When billionaires or company insiders buy a stock, it’s rarely a shot in the dark. They have access to firsthand data, decades of market experience, and a front-row seat to their company’s performance, giving their trades an edge most investors don’t have. They know when fundamentals are strengthening, when valuations look too low, and when the market’s missing something big.

That’s why insider buying is one of the most closely watched signals on Wall Street. It doesn’t mean you should copy every move, but understanding what insiders are doing, and when, can uncover opportunities long before the rest of the market catches on.

In this guide, we’ll break down where to find billionaire and insider stock purchases, how to tell which ones matter, and how to use that data to make smarter, more confident investment decisions.

Discover how much upside your favorite stocks could have using TIKR’s new Valuation Model (It’s free) >>>

Table of Contents:

- Why It’s Worth Tracking Billionaires & Company Insiders

- Case Study: Snowflake Executives and Insider Buying

- How to Track Billionaire & Insider Buys Using TIKR

- Why Insider Buying Can Be a Catalyst

- Pro Tip: Combine Insider Buys with Valuation & Fundamentals

Let’s dive in!

Why It’s Worth Tracking Billionaires & Company Insiders

Tracking billionaire and insider stock purchases helps investors spot high-conviction opportunities. It’s not at all surprising to learn that these individuals often have the best insights into a company’s future, so when they make a trade, it’s a big deal.

Insider buying shows that management and board members have real skin in the game. Like any investor, executives and directors tend to invest their personal money only in their own stock when they believe it is undervalued or poised for better days ahead.

For example, in early 2023, multiple Meta Platforms (META) insiders bought shares after the company saw a sharp selloff. The stock nearly doubled over the next year, a clear indication that they knew something “regular” investors did not.

