Alibaba Group (NYSE: BABA) remains one of the most closely watched names in Chinese tech. After rebounding from its 2022 lows, the stock is up meaningfully, but questions remain about whether the recovery can last. With growth slowing and competition rising, analysts appear split on the path forward.

This article explores where Wall Street thinks Alibaba could trade by 2028. We’ve compiled consensus targets, valuation assumptions, and recent price action to get a sense of the stock’s possible trajectory. These figures reflect current analyst models and are not TIKR’s own predictions.

Unlock our Free Report: 5 AI compounders that analysts believe are undervalued and could deliver years of outperformance with accelerating AI adoption (Sign up for TIKR, it’s free) >>>

Analysts’ Price Target Suggests Limited Upside

Alibaba trades near $155/share as of September 2025. The average analyst target is about $165/share over the next 18 months, which points to about 6% upside.

Forecasts vary widely, from around $131/share to $196/share on a split-adjusted basis. It looks like analysts are divided on how much growth Alibaba can deliver.

The base case suggests only small gains, so conviction may depend on whether you believe Alibaba can outperform these cautious expectations.

See analysts’ growth forecasts and price targets for Alibaba (It’s free!) >>>

Alibaba: Growth Outlook and Valuation

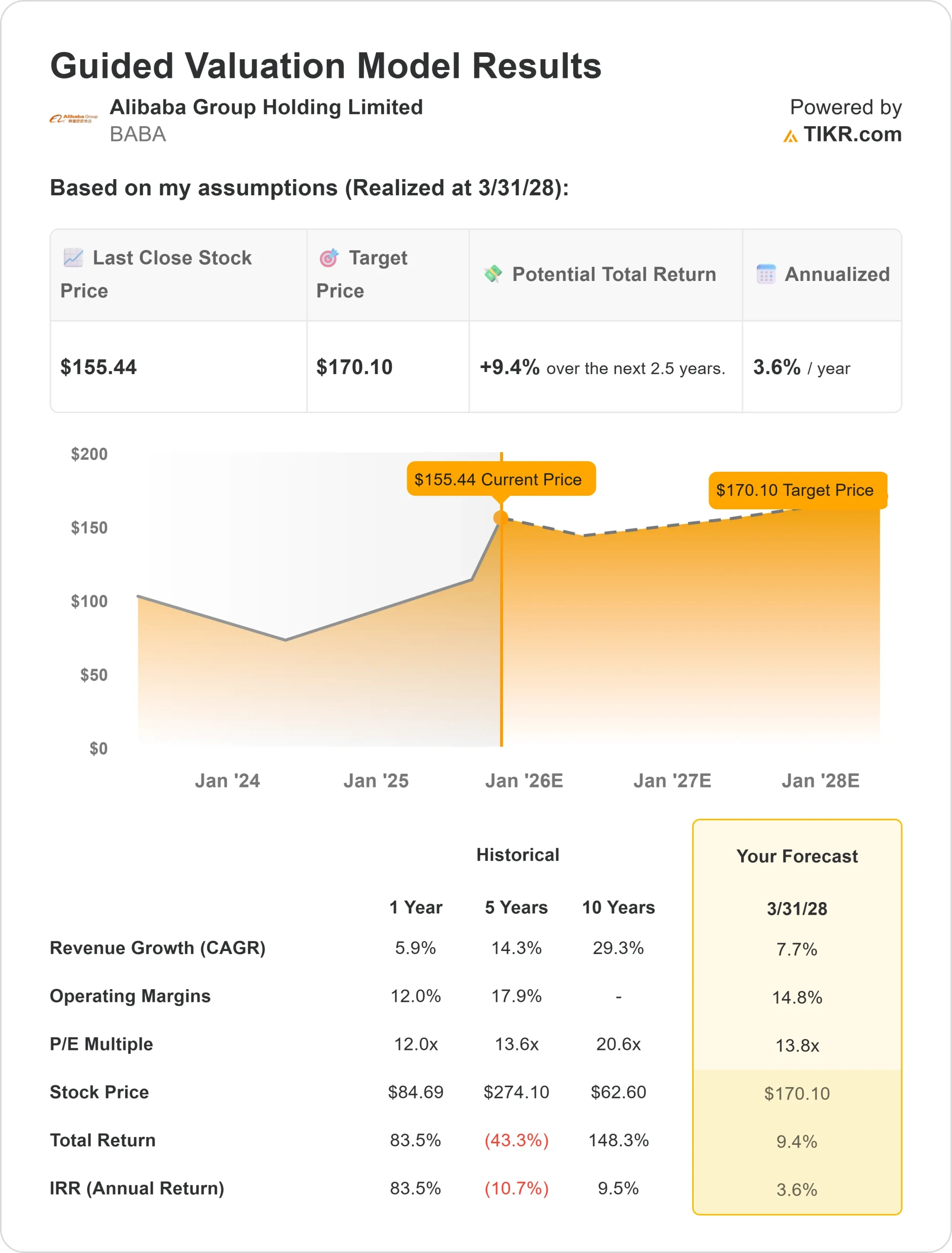

Revenue is projected to grow about 7.7% annually through early 2028, while operating margins could improve from roughly 12% today to about 14.8%. That is progress, but well below Alibaba’s early high-growth phase.

At $155/share, the stock trades near 13.8x forward earnings, close to its long-term average. The guided valuation model suggests the stock could reach about $170/share.

Alibaba looks fairly valued based on current forecasts. Unless margins expand faster or revenue growth surprises, returns may stay modest.

Value stocks like Alibaba in as little as 60 seconds with TIKR (It’s free) >>>

What’s Driving the Optimism?

Alibaba’s stabilizing e-commerce platform, steady momentum in cloud services, and tighter cost control have supported the stock’s recovery. Bulls argue that strong free cash flow gives the company flexibility to reinvest and continue buybacks, which could keep earnings growth on track.

