High-yield dividend stocks are popular with dividend investors because they pay investors cash just for holding them.

But if a company is paying out most of its earnings as dividends, it could be a warning sign. When payout ratios get too high, it can be hard for a company to sustain its dividend.

That’s why many investors look for stocks that offer both a strong dividend yield and a reasonable payout ratio that leaves room for stability or growth.

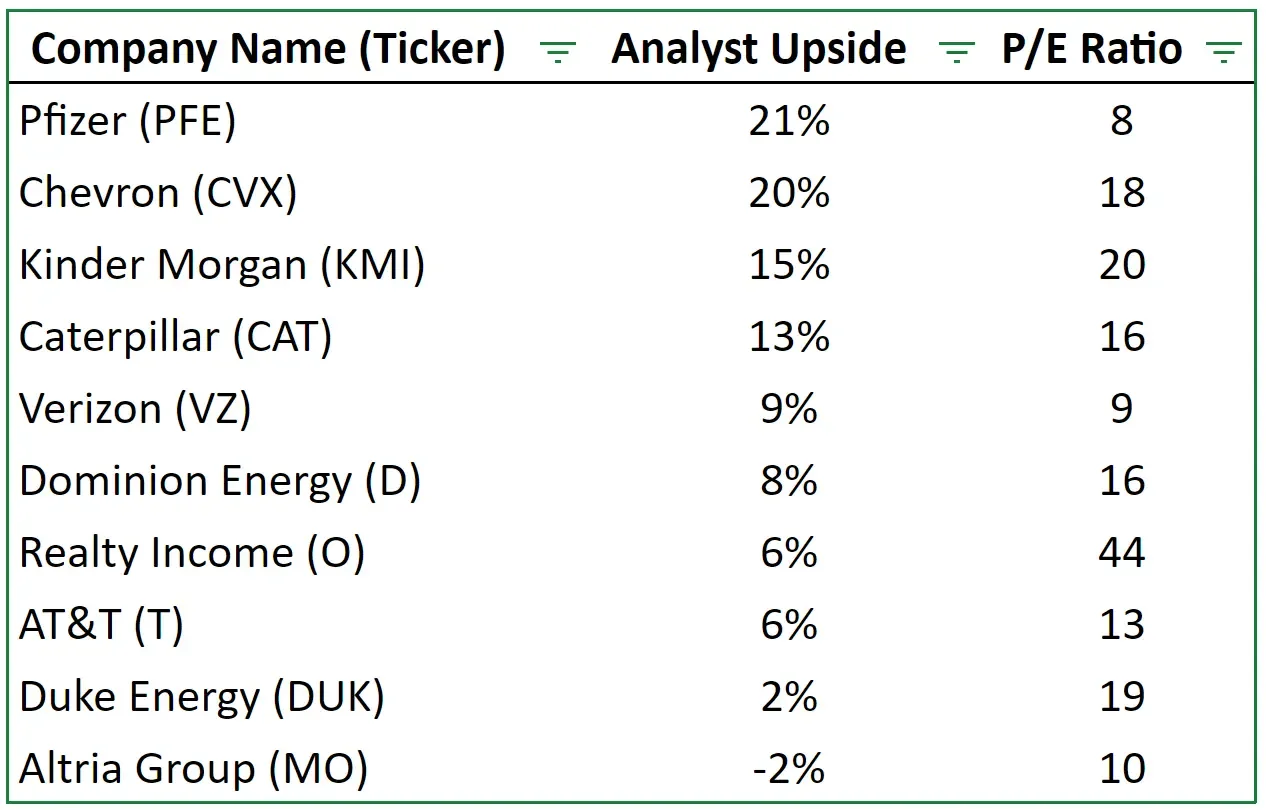

Here are 10 high-yield dividend stocks with reasonable payout ratios that could be worth a closer look today:

Find high-quality high dividend yield stocks today with TIKR >>>

Here are a few of our favorite stocks from this list.