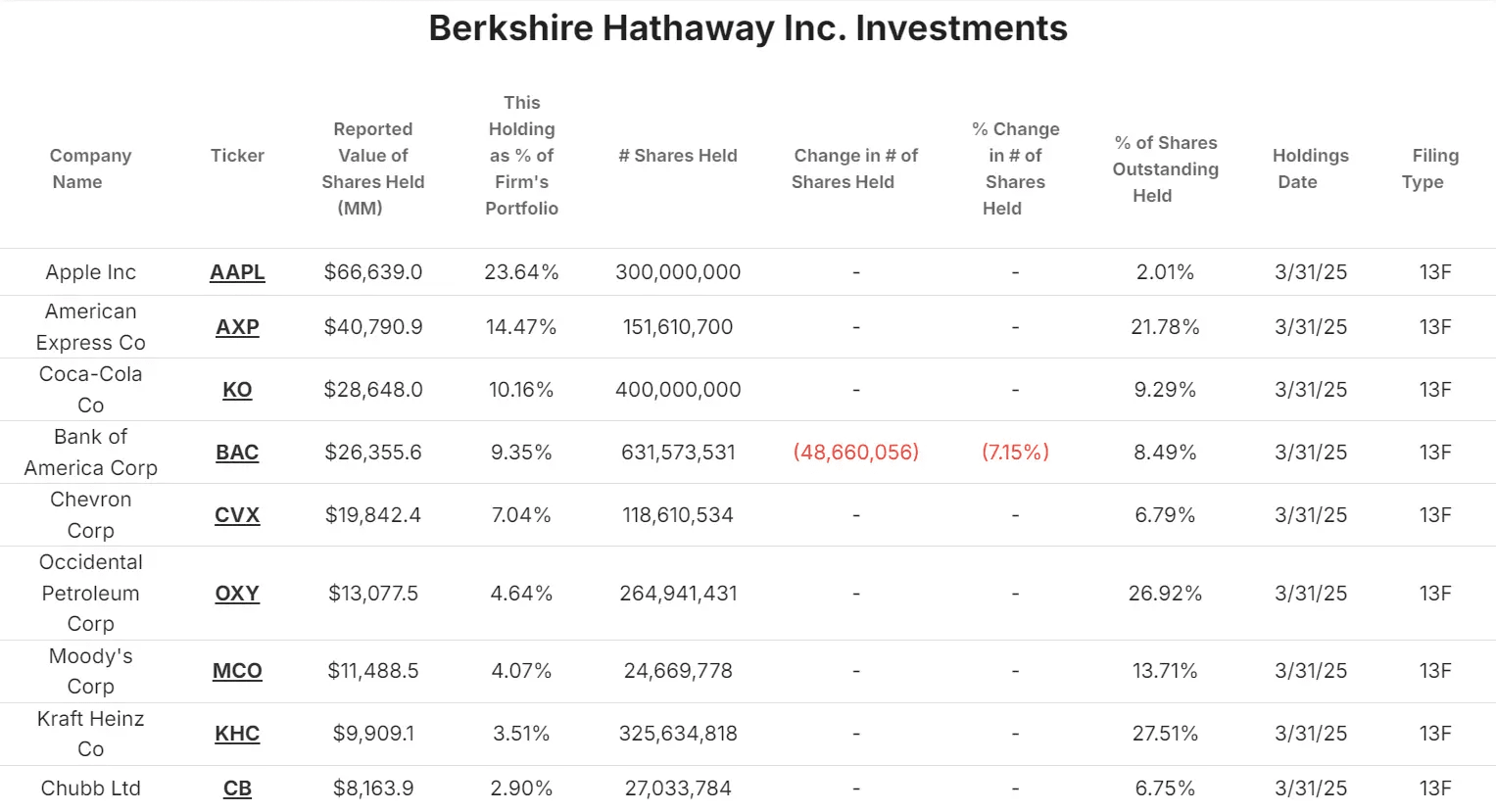

Billionaire investors also offer valuable insights. Warren Buffett’s Berkshire Hathaway once revealed that it had built significant positions in Apple (AAPL) and Occidental Petroleum (OXY) through its 13F filings. These moves signaled high conviction that these stocks were underpriced and had a strong future ahead.

See what stocks billionaires & hedge fund managers are buying today with TIKR >>>

Who Are a Company’s Insiders?

Company insiders include executives (including C-suite members such as the CEO, CFO, COO, CTO, and CMO), members of the company’s Board of Directors, and any shareholders who own over 10% of the company.

These individuals are legally required to report their stock trades to the SEC because their actions can signal confidence (or concern) about a company’s future.

Since insiders and hedge fund managers are required to report their trades, we can track them using tools like TIKR and see what they’re buying.

Case Study: Snowflake Executives and Insider Buying

In late December 2025, Nike Inc. (NKE) wrapped up a difficult year with shares down roughly 19% for 2025, marking the fourth consecutive year of declines. The stock had lost nearly half its value over three years amid weak China sales and tariff headwinds.

During this period, multiple Nike insiders stepped in with open-market purchases. CEO Elliott Hill bought approximately 16,400 shares in a transaction valued at around $1 million, increasing his personal stake by more than 7%. Board member Tim Cook, who also serves as Apple’s CEO, added roughly 50,000 shares, nearly doubling his Nike position. Fellow director Robert Holmes Swan purchased about 8,700 shares, expanding his holdings by 24%.

These cluster buys signaled conviction at a time when the company was navigating a turnaround under Hill’s leadership. Shares rose approximately 4% following the insider activity. Wall Street analysts currently see potential upside of around 21% over the next year, with the average rating at buy.

See what stocks analysts think are undervalued today >>>

How to Track Billionaire & Insider Buys Using TIKR

Instead of digging through SEC filings or outdated spreadsheets, TIKR allows you to instantly see what top investors and insiders are buying, all in one place.

Track Billionaire Investors

On TIKR, you can track any major investor by searching their fund name directly. Type “Berkshire Hathaway,” “Appaloosa Management,” or “Greenlight Capital” into the Track Global Holdings search bar, then navigate to their portfolio view.

Once there, you see:

- Complete global holdings, pulled from 13F filings for US positions and international disclosures for foreign holdings

- Recent activity showing which stocks were added, trimmed, or sold in the latest filing period

- Portfolio weights showing how much capital each position represents

- Share counts and reported market values for every holding

For example, Berkshire Hathaway’s top holdings include Apple, Bank of America, and American Express. The platform also tracks positions that don’t appear in 13Fs, like Berkshire’s Japanese trading company stakes and recent additions to Constellation Brands and Domino’s Pizza. These show up because TIKR pulls from global filing sources, not just SEC data.