If consumer demand improves and margins expand, Alibaba could justify a stronger valuation over time.

Optimists may see a steadier business with enough cash flow to support gradual gains, even if the hyper-growth era does not return.

Bear Case: Regulatory and Growth Risks

Despite the recovery story, Alibaba still faces significant challenges. At $155/share, upside appears limited unless growth accelerates. Heavy competition in e-commerce and cloud, soft consumer spending, and regulatory uncertainty all add risk.

If revenue slows or profitability disappoints, the stock could re-rate lower, leaving little margin for error.

The downside is that Alibaba drifts sideways or weakens if these risks outweigh stabilization efforts.

Outlook for 2028: What Could Alibaba Be Worth?

Under current forecasts, Alibaba’s stock could reach about $170/share by 2028. That would represent less than 10% upside from today’s price, or about 3.6% annualized returns.

That scenario assumes revenue grows ~7.7% annually and operating margins expand to 14.8%. Even with those improvements, the upside looks modest.

Sustained upside likely depends on faster growth or new business drivers. Without that, Alibaba may continue to trade near fair value.

AI Compounders With Massive Upside That Wall Street Is Overlooking

Everyone wants to cash in on AI. But while the crowd chases the obvious names benefiting from AI like NVIDIA, AMD, or Taiwan Semiconductor, the real opportunity may lie on the AI application layer where a handful of compounders are quietly embedding AI into products people already use every day.

TIKR just released a new free report on 5 undervalued compounders that analysts believe could deliver years of outperformance as AI adoption accelerates.

Inside the report, you’ll find:

- Businesses already turning AI into revenue and earnings growth

- Stocks trading below fair value despite strong analyst forecasts

- Unique picks most investors haven’t even considered

If you want to catch the next wave of AI winners, this report is a must-read.

Click here to sign up for TIKR and get your free copy of TIKR’s 5 AI Compounders report today.