Key Stats for EAT Stock

- 1-Day Price Change for EAT stock: 1.6%

- Current Share Price: $157.38

- 52-Week High: $192

- EAT Stock Price Target: $177

What Happened?

Brinker International (EAT) stock rallied after the Chili’s parent company delivered a strong beat on both earnings and revenue for its fiscal fourth quarter.

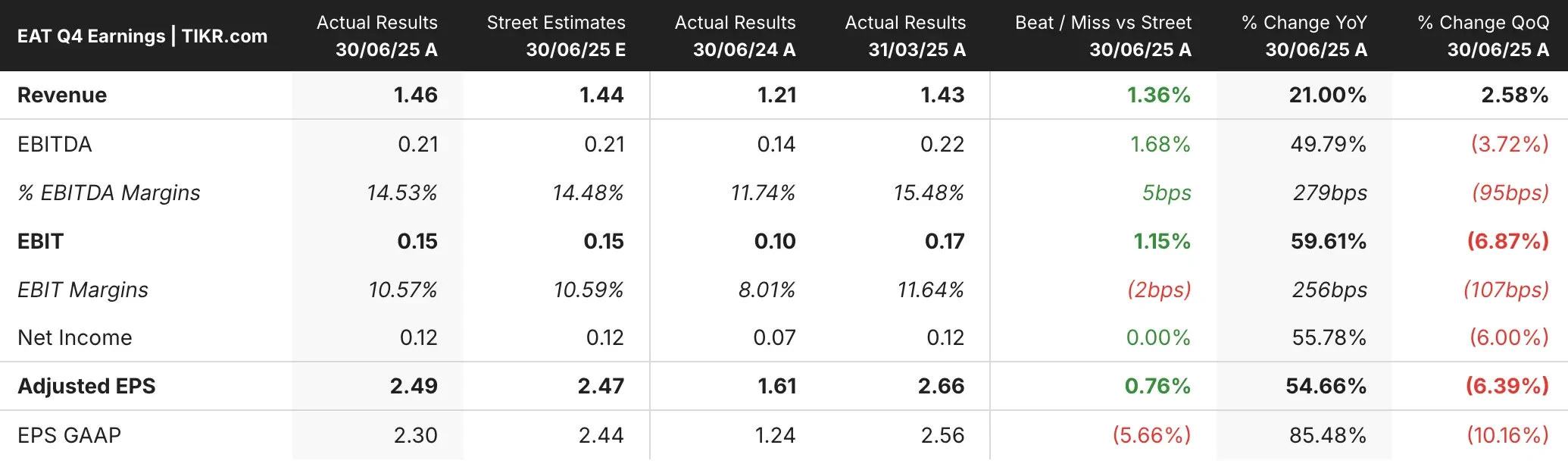

Brinker reported adjusted earnings per share of $2.49, beating analyst expectations of $2.47, while revenue of $1.46 billion exceeded the $1.44 billion consensus estimate.

The standout performance was driven by Chili’s exceptional same-store sales growth of 24%, which outperformed the broader casual dining industry by an impressive 1,890 basis points.

This marked the completion of the third year of Brinker’s turnaround plan, with Chili’s delivering its 17th consecutive quarter of positive same-store sales growth.

For fiscal 2026, Brinker provided optimistic guidance, expecting annual revenues in the range of $5.6 billion to $5.7 billion and adjusted diluted EPS between $9.90 and $10.50, signaling continued confidence in the business momentum.

See analysts’ growth forecasts and price targets for EAT stock (It’s free!) >>>

What the Market Is Telling Us About EAT Stock

The market’s enthusiastic response to EAT stock reflects validation of Brinker’s successful turnaround strategy, which has transformed Chili’s from a struggling chain into a casual dining leader.

The company has improved its operational foundation by investing over $160 million more in labor than in fiscal 2022, while simplifying its menu by eliminating over 25% of items.

Investors are particularly impressed by the sustainability of the growth, with average unit volumes reaching $4.5 million compared to $3.1 million at the end of fiscal 2022.

The company’s restaurant operating margins have expanded dramatically from 11.9% to 17.6% over the same period, demonstrating strong operational leverage.

The strong guidance for fiscal 2026, including plans to “comp the comp” against challenging year-over-year comparisons, suggests management believes the turnaround momentum is durable.

With traffic chosen as the operations team’s “obsession metric” for the coming year and continued investments in food quality and technology, Brinker appears well-positioned to maintain its industry-leading performance in the competitive casual dining sector.

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!