If you’re not sure what hedge funds to track, TIKR breaks out some of the hedge funds by investing strategy, so you can find hedge fund managers that fit your investing style:

You can also click TIKR’s “Ownership” tab for any of these stocks to see which other top investors hold them.

Follow the moves of the world’s best hedge funds with TIKR >>>

Track a Stock’s Insider Ownership

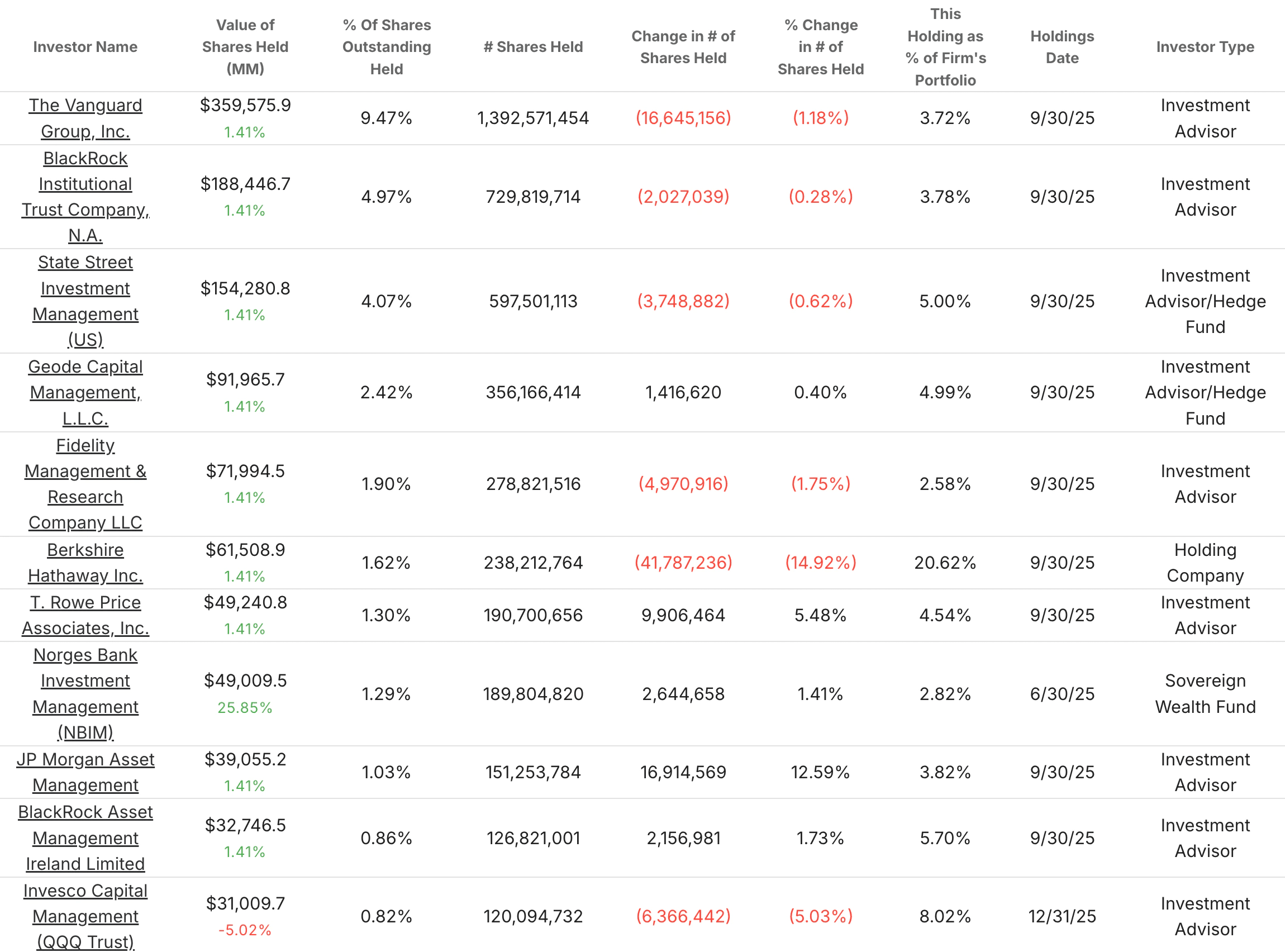

To see the specific stock’s ownership, search for the company on TIKR, then go to the stock’s “Ownership” tab.

