Key Takeaways:

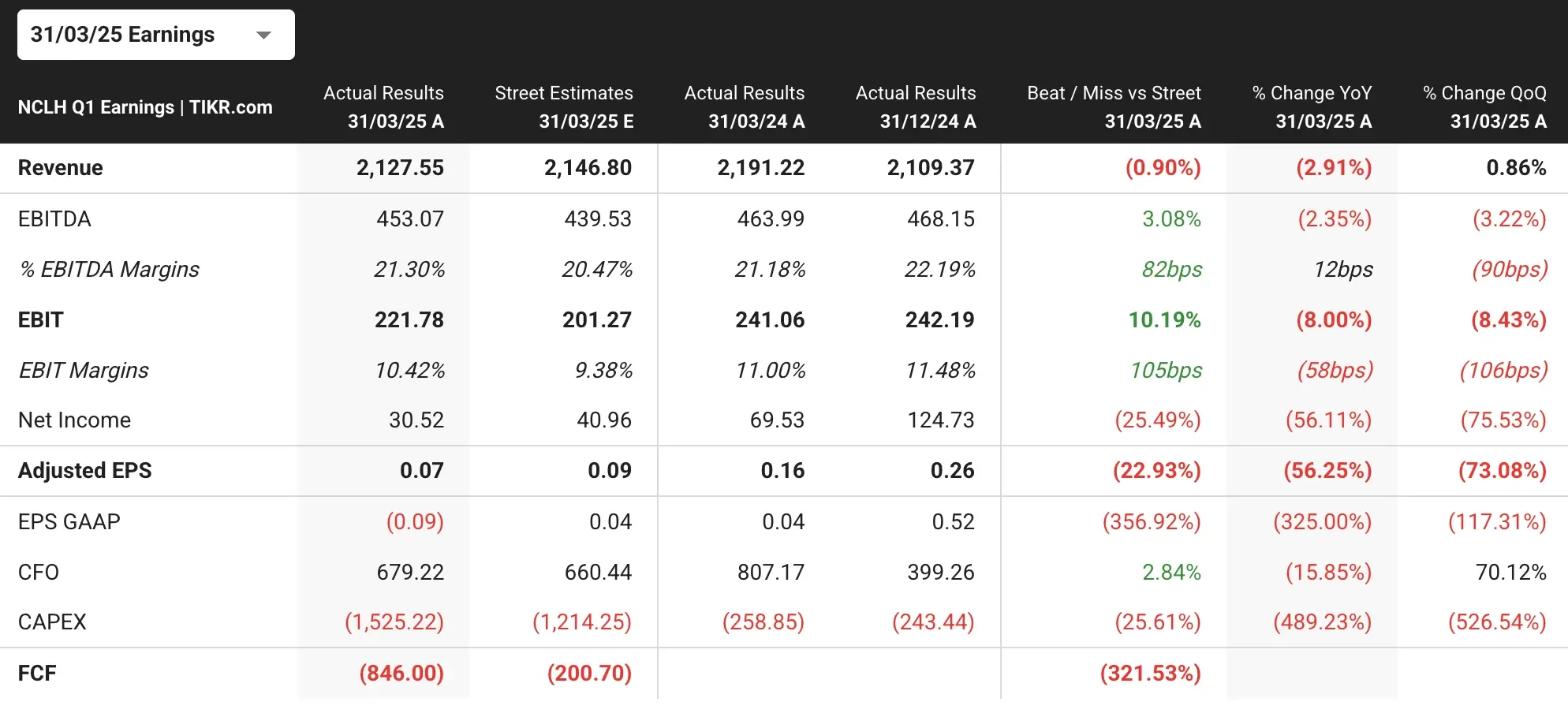

- Norwegian Cruise Line delivered solid Q1 results with $453 million adjusted EBITDA, exceeding guidance.

- The company maintained pricing discipline despite booking softness, prioritizing long-term margin strength over short-term volume.

- Net yield guidance has been lowered to 2-3% growth, while maintaining full-year EBITDA and EPS targets through cost efficiency programs.

- Unlock our Free Report: 5 stock screeners inspired by top investors like Warren Buffett to help you find high-upside stock ideas (Sign up for TIKR, it’s free) >>>

Valued at a market capitalization of $8.4 billion, Norwegian Cruise Line Holdings (NCLH) operates as a leading global cruise company with three distinct brands: Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises, serving premium and luxury market segments.

