Key Stats for Costco Stock

- Price Change for $COST stock: -1%

- Current Share Price: $935

- 52-Week High: $1,078

- $COST Stock Price Target: $1,071

What Happened?

Costco (COST) stock is trading slightly lower despite beating Wall Street expectations on both earnings and revenue for its fiscal fourth quarter.

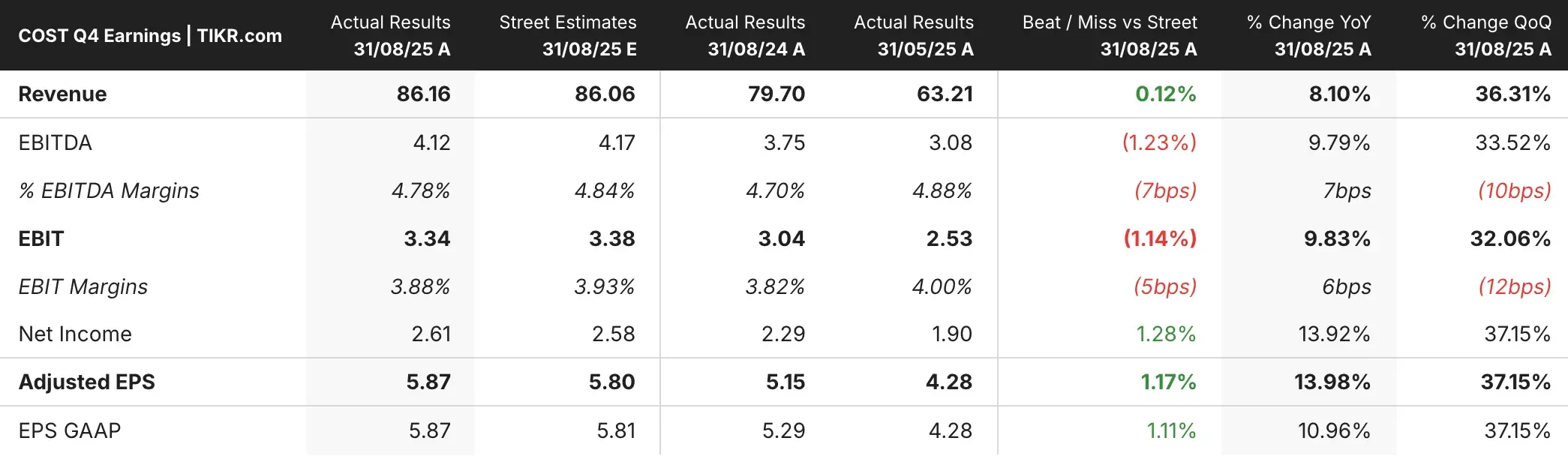

The warehouse retailer reported earnings of $5.87 per share, versus the expected $5.80, while revenue of $86.16 billion narrowly topped estimates of $86.06 billion.

The mixed market reaction reflects investors weighing strong operational results against concerns about decelerating same-store sales growth and margin pressures from tariffs.

Same-store sales rose 6.4% excluding gas and foreign exchange impacts, marking the second consecutive quarter of deceleration from previous levels.

Costco’s membership fee income surged 14% to $1.72 billion, driven by last year’s fee increase and continued member growth to 81 million paid members (up 6.3%).

E-commerce sales increased by 13.5%, while the company opened 27 new warehouses during the fiscal year and plans to open 35 more in fiscal 2026.

CFO Gary Millerchip highlighted the company’s proactive approach to managing tariff impacts, noting that they’ve introduced new Kirkland Signature alternatives for tariff-affected goods and shifted their sourcing strategies.

Approximately one-third of Costco’s U.S. sales originate from imported goods, making tariff management essential for maintaining its margins.

See analysts’ growth forecasts and price targets for Costco stock (It’s free!) >>>

What the Market Is Telling Us About Costco Stock

The muted response to Costco’s stock suggests investors are focused on the retailer’s ability to maintain its value proposition amid inflationary pressures.

While Costco successfully navigated Q4 tariff challenges through supply chain improvements and increased penetration of Kirkland Signature, questions remain about future margin sustainability.

Costco’s renewal rates declined to 89.8% worldwide (from previous highs) as more members sign up online versus in-store, with digital members renewing at slightly lower rates.

However, management views this as a net positive, noting that nearly half of the new members are under 40, representing long-term growth potential.

The market appears cautious about Costco’s underperformance relative to the broader market this year (+2% vs. the S&P 500’s +12%), despite strong operational execution and the successful implementation of a membership fee increase.

The extended executive member hours introduced in June have added approximately 1% to weekly U.S. sales, indicating the ability to drive incremental growth through member benefits.

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!