.

The company’s rapid growth has come with increased investments, resulting in a net loss of $3.6 million in the most recent quarter and a significant reduction in its full-year profit outlook. With a strong balance sheet and high gross margins, Inspire is positioned to benefit from secular trends in sleep health and increased diagnosis rates for OSA.

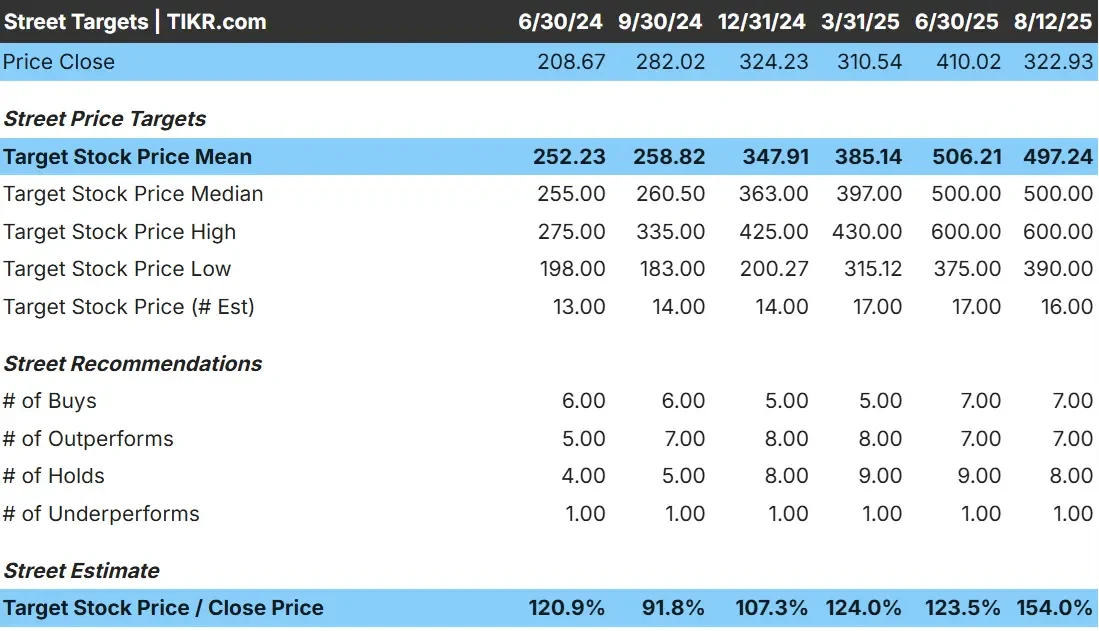

Duolingo (DUOL)

Duolingo (DUOL) is the world’s most popular language learning platform, with over 128.3 million monthly active users and a fast-growing subscription base. Its gamified approach and strong brand have helped it expand beyond language learning into subjects like math and music.

The company’s revenue continues to grow at a rapid pace, with a 41% year-over-year increase in its most recent quarter and full-year guidance for 46% increase in subscription revenue. Duolingo continues to invest in AI-driven personalization and new content, a strategy that helped grow its paid subscriber base by 37% year-over-year to 10.9 million.

As Duolingo continues to monetize its large free user base and expand its product offerings, it is positioned for sustained growth in the global EdTech market.

Track Duolingo’s financials, growth trends, and analyst forecasts on TIKR (it’s free)>>>

Samsara (IOT)

Samsara (IOT) provides cloud-based software and IoT devices that help businesses track and optimize their physical operations, from fleet management to industrial equipment monitoring. Its platform integrates real-time data, AI analytics, and automation to improve efficiency and safety across industries.

Samsara has been growing annual recurring revenue at a rapid pace, with a 31% year-over-year increase in its most recent quarter, reaching $1.535 billion, with strong customer retention and expanding margins. As more companies digitize their operations and seek data-driven insights, Samsara’s platform offers a scalable solution with long-term growth potential.

The company reported a record non-GAAP gross margin of 79% in Q1 2026, which demonstrates strong profitability. Additionally, its growth in customers with an ARR over $100,000 indicates healthy expansion with existing clients.

See if top investors & hedge funds are buying or selling Samsara right now (It’s free) >>>

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!