It has established itself as an innovation leader in the cruise industry through strategic fleet optimization, destination development, and technology integration while maintaining disciplined financial management and margin expansion initiatives.

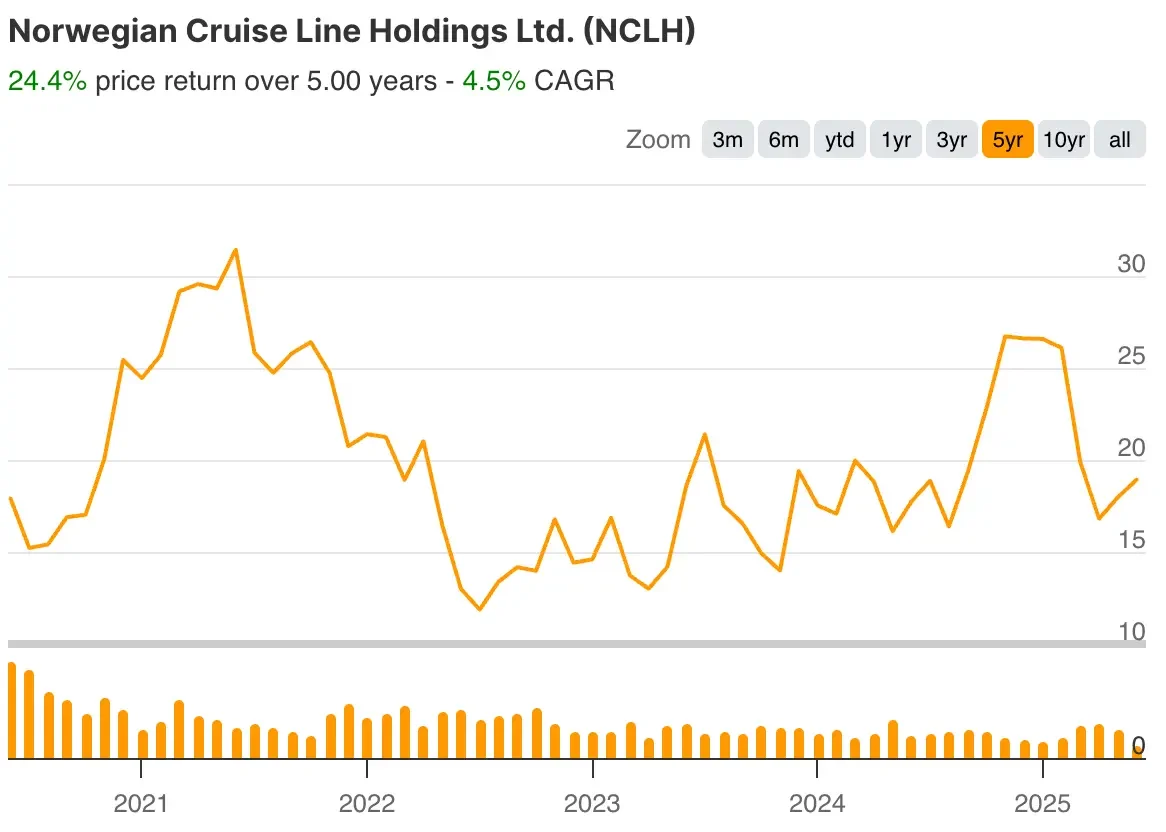

The cruise stock has trailed the broader markets in the last five years. However, given its growth estimates, NCLH stock is poised to deliver outsized gains to shareholders.

Let’s explore why you might consider adding this mid-cap cruise stock to your equity portfolio today.

1. NCLH Stock Maintains Course Despite Headwinds

Norwegian Cruise Line delivered solid Q1 results that met or exceeded guidance across key metrics. Adjusted EBITDA reached $453 million, surpassing the $435 million guidance, while net yields increased 1.2% above expectations, driven by strong close-in bookings in Caribbean and sun destinations.

The company’s trailing 12-month adjusted EBITDA margin expanded 280 basis points to 35.5%, demonstrating continued progress toward the Charting the Course target of 39% margins by 2026.

This improvement reflects Norwegian’s successful balance of revenue optimization and cost management initiatives.