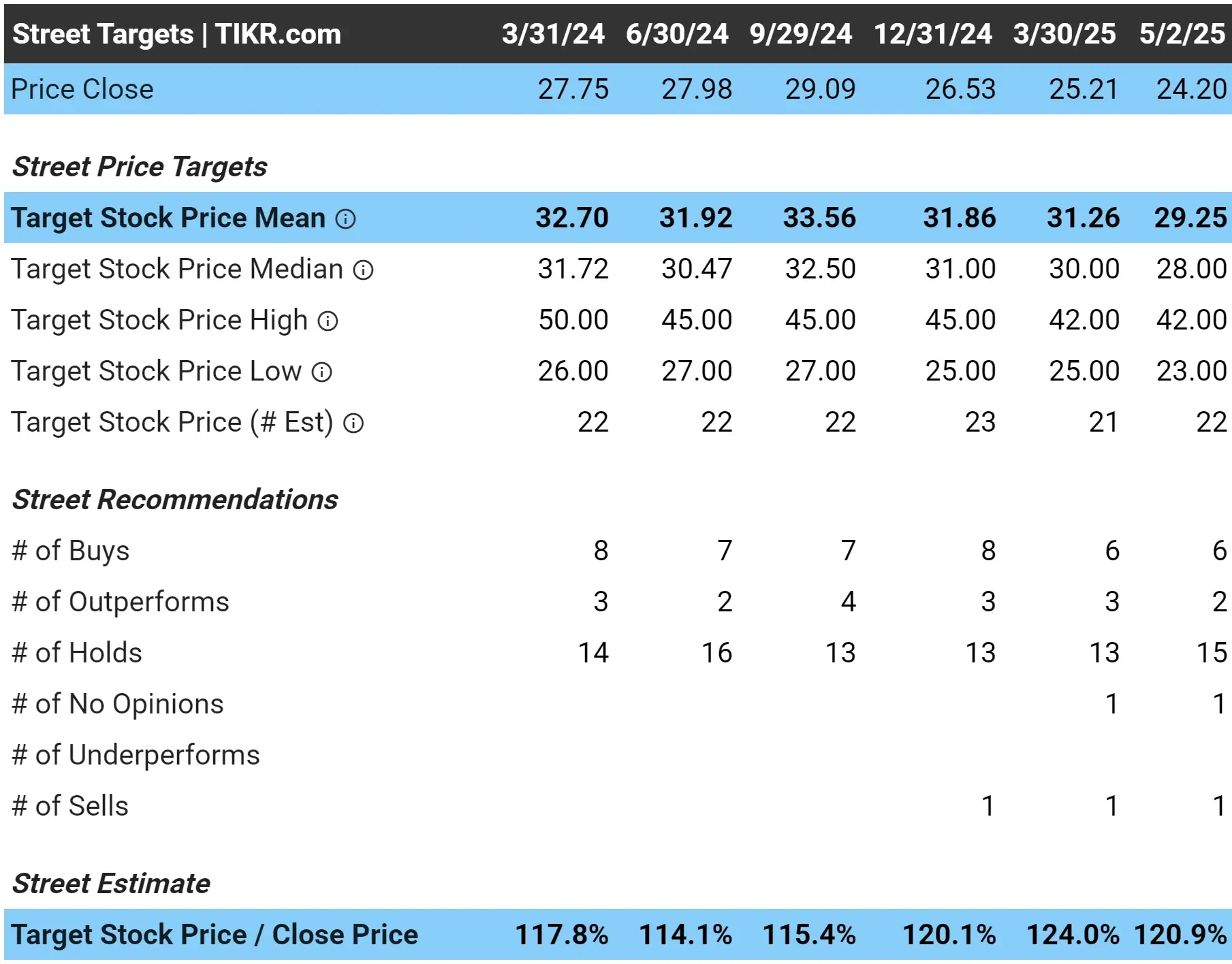

Pfizer (PFE)

- Market Cap: $138 billion

- Industry: Pharmaceuticals

- Analyst Upside: 21%

- P/E Ratio: 8

Company Overview: Pfizer is a global biopharmaceutical company known for developing and manufacturing innovative medicines and vaccines. Its product lineup spans across oncology, vaccines, internal medicine, and rare diseases, with operations in over 100 countries.