It’s usually best to filter top shareholders by hedge fund or individual investor so you can see who the top individual owners are.

On a stock’s Ownership tab, you’ll find:

- Top shareholders (Filtered by investor type)

- Whether they’ve been increasing or decreasing their stake over time

- Their total ownership as a percentage of shares outstanding

Shown below is Apple’s top shareholders, filtered by hedge funds and investment managers. Unsurprisingly, the big-name investment managers like Vanguard and State Street are Apple’s top shareholders, but you can also drill down to see Apple’s top individual shareholders and more:

TIKR’s Ownership tab provides a quick way to see which major investors and hedge funds hold a stock.

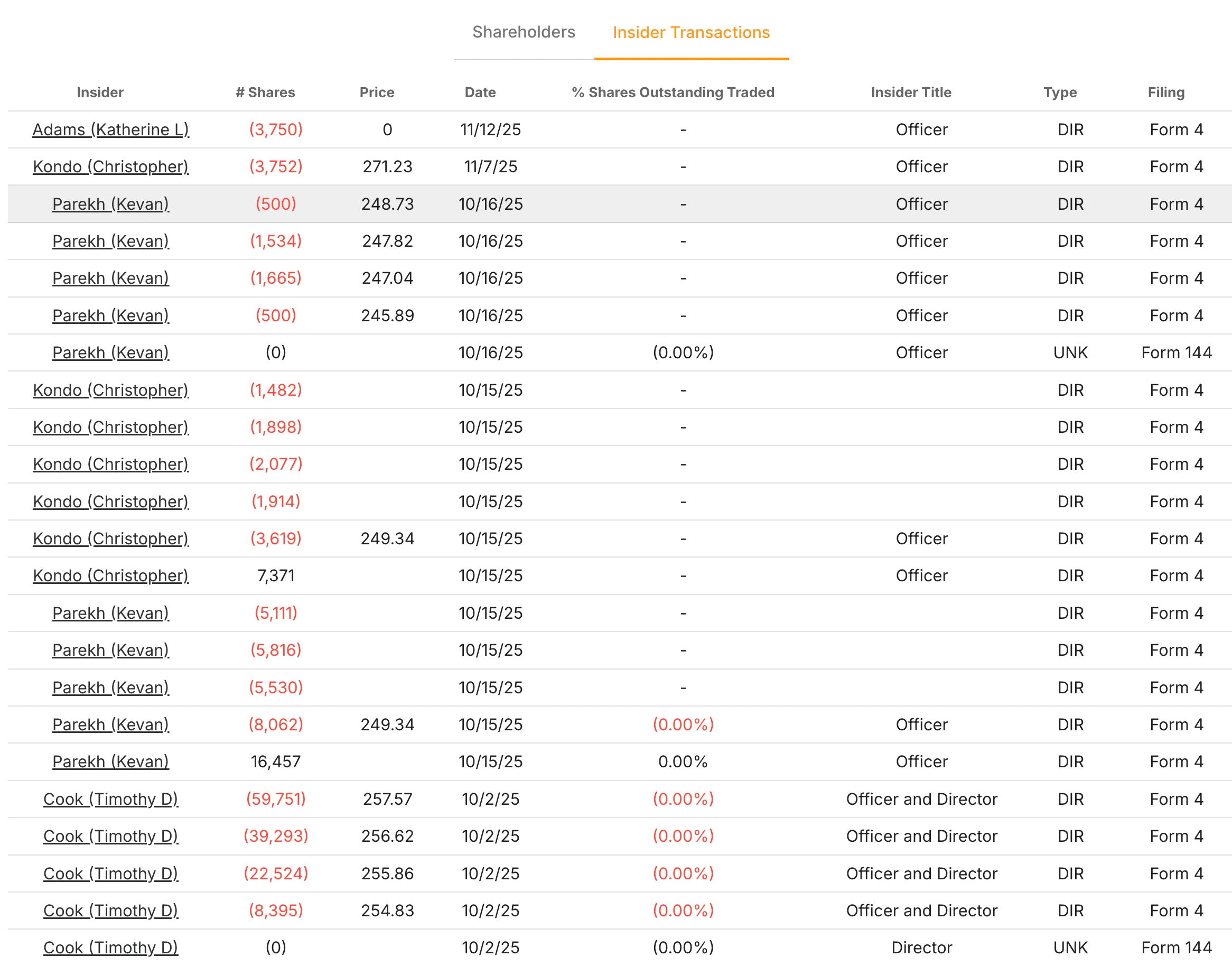

Track Insider Purchases

After searching for a company, you can view a company’s recent Insider Transactions to see if company executives, board members, or principal shareholders are buying or selling the stock.