However, the company experienced some booking volatility in April, particularly for third-quarter European itineraries, leading management to adjust full-year net yield growth guidance to 2-3% from previous expectations.

This adjustment reflects a disciplined approach to pricing, with management prioritizing price integrity over load factor to establish a stronger foundation for future growth.

The delivery of Norwegian Aqua in March marked a significant milestone, representing the first ship designed entirely under the current management’s vision.

The Prima Plus class vessel demonstrates Norwegian’s commitment to balancing return on investment with return on experience. It features innovations like the Aqua Slidecoaster, which optimizes guest satisfaction and space utilization.

Check out NCLH’s full analyst estimates and growth forecast (It’s free) >>>

2. A Differentiated Fleet Strategy

Norwegian’s three-pillar fleet management strategy continues to drive operational efficiency and guest satisfaction. Its approach encompasses bringing new ships online, modernizing existing vessels, and strategically repurposing older tonnage to optimize the overall fleet profile.

The modernization program delivered strong results in Q1. The completion of dry docks for Norwegian Bliss and Norwegian Breakaway introduced guest-focused enhancements, including the industry’s first immersive cinema and dining experience.

These investments reflect management’s commitment to enhancing guest experiences while maintaining focus on financial returns.

Strategic fleet optimization accelerated with charter agreements for four vessels to operators in India and residential cruise markets.

These transactions allow Norwegian to unlock value from older assets while maintaining cash flow streams, reducing average fleet age, and improving operational efficiency.

Destination development represents another key competitive advantage, with significant enhancements announced for Great Stirrup Cay.

The private island improvements, including a new pier that enables the simultaneous docking of two ships and eliminates tendering requirements, position Norwegian to welcome over one million guests annually starting in 2026.

These investments drive higher guest satisfaction while creating opportunities for generating incremental revenue.

3. NCLH Stock Should Benefit From Operational Excellence

Norwegian’s transformation office has developed cost efficiency capabilities over the past 18 months, identifying $300 million in potential savings across the organization.

This program focuses on eliminating waste and achieving operational efficiency without compromising the guest experience, resulting in improved guest satisfaction scores during implementation.

Its technology investments continue to generate measurable returns. The revamped NCL app completed full fleet rollout in January, with over 800,000 guest logins in Q1.

The platform drives pre-cruise revenue through advance bookings while providing valuable consumer insights for personalized marketing and improved guest experiences.

Digital innovation extends to operational efficiency. New AI tools for Care Guides accelerate member service delivery, and live chat features for virtual urgent care reduce response times by 90% while improving provider efficiency by 28%.

These technology investments create scalable advantages that differentiate Norwegian’s guest experience.

The company’s disciplined revenue management approach during recent booking volatility demonstrates strategic maturity.

By maintaining pricing integrity despite short-term booking pressure, Norwegian positions itself to capture higher yields when demand normalizes while protecting long-term brand value and margin potential.