Business Strategy: Pfizer makes money by developing prescription drugs and vaccines, many of which come from in-house R&D or collaborations. The company is focused on rebuilding its post-COVID portfolio through acquisitions, pipeline innovation, and expanding access to emerging markets.

Recent Developments

- Earnings & Profitability: Pfizer’s earnings took a hit after demand for its COVID products fell sharply, but the core business is stabilizing. Adjusted EPS is expected to rebound modestly in 2025 as the company leans into cost cuts and newer drugs.

- Business Growth Trends: Management has made bold moves to reignite growth, including the $43 billion acquisition of Seagen to expand its cancer pipeline and diversify revenue beyond pandemic-era highs.

- Shareholder Returns: Despite short-term headwinds, Pfizer remains committed to shareholder payouts. The stock currently yields over 5% and has maintained its dividend through recent volatility, signaling confidence in long-term cash flow.

Track Pfizer’s financials, growth trends, and analyst forecasts on TIKR >>>

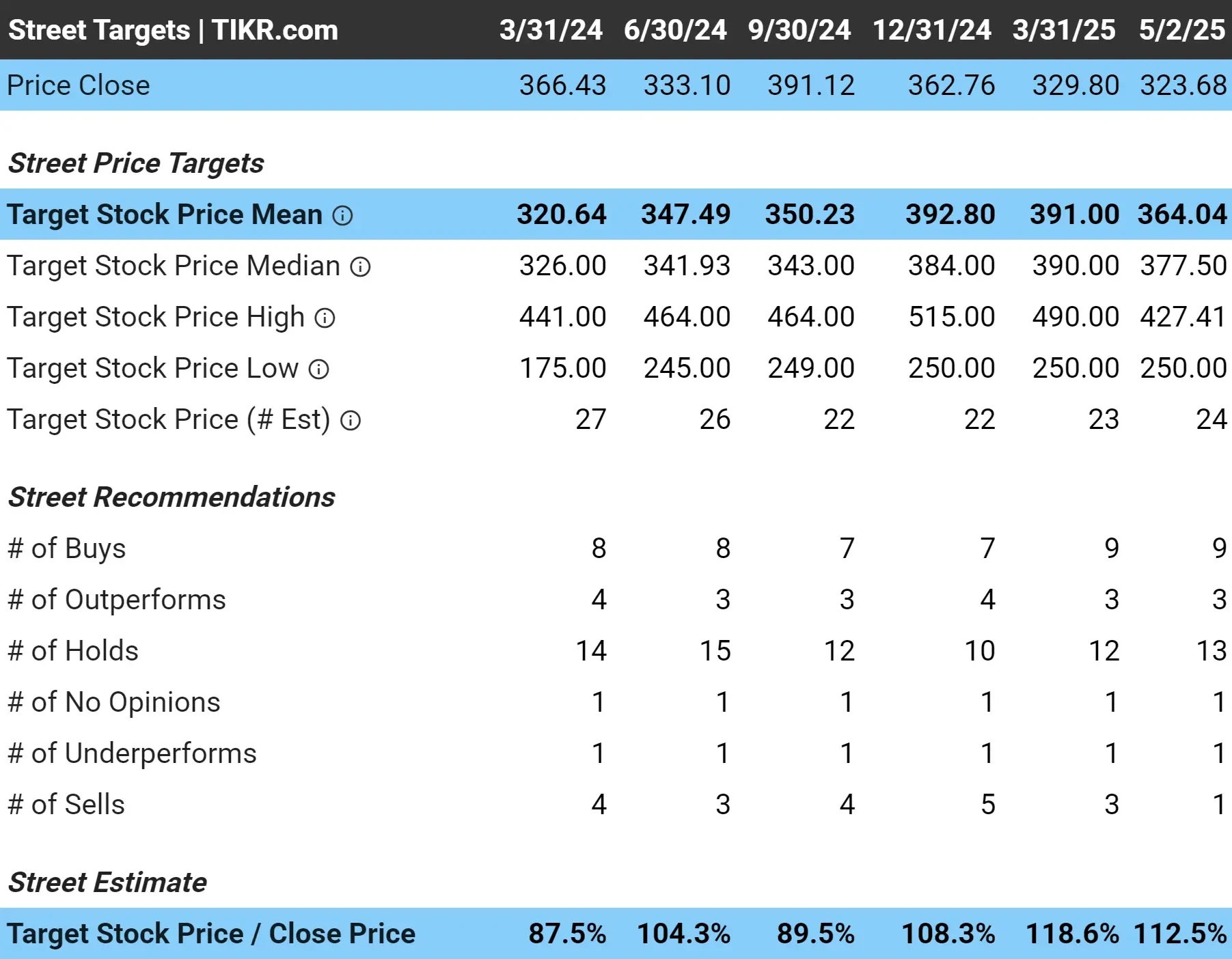

Chevron Corporation (CVX)

- Market Cap: $239 billion

- Industry: Oil, Gas and Consumable Fuels

- Analyst Upside: 20%

- P/E Ratio: 18

Company Overview: Chevron Corporation is a global energy giant, primarily involved in the exploration, production, refining, and marketing of oil and natural gas. Key segments include upstream (oil and gas production) and downstream (refining and distribution).

Business Strategy: Chevron generates revenue through the extraction and sale of oil and gas, alongside its refining operations. The company’s strategy centers on increasing production efficiency, expanding into renewable energy, and maintaining strong cash flow through disciplined capital allocation.

Recent Developments:

- Earnings & Profitability: Chevron has seen strong earnings driven by high energy prices, with solid profitability across both upstream and downstream segments.

- Business Growth Trends: The company is focusing on expanding its renewable energy portfolio, with increasing investments in low-carbon technologies while maintaining a strong position in traditional energy markets.

