Key Takeaways:

- Shell’s dividend yield is currently at 4.3%, which is historically high for the stock.

- Earnings are expected to rebound in 2026, and dividends are expected to grow in the low to mid-single-digits going forward.

- Analysts think that the stock could have nearly 30% upside today.

- Get accurate financial data on over 100,000 global stocks for free on TIKR >>>

Today, Shell is a cash-generating machine trading at a discount. Despite strong earnings, growing demand for LNG, and a commitment to massive shareholder returns, Shell’s stock is down nearly 10% this year.

With a solid dividend yield and management focused on buybacks, investors today could be looking at 30% upside as the market catches up to Shell’s true value.

Why Has Shell’s Stock Price Dropped?

Shell’s stock is down recently, and it mostly comes down to two big reasons:

- Slower economic growth in places like China and Europe has made investors nervous about future energy demand.

- Some funds are selling off oil and gas stocks to meet ESG goals, even if Shell’s business is still strong.

That said, this doesn’t look like a company that’s in trouble. Shell continues to post solid profits and returns cash to shareholders. If sentiment improves, the stock could bounce back quickly.

Find the best stocks to buy today with TIKR (It’s free) >>>

Analysts Think The Stock Has 30% Upside Today

Wall Street remains optimistic about Shell.

Analysts believe stable energy prices, ongoing cost discipline, and strong capital returns could help push the stock higher over the next year.

Analysts have an average price target that’s 28% higher than the stock’s current price, which implies that they see 28% upside for the stock today.

Analysts’ estimates arenʼt always accurate, but itʼs all the more compelling to give a stock a closer look when analysts think the stock has meaningful upside.

1: Dividend Yield

Shell currently offers a dividend yield of around 4.3%, which is right near its 5-year average.

While it’s not as high as it was before Shell reduced its dividend or during the COVID-era spike, the yield has been steadily climbing again since Shell has continued increasing its dividend.

Shell continues to prioritize dividends as a key part of its capital return strategy. The company has also been buying back stock, showing that management is committed to rewarding shareholders even as the business adapts to a changing energy landscape.

Find high-quality dividend stocks that are even better than Shell today. (It’s free) >>>

2: Dividend Safety

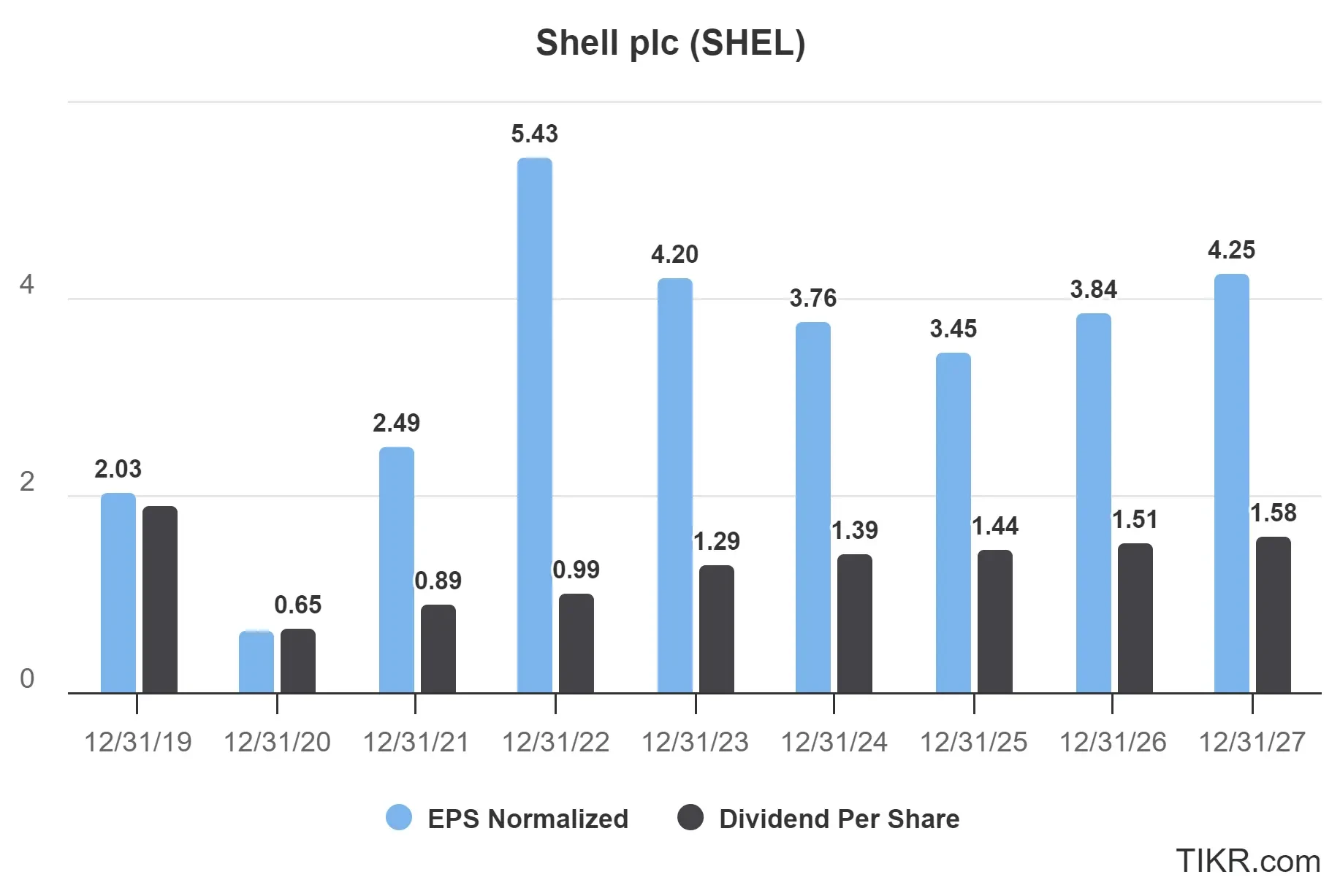

At the end of fiscal year 2024, Shell had a dividend payout ratio of about 37%. That’s a very manageable level for a company like Shell, because we like to see companies with a payout ratio below 70%.

