Key Stats for ASML Stock

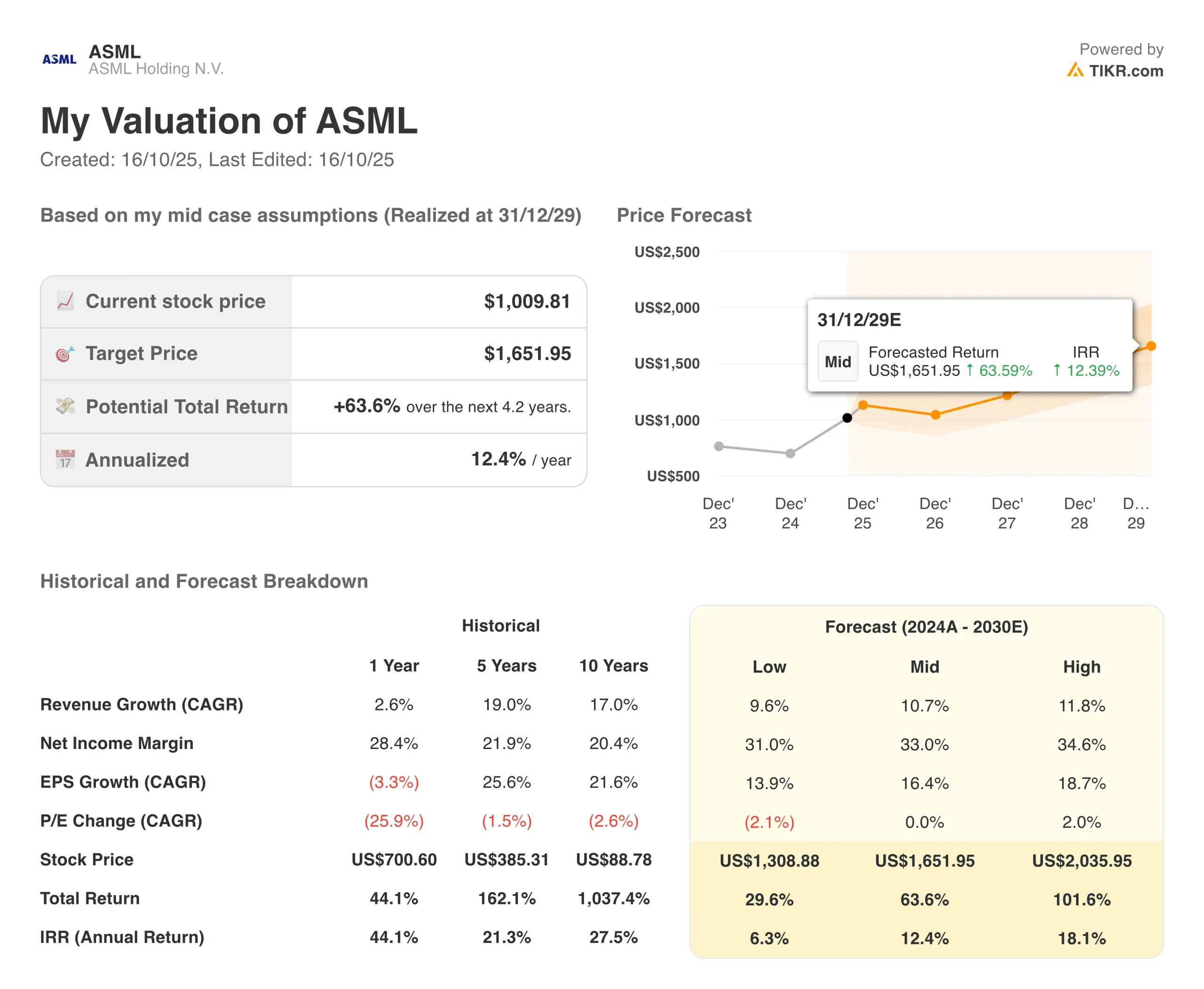

- Price Change for ASML stock: 2.7%

- Current Share Price: $1,010

- 52-Week High: $1,059

- $ASML Stock Price Target: $958

What Happened?

ASML (ASML) stock jumped 3% on Wednesday after the Dutch semiconductor equipment giant provided reassurance about 2026 growth prospects, despite warning of a significant sales decline in China next year.