Valuation Setup for NCLH Stock

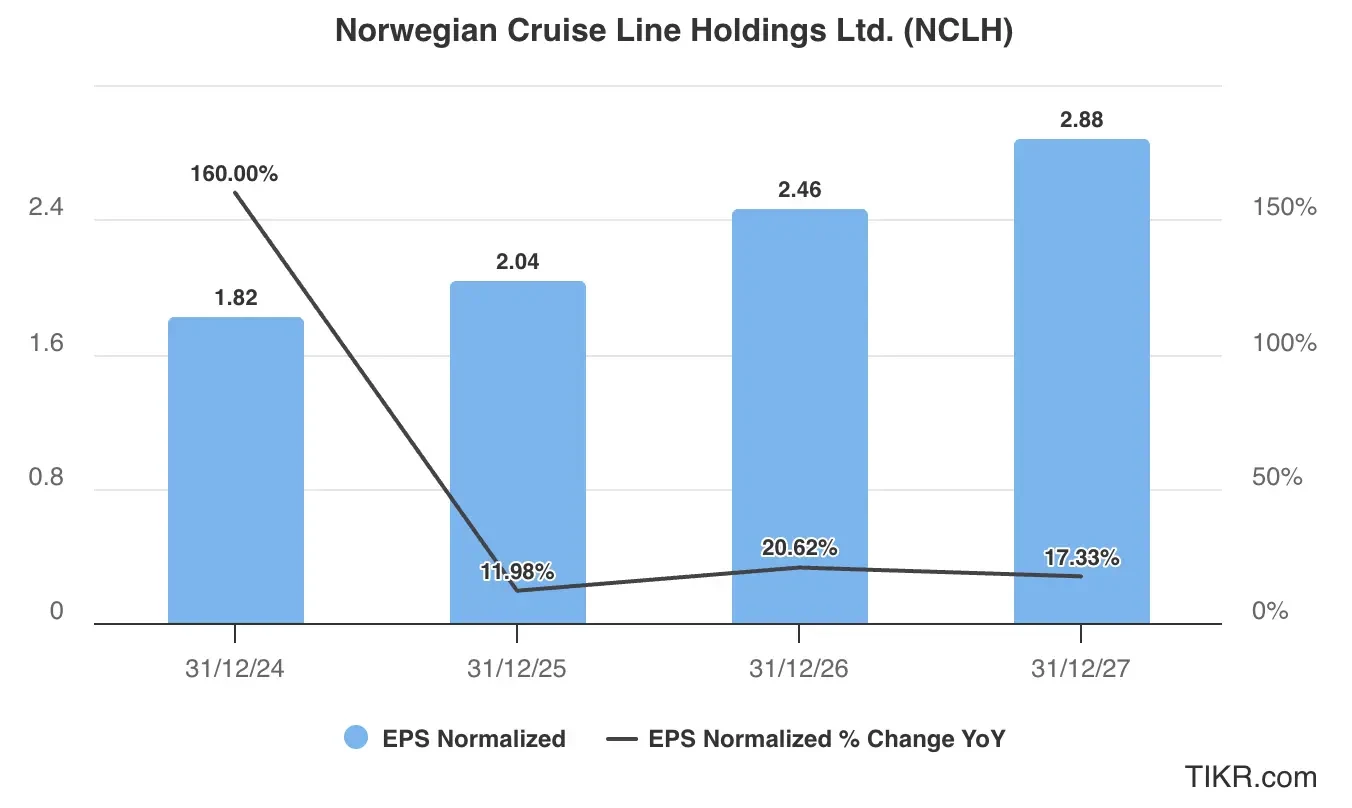

Analysts tracking NCLH stock expect its sales to rise from $9.48 billion in 2024 to $12 billion in 2027, an annual increase of 8.2%. Comparatively, adjusted earnings are forecast to expand from $1.82 per share to $2.88 per share in this period.

NCLH stock currently trades at a forward price-to-earnings multiple of 9x, which is below its 12-month average multiple of 11.4x.

If NCLH Health stock is priced at a multiple of 9x and reaches its projected $2.88 in normalized EPS, it will trade around $26/share in early 2027, indicating an upside potential of almost 37% from current levels.

