Key Stats for PODD Stock

- Today’s Price Change: 21%

- Current Share Price: $310

- 52-Week High: $312

- Analysts’ Price Target: $315

What Happened?

Insulet Corporation (PODD) shares skyrocketed on Friday after the insulin delivery company reported exceptional first-quarter 2025 results that significantly exceeded analysts’ expectations.

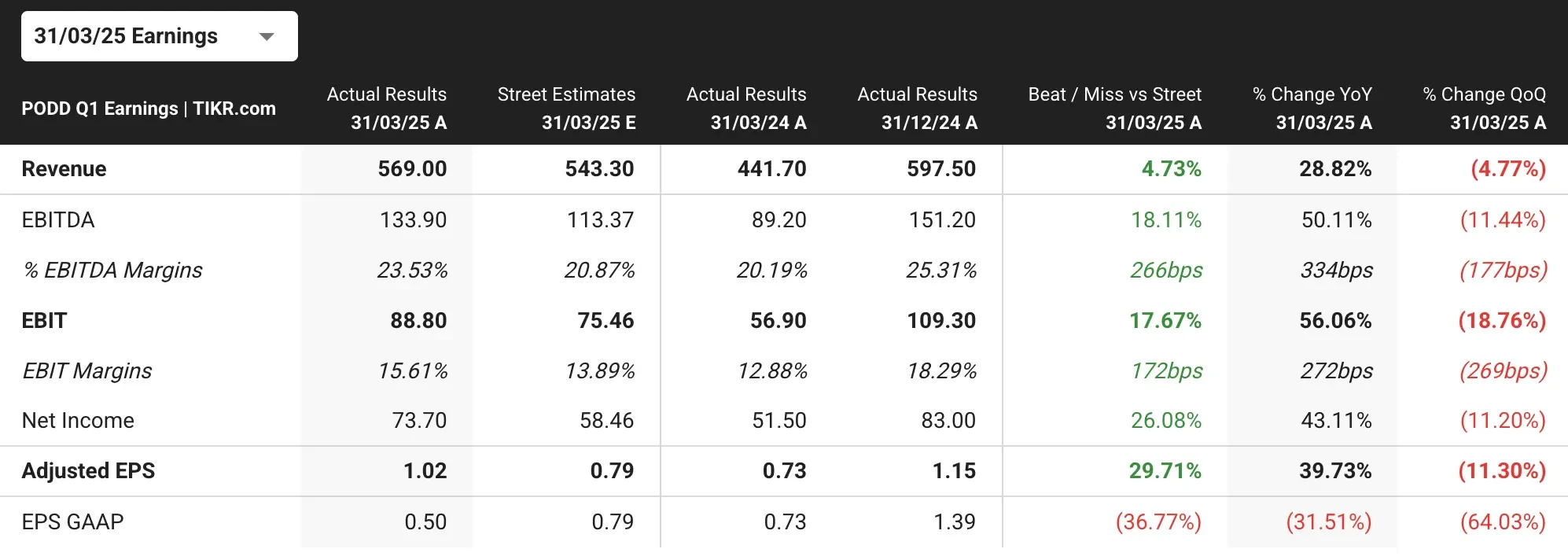

In Q1, Insulet posted adjusted earnings per share of $1.02 on revenue of $569 million, handily beating analyst projections of $0.79 EPS and $543 million in revenue.

Most impressive was the 30% jump in constant currency sales, driven by strong performance in the U.S. market and robust 36% growth in international Omnipod sales.

Adding to investor enthusiasm, Insulet raised its full-year 2025 constant currency revenue growth outlook to 19-22%, up from its previous guidance of 16-20%.

New CEO Ashley McEvoy expressed confidence, stating, “Insulet is just getting started on an exciting journey to revolutionize diabetes management globally.”

See Insulet’s full Q1 earnings transcript (It’s free) >>>

What the Market Is Telling Us

The positive reaction to PODD stock signals that investors view these results as a significant inflection point for Insulet.

While PODD stock is known for volatility (with 14 moves greater than 5% over the past year), today’s 21% surge is exceptional even by Insulet’s standards, indicating a fundamental reassessment of the company’s growth prospects.

Jefferies analysts responded by raising their price target from $350 to $360, describing Insulet as a “top idea for ’25 given a path to robust growth, driven by product differentiation and new indications.”

After trading nearly flat for most of the year, PODD stock broke out to a new 52-week high, suggesting investors are gaining confidence in Insulet’s leadership position in the diabetes management market and its potential for sustained growth.

Find the best stocks to buy today that are even better than Insulet. (It’s free) >>>

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!