You’ll see:

- A full list of recent insider purchases and sales

- The name and title of the insider

- The number of shares traded

- The date of the trade and the price executed

Below, you can see a handful of Apple’s insider transactions over the past few months. There’s been some selling, but that doesn’t necessarily mean Apple is a bad stock or it’s overvalued:

Lots of insider selling isn’t a good sign for a stock, so it’s best to check a stock’s recent Insider Transactions before you make a purchase.

Why Insider Buying Can Be a Catalyst

When insiders buy their own stock, it sends a clear message that they believe the stock is undervalued or has strong prospects ahead.

Insiders are the people who know the business best, such as the CEO, CFO, or board members, who see the company’s internal metrics, growth plans, and customer pipeline.

Unlike analysts or outside investors, they have the closest view of what’s really going on in the business.

That’s why insider buying can act as a short-term or long-term catalyst. In the short term, it can boost confidence and attract other investors.

In the long term, insider buying often signals a disconnect between the market’s perception of a business and the business’s reality, especially in beaten-down or overlooked stocks.

It’s not a perfect signal, but when insiders buy large amounts of stock, especially when several executives are buying at the same time, it’s often a sign that something important is happening.

Multiple Insider Buys

Additionally, it’s often a strong signal of internal conviction when multiple insiders are buying shares of their company around the same time.

For instance, when several executives at Lennar (LEN) bought shares during a housing pullback in 2022, the stock soon rebounded as mortgage sentiment stabilized.

Pro Tip: Combine Insider Buys with Valuation & Fundamentals

An insider’s conviction means more when the fundamentals support it, especially if a company trades at a low valuation, generates healthy cash flow, and if the stock trades well below analysts’ average price target.

As an example, in late 2023, Dollar General’s (DG) stock declined sharply on near-term operational challenges. At the same time, the company continued to generate free cash flow and trade at a discount to historical multiples.

Multiple insiders stepped in to buy the stock, and this drew attention from long-term investors.

Value stocks in less than 60 seconds with TIKR’s new Valuation Model (It’s free) >>>

How to Accurately Value a Stock in Under 30 Seconds

With TIKR’s new Valuation Model tool, you can accurately estimate a stock’s potential share price in 30 seconds or less.

All it takes are three simple inputs:

- Revenue Growth

- Operating Margins

- Exit P/E Multiple

If you’re not sure what to enter, TIKR will enter analysts’ consensus estimates for you.

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued today.

See a stock’s true value in under 30 seconds (Free with TIKR) >>>

FAQ Section:

What is the best way to track billionaire investors’ stock picks?

The best way to track billionaire investors’ stock picks is to use platforms like TIKR to track billionaire investor activity all in one place. TIKR allows you to see top investors’ global portfolio holdings, gathering data from public disclosures that investors are legally required to make.

How can I see what insiders are buying right now?

TIKR offers a real-time feed of what stocks insiders are buying right now through our Insider Transactions. You can track who’s purchasing a stock and see officer-level transactions.

Do billionaire investors always outperform the market?

While not every billionaire investor beats the market, many have long-term track records of success. Investors like Warren Buffett, Seth Klarman, and Joel Greenblatt are known for disciplined strategies that often outperform over time.

Is insider buying a reliable signal?

Insider buying can be a strong signal, especially when paired with business fundamentals and valuation. It shows that company leadership believes in the stock’s long-term value and is willing to invest their own money.

What tools help track smart money stock moves?

TIKR is one of the most comprehensive platforms available to track what the smart money is buying. It combines hedge fund portfolio tracking, recent insider transactions, stock screening, and financial analysis all in one place.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!