Value stocks quicker with TIKR (It’s free, no card required) >>>

Average Analyst Price Target for NCLH Stock

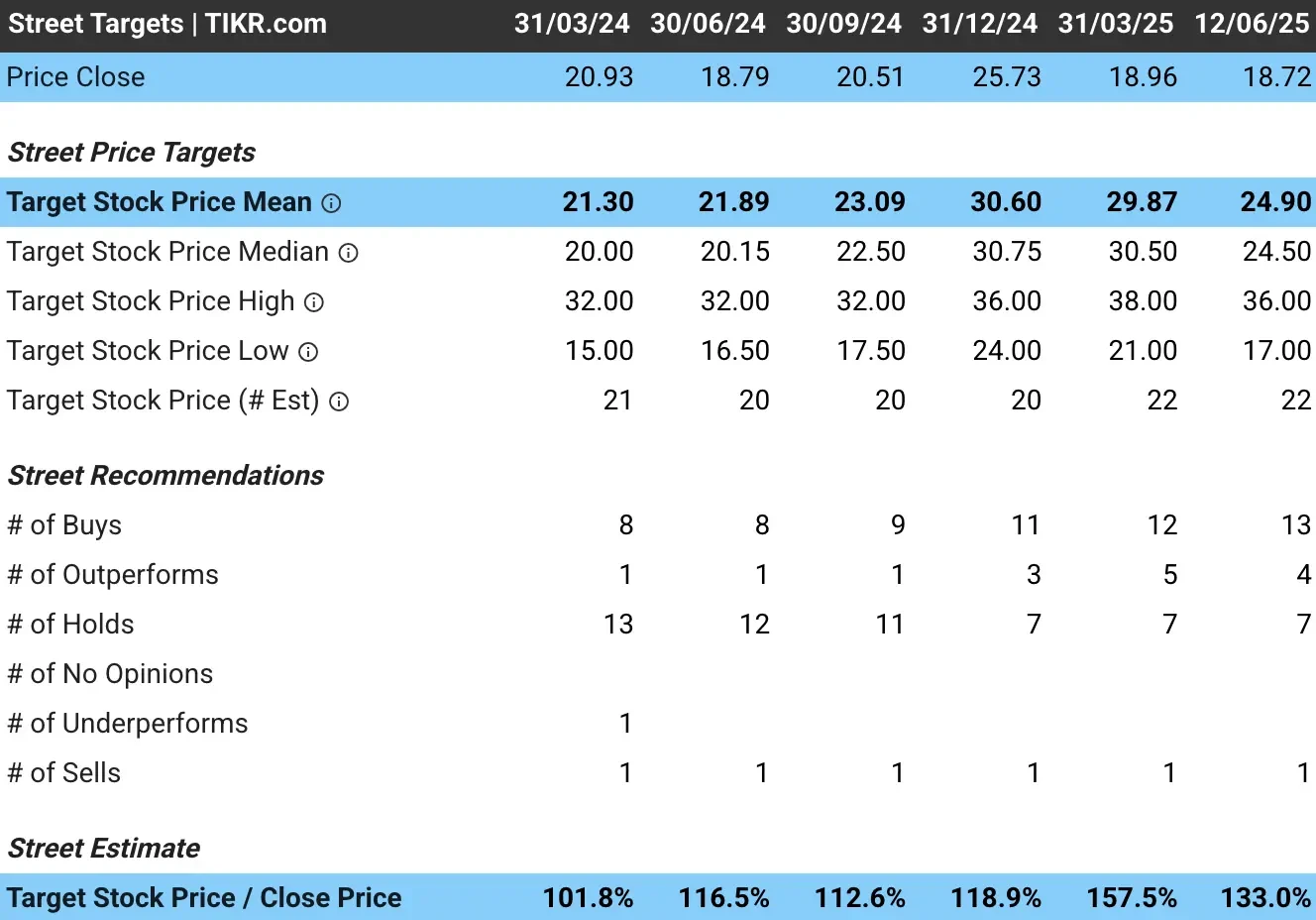

Wall Street remains bullish on NCLH stock, with a consensus price target of $25/share.

That means analysts expect the stock to rise around 33% from current levels over the next 18 months.

Notably, NCLH stock currently has a high target price of $36 and a low target price of $17.

Of the 25 analysts tracking the cruise stock, 17 recommend “Buys”, seven recommend “Hold”, and one recommends “Sell.”

TIKR Takeaway for NCLH Stock

Norwegian Cruise Line presents a compelling investment opportunity for investors seeking exposure to the travel sector, characterized by disciplined operational execution.

A strategic focus on balancing guest experience with financial returns creates sustainable competitive advantages in the premium cruise market.

With strong cost management capabilities, innovative fleet development, and strategic destination investments, Norwegian is well-positioned to achieve its Charting the Course targets, including meaningful margin expansion and continued deleveraging.

The company’s ability to maintain profitability guidance despite revenue headwinds demonstrates the resilience of its business model and the strength of its operational transformation initiatives.

Want to Invest Like Warren Buffett, Joel Greenblatt, or Peter Lynch?

TIKR just published a special report breaking down 5 powerful stock screeners inspired by the exact strategies used by the world’s greatest investors.

In this report, you’ll discover:

- A Buffett-style screener for finding wide-moat compounders at fair prices

- Joel Greenblatt’s formula for high-return, low-risk stocks

- A Peter Lynch-inspired tool to surface fast-growing small caps before Wall Street catches on

Each screener is fully customizable on TIKR, so you can apply legendary investing strategies instantly. Whether you’re looking for long-term compounders or overlooked value plays, these screeners will save you hours and sharpen your edge.

This is your shortcut to proven investing frameworks, backed by real performance data.

Click here to sign up for TIKR and get this full report now, completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!