Key Stats for Carnival Stock

- Price Change for CCL stock: 7%

- Current Share Price: $25.70

- 52-Week High: $28.72

- CCL Stock Price Target: $28.55

What Happened?

Carnival (CCL) stock gained almost 7% on Tuesday, following the cruise giant’s exceptional second-quarter earnings report that exceeded Wall Street expectations.

The world’s largest cruise company delivered adjusted earnings per share of $0.35, crushing analyst estimates of $0.245 by 43%, while revenue climbed 9.1% year-over-year to a record $6.33 billion for the quarter.

The impressive results were driven by strong passenger demand, with 3.4 million guests sailing during the quarter, a 3% increase from the prior year.

More importantly for investors, passenger cruise days increased 4% to 25.3 million, while it successfully reduced costs per available lower berth day by 0.3% and achieved a 6% improvement in fuel efficiency.

See CCL’s full analyst estimates, earnings results, and earnings transcript (It’s free) >>>

Management also announced it has achieved its ambitious 2026 financial targets a full 18 months ahead of schedule. This includes surpassing its 12.5% return on invested capital goal and delivering EBITDA per berth day that’s 52% above 2023 baseline levels.

The company celebrated reaching its highest EBITDA margins in nearly 20 years, demonstrating the effectiveness of its operational improvements and pricing power.

What the Market Is Telling Us About CCL Stock

The market’s response to CCL stock reflects investor confidence in Carnival’s transformation story and its ability to generate substantial cash flows in a challenging environment.

Despite macroeconomic headwinds and geopolitical uncertainties, CCL raised its full-year guidance, now expecting adjusted net income to be more than 40% higher than 2024 levels, $200 million above its March prediction.

With customer deposits reaching all-time highs and CCL’s booking position for 2026 remaining strong at historically high prices, the market is betting that Carnival’s operational excellence will continue translating into superior shareholder returns.

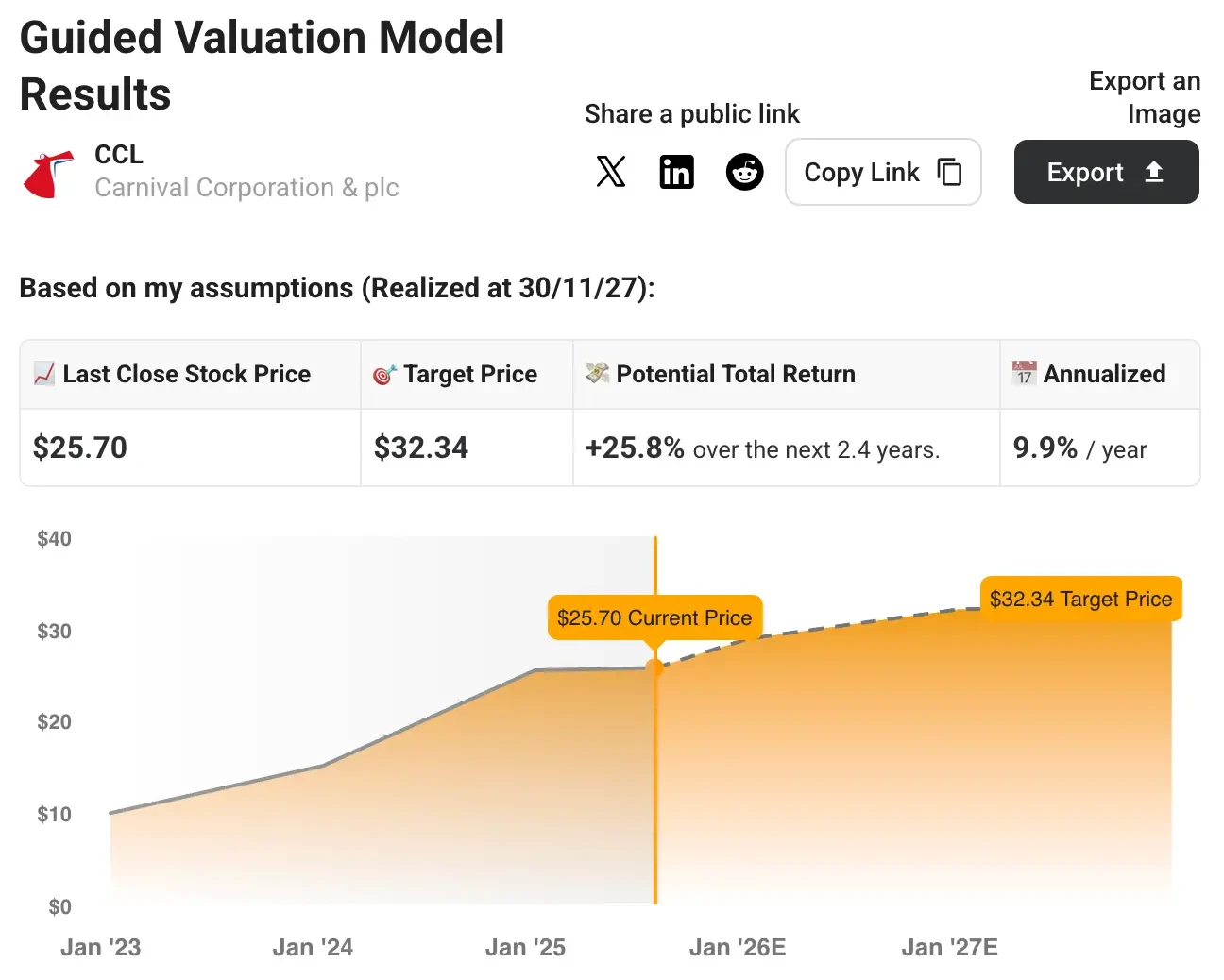

Quickly value any stock with TIKR’s new Valuation Model (It’s free!) >>>

The CCL stock performance validates the company’s strategic focus on same-ship revenue growth and cost discipline, with CEO Josh Weinstein emphasizing that the company sees “so much more potential” beyond current margin levels.

As Carnival prepares to launch its new Caribbean destination, Celebration Key, next month, investors appear confident that the cruise line can maintain its impressive trajectory of delivering record financial results quarter after quarter.

Want to Invest Like Warren Buffett, Joel Greenblatt, or Peter Lynch?

TIKR just published a special report breaking down 5 powerful stock screeners inspired by the exact strategies used by the world’s greatest investors.

In this report, you’ll discover:

- A Buffett-style screener for finding wide-moat compounders at fair prices

- Joel Greenblatt’s formula for high-return, low-risk stocks

- A Peter Lynch-inspired tool to surface fast-growing small caps before Wall Street catches on

Each screener is fully customizable on TIKR, so you can apply legendary investing strategies instantly. Whether you’re looking for long-term compounders or overlooked value plays, these screeners will save you hours and sharpen your edge.

This is your shortcut to proven investing frameworks, backed by real performance data.

Click here to sign up for TIKR and get this full report now, completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!