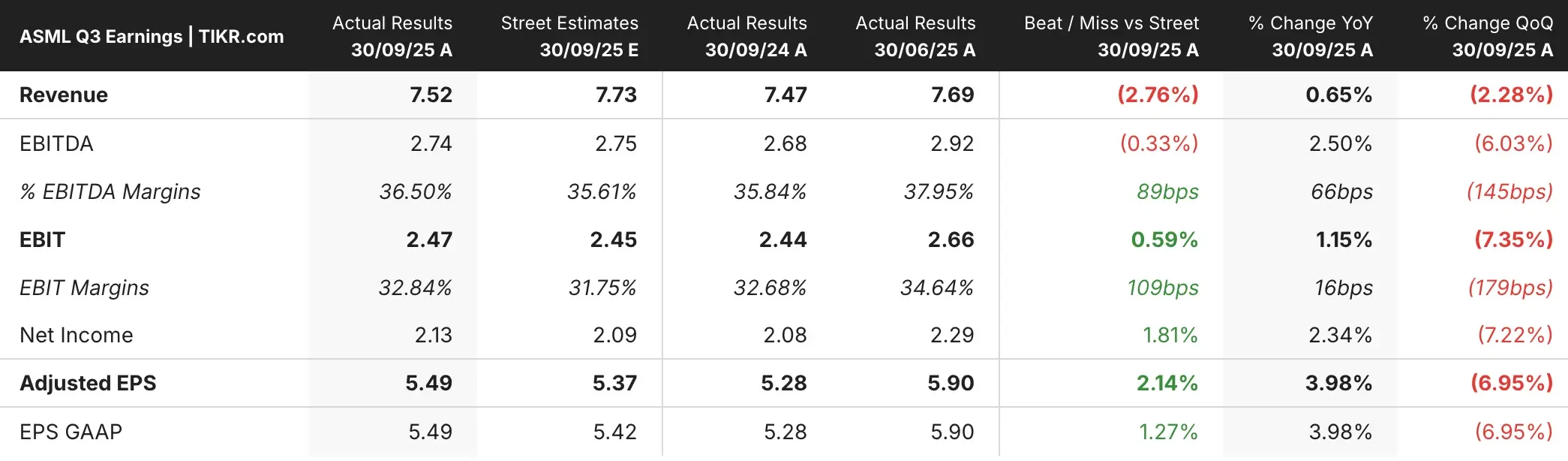

The company’s third quarter results showed net sales of €7.5 billion and net profit of €2.1 billion, roughly in line with analyst expectations.

More importantly, ASML stock received a boost from management’s guidance that 2026 total net sales should not fall below 2025 levels. This marks a notable shift from July, when the company said it couldn’t confirm growth for next year due to macro uncertainty.

CEO Christophe Fouquet pointed to “strong news” around AI infrastructure investments as a key factor reducing previous uncertainties.

ASML logged €5.4 billion in orders during the quarter, primarily driven by the ongoing AI boom. However, Fouquet cautioned that customer demand from China is expected to drop significantly in 2026 compared to the exceptionally strong business levels seen in 2024 and 2025.

ASML maintained its forecast for roughly 15% annual sales growth in 2025, with gross margins around 52%. For the fourth quarter, the company expects sales between €9.2 billion and €9.8 billion.

See analysts’ growth forecasts and price targets for ASML stock (It’s free!) >>>

What the Market Is Telling Us About ASML Stock

The 3% gain in ASML stock suggests investors are relieved by management’s more confident tone about next year, even with China headwinds. The company’s position as Europe’s most valuable listed firm reflects its critical role in the semiconductor supply chain, particularly for advanced AI chips.

Recent analyst upgrades from Morgan Stanley, UBS, and Jefferies point to growing confidence in ASML’s growth drivers.

The expansion of AI chip foundries and semiconductor manufacturing capacity is expected to offset some of the weakness from China.

Additionally, ASML’s partnership with French AI firm Mistral signals the company’s intent to embed AI capabilities deeper into its own products.

While the anticipated decline in China is concerning, especially with potential new U.S. export restrictions looming, the broader AI-driven demand appears strong enough to keep the company on a growth trajectory.

Investors will be watching ASML’s biggest customer, TSMC, which reports earnings on Thursday, for further confirmation of robust demand for advanced lithography systems.

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!