The business continues to generate healthy profits, and it’s been keeping its debt under control, which adds another layer of security to the dividend.

Analysts expect oil prices to remain in a stable range going forward, likely between $70–$85 per barrel. This means that Shell should continue to see stable, slightly growing EPS.

See Shell’s full growth forecast. (It’s free) >>>

3: Dividend Growth Potential

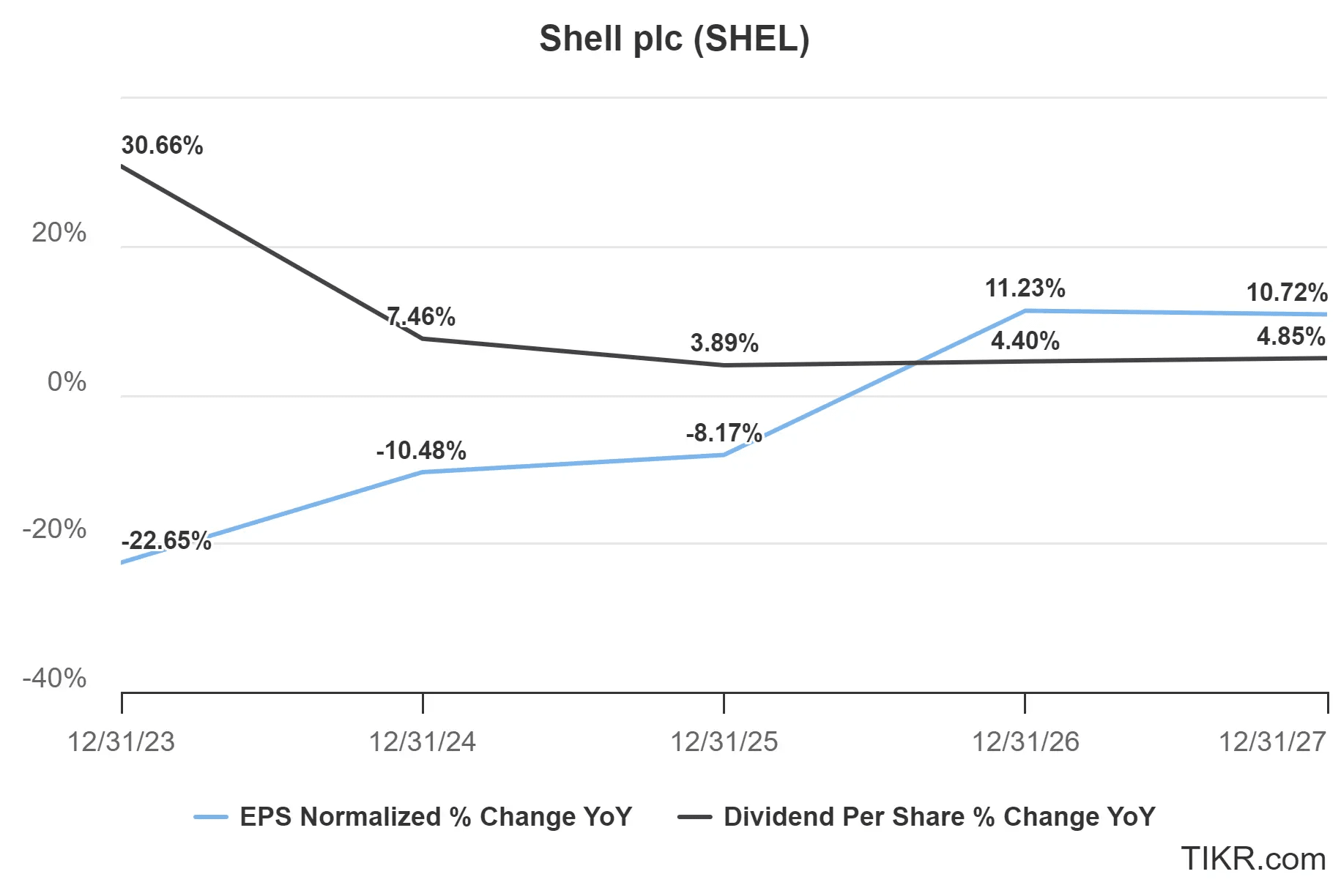

Shell’s dividend growth has been modest lately, but that may be changing in the years ahead.

While earnings were under pressure in 2024 and 2025, analysts expect earnings to rebound in 2026 and beyond as oil prices are expected to hang around $70–$85 per barrel. That momentum could support steady dividend increases, especially as EPS growth outpaces dividend hikes, giving Shell flexibility to sustain dividends over time.

Shell is keeping its dividend sustainable while reinvesting in future growth, which should ultimately benefit patient dividend-focused investors.

TIKR Takeaway

While the energy sector can be volatile, Shell’s focus on disciplined returns and a sustainable dividend makes it a compelling choice for dividend investors, especially while it’s trading at a discount.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks and was built for investors who think of buying stocks as buying a piece of a business.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!