Key Stats for AppLovin Stock

- Today’s Price Change: 15%

- Current Share Price: $348

- 52-Week High: $525

- Analysts’ Price Target: $433

What Happened?

AppLovin (APP) stock is up as much as 15% on Thursday after the advertising technology company reported first-quarter earnings that exceeded analyst expectations and announced the sale of its mobile gaming business.

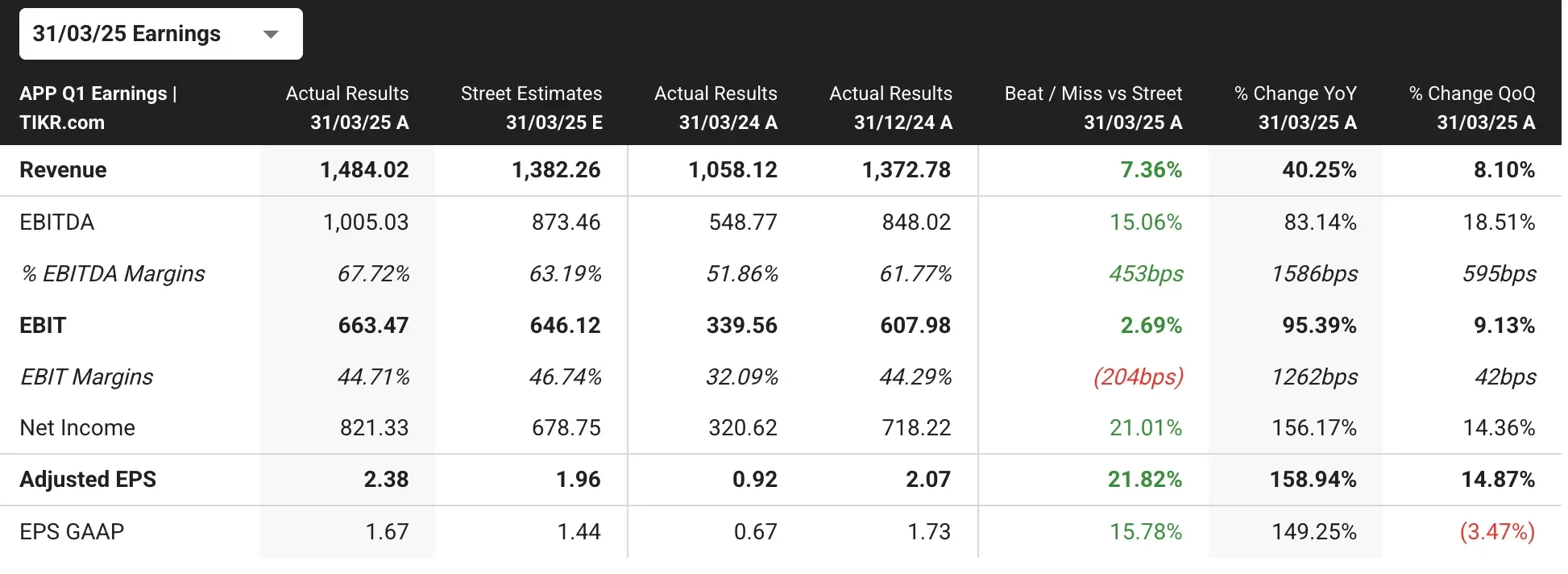

AppLovin reported GAAP earnings per share of $1.67, well above the $1.44 consensus estimate, while revenue came in at $1.48 billion, surpassing the expected $1.38 billion.

AppLovin agreed to sell its mobile gaming business to Tripledot Studios for $400 million in cash in a significant strategic move.

As part of the deal, AppLovin will obtain a 20% ownership stake in Tripledot, which makes popular mobile games like Sudoku Friends, Puzzletime, and Solitaire Classic. The transaction is expected to close in the second quarter of 2025.

In the first quarter, AppLovin more than doubled its earnings per share. Its advertising sales reached $1.16 billion, up from $678 million a year ago, while revenue from the apps business declined 14% to $325 million.

See AppLovin’s full Q1 earnings transcript (It’s free) >>>

What the Market Is Telling Us

The market’s enthusiastic response to AppLovin’s earnings report and business sale highlights investors’ approval of its strategic shift toward focusing exclusively on its high-growth advertising technology business.

By divesting its declining mobile gaming segment, AppLovin is streamlining its operations to capitalize on the rapid advancements in artificial intelligence that have fueled its advertising unit’s historic growth.

Despite the positive earnings, AppLovin provided Q2 revenue guidance of $1.2 billion to $1.22 billion, which fell short of analyst expectations of $1.38 billion.

However, AppLovin stock investors appear focused on the longer-term benefits of the business restructuring rather than the near-term guidance.

The company also made headlines with a blog post describing a proposed deal with ByteDance’s TikTok. The post suggested that the company would not buy TikTok’s U.S. operations but instead merge with the social media company to cover “all assets outside China.”

CEO Adam Foroughi characterized this as a “long shot” but emphasized that AppLovin pursues ambitious opportunities. This potential connection to the high-profile TikTok situation may have further excited investors about AppLovin’s growth prospects.

It’s worth noting that despite this positive reaction, APP stock has faced challenges in 2025. After surging over 700% in 2024 and becoming the top performer in its sector, AppLovin stock dropped 12% in February following short-seller reports questioning its AI-powered AXON advertising software.

Find the best stocks to buy today that are even better than AppLovin. (It’s free) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover.

- Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!