Key Stats for Kenvue Stock

- Price Change for $KVUE stock: -10%

- Current Share Price: $18.6

- 52-Week High: $25.17

- $KVUE Stock Price Target: $22.7

What Happened?

Kenvue (KVUE) stock plunged over 9% on Friday following a Wall Street Journal report that Health and Human Services Secretary Robert F. Kennedy Jr. will likely release a government report linking autism to Tylenol use during pregnancy.

The report, expected this month, could suggest a connection between the company’s flagship pain medication and the developmental disorder.

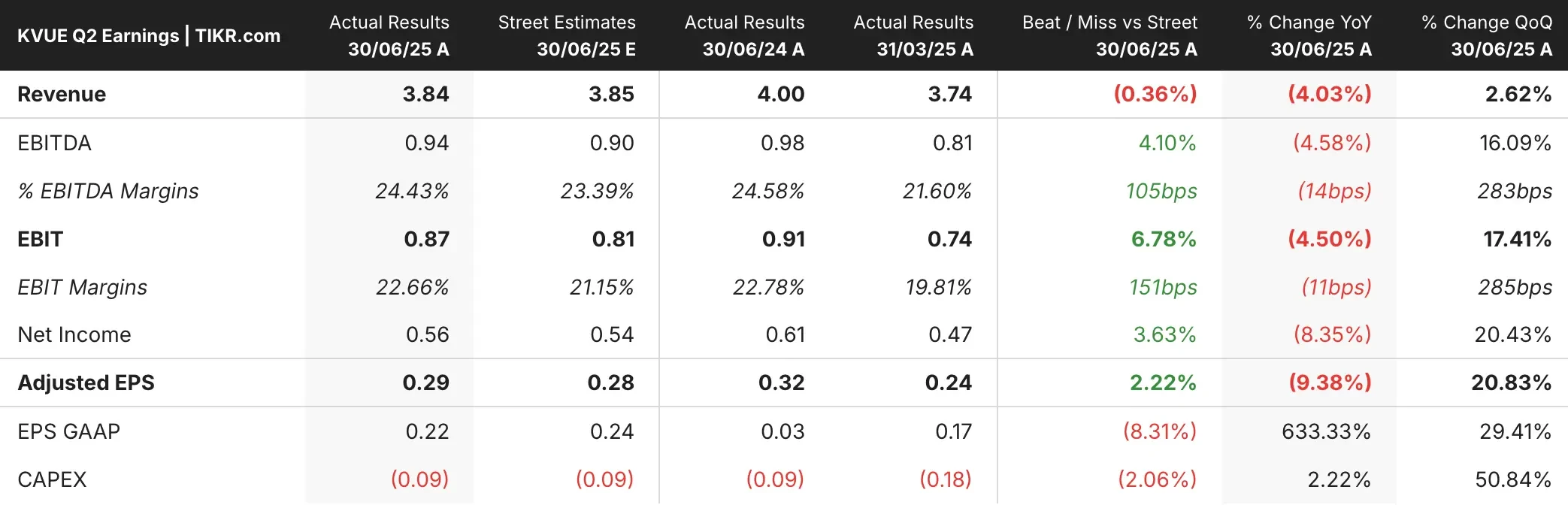

This development adds regulatory uncertainty to an already challenging period for Kenvue, which reported disappointing second-quarter results with organic sales declining 4.2% and revised full-year guidance downward.

The consumer health giant, which spun off from Johnson & Johnson in 2023, has been struggling with execution issues and what interim CEO Kirk Perry described as “self-induced complexity” across its operations.

An HHS spokesperson said the agency is “using gold-standard science to get to the bottom of America’s unprecedented rise in autism rates,” while cautioning that claims about the report’s contents remain “speculation” until its official release.

See analysts’ growth forecasts and price targets for Kenvue stock (It’s free!) >>>

What the Market Is Telling Us About Kenvue Stock

The sharp sell-off in KVUE stock reflects investor concerns about potential regulatory action against one of Kenvue’s most important products.

Tylenol has been a consistent bright spot for the company, with the brand gaining market share for 12 consecutive quarters in the U.S. adult segment.

However, BNP Paribas analyst Navann Ty noted that the “hurdle to proving causation is high,” particularly given that similar litigation previously concluded in Kenvue’s favor.

A federal judge dismissed related lawsuits in 2024, citing a lack of scientific evidence. The FDA has also stated it has not found “clear evidence” that appropriate acetaminophen use during pregnancy causes adverse outcomes.

The market reaction to Kenvue appears to reflect broader uncertainty around Kennedy’s approach to established medical treatments, combined with Kenvue’s ongoing operational challenges as the company works to simplify its business model and improve execution under new leadership.

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!