- Shareholder Returns: Chevron continues to reward investors with a 4.7% dividend yield and share buybacks, maintaining strong dividend payments even in volatile market conditions.

Find stocks that we like even better than Chevron with TIKR >>>

Caterpillar Inc. (CAT)

- Market Cap: $147 billion

- Industry: Machinery

- Analyst Upside: 13%

- P/E Ratio: 16

Company Overview: Caterpillar Inc. is a global leader in the design and manufacture of heavy equipment and engines, primarily for the construction, mining, and energy sectors.

Business Strategy: Caterpillar generates revenue through the sale of construction and mining equipment, along with related services and financing. The company focuses on innovation, enhancing operational efficiency, and expanding its presence in global infrastructure projects, while increasingly incorporating digital technologies into its offerings.

Recent Developments:

- Earnings & Profitability: Caterpillar posted solid earnings growth, driven by strong demand in construction and mining, alongside improved operational efficiency.

- Business Growth Trends: The company continues to expand its presence in global infrastructure projects, with a focus on automation and digital solutions to enhance equipment performance.

- Shareholder Returns: Caterpillar offers a 4.7% dividend yield and continues to repurchase shares as part of its capital return strategy.

Find stocks that are better buys today than Caterpillar (It’s free) >>>

TIKR Takeaway

Each of the 10 stocks in this list looks like it offers:

- A dividend yield that stands out in today’s market

- A payout ratio that looks sustainable based on expected earnings

- Long-term relevance in their industries and consistent shareholder returns

These stocks could be worth a further look for investors looking for high-yielding dividend stocks that are sustainable.

- Looking for deeply undervalued stocks? Browse TIKR’s stock screener to find the best stocks to buy today.

- Already love the stocks you own? Get real-time news and in-depth stock insights when you add your holdings to your watchlist on TIKR.

- Want to stay ahead? TIKR’s analysts’ estimates give you 5 years of Wall Street forecasts so you can feel confident in the stocks you invest in.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!